Answered step by step

Verified Expert Solution

Question

1 Approved Answer

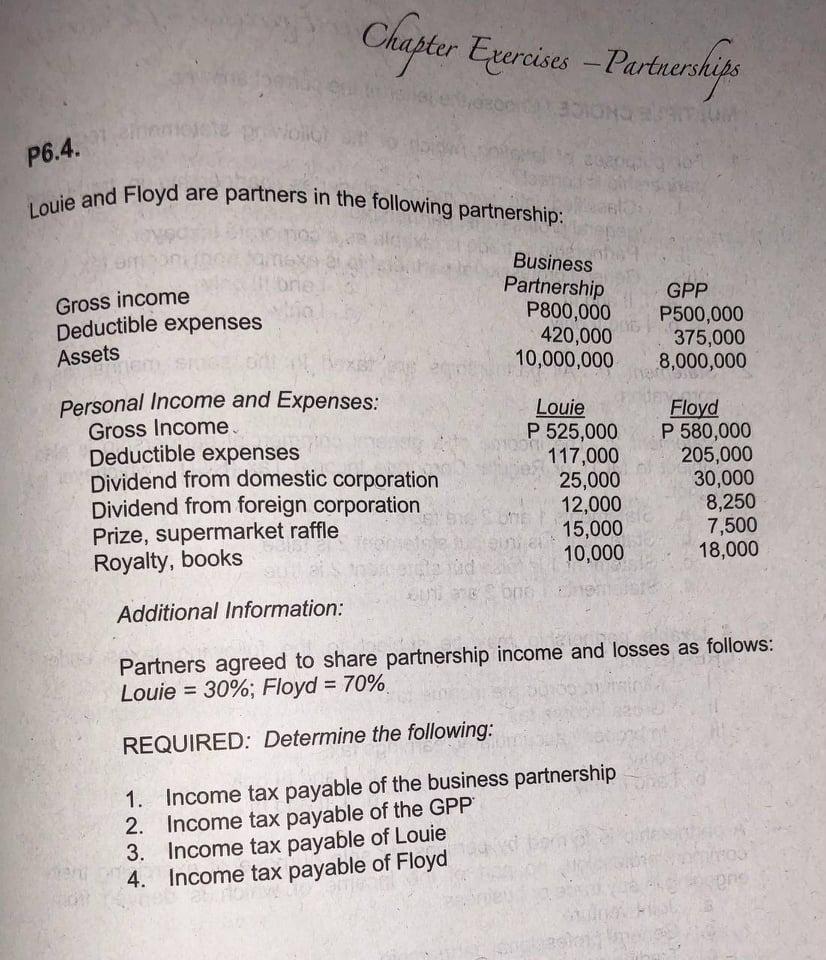

P6.4. Cop Louie and Floyd are partners in the following partnership: 1000 mexa It brie bia Gross income Deductible expenses Assets Chapter Exercises -Partnerships

P6.4. Cop Louie and Floyd are partners in the following partnership: 1000 mexa It brie bia Gross income Deductible expenses Assets Chapter Exercises -Partnerships Sezon BOTONG TUM 3010 tend Personal Income and Expenses: Gross Income. Deductible expenses Dividend from domestic corporation Dividend from foreign corporation Prize, supermarket raffle Royalty, books Business Partnership P800,000 420,000 10,000,000 1. 2. 3. Income tax payable of Louie 4. Income tax payable of Floyd Louie P 525,000 117,000 ST COME Suar id niebne 25,000 12,000 15,000 10,000 GPP P500,000 375,000 8,000,000 Floyd P 580,000 205,000 30,000 8,250 7,500 18,000 Additional Information: Partners agreed to share partnership income and losses as follows: Louie = 30%; Floyd = 70% REQUIRED: Determine the following: Income tax payable of the business partnership Income tax payable of the GPP colony kmenes ene

Step by Step Solution

There are 3 Steps involved in it

Step: 1

problema 50 kil RALE VGS VD 18V VGS Vin VDD18V Max ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started