Answered step by step

Verified Expert Solution

Question

1 Approved Answer

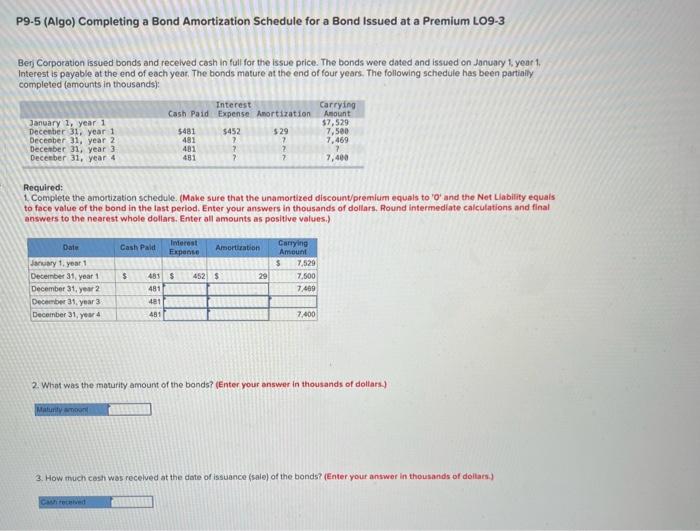

P9-5 (Algo) Completing a Bond Amortization Schedule for a Bond Issued at a Premium LO9-3 Berj Corporation issued bonds and received cash in full

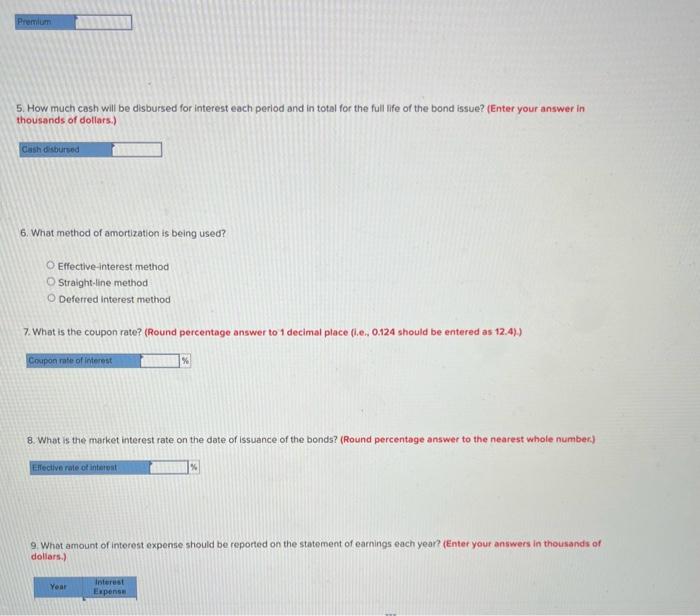

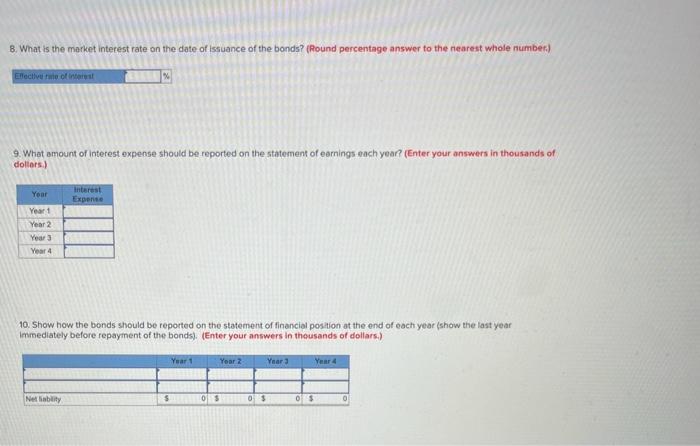

P9-5 (Algo) Completing a Bond Amortization Schedule for a Bond Issued at a Premium LO9-3 Berj Corporation issued bonds and received cash in full for the issue price. The bonds were dated and issued on January 1, year 1. Interest is payable at the end of each year. The bonds mature at the end of four years. The following schedule has been partially completed (amounts in thousands): Interest January 1, year 1 December 31, year 1 December 31, year 21 December 31, year 3 December 31, year 4 Required: Carrying Cash Paid Expense Amortization Amount $7,529 5481 481 $452 2 $29 7,500 7 481 481 ? 7 7,469 7,400 1. Complete the amortization schedule. (Make sure that the unamortized discount/premium equals to '0' and the Net Liability equals to face value of the bond in the last period. Enter your answers in thousands of dollars. Round intermediate calculations and final answers to the nearest whole dollars. Enter all amounts as positive values.) Date January 1, year 1 December 31, year 1 December 31, year 2 Cash Paid Interest Expense Amortization Carrying Amount $ 7,529 $ 481 $ 452 $ 29 7,500 481 7,489 December 31, year 3. 481 December 31, year 4 481 7,400 2. What was the maturity amount of the bands? (Enter your answer in thousands of dollars.) Maturity amount 3. How much cash was received at the date of issuance (sale) of the bonds? (Enter your answer in thousands of dollars.) Cash received Premium 5. How much cash will be disbursed for interest each period and in total for the full life of the bond issue? (Enter your answer in thousands of dollars.) Cash disbursed 6. What method of amortization is being used? O Effective-interest method O Straight-line method O Deferred interest method 7. What is the coupon rate? (Round percentage answer to 1 decimal place (i.e., 0.124 should be entered as 12.4).) Coupon rate of interest 8. What is the market interest rate on the date of issuance of the bonds? (Round percentage answer to the nearest whole number.) Effective rate of interest % 9. What amount of interest expense should be reported on the statement of earnings each year? (Enter your answers in thousands of dollars.) Year Interest Expense 8. What is the market interest rate on the date of issuance of the bonds? (Round percentage answer to the nearest whole number.) Effective rate of interest 9. What amount of interest expense should be reported on the statement of earnings each year? (Enter your answers in thousands of dollars.) Year Interest Expense Year 1 Year 2 Year 3 Year 4 10. Show how the bonds should be reported on the statement of financial position at the end of each year (show the last year Immediately before repayment of the bonds). (Enter your answers in thousands of dollars.) Year 1 Year 2 Year 3 Year 4 Net liability $ 05 0 $ 0 $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started