Answered step by step

Verified Expert Solution

Question

1 Approved Answer

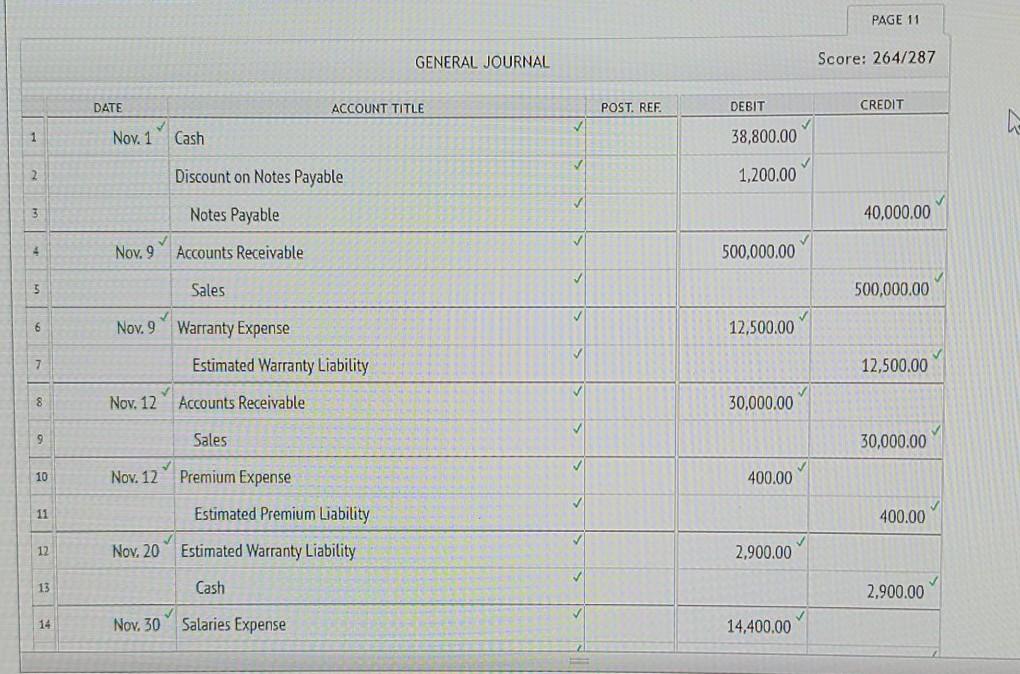

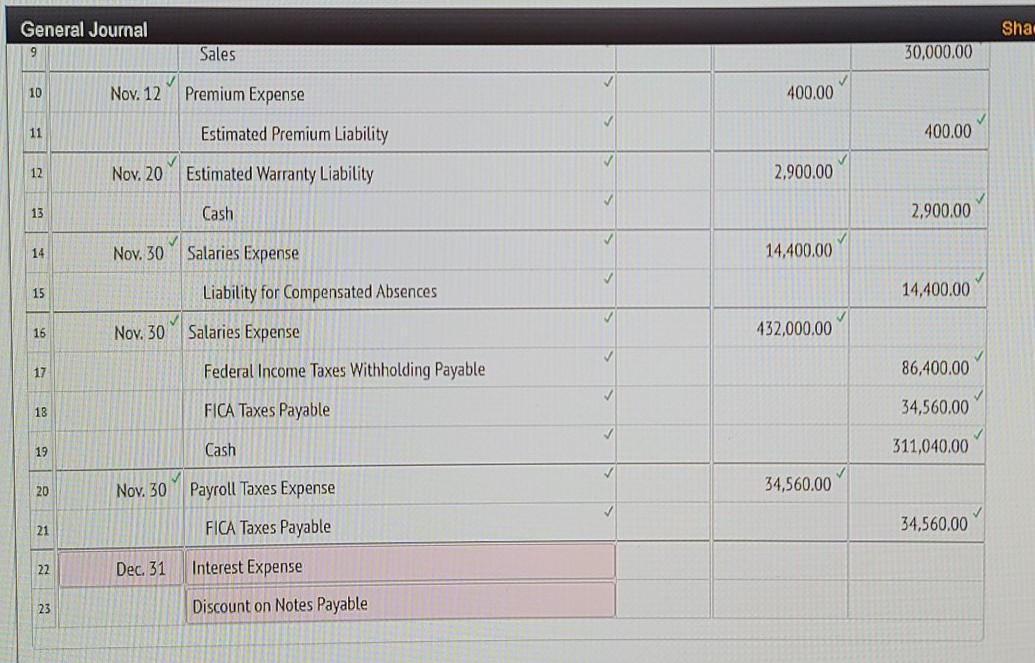

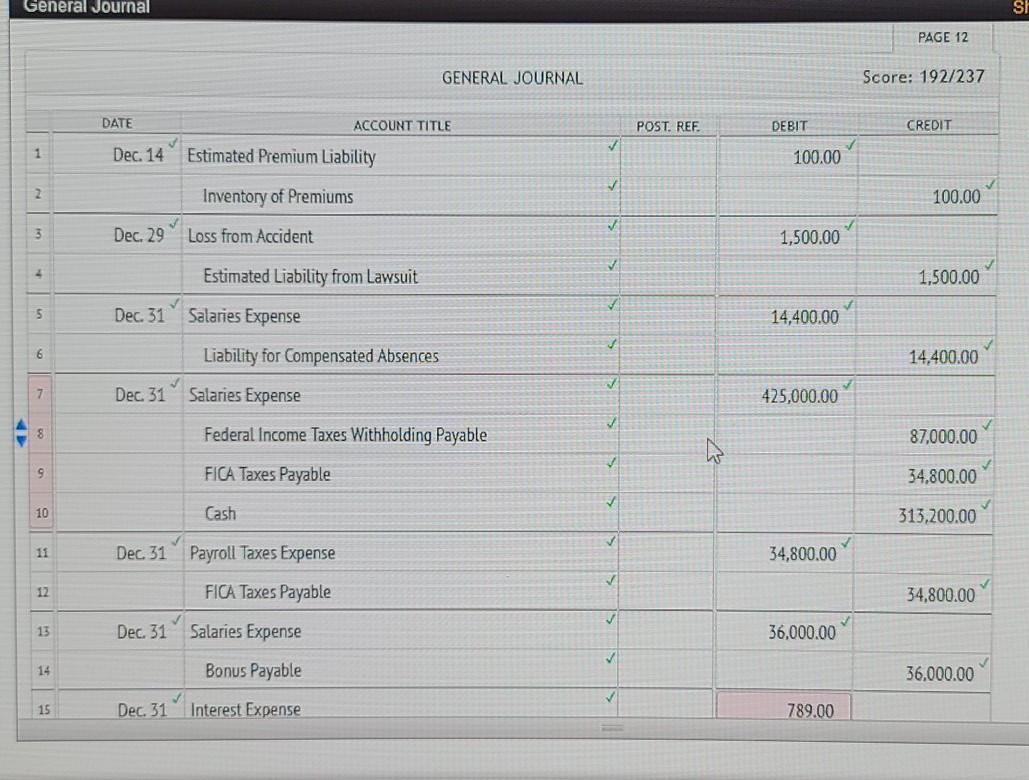

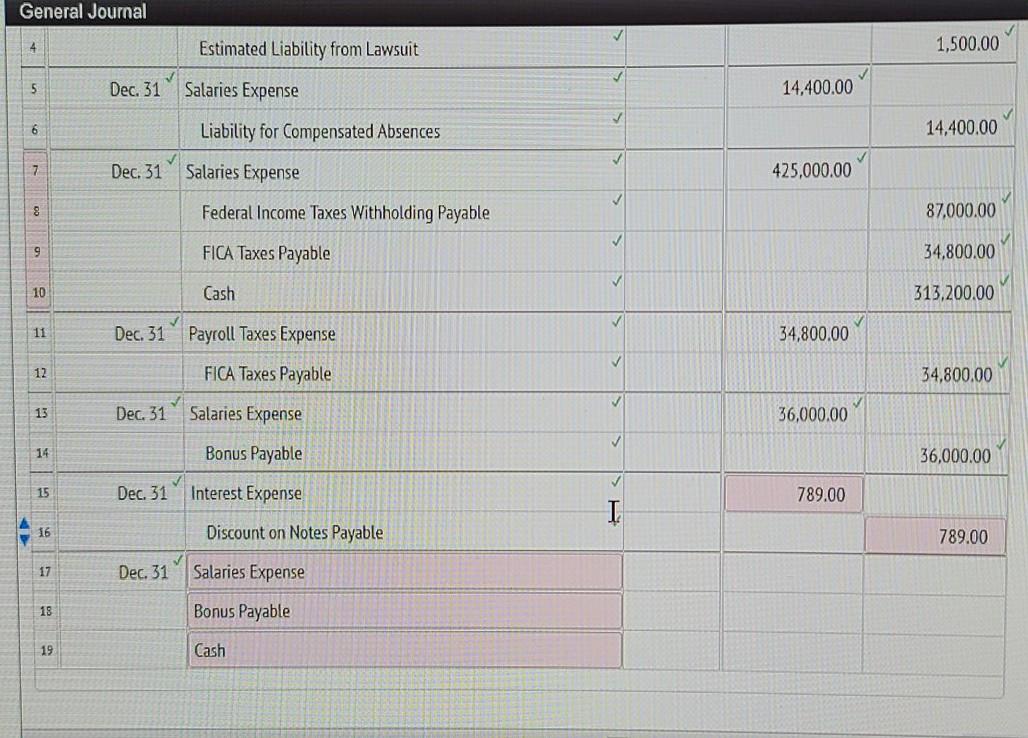

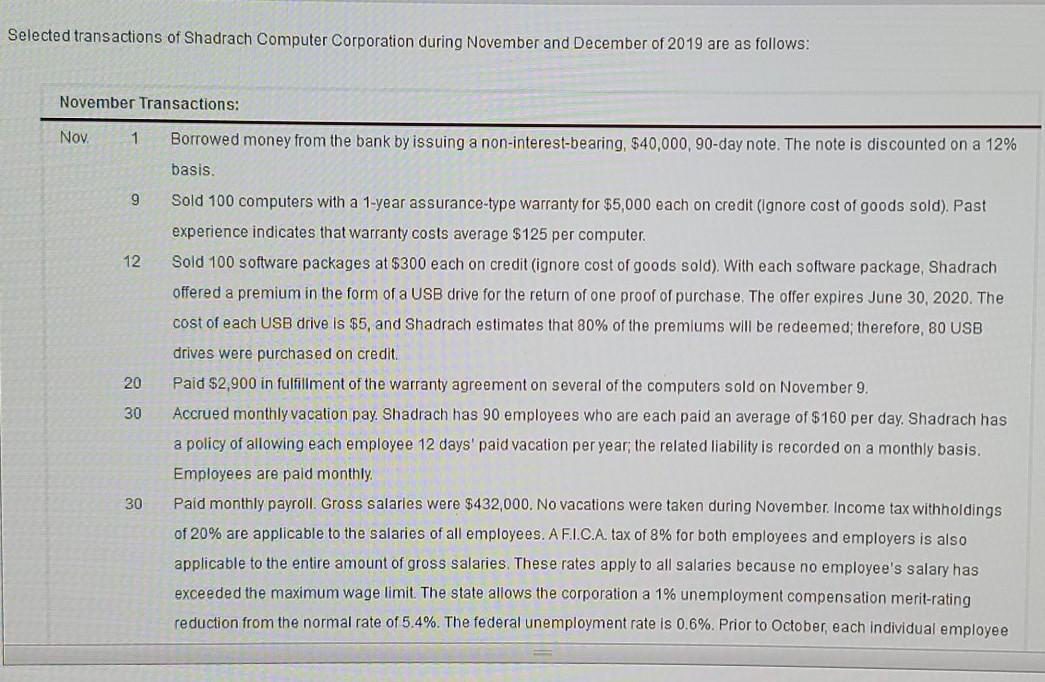

PAGE 11 GENERAL JOURNAL Score: 264/287 DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT 1 Nov. 1 Cash 38,800.00 2 Discount on Notes Payable 1,200.00 3

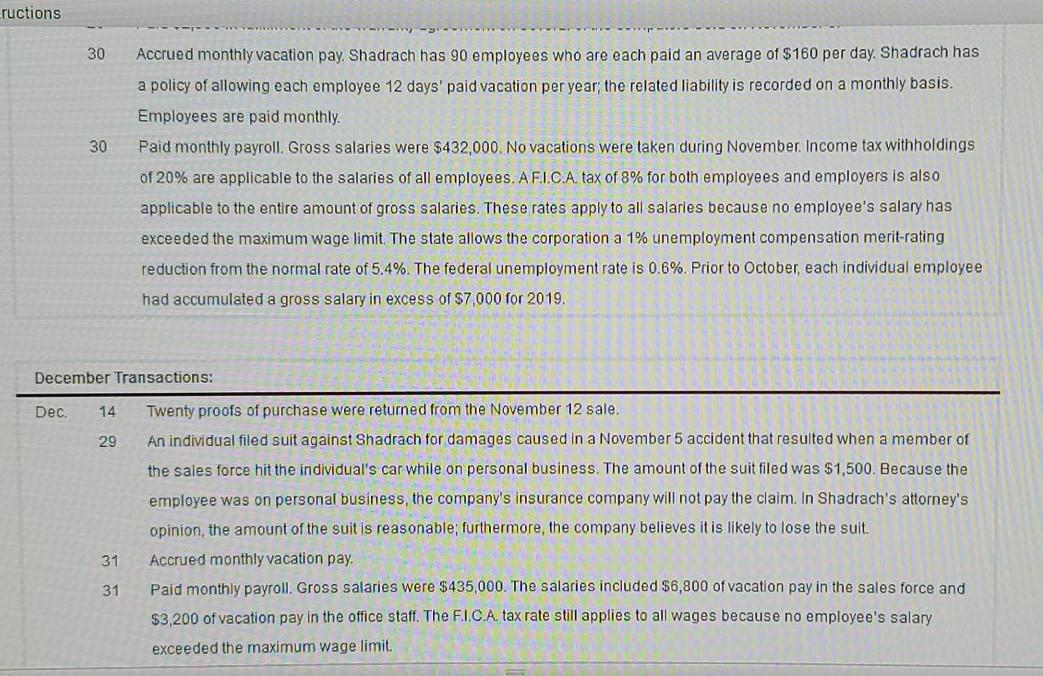

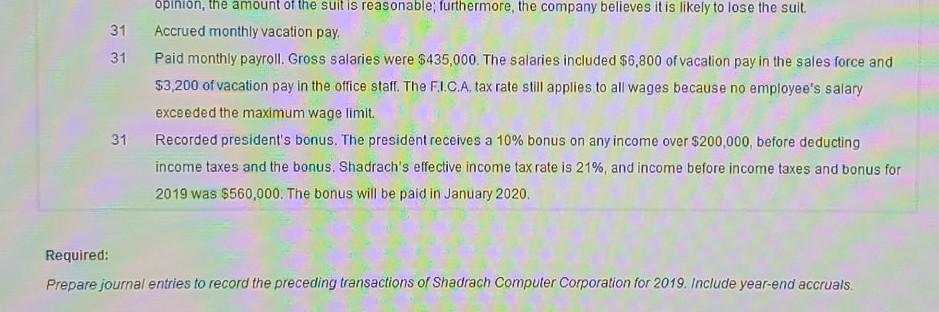

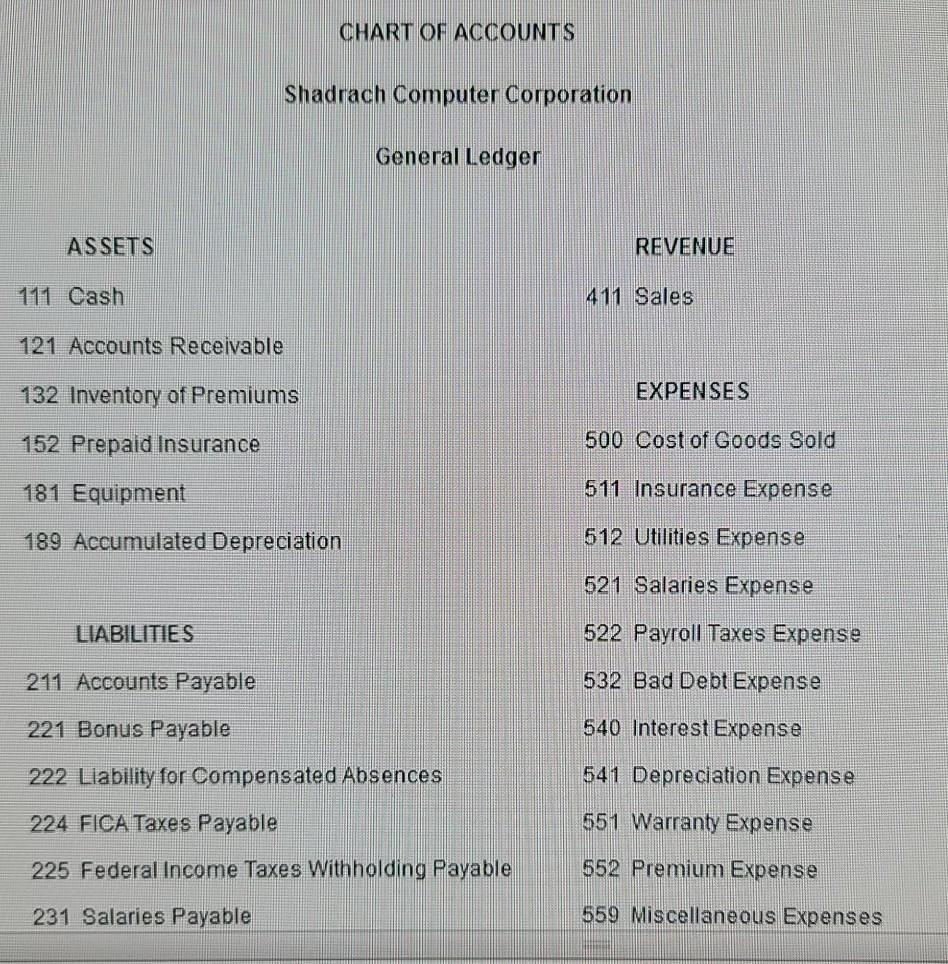

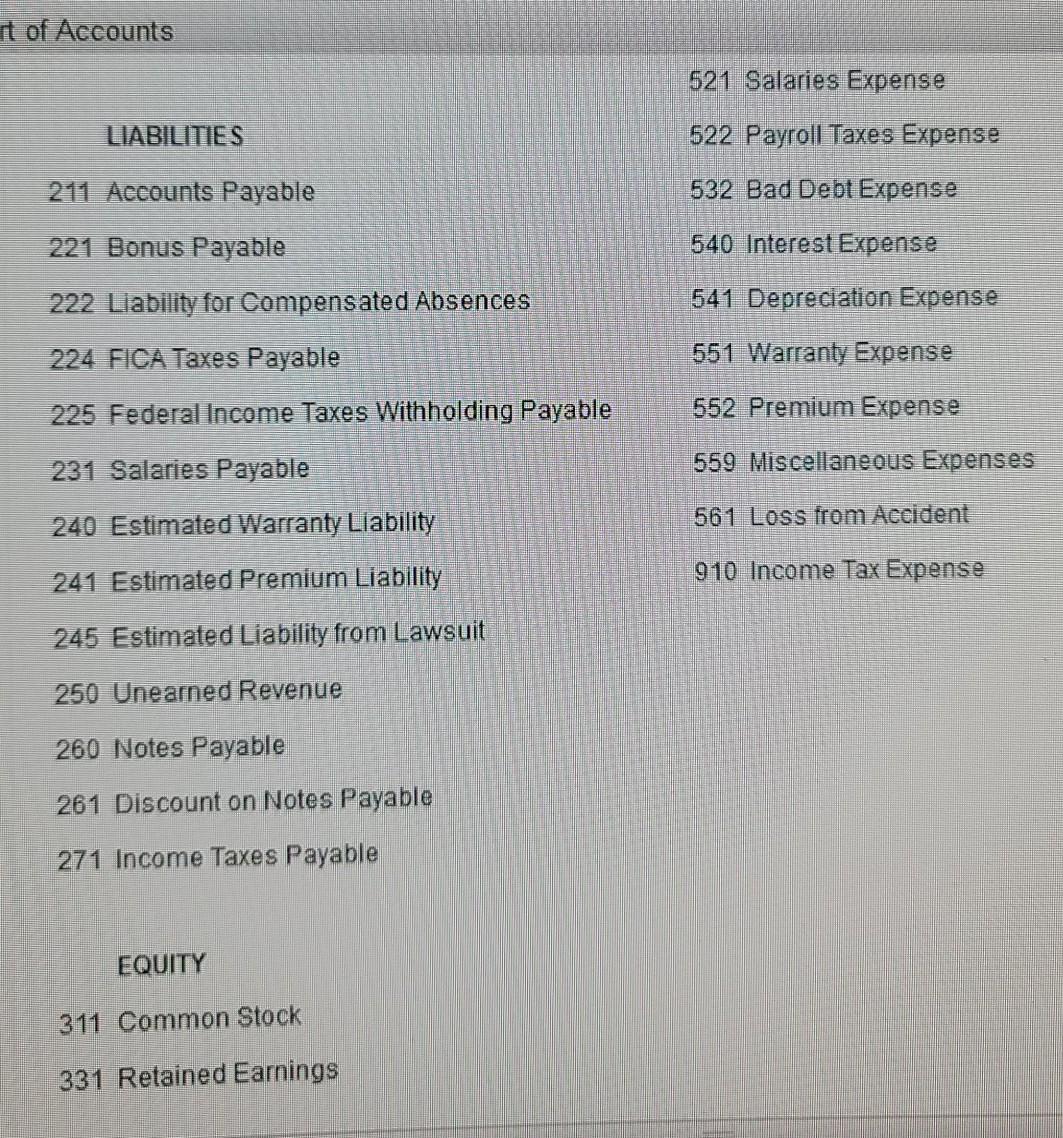

PAGE 11 GENERAL JOURNAL Score: 264/287 DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT 1 Nov. 1 Cash 38,800.00 2 Discount on Notes Payable 1,200.00 3 Notes Payable 40,000.00 Nov. 9 Accounts Receivable 500,000.00 5 Sales 500,000.00 6 Nov.9 Warranty Expense 12,500.00 7 Estimated Warranty Liability 12,500.00 8 Nov. 12 Accounts Receivable 30,000.00 9 Sales 30,000.00 10 Nov. 12 Premium Expense 400.00 11 Estimated Premium Liability 400.00 12 Nov, 20 Estimated Warranty