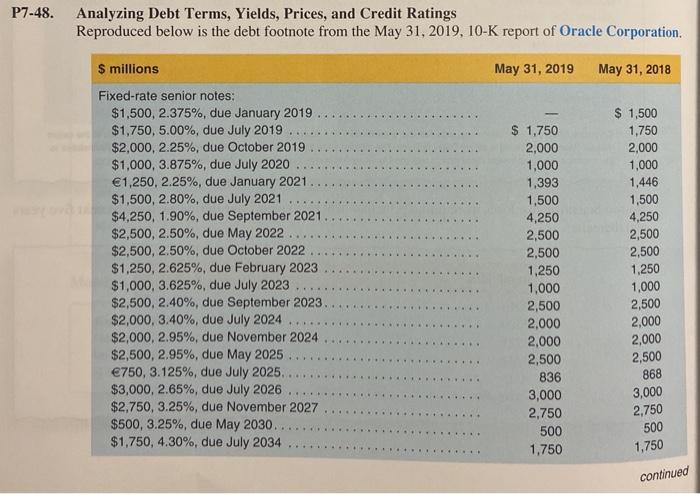

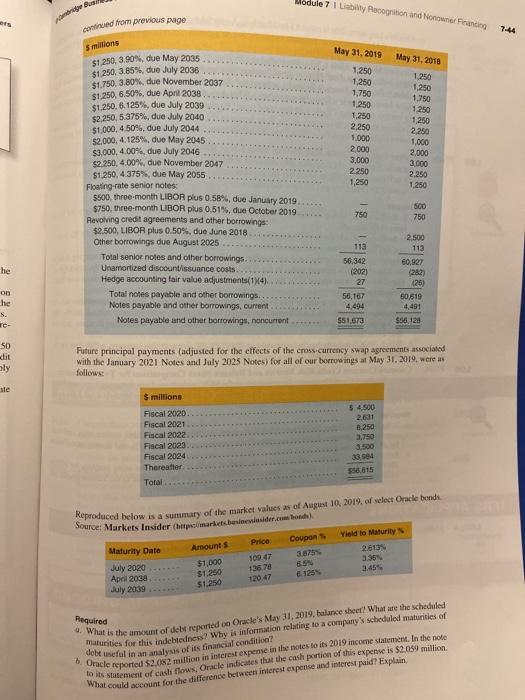

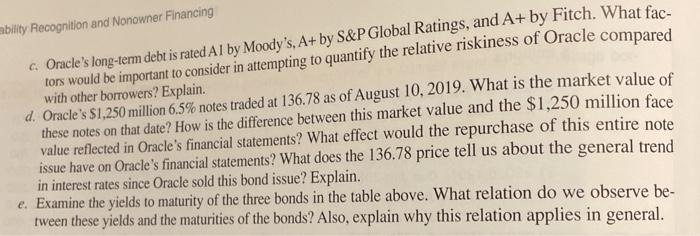

P7-48. Analyzing Debt Terms, Yields, Prices, and Credit Ratings Reproduced below is the debt footnote from the May 31, 2019, 10-K report of Oracle Corporation. May 31, 2019 May 31, 2018 $ millions Fixed-rate senior notes: $1,500, 2.375%, due January 2019 $1,750, 5.00%, due July 2019 $2,000, 2.25%, due October 2019 $1,000, 3.875%, due July 2020 1,250, 2.25%, due January 2021 $1,500, 2.80%, due July 2021 $4,250, 1.90%, due September 2021 $2,500, 2.50%, due May 2022 $2,500, 2.50%, due October 2022 $1,250, 2.625%, due February 2023 $1,000, 3.625%, due July 2023 $2,500, 2.40%, due September 2023 $2,000, 3.40%, due July 2024 $2,000, 2.95%, due November 2024 $2,500, 2.95%, due May 2025 750, 3.125%, due July 2025, $3,000, 2.65%, due July 2026 $2,750, 3.25%, due November 2027 $500, 3.25%, due May 2030. $1,750, 4.30%, due July 2034 $ 1,750 2,000 1,000 1,393 1,500 4,250 2,500 2,500 1.250 1,000 2,500 2,000 2,000 2,500 $ 1,500 1,750 2,000 1,000 1,446 1,500 4,250 2,500 2,500 1.250 1,000 2,500 2,000 2,000 836 3,000 2,750 500 1,750 2,500 868 3,000 2,750 500 1,750 continued Module 71 abaty Recognition and onowe Francing contred from previous page smilions May 31, 2019 1250 1,250 1,750 1250 1.250 2.250 1.000 2,000 3,000 2250 1,250 May 31, 2018 1.250 1250 1.750 1250 1,250 2,250 1,000 2.000 2.250 1.250 $1.250, 3.90%, due May 2035 $1.250, 3.85% due July 2038 $1.750, 3.80% due November 2037 $1.250, 6.50%, due April 2038 $1.250, 6.125%, due July 2039 $2.250, 5.375%, due July 2040 $1,000, 450%, due July 2044 $2,000, 4.125%, duo May 2045 $3,000, 400%, due July 2046 $2.250, 400%, due November 2047 $1,250, 4.375%, due May 2055 Floating rate senior notes: 5500, three-month LIBOR plus 0.58%, due January 2019 $750, three-month LIBOR plus 0.51%, due October 2019 Revolving credit agreements and other borrowings: $2.500, LIBOR plus 0.50%, due June 2018 Other borrowings due August 2025 Total senior notes and other borrowings Unamortized discount/issuance costs Hedge accounting fair value adjustments (14) Total notes payable and other borrowings Notes payable and other borrowings, current Notes payable and other borrowings, noncurrent 750 500 750 he 113 56,342 (202) 27 56.167 4494 $51.673 2,500 113 60,927 (282) (25) 50519 on he S. re- $56,128 50 dit aly Future principal payments adjusted for the effects of the cross-currency swap agreements associated with the January 2021 Notes and July 2025 Notes) for all of our borrowings at May 31, 2019, were as follows: ste $ millions Fiscal 2020 Fiscal 2021 Fiscal 2022 Fiscal 2023 Fiscal 2024 Thereafter Total 5 4.500 2.631 8.250 2.750 3.500 33.994 556.615 Reproduced below is a summary of the market values as of August 10, 2019. of select Oracle bonds Source: Markets Insider (http:/marketsheder.com Price Coupons Yield to Maturity 2613 Amounts $1,000 Maturity Date July 2020 April 2038 