Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Page 1 of 2 > Note: Please create your own Excel file to conduct the project analysis and make sure of showing all necessary

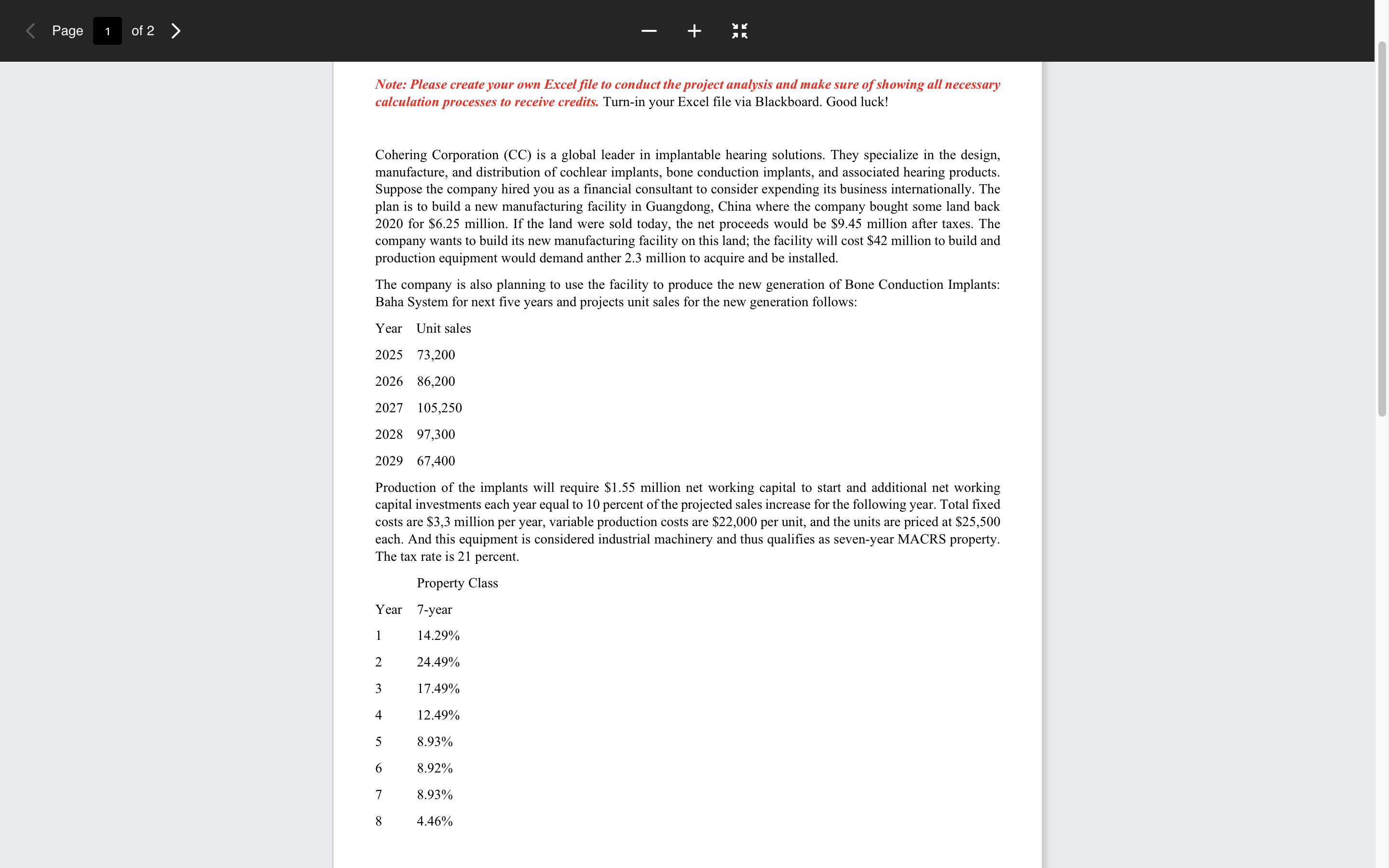

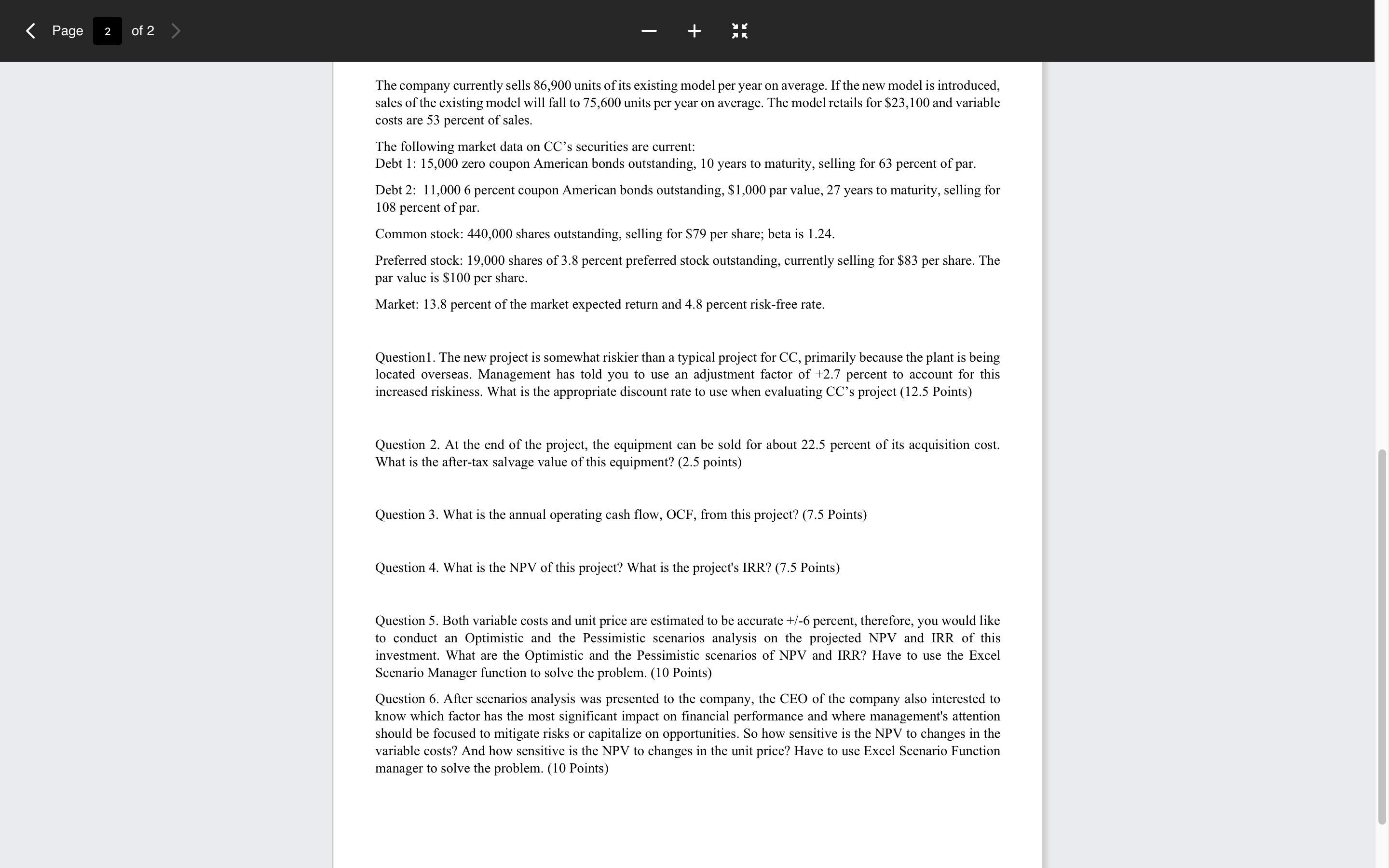

Page 1 of 2 > Note: Please create your own Excel file to conduct the project analysis and make sure of showing all necessary calculation processes to receive credits. Turn-in your Excel file via Blackboard. Good luck! Cohering Corporation (CC) is a global leader in implantable hearing solutions. They specialize in the design, manufacture, and distribution of cochlear implants, bone conduction implants, and associated hearing products. Suppose the company hired you as a financial consultant to consider expending its business internationally. The plan is to build a new manufacturing facility in Guangdong, China where the company bought some land back 2020 for $6.25 million. If the land were sold today, the net proceeds would be $9.45 million after taxes. The company wants to build its new manufacturing facility on this land; the facility will cost $42 million to build and production equipment would demand anther 2.3 million to acquire and be installed. The company is also planning to use the facility to produce the new generation of Bone Conduction Implants: Baha System for next five years and projects unit sales for the new generation follows: Year Unit sales 2025 73,200 2026 86,200 2027 105,250 2028 97,300 2029 67,400 Production of the implants will require $1.55 million net working capital to start and additional net working capital investments each year equal to 10 percent of the projected sales increase for the following year. Total fixed costs are $3,3 million per year, variable production costs are $22,000 per unit, and the units are priced at $25,500 each. And this equipment is considered industrial machinery and thus qualifies as seven-year MACRS property. The tax rate is 21 percent. Property Class Year 7-year 1 14.29% 2 24.49% 3 17.49% 4 12.49% 5 8.93% 6 8.92% 7 8.93% 8 4.46% Page 2 of 2 > The company currently sells 86,900 units of its existing model per year on average. If the new model is introduced, sales of the existing model will fall to 75,600 units per year on average. The