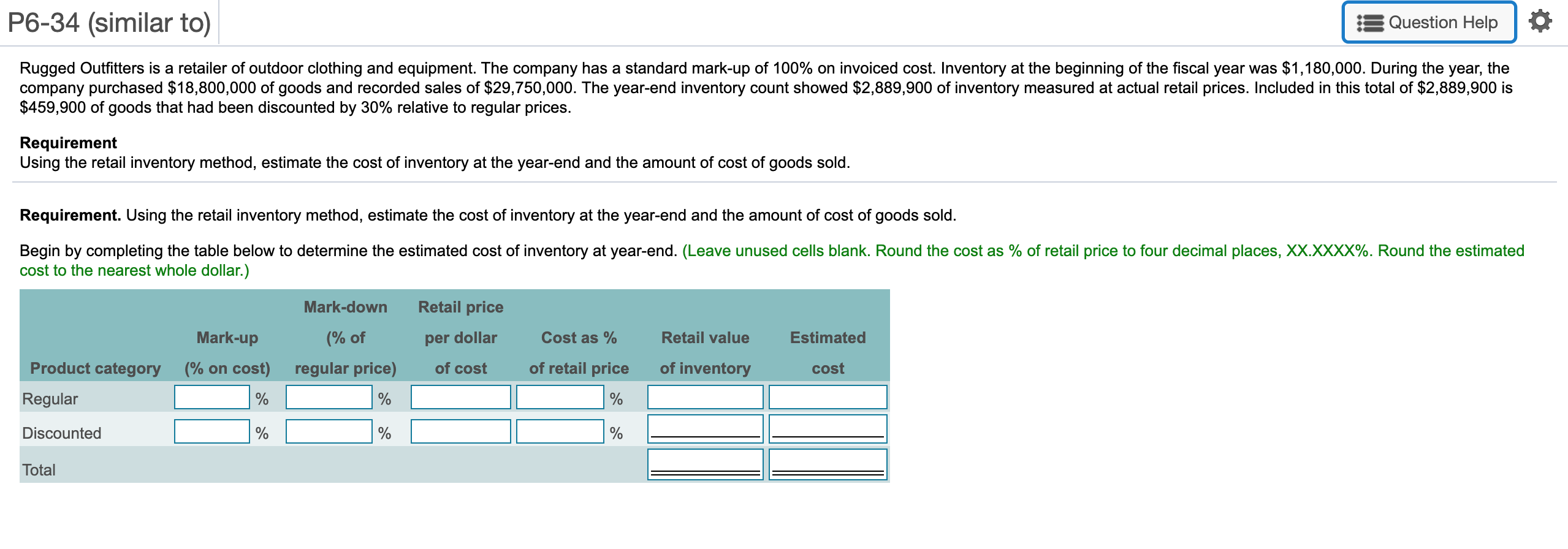

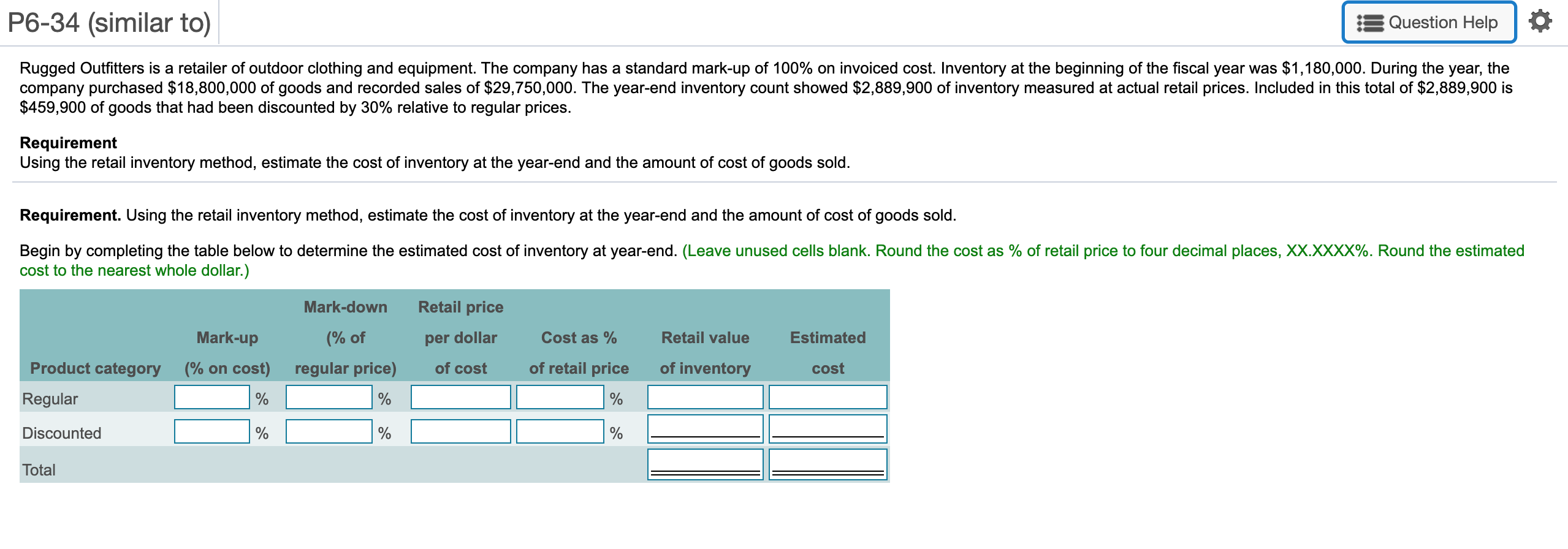

P6-34 (similar to) Question Help Rugged Outfitters is a retailer of outdoor clothing and equipment. The company has a standard mark-up of 100% on invoiced cost. Inventory at the beginning of the fiscal year was $1,180,000. During the year, the company purchased $18,800,000 of goods and recorded sales of $29,750,000. The year-end inventory count showed $2,889,900 of inventory measured at actual retail prices. Included in this total of $2,889,900 is $459,900 of goods that had been discounted by 30% relative to regular prices. Requirement Using the retail inventory method, estimate the cost of inventory at the year-end and the amount of cost of goods sold. Requirement. Using the retail inventory method, estimate the cost of inventory at the year-end and the amount of cost of goods sold. Begin by completing the table below to determine the estimated cost of inventory at year-end. (Leave unused cells blank. Round the cost as % of retail price to four decimal places, XX.XXXX%. Round the estimated cost to the nearest whole dollar.) Mark-down Retail price Mark-up (% of per dollar Cost as % Retail value Estimated (% on cost regular price) of cost of retail price of inventory cost Product category Regular Discounted % D % D % D D % Total P6-34 (similar to) Question Help Rugged Outfitters is a retailer of outdoor clothing and equipment. The company has a standard mark-up of 100% on invoiced cost. Inventory at the beginning of the fiscal year was $1,180,000. During the year, the company purchased $18,800,000 of goods and recorded sales of $29,750,000. The year-end inventory count showed $2,889,900 of inventory measured at actual retail prices. Included in this total of $2,889,900 is $459,900 of goods that had been discounted by 30% relative to regular prices. Requirement Using the retail inventory method, estimate the cost of inventory at the year-end and the amount of cost of goods sold. Requirement. Using the retail inventory method, estimate the cost of inventory at the year-end and the amount of cost of goods sold. Begin by completing the table below to determine the estimated cost of inventory at year-end. (Leave unused cells blank. Round the cost as % of retail price to four decimal places, XX.XXXX%. Round the estimated cost to the nearest whole dollar.) Mark-down Retail price Mark-up (% of per dollar Cost as % Retail value Estimated (% on cost regular price) of cost of retail price of inventory cost Product category Regular Discounted % D % D % D D % Total