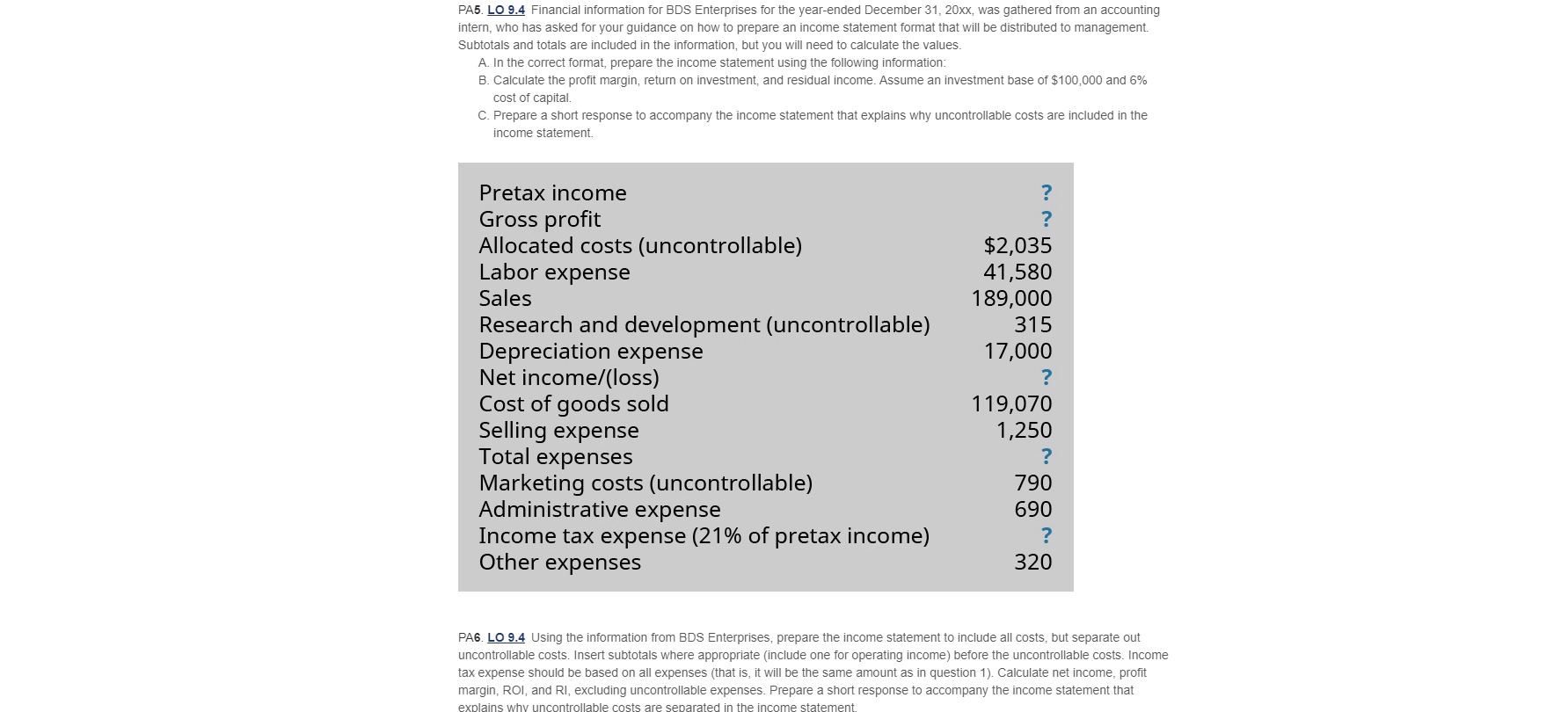

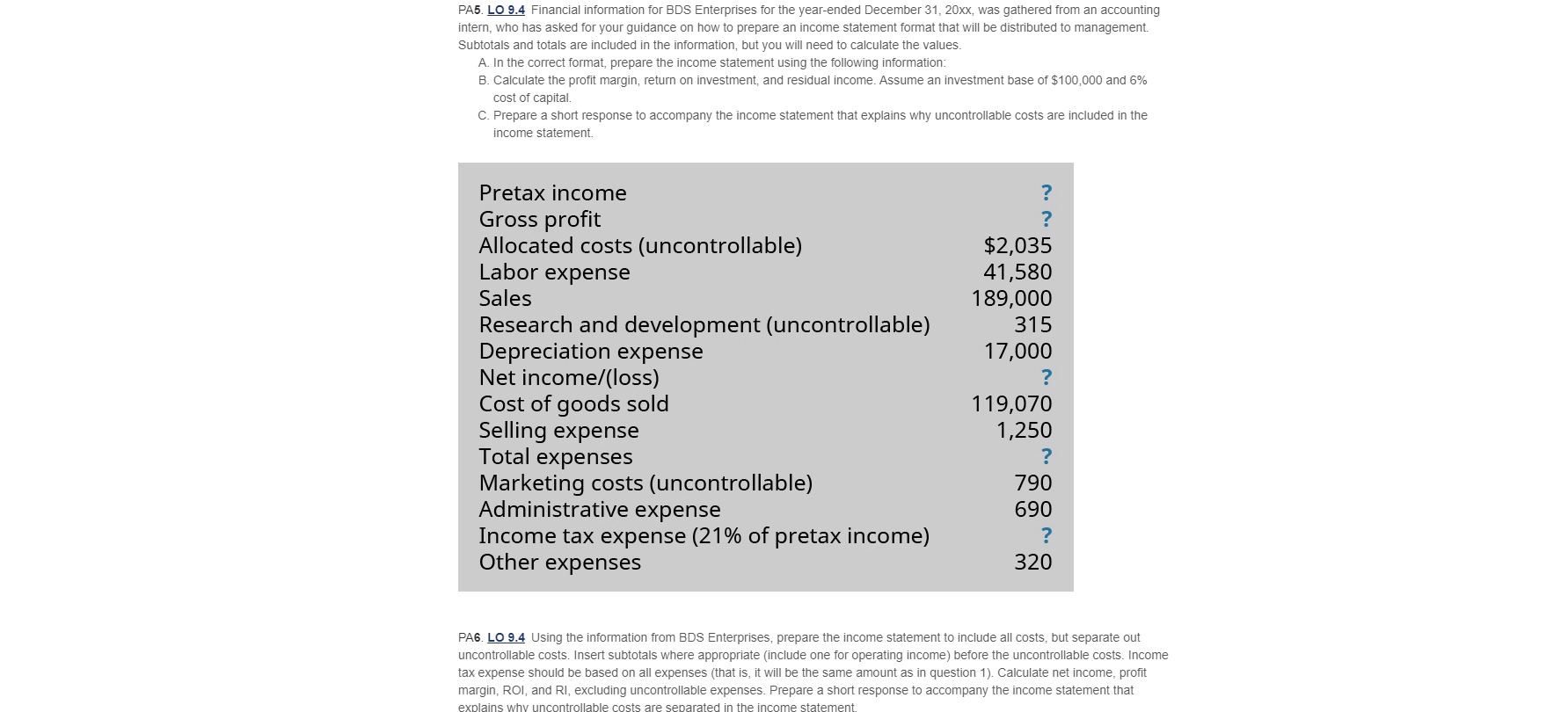

PA5. LO 9.4 Financial information for BDS Enterprises for the year-ended December 31, 20xx, was gathered from an accounting intern, who has asked for your guidance on how to prepare an income statement format that will be distributed to management. Subtotals and totals are included in the information, but you will need to calculate the values. A. In the correct format, prepare the income statement using the following information: B. Calculate the profit margin, return on investment, and residual income. Assume an investment base of $100,000 and 6% cost of capital. C. Prepare a short response to accompany the income statement that explains why uncontrollable costs are included in the income statement $2,035 41,580 189,000 315 17,000 Pretax income Gross profit Allocated costs (uncontrollable) Labor expense Sales Research and development (uncontrollable) Depreciation expense Net income/(loss) Cost of goods sold Selling expense Total expenses Marketing costs (uncontrollable) Administrative expense Income tax expense (21% of pretax income) Other expenses 119,070 1,250 790 690 320 PA6. LO 9.4 Using the information from BDS Enterprises, prepare the income statement to include all costs, but separate out uncontrollable costs. Insert subtotals where appropriate (include one for operating income) before the uncontrollable costs. Income tax expense should be based on all expenses (that is, it will be the same amount as in question 1). Calculate net income, profit margin, ROI, and RI, excluding uncontrollable expenses. Prepare a short response to accompany the income statement that explains why uncontrollable