Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Page 14 (e) Arnott plc raised a 500,000 invoice for intra group management fees due from Pilkington Ltd on 25 March 2021. This invoice was

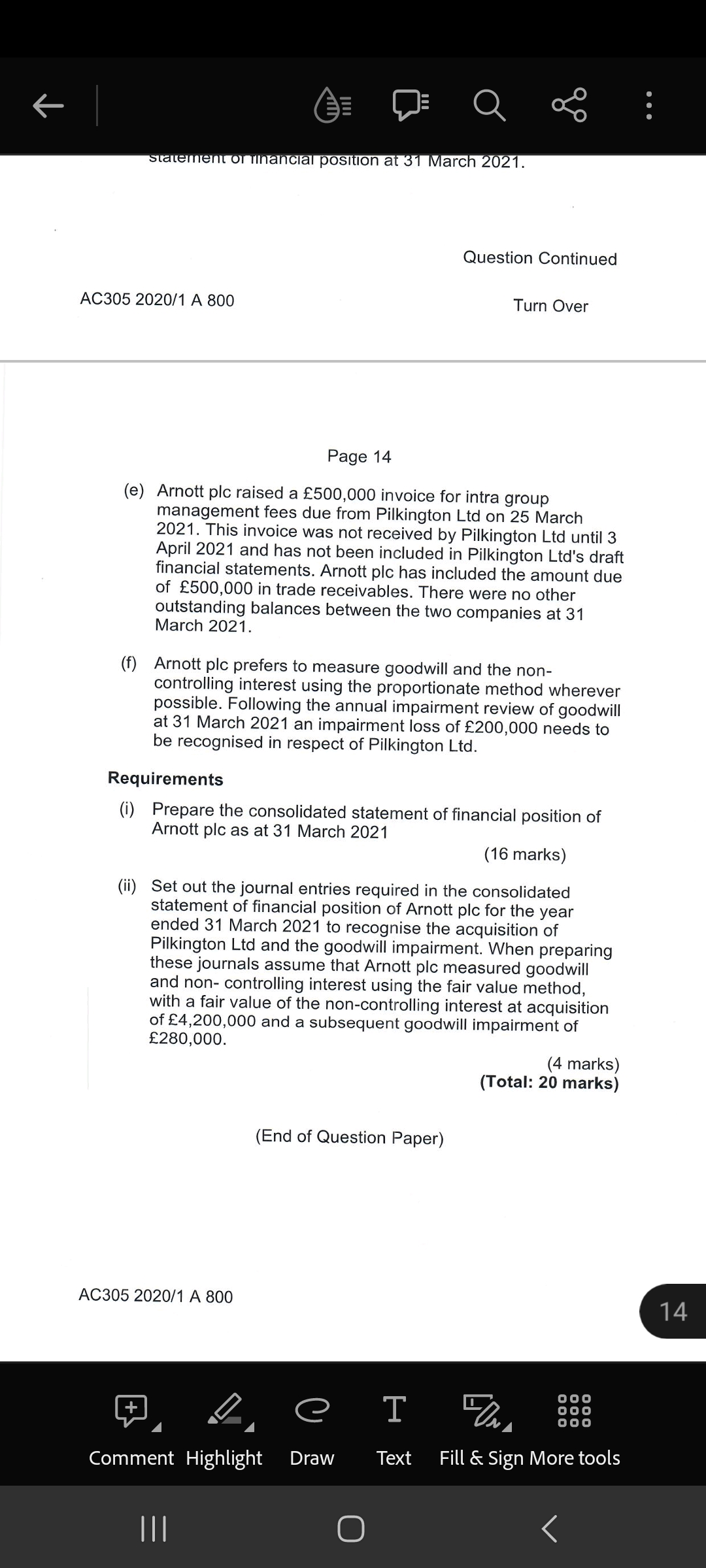

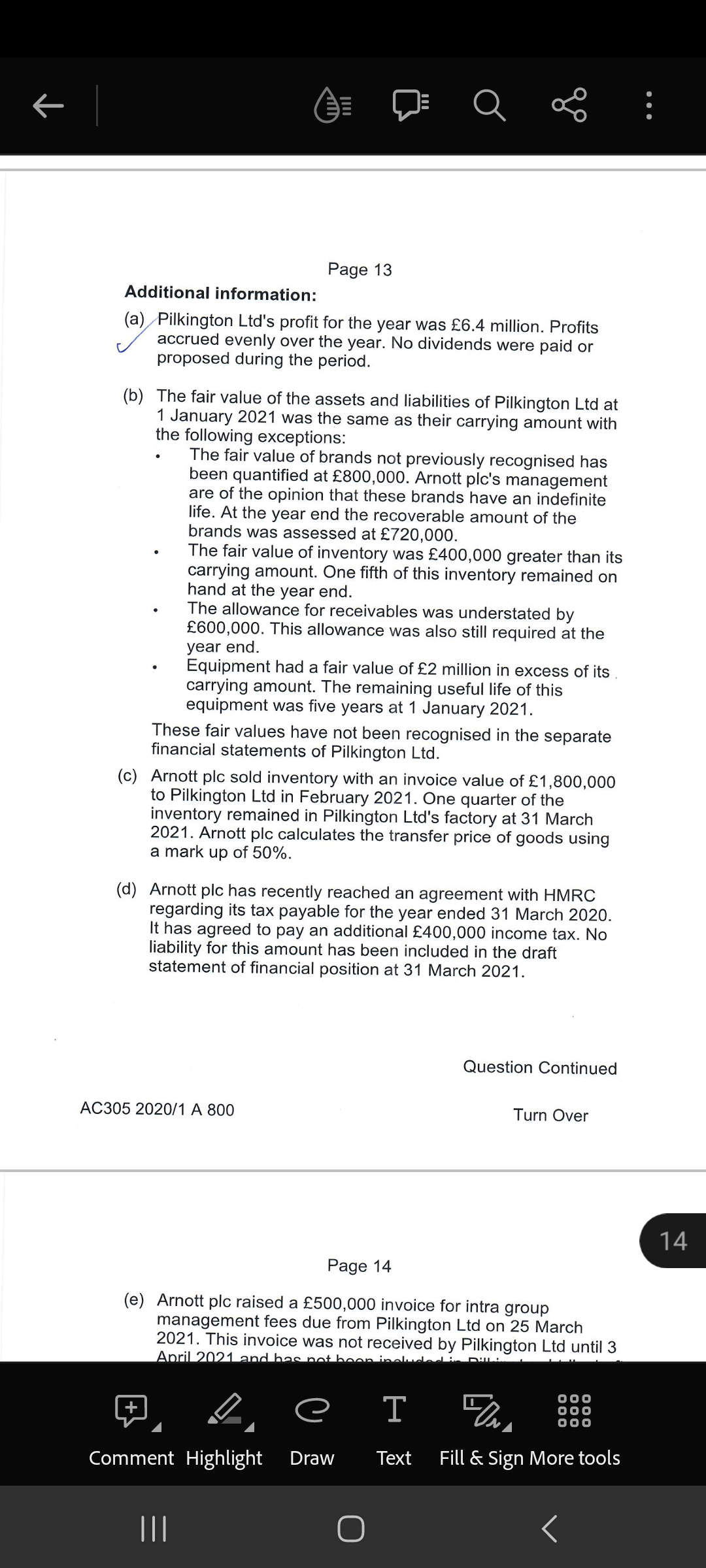

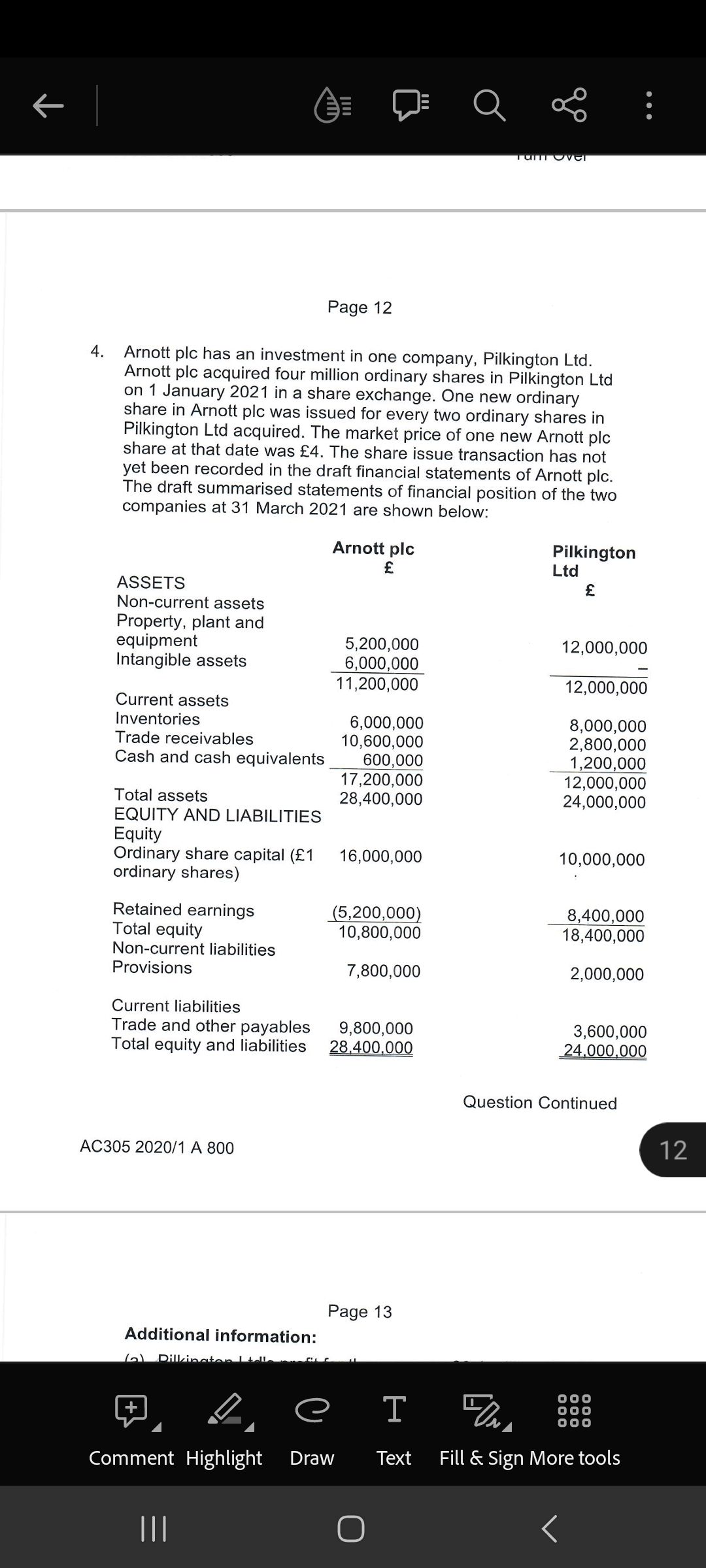

Page 14 (e) Arnott plc raised a 500,000 invoice for intra group management fees due from Pilkington Ltd on 25 March 2021. This invoice was not received by Pilkington Ltd until 3 April 2021 and has not been included in Pilkington Ltd's draft financial statements. Arnott plc has included the amount due of 500,000 in trade receivables. There were no other outstanding balances between the two companies at 31 March 2021. (f) Arnott plc prefers to measure goodwill and the noncontrolling interest using the proportionate method wherever possible. Following the annual impairment review of goodwill at 31 March 2021 an impairment loss of 200,000 needs to be recognised in respect of Pilkington Ltd. Requirements (i) Prepare the consolidated statement of financial position of Arnott plc as at 31 March 2021 (16 marks) (ii) Set out the journal entries required in the consolidated statement of financial position of Arnott plc for the year ended 31 March 2021 to recognise the acquisition of Pilkington Ltd and the goodwill impairment. When preparing these journals assume that Arnott plc measured goodwill and non- controlling interest using the fair value method, with a fair value of the non-controlling interest at acquisition of 4,200,000 and a subsequent goodwill impairment of 280,000. (4 marks) (Total: 20 marks) (End of Question Paper) Additional information: (a) Pilkington Ltd's profit for the year was 6.4 million. Profits accrued evenly over the year. No dividends were paid or proposed during the period. (b) The fair value of the assets and liabilities of Pilkington Ltd at 1 January 2021 was the same as their carrying amount with the