Answered step by step

Verified Expert Solution

Question

1 Approved Answer

p9-4 nk, and to repay the lean he will make 360 mo interest) of S1,199.10 per month over the next 30 years. David can deduct

p9-4

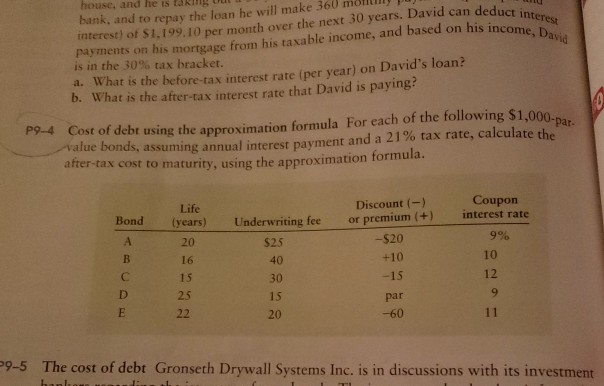

nk, and to repay the lean he will make 360 mo interest) of S1,199.10 per month over the next 30 years. David can deduct in payments on his mortgage from his taxable income, and based on his income est house, and he is ARTg uul ct inte is in the 30% tax bracket. a. What is the before-tax interest rate (per year) on David's loan? b. What is the after-tax interest rate that David is paying? P9-4 Cost of debt using the approximation formula For each of the following $1,000 -value bonds, assuming annual interest payment and a 21% tax rate, calculate the ar after-tax cost to maturity, using the approximation formula Life Discount (- Coupon ond (years) Underwriting fee or premium (+) interest rate 20 16 15 25 $25 40 30 15 20 -$20 +10 -15 par -60 996 10 12 9-5 The cost of debt Gronseth Drywall Systems Inc. is in discussions with its investmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started