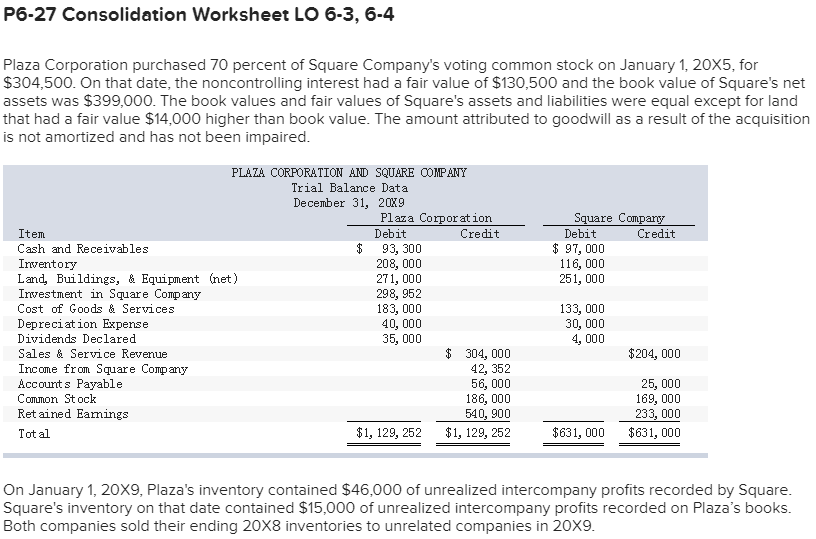

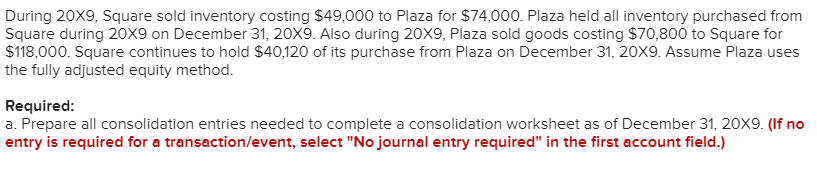

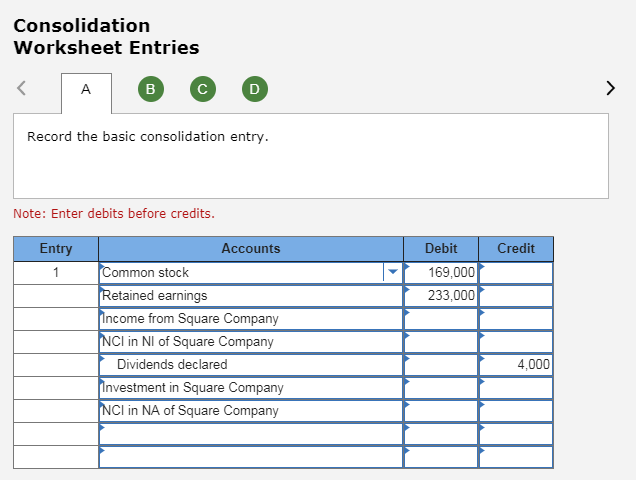

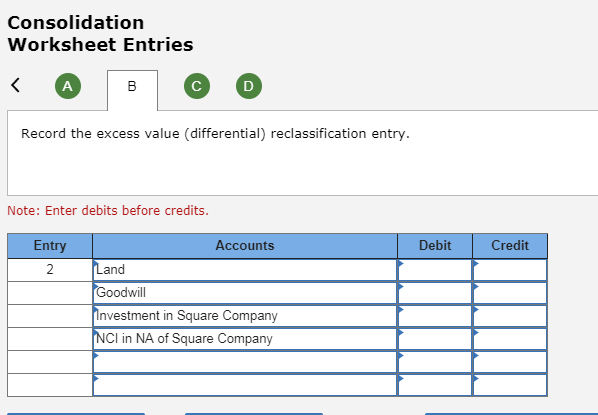

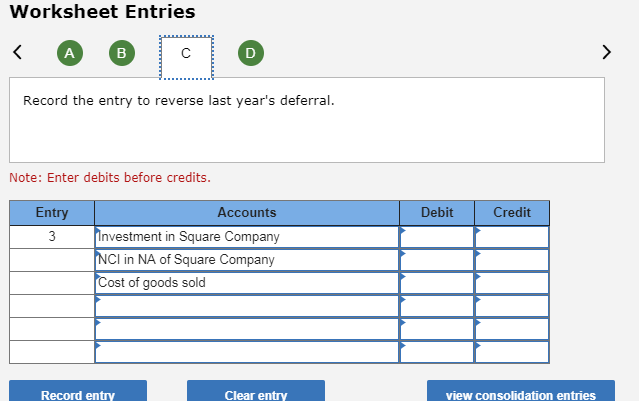

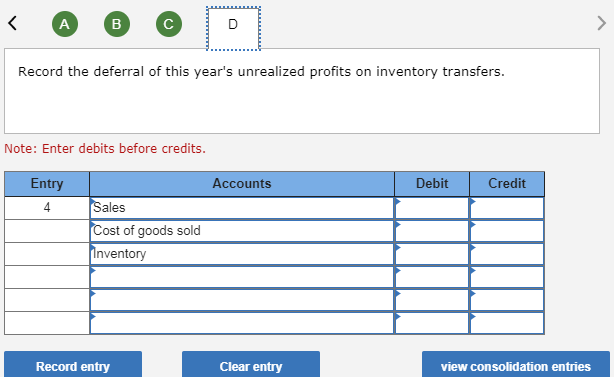

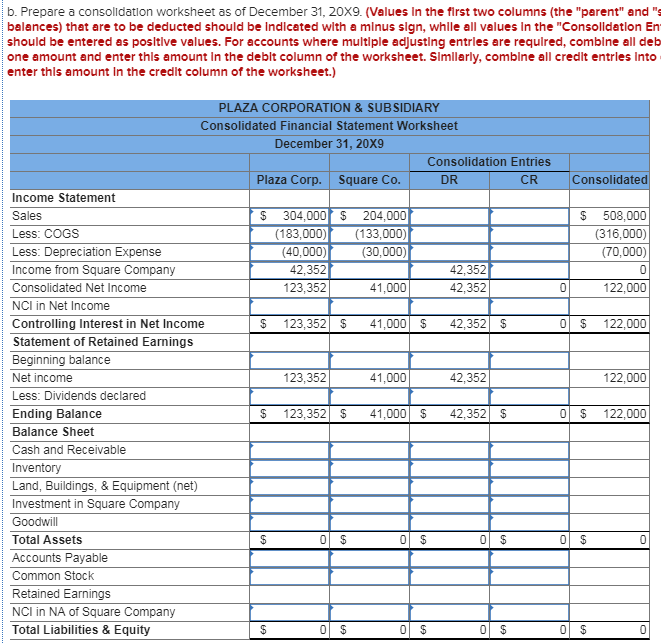

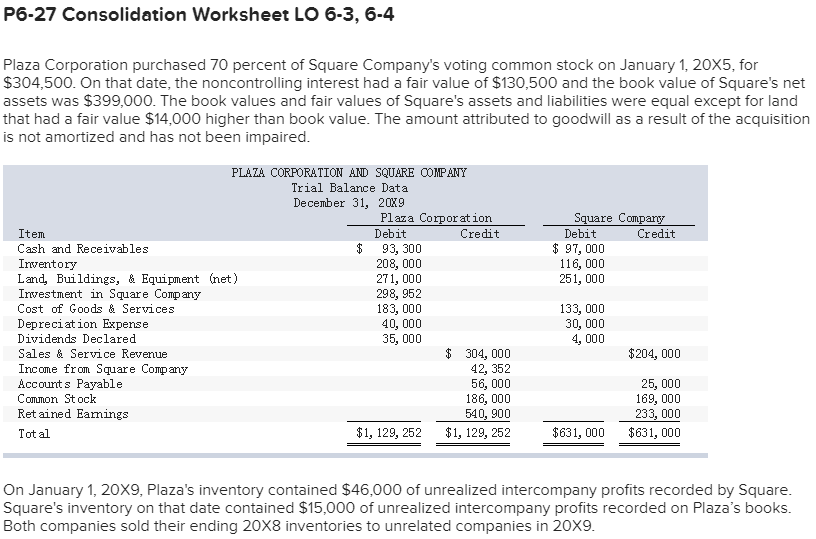

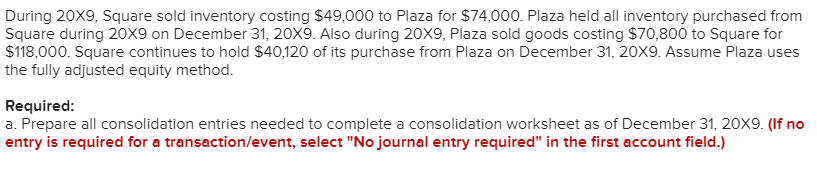

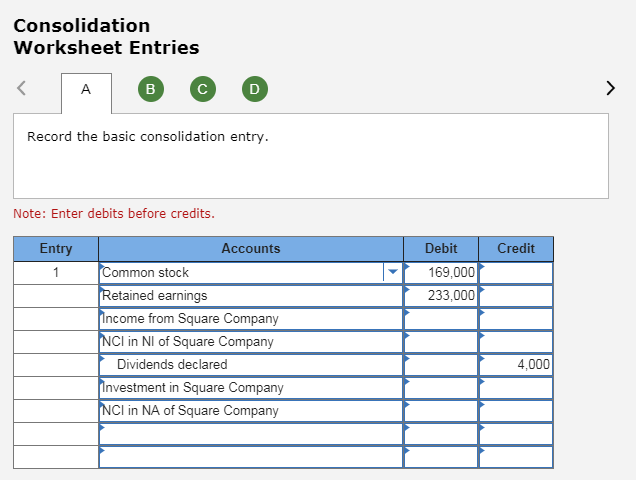

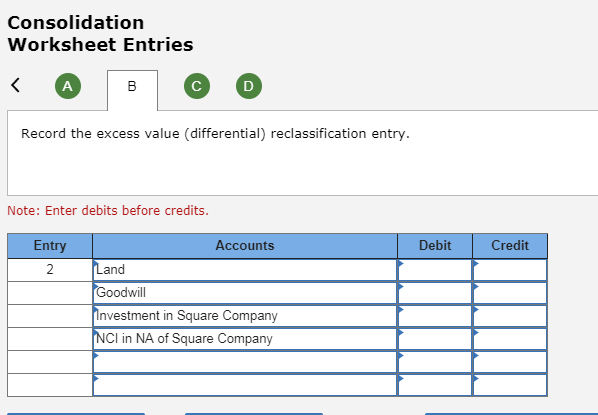

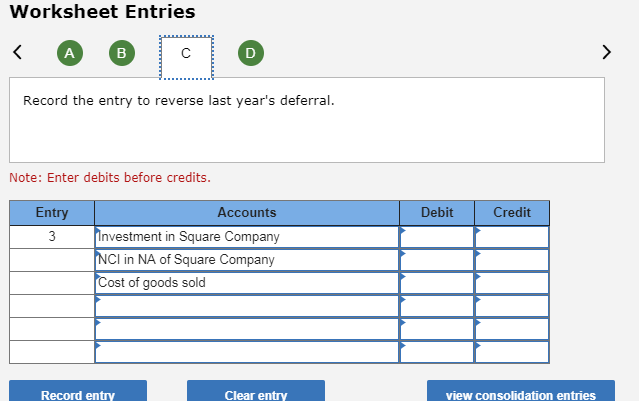

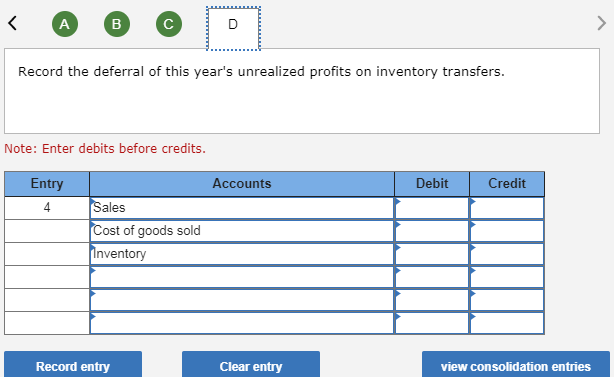

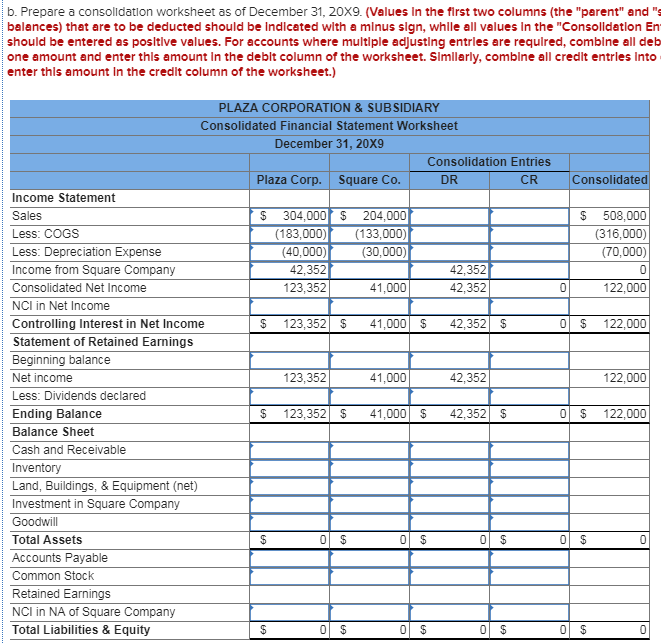

P6-27 Consolidation Worksheet LO 6-3, 6-4 Plaza Corporation purchased 70 percent of Square Company's voting common stock on January 1, 20x5, for $304,500. On that date, the noncontrolling interest had a fair value of $130,500 and the book value of Square's net assets was $399,000. The book values and fair values of Square's assets and liabilities were equal except for land that had a fair value $14,000 higher than book value. The amount attributed to goodwill as a result of the acquisition is not amortized and has not been impaired PLATA CORPORATION AND SQUARE COMPANY Trial Balance Data December 31, 20X9 Plaza Corpor ation Debit 93, 300 208, 000 271, 000 298, 952 