Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P6-2 Upstream and Downstream Sale of Depreciable Asset Jenna OYJ was a 90 percent-owned subsidiary of Mikko OYJ, which was acquired in 2012. At

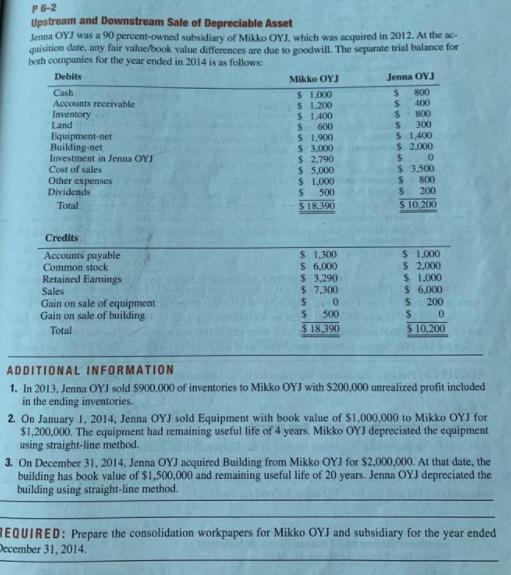

P6-2 Upstream and Downstream Sale of Depreciable Asset Jenna OYJ was a 90 percent-owned subsidiary of Mikko OYJ, which was acquired in 2012. At the ac- quisition date, any fair value/book value differences are due to goodwill. The separate trial balance for both companies for the year ended in 2014 is as follows: Debits Cash Mikko OYJ Jenna OYJ $ 1,000 $ 800 Accounts receivable $ 1,200 S 400 Inventory $1,400 $ 800 Land $ 600 $ 300 Equipment-net $ 1,900 $1,400 Building-net $ 3,000 $ 2,000 Investment in Jenna OYJ $ 2.790 $ 0 Cost of sales $ 5,000 $ 3.500 Other expenses $ 1,000 S 800 Dividends S 500 $ 200 $ 18,390 $ 10,200 Total Credits Accounts payable Common stock Retained Earnings Sales Gain on sale of equipment Gain on sale of building Total $ $ 1,300 6,000 $ 1,000 $ 2,000 $ 3,290 $ 1.000 $ 7,300 $ 6,000 $ 0 S $ 500 $ 200 0 $18,390 $ 10,200 ADDITIONAL INFORMATION 1. In 2013, Jenna OYJ sold $900,000 of inventories to Mikko OYJ with $200,000 unrealized profit included in the ending inventories. 2. On January 1, 2014, Jenna OYJ sold Equipment with book value of $1,000,000 to Mikko OYJ for $1,200,000. The equipment had remaining useful life of 4 years. Mikko OYJ depreciated the equipment using straight-line method. 3. On December 31, 2014, Jenna OYJ acquired Building from Mikko OYJ for $2,000,000. At that date, the building has book value of $1,500,000 and remaining useful life of 20 years. Jenna OYJ depreciated the building using straight-line method. REQUIRED: Prepare the consolidation workpapers for Mikko OYJ and subsidiary for the year ended December 31, 2014.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started