Liability 2,900.00 13 Cash 2,900.00 14 Nov. 30 Salaries Expense 14,400.00 General Journal Sha Sales 30,000.00 10 Nov. 12 Premium Expense 400.00 11 Estimated Premium Liability 400.00 12 Nov. 20 Estimated Warranty Liability 2,900.00 13 Cash 2,900.00 14 Nov. 30 Salaries Expense 14.400.00 15 Liability for Compensated Absences 14,400.00 15 Nov. 30 Salaries Expense 432,000.00 17 Federal Income Taxes Withholding Payable 86,400.00 18 FICA Taxes Payable 34,560.00 19 Cash 311,040.00 20 34,560.00 Nov. 30 Payroll Taxes Expense 21 34,560.00 FICA Taxes Payable 22 Dec. 31 Interest Expense 23 Discount on Notes Payable General Journal SI PAGE 12 GENERAL JOURNAL Score: 192/237 DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT 1 Dec. 14 Estimated Premium Liability 100.00 2 Inventory of Premiums 100.00 3 Dec. 29 Loss from Accident 1,500.00 2 Estimated Liability from Lawsuit 1,500.00 5 Dec. 31 Salaries Expense 14,400.00 6 Liability for Compensated Absences 14,400.00 7 Dec 31 Salaries Expense 425,000.00 8 Federal Income Taxes Withholding Payable 87,000.00 9 FICA Taxes Payable 34,800.00 10 Cash 