Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Page 1 Page 2 what is the difference between direct and - 1 indirect methods that used to lay out a cash flow statement )

Page 1

Page 2

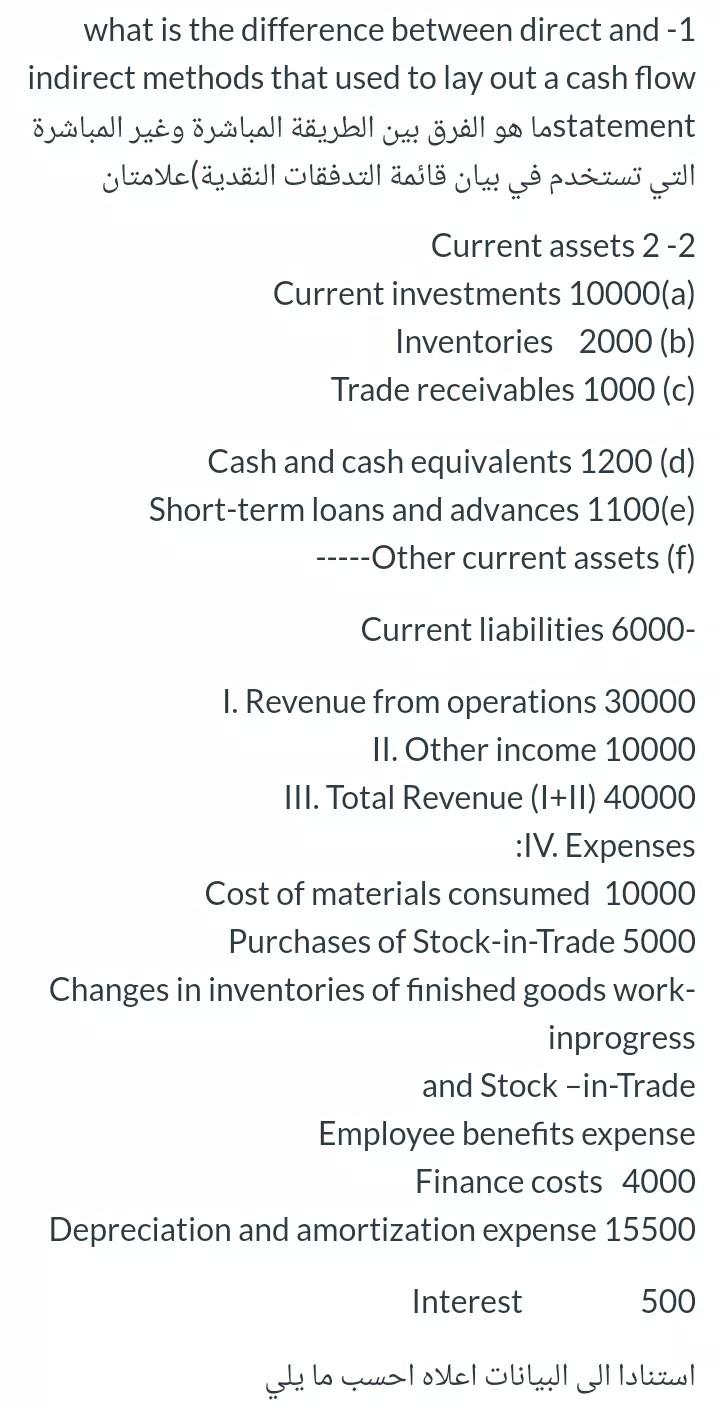

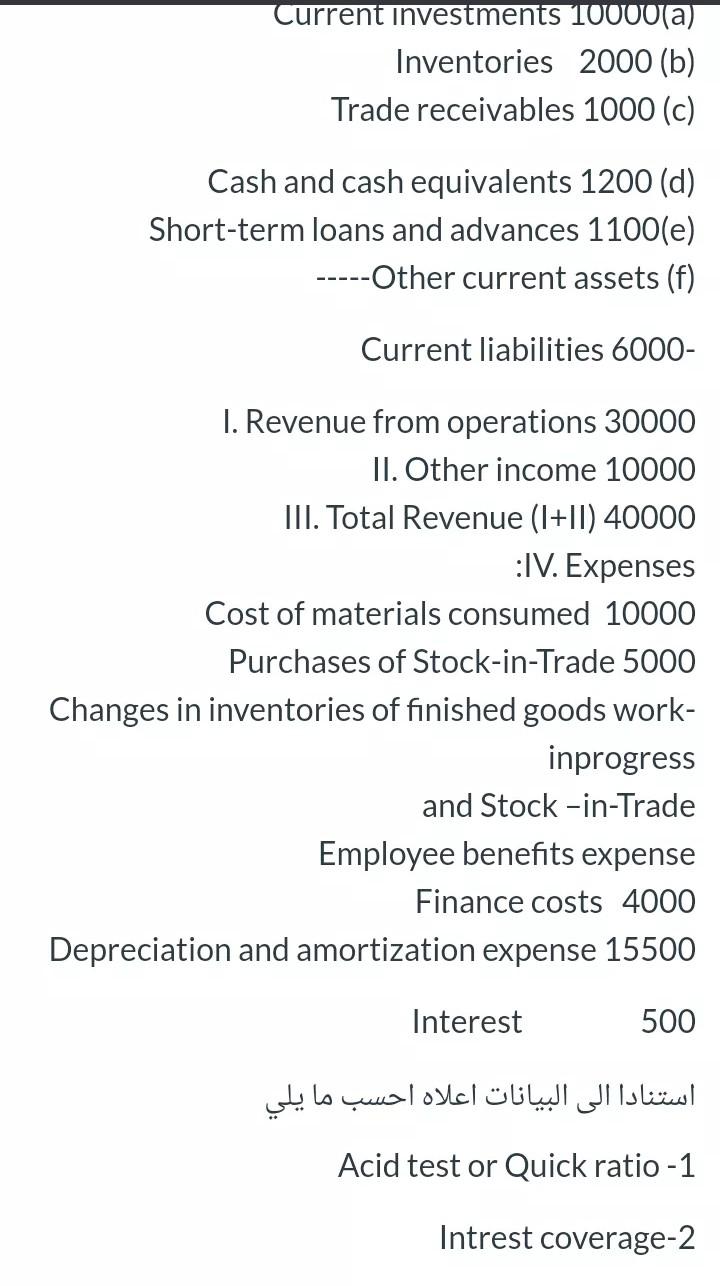

what is the difference between direct and - 1 indirect methods that used to lay out a cash flow statement ) Current assets 2-2 Current investments 10000(a) Inventories 2000 (b) Trade receivables 1000 (c) Cash and cash equivalents 1200 (d) Short-term loans and advances 1100(e) -----Other current assets (f) Current liabilities 6000- I. Revenue from operations 30000 II. Other income 10000 III. Total Revenue (I+II) 40000 :IV. Expenses Cost of materials consumed 10000 Purchases of Stock-in-Trade 5000 Changes in inventories of finished goods work- inprogress and Stock -in-Trade Employee benefits expense Finance costs 4000 Depreciation and amortization expense 15500 Interest 500 Current investments 10000(a) Inventories 2000 (b) Trade receivables 1000 (c) Cash and cash equivalents 1200 (d) Short-term loans and advances 1100(e) -----Other current assets (f) Current liabilities 6000- I. Revenue from operations 30000 II. Other income 10000 III. Total Revenue (I+II) 40000 :IV. Expenses Cost of materials consumed 10000 Purchases of Stock-in-Trade 5000 Changes in inventories of finished goods work- inprogress and Stock -in-Trade Employee benefits expense Finance costs 