Answered step by step

Verified Expert Solution

Question

1 Approved Answer

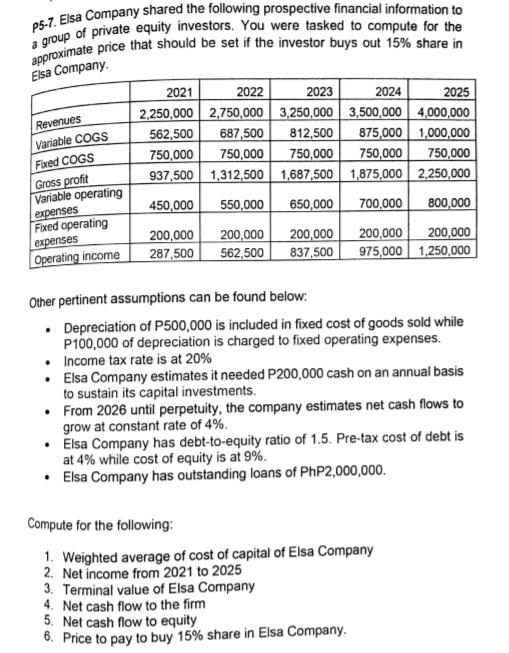

P5-7. Elsa Company shared the following prospective financial information to approximate price that should be set if the investor buys out 15% share in

P5-7. Elsa Company shared the following prospective financial information to approximate price that should be set if the investor buys out 15% share in a group of private equity investors. You were tasked to compute for the Elsa Company. Revenues Variable COGS Fixed COGS Gross profit Variable operating expenses Fixed operating expenses Operating income 2021 2022 2023 2024 2025 2,250,000 2,750,000 3,250,000 3,500,000 4,000,000 562,500 687,500 812,500 875,000 1,000,000 750,000 750,000 750,000 750,000 750,000 937,500 1,312,500 1,687,500 1,875,000 2,250,000 450,000 550,000 650,000 700,000 800,000 200,000 200,000 200,000 200,000 200,000 287,500 975,000 1,250,000 562,500 837,500 Other pertinent assumptions can be found below. . Depreciation of P500,000 is included in fixed cost of goods sold while P100,000 of depreciation is charged to fixed operating expenses. Income tax rate is at 20% Elsa Company estimates it needed P200,000 cash on an annual basis to sustain its capital investments. From 2026 until perpetuity, the company estimates net cash flows to grow at constant rate of 4%. Elsa Company has debt-to-equity ratio of 1.5. Pre-tax cost of debt is at 4% while cost of equity is at 9%. Elsa Company has outstanding loans of PhP2,000,000. Compute for the following: 1. Weighted average of cost of capital of Elsa Company 2. Net income from 2021 to 2025 3. Terminal value of Elsa Company 4. Net cash flow to the firm 5. Net cash flow to equity 6. Price to pay to buy 15% share in Elsa Company.

Step by Step Solution

★★★★★

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 WACC 55 2 Net Income P000 2021 2022 2023 2024 2025 Net Income 230 450 670 780 1000 3 Termin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started