313,200.00 11 Dec 31 Payroll Taxes Expense 34,800.00 12 FICA Taxes Payable 34,800.00 13 Dec. 31 Salaries Expense 36,000.00 14 Bonus Payable 36,000.00 15 Dec. 31 Interest Expense 789.00 General Journal 1,500.00 Estimated Liability from Lawsuit Dec. 31 Salaries Expense 5 14,400.00 6 Liability for Compensated Absences 14,400.00 7 Dec. 31 Salaries Expense 425,000.00 8 Federal Income Taxes Withholding Payable 87.000.00 9 FICA Taxes Payable 34,800.00 10 Cash 313,200.00 11 Dec. 31 Payroll Taxes Expense 34,800.00 12 FICA Taxes Payable 34,800.00 13 Dec. 31 Salaries Expense 36,000.00 14 Bonus Payable 36,000.00 15 Dec. 31 Interest Expense 789.00 I 16 Discount on Notes Payable 789.00 17 Dec. 31 Salaries Expense 18 Bonus Payable 19 Cash Selected transactions of Shadrach Computer Corporation during November and December of 2019 are as follows: November Transactions: Nov. 1 Borrowed money from the bank by issuing a non-interest-bearing, $40,000, 90-day note. The note is discounted on a 12% basis 9 12 20 30 Sold 100 computers with a 1-year assurance-type warranty for $5,000 each on credit (Ignore cost of goods sold). Past experience indicates that warranty costs average $125 per computer. Sold 100 software packages at $300 each on credit (ignore cost of goods sold). With each software package, Shadrach offered a premium in the form of a USB drive for the return of one proof of purchase. The offer expires June 30, 2020. The cost of each USB drive is $5, and Shadrach estimates that 80% of the premiums will be redeemed therefore, 80 USB drives were purchased on credit. Paid $2,900 in fulfillment of the warranty agreement on several of the computers sold on November 9. Accrued monthly vacation pay. Shadrach has 90 employees who are each paid an average of $160 per day. Shadrach has a policy of allowing each employee 12 days' paid vacation per year, the related liability is recorded on a monthly basis. Employees are paid monthly Paid monthly payroll. Gross salaries were $432,000. No vacations were taken during November. Income tax withholdings of 20% are applicable to the salaries of all employees. AF.I.C.A. tax of 8% for both employees and employers is also applicable to the entire amount of gross salaries. These rates apply to all salaries because no employee's salary has exceeded the maximum wage limit. The state allows the corporation a 1% unemployment compensation merit-rating reduction from the normal rate of 5.4%. The federal unemployment rate is 0.6%. Prior to October, each individual employee 30 ructions 30 30 Accrued monthly vacation pay. Shadrach has 90 employees who are each paid an average of $160 per day. Shadrach has a policy of allowing each employee 12 days' paid vacation per year, the related liability is recorded on a monthly basis. Employees are paid monthly Paid monthly payroll. Gross salaries were $432,000. No vacations were taken during November. Income tax withholdings of 20% are applicable to the salaries of all employees. AFI.C.A tax of 8% for both employees and employers is also applicable to the entire amount of gross salaries. These rates apply to all salaries because no employee's salary has exceeded the maximum wage limit. The state allows the corporation a 1% unemployment compensation merit-rating reduction