July 2039 109.47 13678 120 47 3:45 125 $1,250 Required 9. What is the amount of debt reported on Oracle's May 1, 2019, balance sheet? What are the scheduled Maturities for this indebtedness? Why is information relating to a company's scheduled maturities of debt useful in an analyses of its financial condition? Oracle reported $20 million in interest expense in the notes to its 2019 income statement. In the note to its statement of cash flows, Oracle indicates that the cash portion of this expense is $2.059 million What could account for the difference between interest expense and interest paid? Explain, mbility Recognition and Nonowner Financing c. Oracle's long-term debt is rated A1 by Moody's, A+ by S&P Global Ratings, and A+ by Fitch. What fac- tors would be important to consider in attempting to quantify the relative riskiness of Oracle compared d. Oracle's $1,250 million 6.5% notes traded at 136.78 as of August 10, 2019. What is the market value of these notes on that date? How is the difference between this market value and the $1,250 million face value reflected in Oracle's financial statements? What effect would the repurchase of this entire note issue have on Oracle's financial statements? What does the 136.78 price tell us about the general trend in interest rates since Oracle sold this bond issue? Explain. e. Examine the yields to maturity of the three bonds in the table above. What relation do we observe be- tween these yields and the maturities of the bonds? Also, explain why this relation applies in general. P7-48. Analyzing Debt Terms, Yields, Prices, and Credit Ratings Reproduced below is the debt footnote from the May 31, 2019, 10-K report of Oracle Corporation. May 31, 2019 May 31, 2018 $ millions Fixed-rate senior notes: $1,500, 2.375%, due January 2019 $1,750, 5.00%, due July 2019 $2,000, 2.25%, due October 2019 $1,000, 3.875%, due July 2020 1,250, 2.25%, due January 2021 $1,500, 2.80%, due July 2021 $4,250, 1.90%, due September 2021 $2,500, 2.50%, due May 2022 $2,500, 2.50%, due October 2022 $1,250, 2.625%, due February 2023 $1,000, 3.625%, due July 2023 $2,500, 2.40%, due September 2023 $2,000, 3.40%, due July 2024 $2,000, 2.95%, due November 2024 $2,500, 2.95%, due May 2025 750, 3.125%, due July 2025, $3,000, 2.65%, due July 2026 $2,750, 3.25%, due November 2027 $500, 3.25%, due May 2030. $1,750, 4.30%, due July 2034 $ 1,750 2,000 1,000 1,393 1,500 4,250 2,500 2,500 1.250 1,000 2,500 2,000 2,000 2,500 $ 1,500 1,750 2,000 1,000 1,446 1,500 4,250 2,500 2,500 1.250 1,000 2,500 2,000 2,000 836 3,000 2,750 500 1,750 2,500 868 3,000 2,750 500 1,750 continued Module 71 abaty Recognition and onowe Francing contred from previous page smilions May 31, 2019 1250 1,250 1,750 1250 1.250 2.250 1.000 2,000 3,000 2250 1,250 May 31, 2018 1.250 1250 1.750 1250 1,250 2,250 1,000 2.000 2.250 1.250 $1.250, 3.90%, due May 2035 $1.250, 3.85% due July 2038 $1.750, 3.80% due November 2037 $1.250, 6.50%, due April 