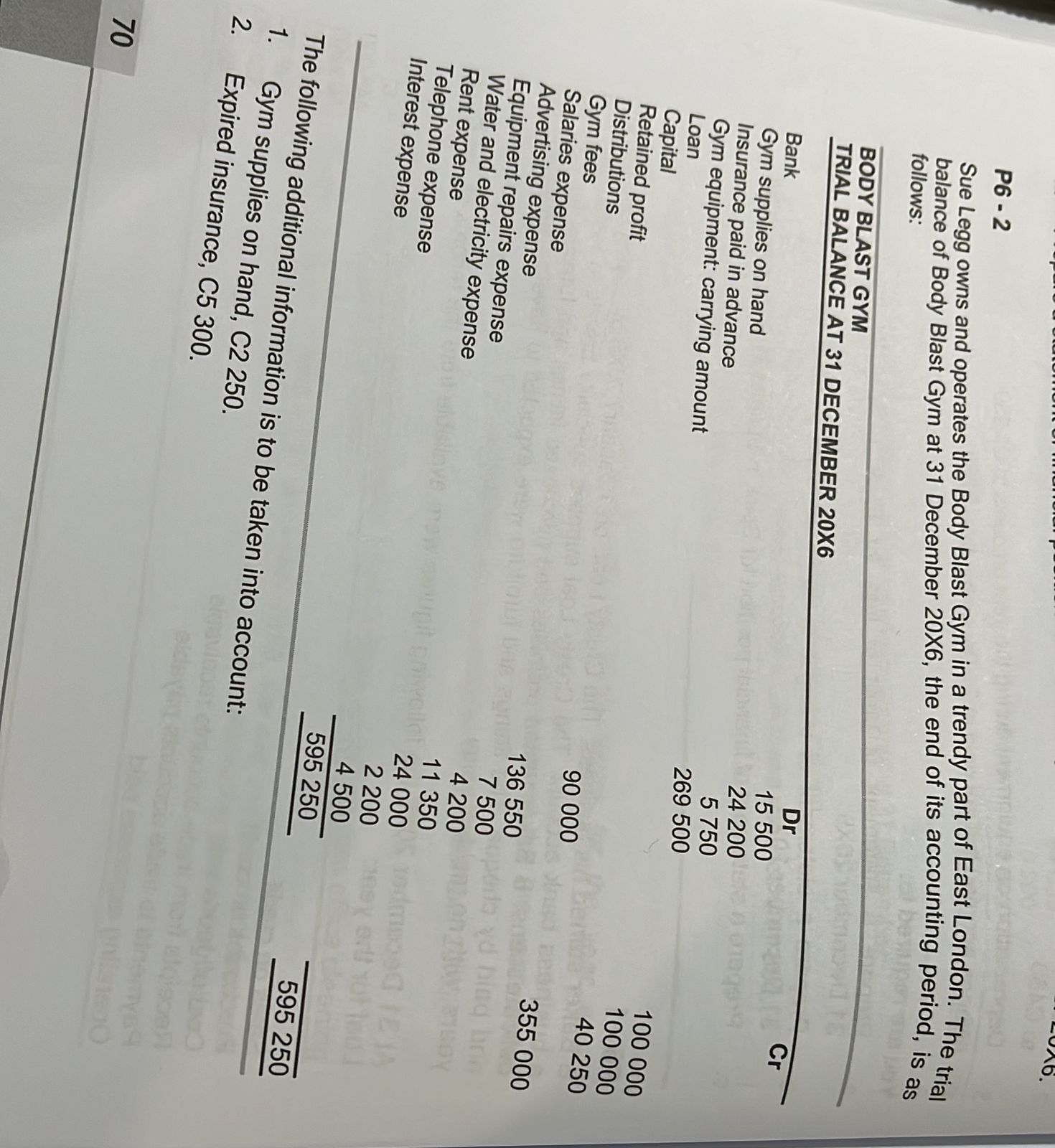

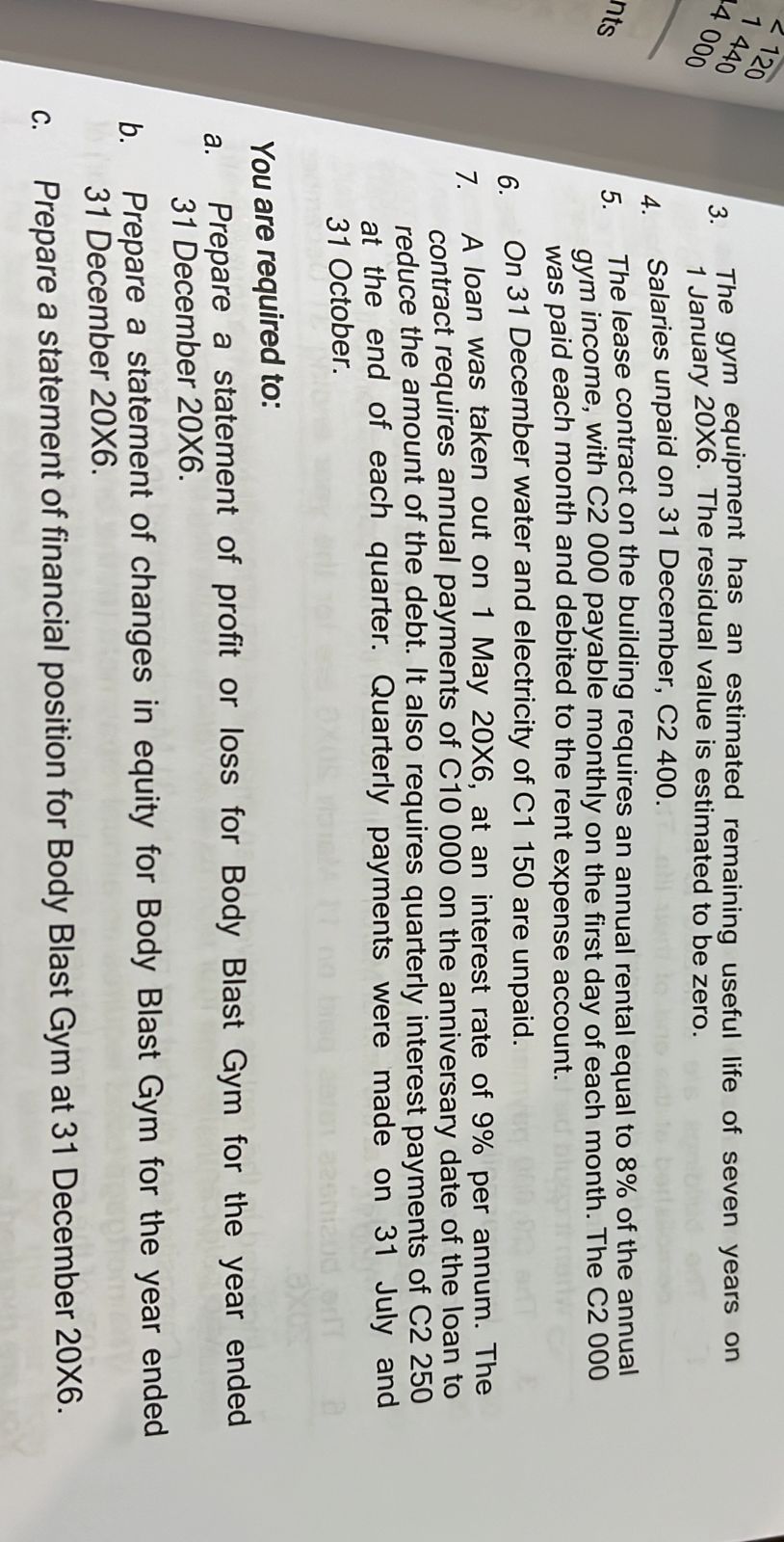

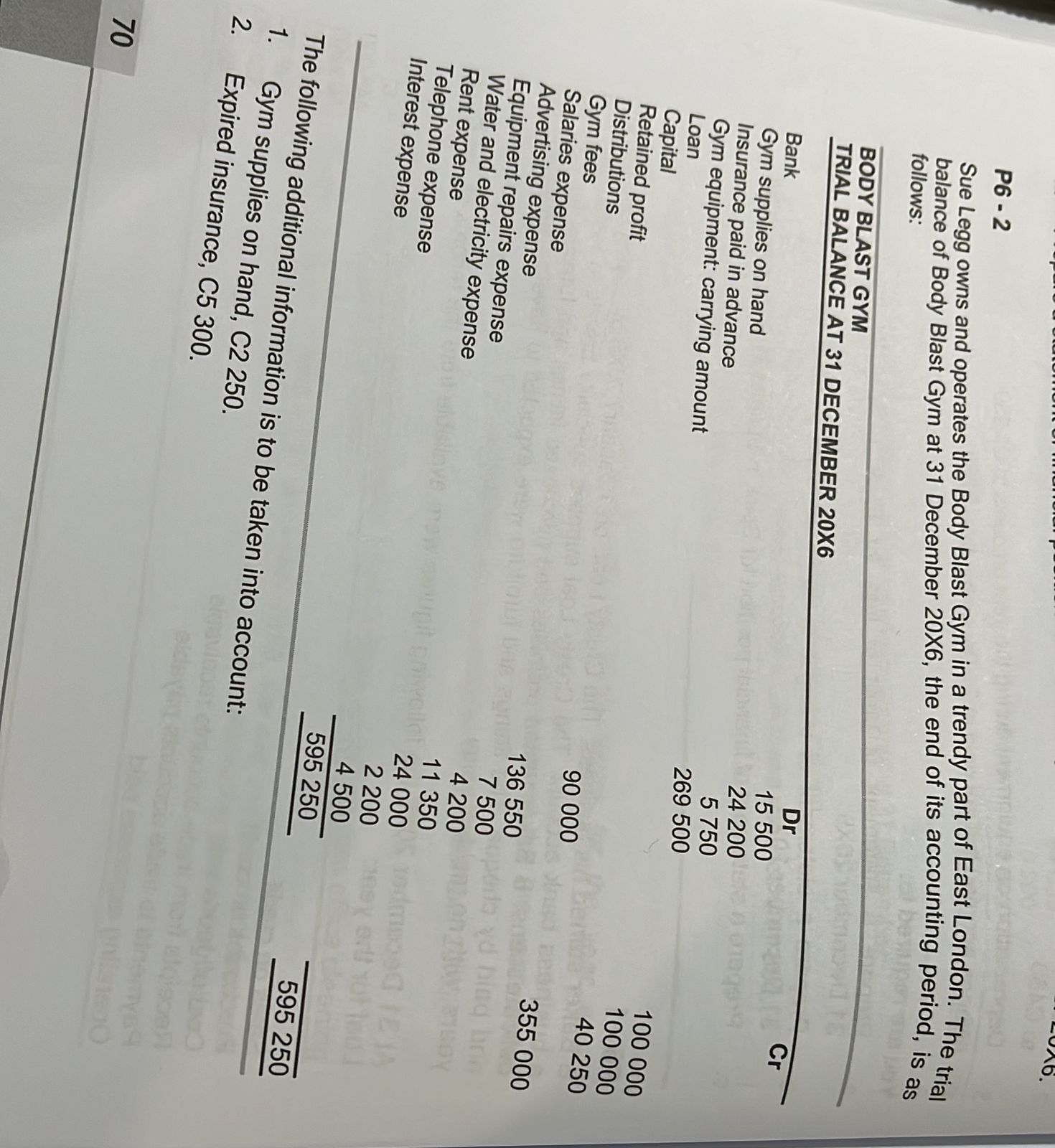

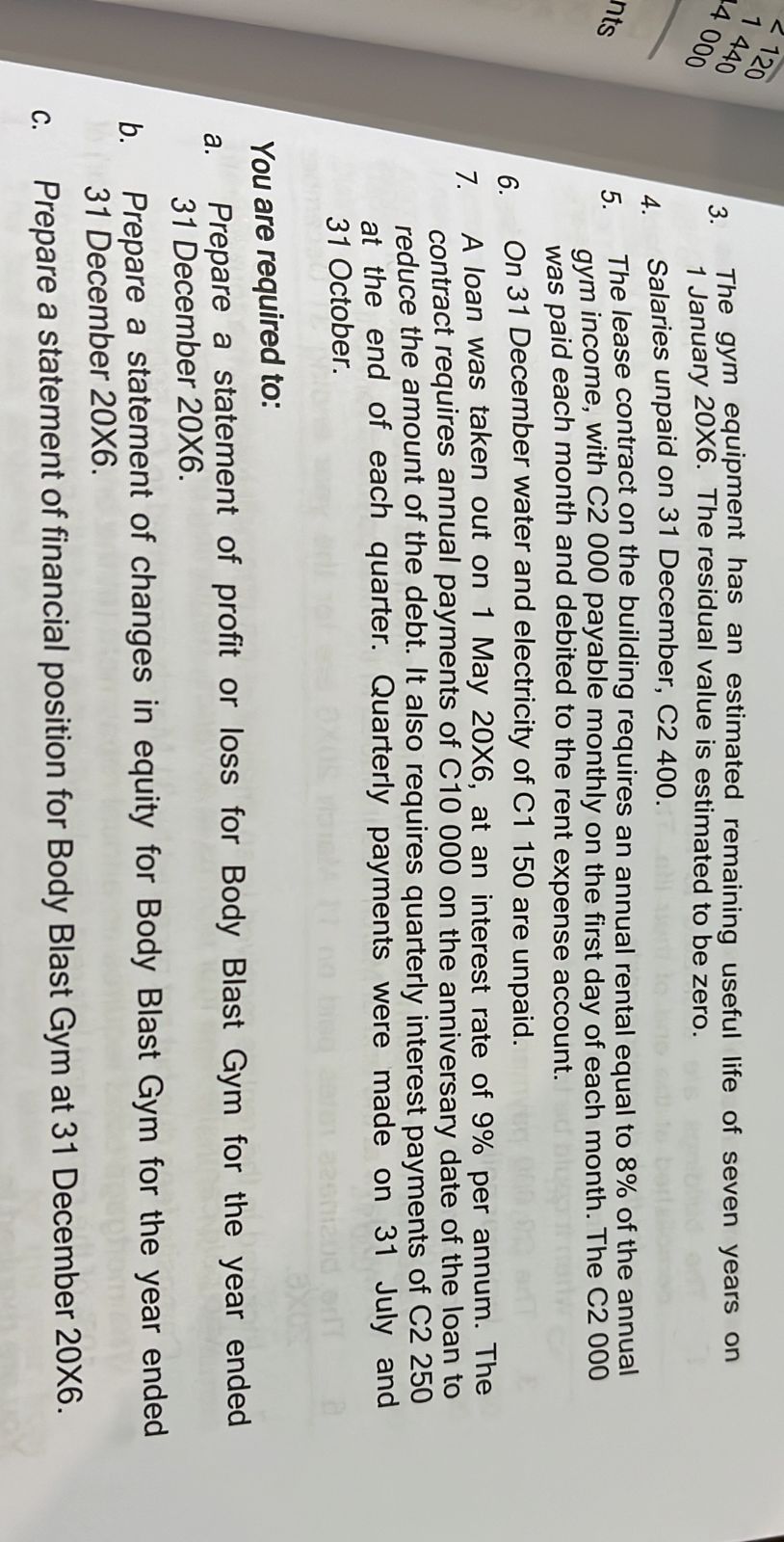

P6 - 2 Sue Legg owns and operates the Body Blast Gym in a trendy part of East London. The trial balance of Body Blast Gym at 31 December 20X6, the end of its accounting period, is as follows: Th 1. Gym supplies on hand, C2 is to be taken into account: 2. Expired insurance, C5300. 3. The gym equipment has an estimated remaining useful life of seven years on 1 January 20X6. The residual value is estimated to be zero. 4. Salaries unpaid on 31 December, C2 400. 