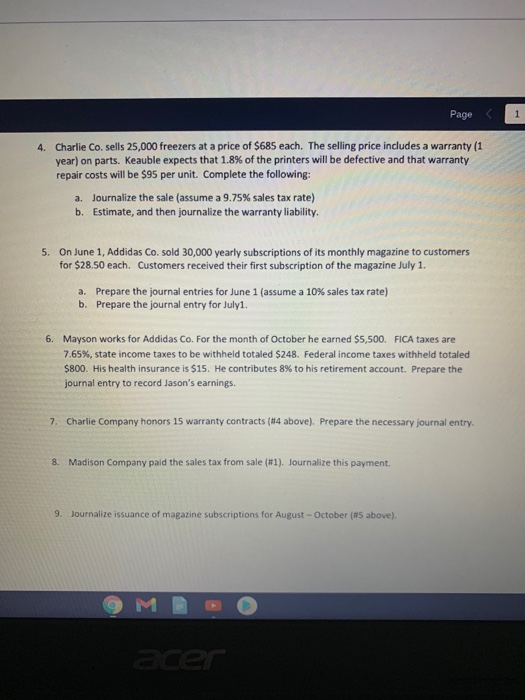

Page 1 4. Charlie Co. sells 25,000 freezers at a price of $685 each. The selling price includes a warranty (1 year) on parts. Keauble expects that 1.8% of the printers will be defective and that warranty repair costs will be $95 per unit. Complete the following: a. Journalize the sale (assume a 9.75% sales tax rate) b. Estimate, and then journalize the warranty liability. 5. On June 1, Addidas Co. sold 30,000 yearly subscriptions of its monthly magazine to customers for $28.50 each. Customers received their first subscription of the magazine July 1. a. Prepare the journal entries for June 1 (assume a 10% sales tax rate) b. Prepare the journal entry for July1. 6. Mayson works for Addidas Co. For the month of October he earned $5,500. FICA taxes are 7.65%, state income taxes to be withheld totaled $248. Federal income taxes withheld totaled $800. His health insurance is $15. He contributes 8% to his retirement account. Prepare the journal entry to record Jason's earnings. 7. Charlie Company honors 15 warranty contracts (#4 above). Prepare the necessary journal entry. 8. Madison Company paid the sales tax from sale (#1). Journalize this payment. 9 Journalize issuance of magazine subscriptions for August - October (#5 above). 9 MB acer Page 1 4. Charlie Co. sells 25,000 freezers at a price of $685 each. The selling price includes a warranty (1 year) on parts. Keauble expects that 1.8% of the printers will be defective and that warranty repair costs will be $95 per unit. Complete the following: a. Journalize the sale (assume a 9.75% sales tax rate) b. Estimate, and then journalize the warranty liability. 5. On June 1, Addidas Co. sold 30,000 yearly subscriptions of its monthly magazine to customers for $28.50 each. Customers received their first subscription of the magazine July 1. a. Prepare the journal entries for June 1 (assume a 10% sales tax rate) b. Prepare the journal entry for July1. 6. Mayson works for Addidas Co. For the month of October he earned $5,500. FICA taxes are 7.65%, state income taxes to be withheld totaled $248. Federal income taxes withheld totaled $800. His health insurance is $15. He contributes 8% to his retirement account. Prepare the journal entry to record Jason's earnings. 7. Charlie Company honors 15 warranty contracts (#4 above). Prepare the necessary journal entry. 8. Madison Company paid the sales tax from sale (#1). Journalize this payment. 9 Journalize issuance of magazine subscriptions for August - October (#5 above). 9 MB acer