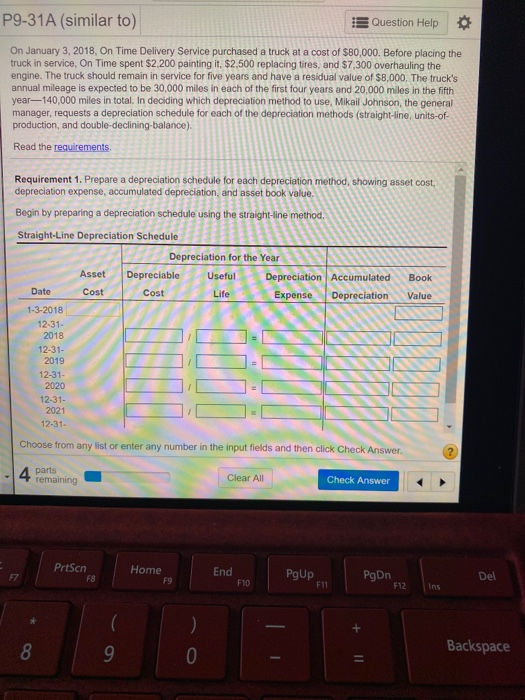

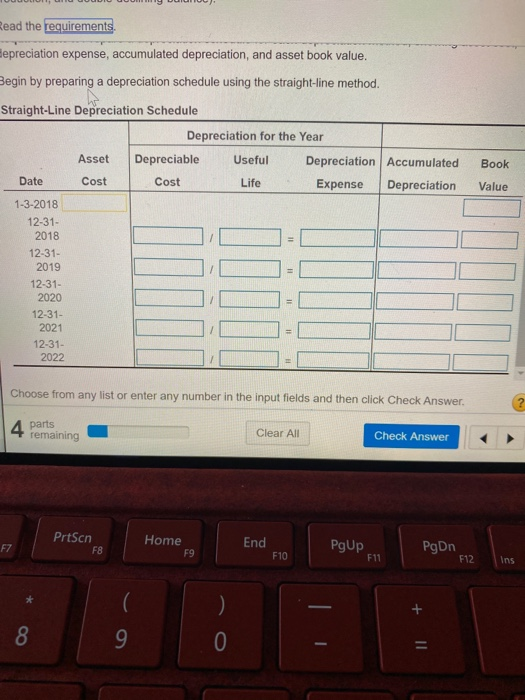

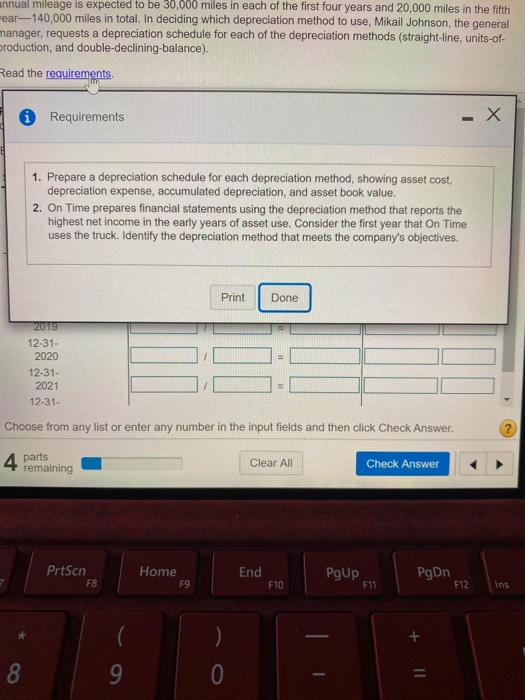

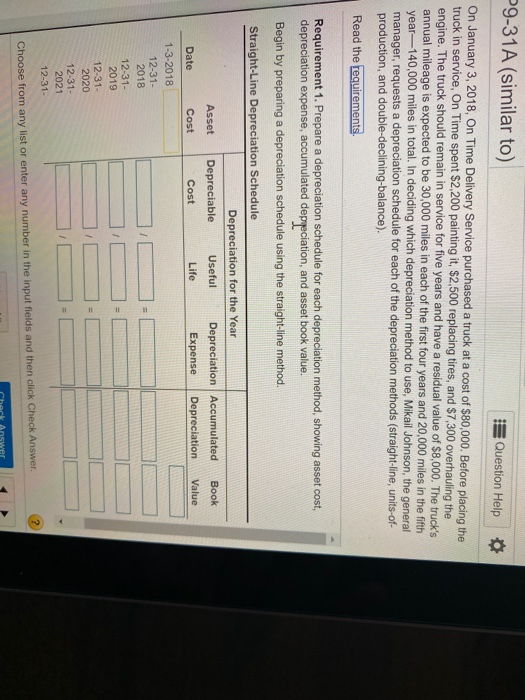

P9-31A (similar to) Question Help On January 3, 2018, On Time Delivery Service purchased a truck at a cost of $80,000. Before placing the truck in service, On Time spent $2.200 painting it, $2,500 replacing tires, and $7,300 overhauling the engine. The truck should remain in service for five years and have a residual value of $8,000. The truck's annual mileage is expected to be 30,000 miles in each of the first four years and 20,000 miles in the fifth year-140,000 miles in total. In deciding which depreciation method to use, Mikail Johnson, the general manager, requests a depreciation schedule for each of the depreciation methods (straight-line, units-of- production, and double-declining-balance). Read the requirements Requirement 1. Prepare a depreciation schedule for each depreciation method, showing asset cost, depreciation expense, accumulated depreciation and asset book value. Begin by preparing a depreciation schedule using the straight-line method. Straight-Line Depreciation Schedule Depreciation for the Year Asset Depreciable Useful Depreciation Accumulated Book Date Cost Cost Life Expense Depreciation Value 1-3-2018 12-31. 2018 -12-31- 2019 12-31- 2020 12-31- Choose from any list or enter any number in the input fields and then click Check Answer. A parts 4 remaining Check Answer Presen, PrtScn Home Home | End no End PSUP on I Pyon z lini Pg UP an PgDn 412 Del FB Del Backspace ead the requirements epreciation expense, accumulated depreciation, and asset book value. egin by preparing a depreciation schedule using the straight-line method. Book Value Straight-Line Depreciation Schedule Depreciation for the Year Asset Depreciable Useful Depreciation Accumulated Date Cost Cost Life Expense Depreciation 1-3-2018 12-31 2018 12-31- 2019 12-31- 2020 12-31- 2021 12-31- 2022 Choose from any list or enter any number in the input fields and then click Check Answer. 