Question

Pabloski Co. has just paid a cash dividend of $4 per share. Investors require a 16% return from investments such as this. The company

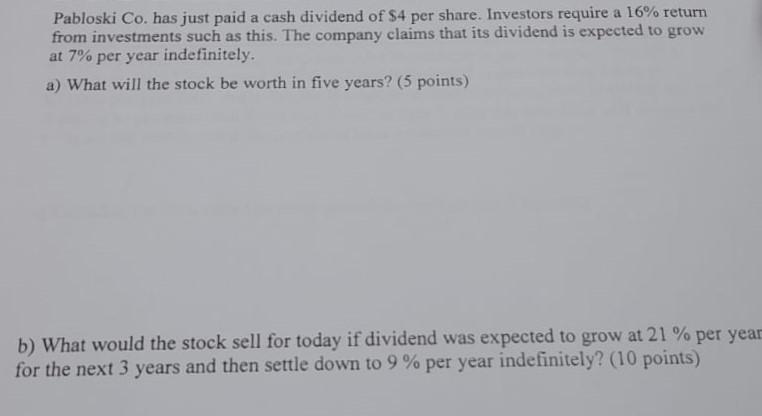

Pabloski Co. has just paid a cash dividend of $4 per share. Investors require a 16% return from investments such as this. The company claims that its dividend is expected to grow at 7% per year indefinitely. a) What will the stock be worth in five years? (5 points) b) What would the stock sell for today if dividend was expected to grow at 21 % per year for the next 3 years and then settle down to 9% per year indefinitely? (10 points)

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the stock value we can use the dividend discount model DDM formula The DDM formula is as follows Stock Value Dividend Required Rate of Re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance A Focused Approach

Authors: Michael C. Ehrhardt, Eugene F. Brigham

6th edition

1305637100, 978-1305637108

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App