from the normal rate of 5.4%. The federal unemployment rate is 0.6%. Prior to October, each individual employee had accumulated a gross salary in excess of $7,000 for 2019. December Transactions: Dec. 14 Twenty proofs of purchase were returned from the November 12 sale. 29 An individual filed suit against Shadrach for damages caused in a November 5 accident that resulted when a member of the sales force hit the individual's car while on personal business. The amount of the suit filed was $1,500. Because the employee was on personal business, the company's insurance company will not pay the claim. In Shadrach's attorney's opinion, the amount of the suit is reasonable, furthermore, the company believes it is likely to lose the suit. Accrued monthly vacation pay. Paid monthly payroll. Gross salaries were $435,000. The salaries included $6,800 of vacation pay in the sales force and $3,200 of vacation pay in the office staff. The F.I.C.A. tax rate still applies to all wages because no employee's salary exceeded the maximum wage limit. 31 31 31 31 opinion, the amount of the suit is reasonable; furthermore, the company believes it is likely to lose the suit. Accrued monthly vacation pay. Paid monthly payroll. Gross salaries were $435,000. The salaries included $6,800 of vacation pay in the sales force and $3,200 of vacation pay in the office staff. The FI.C.A. tax rate still applies to all wages because no employee's salary exceeded the maximum wage limit. Recorded president's bonus. The president receives a 10% bonus on any income over $200,000, before deducting income taxes and the bonus. Shadrach's effective income tax rate is 21%, and income before income taxes and bonus for 2019 was $560,000. The bonus will be paid in January 2020 31 Required: Prepare journal entries to record the preceding transactions of Shadrach Computer Corporation for 2019. Include year-end accruals. CHART OF ACCOUNTS Shadrach Computer Corporation General Ledger ASSETS REVENUE 111 Cash 411 Sales 121 Accounts Receivable 132 Inventory of Premiums EXPENSES 152 Prepaid Insurance 500 Cost of Goods Sold 181 Equipment 511 Insurance Expense 189 Accumulated Depreciation 512 Utilities Expense 521 Salaries Expense LIABILITIES 522 Payroll Taxes Expense 211 Accounts Payable 532 Bad Debt Expense 221 Bonus Payable 540 Interest Expense 222 Liability for Compensated Absences 541 Depreciation Expense 224 FICA Taxes Payable 551 Warranty Expense 225 Federal Income Taxes Withholding Payable 552 Premium Expense 231 Salaries Payable 559 Miscellaneous Expenses It of Accounts 521 Salaries Expense LIABILITIES 522 Payroll Taxes Expense 211 Accounts Payable 532 Bad Debt Expense 221 Bonus Payable 540 Interest Expense 222 Liability for Compensated Absences 541 Depreciation Expense 224 FICA Taxes Payable 551 Warranty Expense 225 Federal Income Taxes Withholding Payable 552 Premium Expense 231 Salaries Payable 69 Miscellaneous Expenses 240 Estimated Warranty Liability 561 Loss from Accident 241 Estimated Premium Liability 910 Income Tax Expense 245 Estimated Liability from Lawsuit 250 Unearned Revenue 260 Notes Payable 261 Discount on Notes Payable 271 Income Taxes Payable EQUITY 311 Common Stock 331 Retained Earnings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started