Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Packers Limited (Packers) has a financial year end of 30 September. On 1 August 20x6, Packers purchased a piece of freehold land for $250,000

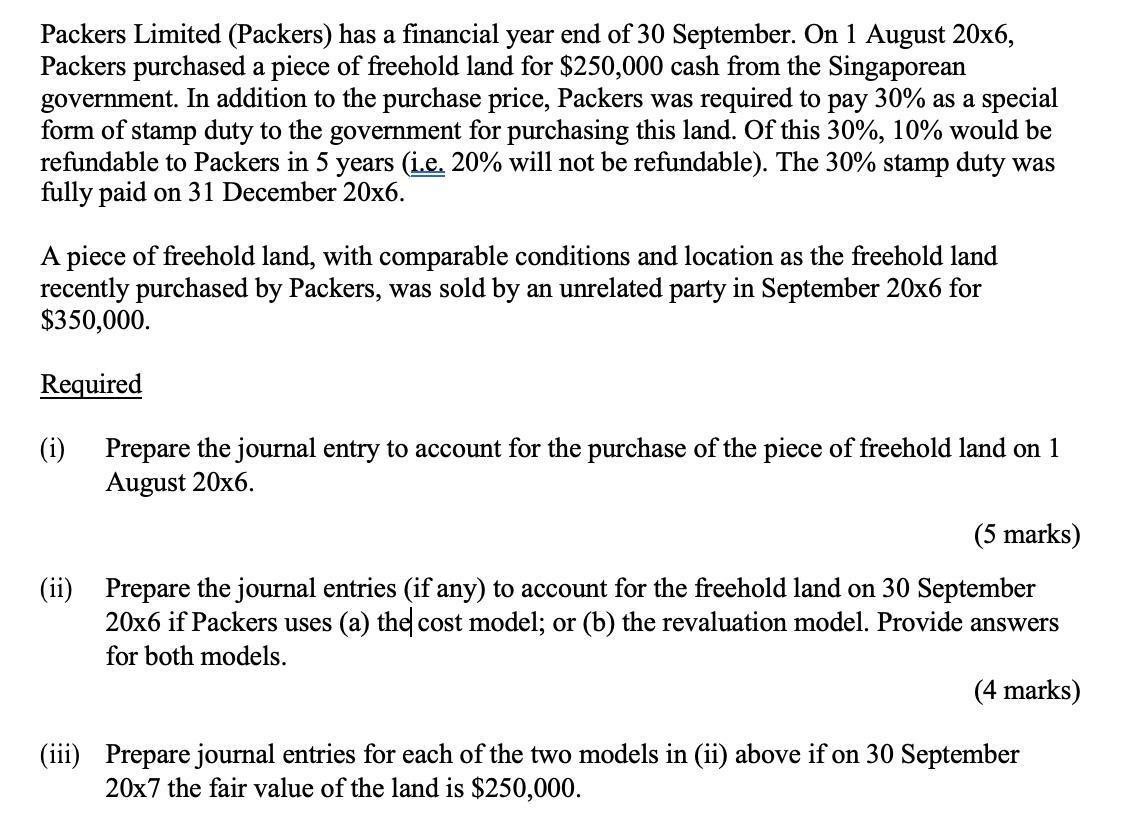

Packers Limited (Packers) has a financial year end of 30 September. On 1 August 20x6, Packers purchased a piece of freehold land for $250,000 cash from the Singaporean government. In addition to the purchase price, Packers was required to pay 30% as a special form of stamp duty to the government for purchasing this land. Of this 30%, 10% would be refundable to Packers in 5 years (i.e. 20% will not be refundable). The 30% stamp duty was fully paid on 31 December 20x6. A piece of freehold land, with comparable conditions and location as the freehold land recently purchased by Packers, was sold by an unrelated party in September 20x6 for $350,000. Required (i) Prepare the journal entry to account for the purchase of the piece of freehold land on 1 August 20x6. (5 marks) (ii) Prepare the journal entries (if any) to account for the freehold land on 30 September 20x6 if Packers uses (a) the cost model; or (b) the revaluation model. Provide answers for both models. (4 marks) (iii) Prepare journal entries for each of the two models in (ii) above if on 30 September 20x7 the fair value of the land is $250,000.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Under Cost model the carrying value of asset is recorded as initial cost less impairments ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started