Answered step by step

Verified Expert Solution

Question

1 Approved Answer

page 10 (4) In-house legal counsel. E. Be aware in evaluating management's responses to inquiries that it is often in the best position to perpetrate

page 10

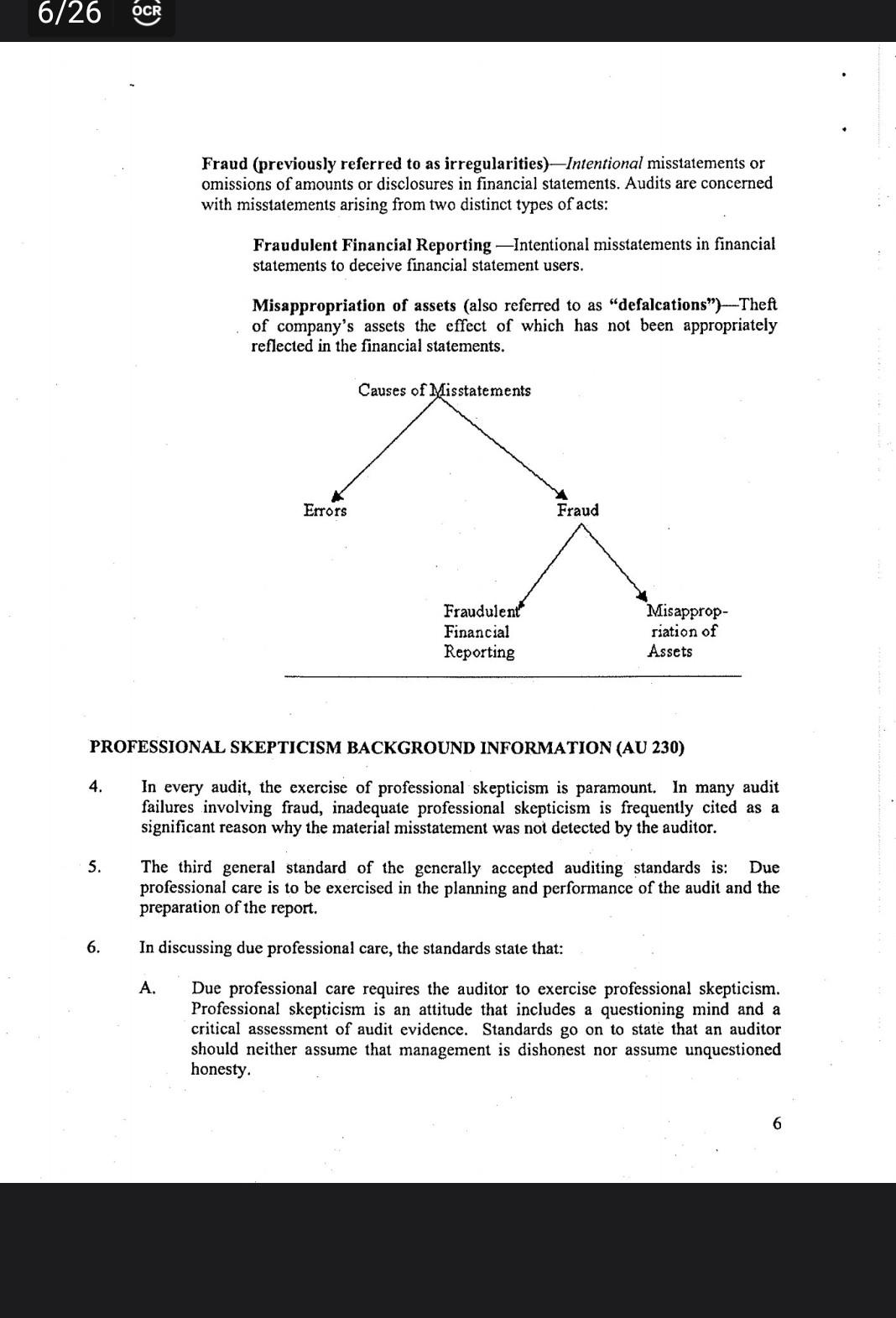

(4) In-house legal counsel. E. Be aware in evaluating management's responses to inquiries that it is often in the best position to perpetrate fraud. 13. Considering the results of analytical procedures performed in planning the audit: A. When unexpected results occur, consider the risk of material misstatement due to fraud. B. Perform analytical procedures on revenue during the planning of the audit to identify unusual or unexpected relationships. C. Because analytical procedures performed during planning often use data aggregated at a high level, results obtained often only provide a broad initial indication about whether a material misstatement exists. 14. An auditor should consider fraud risk factors, which are events or conditions that indicate incentives/pressures to perpetrate fraud, opportunities to carry out fraud, or attitude/rationalization to justify a fraudulent action: A. The auditor should use professional judgment in determining whether a risk factor is present and in identifying and assessing the risk of material misstatement due to fraud. B. While fraud risk factors do not necessarily indicate the existence of fraud, they often are present when fraud exists. 15. Other information that should be considered includes the discussion among audit team members, reviews of interim financial statements, and the consideration of identified inherent risks. IDENTIFYING RISKS THAT MAY RESULT IN A MATERIAL MISSTATEMENT DUE TO FRAUD 16. It is helpful when identifying risks of fraud to consider the three conditions ordinarily present when a material misstatement due to fraud ordinarily occursincentives/pressures, opportunities, and attitude/rationalization. Fraud experts often refer to these three conditions as the fraud triangle. 17. The auditor should evaluate whether identified risks of material misstatement due to fraud can be related to specific accounts, assertions, or whether they relate more pervasively to the financial statements as a whole. 18. The identification of a risk of material misstatement due to fraud includes consideration of the type of risk (fraudulent financial reporting or misappropriation of assets), the significance of the risk, the likelihood of the risk, and the pervasiveness of the risk. 19. A presumption of improper revenue recognition is a fraud risk. 20. The auditor should always address the risk of management override of controls. Fraud (previously referred to as irregularities)-Intentional misstatements or omissions of amounts or disclosures in financial statements. Audits are concerned with misstatements arising from two distinct types of acts: Fraudulent Financial Reporting - Intentional misstatements in financial statements to deceive financial statement users. Misappropriation of assets (also referred to as "defalcations")-Theft of company's assets the effect of which has not been appropriately reflected in the financial statements. PROFESSIONAL SKEPTICISM BACKGROUND INFORMATION (AU 230) 4. In every audit, the exercise of professional skepticism is paramount. In many audit failures involving fraud, inadequate professional skepticism is frequently cited as a significant reason why the material misstatement was not detected by the auditor. 5. The third general standard of the generally accepted auditing standards is: Due professional care is to be exercised in the planning and performance of the audit and the preparation of the report. 6. In discussing due professional care, the standards state that: A. Due professional care requires the auditor to exercise professional skepticism. Professional skepticism is an attitude that includes a questioning mind and a critical assessment of audit evidence. Standards go on to state that an auditor should neither assume that management is dishonest nor assume unquestioned honesty

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started