model retails for $23,100 and variable costs are 53 percent of sales. The following market data on CC's securities are current: Debt 1: 15,000 zero coupon American bonds outstanding, 10 years to maturity, selling for 63 percent of par. Debt 2: 11,000 6 percent coupon American bonds outstanding, $1,000 par value, 27 years to maturity, selling for 108 percent of par. Common stock: 440,000 shares outstanding, selling for $79 per share; beta is 1.24. Preferred stock: 19,000 shares of 3.8 percent preferred stock outstanding, currently selling for $83 per share. The par value is $100 per share. Market: 13.8 percent of the market expected return and 4.8 percent risk-free rate. Question1. The new project is somewhat riskier than a typical project for CC, primarily because the plant is being located overseas. Management has told you to use an adjustment factor of +2.7 percent to account for this increased riskiness. What is the appropriate discount rate to use when evaluating CC's project (12.5 Points) Question 2. At the end of the project, the equipment can be sold for about 22.5 percent of its acquisition cost. What is the after-tax salvage value of this equipment? (2.5 points) Question 3. What is the annual operating cash flow, OCF, from this project? (7.5 Points) Question 4. What is the NPV of this project? What is the project's IRR? (7.5 Points) Question 5. Both variable costs and unit price are estimated to be accurate +/-6 percent, therefore, you would like to conduct an Optimistic and the Pessimistic scenarios analysis on the projected NPV and IRR of this investment. What are the Optimistic and the Pessimistic scenarios of NPV and IRR? Have to use the Excel Scenario Manager function to solve the problem. (10 Points) Question 6. After scenarios analysis was presented to the company, the CEO of the company also interested to know which factor has the most significant impact on financial performance and where management's attention should be focused to mitigate risks or capitalize on opportunities. So how sensitive is the NPV to changes in the variable costs? And how sensitive is the NPV to changes in the unit price? Have to use Excel Scenario Function manager to solve the problem. (10 Points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started