4000 Depreciation and amortization expense 15500 Interest 500 Acid test or Quick ratio - 1 Intrest coverage-2 what is the difference between direct and - 1 indirect methods that used to lay out a cash flow statement ) Current assets 2-2 Current investments 10000(a) Inventories 2000 (b) Trade receivables 1000 (c) Cash and cash equivalents 1200 (d) Short-term loans and advances 1100(e) -----Other current assets (f) Current liabilities 6000- I. Revenue from operations 30000 II. Other income 10000 III. Total Revenue (I+II) 40000 :IV. Expenses Cost of materials consumed 10000 Purchases of Stock-in-Trade 5000 Changes in inventories of finished goods work- inprogress and Stock -in-Trade Employee benefits expense Finance costs 4000 Depreciation and amortization expense 15500 Interest 500 Current investments 10000(a) Inventories 2000 (b) Trade receivables 1000 (c) Cash and cash equivalents 1200 (d) Short-term loans and advances 1100(e) -----Other current assets (f) Current liabilities 6000- I. Revenue from operations 30000 II. Other income 10000 III. Total Revenue (I+II) 40000 :IV. Expenses Cost of materials consumed 10000 Purchases of Stock-in-Trade 5000 Changes in inventories of finished goods work- inprogress and Stock -in-Trade Employee benefits expense Finance costs 4000 Depreciation and amortization expense 15500 Interest 500 Acid test or Quick ratio - 1 Intrest coverage-2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started