costs are separated in the income statement PA5. LO 9.4 Financial information for BDS Enterprises for the year-ended December 31, 20xx, was gathered from an accounting intern, who has asked for your guidance on how to prepare an income statement format that will be distributed to management. Subtotals and totals are included in the information, but you will need to calculate the values. A. In the correct format, prepare the income statement using the following information: B. Calculate the profit margin, return on investment, and residual income. Assume an investment base of $100,000 and 6% cost of capital. C. Prepare a short response to accompany the income statement that explains why uncontrollable costs are included in the income statement $2,035 41,580 189,000 315 17,000 Pretax income Gross profit Allocated costs (uncontrollable) Labor expense Sales Research and development (uncontrollable) Depreciation expense Net income/(loss) Cost of goods sold Selling expense Total expenses Marketing costs (uncontrollable) Administrative expense Income tax expense (21% of pretax income) Other expenses 119,070 1,250 790 690 320 PA6. LO 9.4 Using the information from BDS Enterprises, prepare the income statement to include all costs, but separate out uncontrollable costs. Insert subtotals where appropriate (include one for operating income) before the uncontrollable costs. Income tax expense should be based on all expenses (that is, it will be the same amount as in question 1). Calculate net income, profit margin, ROI, and RI, excluding uncontrollable expenses. Prepare a short response to accompany the income statement that explains why uncontrollable costs are separated in the income statement