183, 000 quare Comp Debit 97, 000 116, 000 251, 000 Item Cash and Receivables Irwentory Land, Buildings, & Equipment (net) Irvestment in Square Comp any Cost of Goods & Services Depreciation Expense Dividends Declared Sales & Service Revenue ncome Trom Sqiare Comp anny Account s Payable Common Stock Ret ained Eanings Tot al Credit Credit $ 133, 000 30, 000 40, 000 35, 000 4, 000 304, 000 42, 352 56, 000 186, 000 540, 900 $1,129, 252 $204, 000 25, 000 169, 000 233, 000 $631, 000 $1, 129, 252 $631, 000 On January 1, 20X9, Plaza's inventory contained $46,000 of unrealized intercompany profits recorded by Square Square's inventory on that date contained $15,000 of unrealized intercompany profits recorded on Plaza's books. Both companies sold their ending 20X8 inventories to unrelated companies in 20x9 During 20X9, Square sold inventory costing $49,000 to Plaza for $74,000. Plaza held all inventory purchased from Square during 20X9 on December 31, 20X9. Also during 20X9, Plaza sold goods costing $70,800 to Square for $118,000. Square continues to hold $40,120 of its purchase from Plaza on December 31, 20X9. Assume Plaza uses the fully adjusted equity method. Required a. Prepare all consolidation entries needed to complete a consolidation worksheet as of December 31, 20X9. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Consolidation Worksheet Entries Record the basic consolidation entry Note: Enter debits before credits. Entry Accounts Debit 169,000 233,000 Credit Common stock Retained earnings ncome from Square Company NCI in NI of Square Company Dividends declared nvestment in Square Company NCI in NA of Square Company 4,000 Consolidation Worksheet Entries Record the excess value (differential) reclassification entry Note: Enter debits before credits. Entry Accounts Debit Credit Land Goodwill nvestment in Square Company NCI in NA of Square Company Worksheet Entries Record the entry to reverse last year's deferral. Note: Enter debits before credits. Entry Accounts Debit Credit Investment in Square Company NCI in NA of Square Company Cost of goods sold Record entry Clear entry view consolidation entries Record the deferral of this year's unrealized profits on inventory transfers Note: Enter debits before credits. Entry Accounts Debit Credit Sales Cost of goods sold Inventory 4 Record entry Clear entry view consolidation entries b. Prepare a consolidation worksheet as of December 31, 20X9. (Values In the first two columns (the "parent" and "s balances) that are to be deducted should be Indicated wlth a minus sign, whle all values In the "Consolidation En should be entered as posltive values. For accounts where multlple adjusting entrles are required, comblne all deb one amount and enter this amount In the deblt column of the worksheet. Simllarly, combine all credit entrles Into enter this amount In the credit column of the worksheet.) PLAZA CORPORATION &SUBSIDIA Consolidated Financial Statement Worksheet December 31, 20X9 Consolidation Entries Plaza Corp. Square Co. DR CR Consolidated Income Statement Sales Less: COGS Less. Depreciation Expense Income from Square Company Consolidated Net Income NCI in Net Income Controlling Interest in Net Income Statement of Retained Earnings Beginning balance Net income Less: Dividends declared Ending Balance Balance Sheet Cash and Receivable Inventory Land, Buildings, & Equipment (net) Investment in Square Company Goodwil Total Assets Accounts Payable Common Stock Retained Earnings NCI in NA of Square Company Total Liabilities & Equity (183,000) (133,000) (30,000) $ 508,000 (316,000) (70,000) (40,000) 42,352 123,352 42,352 42,352 41,000 122,000 $123,352 $ 41,000$42,352 $ O 122,000 123,352 41,000 42,352 122,000 $ 123,352$ 41,000$ 42,352 $ 0 $ 122,000 0 $ 0 $ 0 $ 0 $ O $ O $ O $ O $