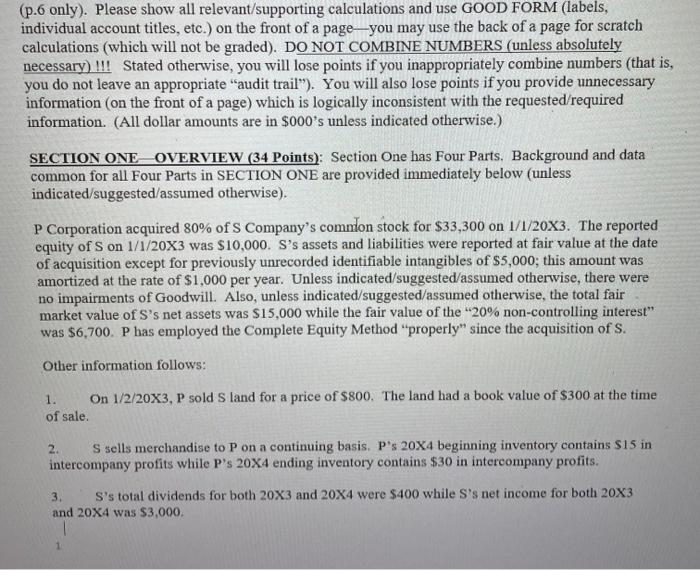

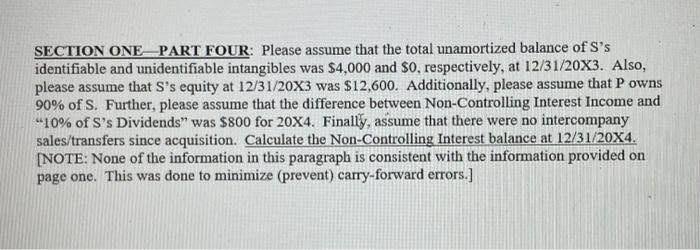

(p.6 only). Please show all relevant/supporting calculations and use GOOD FORM (labels, individual account titles, etc.) on the front of a pageyou may use the back of a page for scratch calculations (which will not be graded). DO NOT COMBINE NUMBERS (unless absolutely necessary) !!! Stated otherwise, you will lose points if you inappropriately combine numbers (that is, you do not leave an appropriate "audit trail"). You will also lose points if you provide unnecessary information on the front of a page) which is logically inconsistent with the requested/required information. (All dollar amounts are in $000's unless indicated otherwise.) SECTION ONE OVERVIEW (34 Points): Section One has Four Parts. Background and data common for all Four Parts in SECTION ONE are provided immediately below (unless indicated/suggested/assumed otherwise). P Corporation acquired 80% of Company's complon stock for $33,300 on 1/1/20X3. The reported equity of S on 1/1/20X3 was $10,000. S's assets and liabilities were reported at fair value at the date of acquisition except for previously unrecorded identifiable intangibles of $5,000; this amount was amortized at the rate of $1,000 per year. Unless indicated/suggested/assumed otherwise, there were no impairments of Goodwill. Also, unless indicated/suggested/assumed otherwise, the total fair market value of S's net assets was $15,000 while the fair value of the 20% non-controlling interest was $6,700. P has employed the Complete Equity Method "properly" since the acquisition of s. Other information follows: 1. On 1/2/20X3, P sold s land for a price of $800. The land had a book value of $300 at the time of sale. 2. S sells merchandise to P on a continuing basis. P's 20X4 beginning inventory contains S15 in intercompany profits while P's 20X4 ending inventory contains $30 in intercompany profits. 3 S's total dividends for both 20x3 and 20X4 were $400 while S's net income for both 20X3 and 20X4 was $3,000. SECTION ONE PART FOUR: Please assume that the total unamortized balance of S's identifiable and unidentifiable intangibles was $4,000 and $0, respectively, at 12/31/20X3. Also, please assume that S's equity at 12/31/20X3 was $12,600. Additionally, please assume that P owns 90% of S. Further, please assume that the difference between Non-Controlling Interest Income and "10% of S's Dividends was $800 for 20X4. Finally, assume that there were no intercompany sales/transfers since acquisition. Calculate the Non-Controlling Interest balance at 12/31/20X4. [NOTE: None of the information in this paragraph is consistent with the information provided on page one. This was done to minimize (prevent) carry-forward errors.] (p.6 only). Please show all relevant/supporting calculations and use GOOD FORM (labels, individual account titles, etc.) on the front of a pageyou may use the back of a page for scratch calculations (which will not be graded). DO NOT COMBINE NUMBERS (unless absolutely necessary) !!! Stated otherwise, you will lose points if you inappropriately combine numbers (that is, you do not leave an appropriate "audit trail"). You will also lose points if you provide unnecessary information on the front of a page) which is logically inconsistent with the requested/required information. (All dollar amounts are in $000's unless indicated otherwise.) SECTION ONE OVERVIEW (34 Points): Section One has Four Parts. Background and data common for all Four Parts in SECTION ONE are provided immediately below (unless indicated/suggested/assumed otherwise). P Corporation acquired 80% of Company's complon stock for $33,300 on 1/1/20X3. The reported equity of S on 1/1/20X3 was $10,000. S's assets and liabilities were reported at fair value at the date of acquisition except for previously unrecorded identifiable intangibles of $5,000; this amount was amortized at the rate of $1,000 per year. Unless indicated/suggested/assumed otherwise, there were no impairments of Goodwill. Also, unless indicated/suggested/assumed otherwise, the total fair market value of S's net assets was $15,000 while the fair value of the 20% non-controlling interest was $6,700. P has employed the Complete Equity Method "properly" since the acquisition of s. Other information follows: 1. On 1/2/20X3, P sold s land for a price of $800. The land had a book value of $300 at the time of sale. 2. S sells merchandise to P on a continuing basis. P's 20X4 beginning inventory contains S15 in intercompany profits while P's 20X4 ending inventory contains $30 in intercompany profits. 3 S's total dividends for both 20x3 and 20X4 were $400 while S's net income for both 20X3 and 20X4 was $3,000. SECTION ONE PART FOUR: Please assume that the total unamortized balance of S's identifiable and unidentifiable intangibles was $4,000 and $0, respectively, at 12/31/20X3. Also, please assume that S's equity at 12/31/20X3 was $12,600. Additionally, please assume that P owns 90% of S. Further, please assume that the difference between Non-Controlling Interest Income and "10% of S's Dividends was $800 for 20X4. Finally, assume that there were no intercompany sales/transfers since acquisition. Calculate the Non-Controlling Interest balance at 12/31/20X4. [NOTE: None of the information in this paragraph is consistent with the information provided on page one. This was done to minimize (prevent) carry-forward errors.]