4 parts 4 remaining Clear All Check Answer PrtScn Home End PgUP PgDn F10 FIT 512 ins innual mileage is expected to be 30,000 miles in each of the first four years and 20,000 miles in the fifth ear--140,000 miles in total, in deciding which depreciation method to use, Mikail Johnson, the general manager, requests a depreciation schedule for each of the depreciation methods (straight-line, units-of- production, and double-declining-balance). Read the requirements * Requirements 1. Prepare a depreciation schedule for each depreciation method, showing asset cost, depreciation expense, accumulated depreciation, and asset book value. 2. On Time prepares financial statements using the depreciation method that reports the highest net income in the early years of asset use. Consider the first year that On Time uses the truck. Identify the depreciation method that meets the company's objectives. Print [Done] Print 2019 12-31- 2020 12-31- 2021 12-31- Choose from any list or enter any number in the input fields and then click Check Answer. 4 parts Clear All Check Answer remaining - Prisen Pitsch FB | Home Home. | End Aro | PgUP A End FIO POUP FHD 1 PgDin A2 ling pgo 512 ins P9-31A (similar to) Question Help On January 3, 2018, On Time Delivery Service purchased a truck at a cost of $80,000. Before placing the truck in service, On Time spent $2,200 painting it, $2,500 replacing tires, and $7,300 overhauling the engine. The truck should remain in service for five years and have a residual value of $8,000. The truck's annual mileage is expected to be 30,000 miles in each of the first four years and 20,000 miles in the fifth year-140,000 miles in total. In deciding which depreciation method to use, Mikail Johnson, the general manager, requests a depreciation schedule for each of the depreciation methods (straight-line, units-of- production, and double-declining-balance). Read the requirements Requirement 1. Prepare a depreciation schedule for each depreciation method, showing asset cost, depreciation expense, accumulated depreciation, and asset book value. Begin by preparing a depreciation schedule using the straight-line method. Straight-Line Depreciation Schedule Depreciation for the Year Asset Depreciable Useful Depreciation Accumulated Book Date Cost Cost Life Expense Depreciation Value 1-3-2018 12-31- 2018 12-31- 2019 12-31- 2020 12-31- 2021 12-31- 1 Choose from any list or enter any number in the input fields and then click Check Answer. Check