Answered step by step

Verified Expert Solution

Question

1 Approved Answer

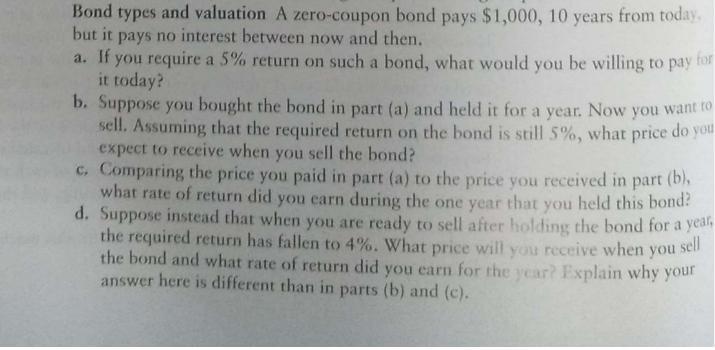

Bond types and valuation A zero-coupon bond pays $1,000, 10 years from today. but it pays no interest between now and then. a. If

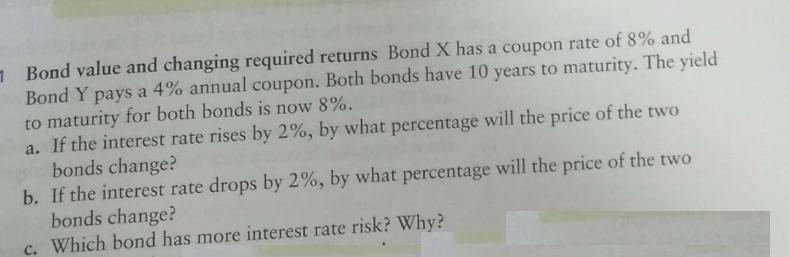

Bond types and valuation A zero-coupon bond pays $1,000, 10 years from today. but it pays no interest between now and then. a. If you require a 5% return on such a bond, what would you be willing to pay for it today? b. Suppose you bought the bond in part (a) and held it for a year. Now you want to sell. Assuming that the required return on the bond is still 5%, what price do you expect to receive when you sell the bond? c. Comparing the price you paid in part (a) to the price you received in part (b), what rate of return did you earn during the one year that you held this bond? d. Suppose instead that when you are ready to sell after holding the bond for a year, the required return has fallen to 4%. What price will you receive when the bond and what rate of return did you earn for the year? Explain why your answer here is different than in parts (b) and (c). sell you 7 Bond value and changing required returns Bond X has a coupon rate of 8% and Bond Y pays a 4% annual coupon. Both bonds have 10 years to maturity. The yield to maturity for both bonds is now 8%. a. If the interest rate rises by 2%, by what percentage will the price of the two bonds change? b. If the interest rate drops by 2%, by what percentage will the price of the two bonds change? c. Which bond has more interest rate risk? Why?

Step by Step Solution

★★★★★

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a If you require a 5 return on such a bond what would you be willing to pay for it today The present value of a zerocoupon bond is calculated by using the formula PVFV1rt where FV is the face value r ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started