following exceptions: - The fair value of brands not previously recognised has been quantified at 800,000. Arnott plc's management are of the opinion that these brands have an indefinite life. At the year end the recoverable amount of the brands was assessed at 720,000. - The fair value of inventory was 400,000 greater than its carrying amount. One fifth of this inventory remained on hand at the year end. - The allowance for receivables was understated by 600,000. This allowance was also still required at the year end. - Equipment had a fair value of 2 million in excess of its carrying amount. The remaining useful life of this equipment was five years at 1 January 2021. These fair values have not been recognised in the separate financial statements of Pilkington Ltd. (c) Arnott plc sold inventory with an invoice value of 1,800,000 to Pilkington Ltd in February 2021. One quarter of the inventory remained in Pilkington Ltd's factory at 31 March 2021. Arnott plc calculates the transfer price of goods using a mark up of 50%. (d) Arnott plc has recently reached an agreement with HMRC regarding its tax payable for the year ended 31 March 2020. It has agreed to pay an additional 400,000 income tax. No liability for this amount has been included in the draft statement of financial position at 31 March 2021. Question Continued AC305 2020/1 A 800 Turn Over Page 14 (e) Arnott plc raised a 500,000 invoice for intra group management fees due from Pilkington Ltd on 25 March 2021. This invoice was not received by Pilkington Ltd until 3 4. Arnott plc has an investment in one company, Pilkington Ltd. Arnott plc acquired four million ordinary shares in Pilkington Ltd on 1 January 2021 in a share exchange. One new ordinary share in Arnott plc was issued for every two ordinary shares in Pilkington Ltd acquired. The market price of one new Arnott plc share at that date was 4. The share issue transaction has not yet been recorded in the draft financial statements of Arnott plc. The draft summarised statements of financial position of the two companies at 31 March 2021 are shown below

