P8-7 (Algo) Determining Financial Statement Effects of Deferred Revenues LO8-1

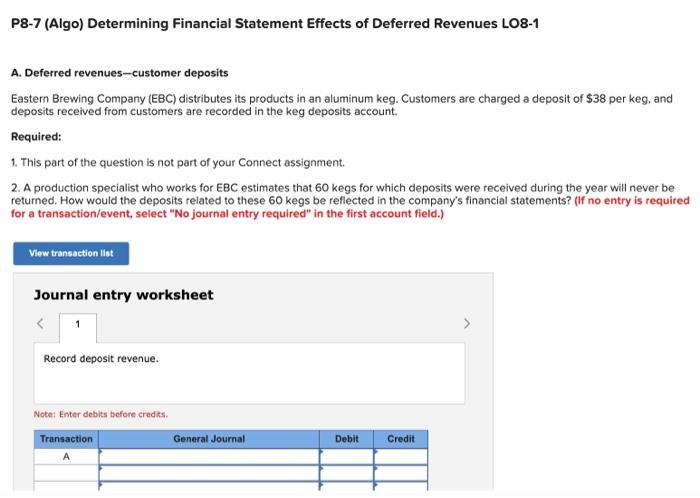

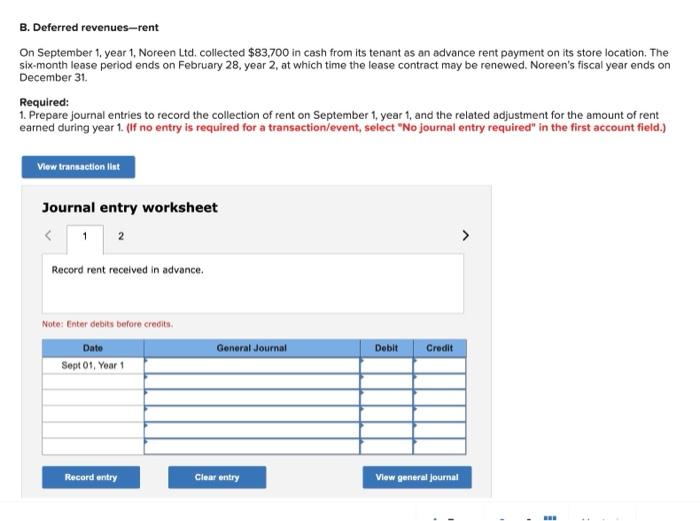

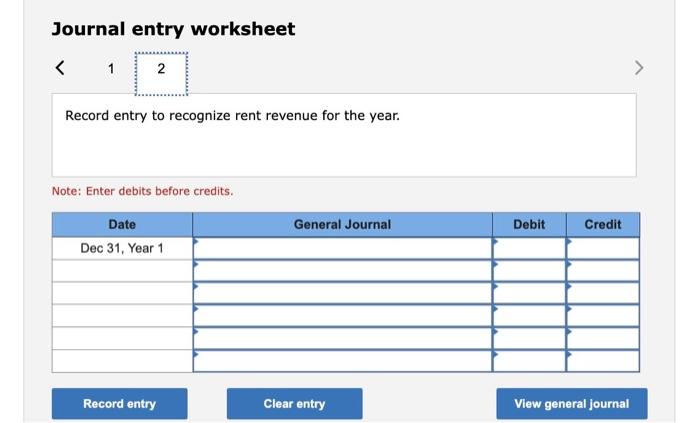

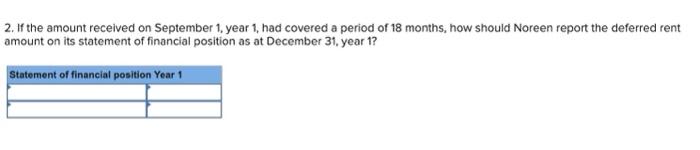

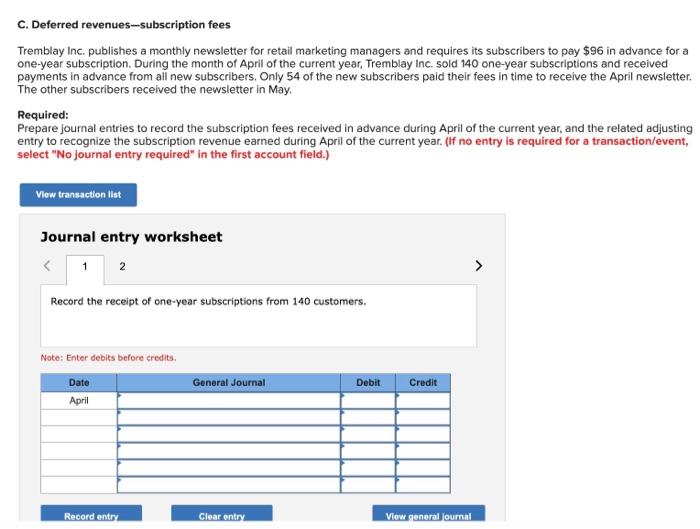

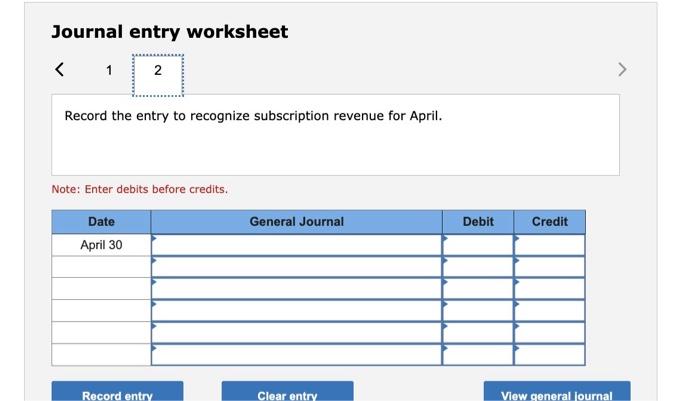

P8-7 (Algo) Determining Financial Statement Effects of Deferred Revenues LO8-1 A. Deferred revenues-customer deposits Eastern Brewing Company (EBC) distributes its products in an aluminum keg. Customers are charged a deposit of $38 per keg, and deposits received from customers are recorded in the keg deposits account. Required: 1. This part of the question is not part of your Connect assignment. 2. A production specialist who works for EBC estimates that 60 kegs for which deposits were received during the year will never be returned. How would the deposits related to these 60 kegs be reflected in the company's financial statements? (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) B. Deferred revenues-rent On September 1, year 1, Noreen Ltd. collected $83,700 in cash from its tenant as an advance rent payment on its store location. The six-month lease period ends on February 28, year 2, at which time the lease contract may be renewed. Noreen's fiscal year ends on December 31 . Required: 1. Prepare journal entries to record the collection of rent on September 1 , year 1 , and the related adjustment for the amount of rent earned during year 1. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Journal entry worksheet Record entry to recognize rent revenue for the year. Note: Enter debits before credits. 2. If the amount received on September 1, year 1, had covered a period of 18 months, how should Noreen report the deferred rent amount on its statement of financial position as at December 31, year 1? C. Deferred revenues-subscription fees Tremblay Inc. publishes a monthly newsletter for retail marketing managers and requires its subscribers to pay $96 in advance for a one-year subscription. During the month of April of the current year, Tremblay Inc. sold 140 one-year subscriptions and received payments in advance from all new subscribers. Only 54 of the new subscribers paid their fees in time to receive the April newsletter. The other subscribers recelved the newsletter in May. Required: Prepare journal entries to record the subscription fees received in advance during April of the current year, and the related adjusting entry to recognize the subscription revenue earned during April of the current year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the receipt of one-year subscriptions from 140 customers. Note: Enter debits before credits. Journal entry worksheet Record the entry to recognize subscription revenue for April. Note: Enter debits before credits