Answered step by step

Verified Expert Solution

Question

1 Approved Answer

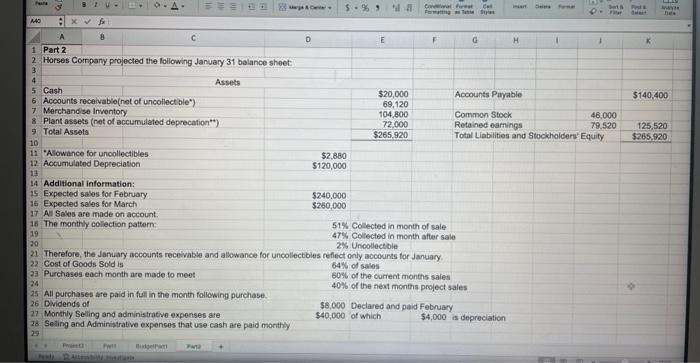

PA MO 3 :x f 8 A 1 Part 2 2 Horses Company projected the following January 31 balance sheet 3 Assets 4 5

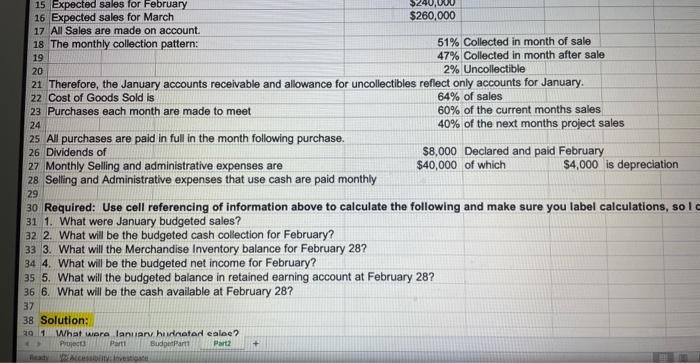

PA MO 3 :x f 8 A 1 Part 2 2 Horses Company projected the following January 31 balance sheet 3 Assets 4 5 Cash 6 Accounts receivable(net of uncollectible") 10. 11 "Allowance for uncollectibles 12 Accumulated Depreciation 7 Merchandise Inventory & Plant assets (net of accumulated deprecation") 9 Total Assets 13 14 Additional information: 15 Expected sales for February 16 Expected sales for March 17 All Sales are made on account. 18 The monthly collection pattern: 19 Penda C 27 Monthly Selling and administrative expenses are 28 Seling and Administrative expenses that use cash are paid monthly Print FERRE Pwll Budget PW12 D $ % 9 $2,880 $120,000 $240,000 $260,000 18 $20,000 69,120 104,800 72,000 $265,920 20 21 Therefore, the January accounts receivable and allowance for uncollectibles reflect only accounts for January 22 Cost of Goods Sold is 64% of sales 23 Purchases each month are made to meet 60% of the current months sales 24 40% of the next months project sales 25 All purchases are paid in full in the month following purchase. 26 Dividends of Cont C Formatting S F Accounts Payable 51% Collected in month of sale 47% Collected in month after sale 2% Uncollectible G $8,000 Declared and paid February $40,000 of which H Common Stock Retained earnings Total Liabilities and Stockholders' Equity $4,000 is depreciation 1 J Sat Fr 46,000 79,520 PH& www Des $140,400 125,520 $265,920 15 Expected sales for February 16 Expected sales for March 17 All Sales are made on account. 18 The monthly collection pattern: 19 20 21 Therefore, the January accounts receivable and allowance for uncollectibles reflect only accounts for January. 22 Cost of Goods Sold is 23 Purchases each month are made to meet 24 25 All purchases are paid in full in the month following purchase. 26 Dividends of 27 Monthly Selling and administrative expenses are 28 Selling and Administrative expenses that use cash are paid monthly 29 30 Required: Use cell referencing of information above to calculate the following and make sure you label calculations, so lo 31 1. What were January budgeted sales? Part $260,000 32 2. What will be the budgeted cash collection for February? 33 3. What will the Merchandise Inventory balance for February 28? 34 4. What will be the budgeted net income for February? 35 5. What will the budgeted balance in retained earning account at February 28? 36 6. What will be the cash available at February 28? 37 38 Solution: 20 1 What ware January hudinated ealee? Projects BudgetPart Part2 > Ready Accessibility: Investigate + 51% Collected in month of sale 47% Collected in month after sale 2% Uncollectible 64% of sales 60% of the current months sales 40% of the next months project sales $8,000 Declared and paid February $40,000 of which $4,000 is depreciation

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate the January budgeted sales we can refer to cell D2 which shows the total liabilities and stockholders equity The value in this cell rep...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started