Page 14 (e) Arnott plc raised a 500,000 invoice for intra group management fees due from Pilkington Ltd on 25 March 2021. This invoice was not received by Pilkington Ltd until 3 April 2021 and has not been included in Pilkington Ltd's draft financial statements. Arnott plc has included the amount due of 500,000 in trade receivables. There were no other outstanding balances between the two companies at 31 March 2021. (f) Arnott plc prefers to measure goodwill and the noncontrolling interest using the proportionate method wherever possible. Following the annual impairment review of goodwill at 31 March 2021 an impairment loss of 200,000 needs to be recognised in respect of Pilkington Ltd. Requirements (i) Prepare the consolidated statement of financial position of Arnott plc as at 31 March 2021 (16 marks) (ii) Set out the journal entries required in the consolidated statement of financial position of Arnott plc for the year ended 31 March 2021 to recognise the acquisition of Pilkington Ltd and the goodwill impairment. When preparing these journals assume that Arnott plc measured goodwill and non- controlling interest using the fair value method, with a fair value of the non-controlling interest at acquisition of 4,200,000 and a subsequent goodwill impairment of 280,000. (4 marks) (Total: 20 marks) (End of Question Paper) Additional information: (a) Pilkington Ltd's profit for the year was 6.4 million. Profits accrued evenly over the year. No dividends were paid or proposed during the period. (b) The fair value of the assets and liabilities of Pilkington Ltd at 1 January 2021 was the same as their carrying amount with the following exceptions: - The fair value of brands not previously recognised has been quantified at 800,000. Arnott plc's management are of the opinion that these brands have an indefinite