5. The lease contract on the building requires an annual rental equal to 8% of the annual gym income, with C2 000 payable monthly on the first day of each month. The C2 000 was paid each month and debited to the rent expense account. 6. On 31 December water and electricity of C1 150 are unpaid. 7. A loan was taken out on 1 May 20X6, at an interest rate of 9% per annum. The contract requires annual payments of C10 000 on the anniversary date of the loan to reduce the amount of the debt. It also requires quarterly interest payments of C2 250 at the end of each quarter. Quarterly payments were made on 31 July and 31 October. You are required to: Prepare a statement of profit or loss for Body Blast Gym for the year ended 31 December 206. Prepare a statement of changes in equity for Body Blast Gym for the year ended 31 December 206. Prepare a statement of financial position for Body Blast Gym at 31 December 20X6. P6 - 2 Sue Legg owns and operates the Body Blast Gym in a trendy part of East London. The trial balance of Body Blast Gym at 31 December 20X6, the end of its accounting period, is as follows: Th 1. Gym supplies on hand, C2 is to be taken into account: 2. Expired insurance, C5300. 3. The gym equipment has an estimated remaining useful life of seven years on 1 January 20X6. The residual value is estimated to be zero. 4. Salaries unpaid on 31 December, C2 400. 5. The lease contract on the building requires an annual rental equal to 8% of the annual gym income, with C2 000 payable monthly on the first day of each month. The C2 000 was paid each month and debited to the rent expense account. 6. On 31 December water and electricity of C1 150 are unpaid. 7. A loan was taken out on 1 May 20X6, at an interest rate of 9% per annum. The contract requires annual payments of C10 000 on the anniversary date of the loan to reduce the amount of the debt. It also requires quarterly interest payments of C2 250 at the end of each quarter. Quarterly payments were made on 31 July and 31 October. You are required to: Prepare a statement of profit or loss for Body Blast Gym for the year ended 31 December 206. Prepare a statement of changes in equity for Body Blast Gym for the year ended 31 December 206. Prepare a statement of financial position for Body Blast Gym at 31 December 20X6