2038 $1.250, 6.125%, due July 2039 $2.250, 5.375%, due July 2040 $1,000, 450%, due July 2044 $2,000, 4.125%, duo May 2045 $3,000, 400%, due July 2046 $2.250, 400%, due November 2047 $1,250, 4.375%, due May 2055 Floating rate senior notes: 5500, three-month LIBOR plus 0.58%, due January 2019 $750, three-month LIBOR plus 0.51%, due October 2019 Revolving credit agreements and other borrowings: $2.500, LIBOR plus 0.50%, due June 2018 Other borrowings due August 2025 Total senior notes and other borrowings Unamortized discount/issuance costs Hedge accounting fair value adjustments (14) Total notes payable and other borrowings Notes payable and other borrowings, current Notes payable and other borrowings, noncurrent 750 500 750 he 113 56,342 (202) 27 56.167 4494 $51.673 2,500 113 60,927 (282) (25) 50519 on he S. re- $56,128 50 dit aly Future principal payments adjusted for the effects of the cross-currency swap agreements associated with the January 2021 Notes and July 2025 Notes) for all of our borrowings at May 31, 2019, were as follows: ste $ millions Fiscal 2020 Fiscal 2021 Fiscal 2022 Fiscal 2023 Fiscal 2024 Thereafter Total 5 4.500 2.631 8.250 2.750 3.500 33.994 556.615 Reproduced below is a summary of the market values as of August 10, 2019. of select Oracle bonds Source: Markets Insider (http:/marketsheder.com Price Coupons Yield to Maturity 2613 Amounts $1,000 Maturity Date July 2020 April 2038 July 2039 109.47 13678 120 47 3:45 125 $1,250 Required 9. What is the amount of debt reported on Oracle's May 1, 2019, balance sheet? What are the scheduled Maturities for this indebtedness? Why is information relating to a company's scheduled maturities of debt useful in an analyses of its financial condition? Oracle reported $20 million in interest expense in the notes to its 2019 income statement. In the note to its statement of cash flows, Oracle indicates that the cash portion of this expense is $2.059 million What could account for the difference between interest expense and interest paid? Explain, mbility Recognition and Nonowner Financing c. Oracle's long-term debt is rated A1 by Moody's, A+ by S&P Global Ratings, and A+ by Fitch. What fac- tors would be important to consider in attempting to quantify the relative riskiness of Oracle compared d. Oracle's $1,250 million 6.5% notes traded at 136.78 as of August 10, 2019. What is the market value of these notes on that date? How is the difference between this market value and the $1,250 million face value reflected in Oracle's financial statements? What effect would the repurchase of this entire note issue have on Oracle's financial statements? What does the 136.78 price tell us about the general trend in interest rates since Oracle sold this bond issue? Explain. e. Examine the yields to maturity of the three bonds in the table above. What relation do we observe be- tween these yields and the maturities of the bonds? Also, explain why this relation applies in general