life. At the year end the recoverable amount of the brands was assessed at 720,000. - The fair value of inventory was 400,000 greater than its carrying amount. One fifth of this inventory remained on hand at the year end. - The allowance for receivables was understated by 600,000. This allowance was also still required at the year end. - Equipment had a fair value of 2 million in excess of its carrying amount. The remaining useful life of this equipment was five years at 1 January 2021. These fair values have not been recognised in the separate financial statements of Pilkington Ltd. (c) Arnott plc sold inventory with an invoice value of 1,800,000 to Pilkington Ltd in February 2021. One quarter of the inventory remained in Pilkington Ltd's factory at 31 March 2021. Arnott plc calculates the transfer price of goods using a mark up of 50%. (d) Arnott plc has recently reached an agreement with HMRC regarding its tax payable for the year ended 31 March 2020. It has agreed to pay an additional 400,000 income tax. No liability for this amount has been included in the draft statement of financial position at 31 March 2021. Question Continued AC305 2020/1 A 800 Turn Over Page 14 (e) Arnott plc raised a 500,000 invoice for intra group management fees due from Pilkington Ltd on 25 March 2021. This invoice was not received by Pilkington Ltd until 3 4. Arnott plc has an investment in one company, Pilkington Ltd. Arnott plc acquired four million ordinary shares in Pilkington Ltd on 1 January 2021 in a share exchange. One new ordinary share in Arnott plc was issued for every two ordinary shares in Pilkington Ltd acquired. The market price of one new Arnott plc share at that date was 4. The share issue transaction has not yet been recorded in the draft financial statements of Arnott plc. The draft summarised statements of financial position of the two companies at 31 March 2021 are shown below Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started