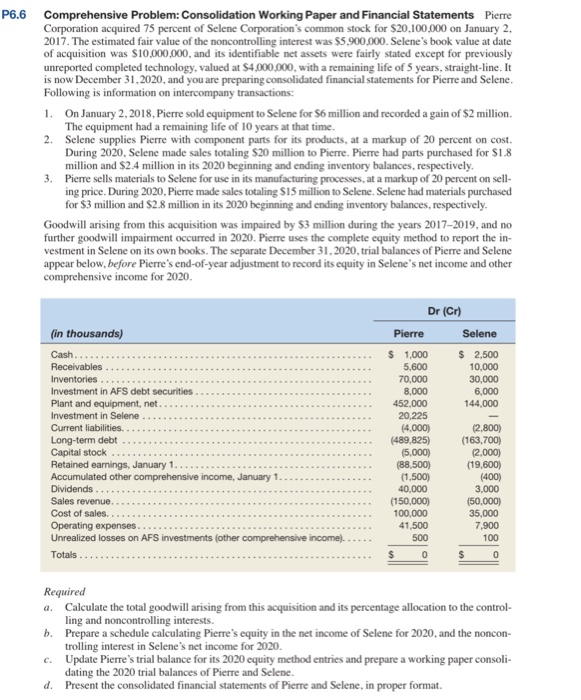

P6.6 Comprehensive Problem: Consolidation Working Paper and Financial Statements Corporation acquired 75 percent of Selene Corporation's common stock for $20,100,000 on January 2 2017. The estimated fair value of the noncontrolling interest was $5,900,000. Selene's book value at date of acquisition was $10,000,000, and its identifiable net assets were fairly stated except for previously unreported completed technology, valued at S4,000,000, with a remaining life of 5 years, straight-line. It is now December 31,2020, and you are preparing consolidated financial statements for Pierre and Selene Following is information on intercompany transactions: Pierre 1. On January 2,2018, Pierre sold equipment to Selene for $6 million and recorded a gain of $2 million The equipment had a remaining life of 10 years at that time. 2. Selene supplies Pierre with component parts for its products, at a markup of 20 percent on cost During 2020, Selene made sales totaling $20 million to Pierre. Pierre had parts purchased for $1.8 million and $2.4 million in its 2020 beginning and ending inventory balances, respectively. 3. Pierre sells materials to Selene for use in its manufacturing processes, at a markup of 20 percent on sell- ing price. During 2020, Pierre made sales totaling $15 million to Selene. Selene had materials purchased for $3 million and $2.8 million in its 2020 beginning and ending inventory balances, respectively. Goodwill arising from this acquisition was impaired by $3 million during the years 2017-2019, and no further goodwill impairment occurred in 2020. Pierre uses the complete equity method to report the in- vestment in Selene on its own books. The separate December 31,2020, trial balances of Pierre and Selene appear below, before Pierre's end-of-year adjustment to record its equity in Selene's net income and other comprehensive income for 2020 Dr (Cr) (in thousands) Selene Cash S 1,000 5,600 $ 2,500 0,000 30,000 6,000 44,000 Plant and equipment, net Investment in Selene Current liabilities. Long-term debt Capital stock Retained eanings, January 1 Accumulated other comprehensive income, January 1 8,000 452.000 20,225 4,000) 489,825) (2,800) (5,000) (163,700) (19,600) (400) 3,000 50,000) 35,000 7,900 100 (2,000) (88,500) (1,500) Sales revenue Cost of sales. (150,000) 100,000 41,500 500 Unrealized losses on AFS investments (other comprehensive income). Totals Required a. Calculate the total goodwill arising from this acquisition and its percentage allocation to the control- b. Prepare a schedule calculating Pierre's equity in the net income of Selene for 2020, and the noncon- c. Update Pierre's trial balance for its 2020 equity method entries and prepare a working paper consoli- d. Present the consolidated financial statements of Pierre and Selene, in proper format ling and noncontrolling interests trolling interest in Selene's net income for 2020. dating the 2020 trial balances of Pierre and Selene