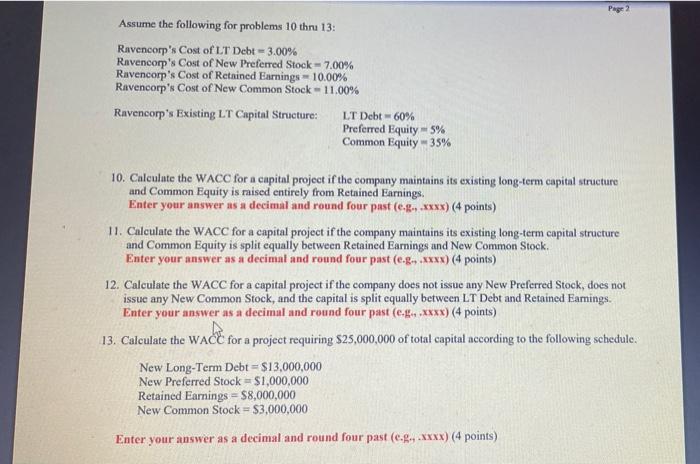

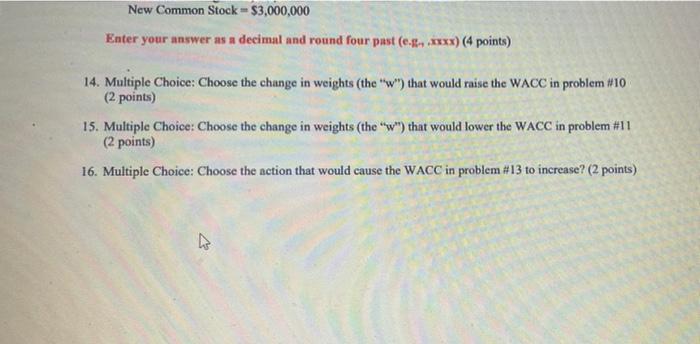

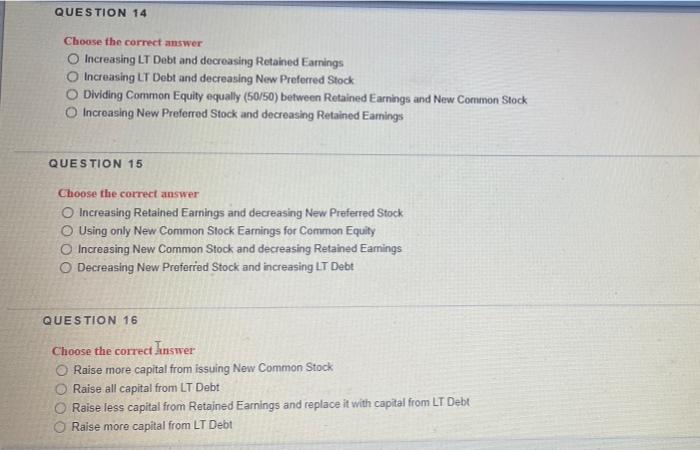

Page 2 Assume the following for problems 10 thru 13: Ravencorp's Cost of LT Debt-3.00% Ravencorp's Cost of New Preferred Stock-7.00% Ravencorp's Cost of Retained Earnings - 10.00% Ravencorp's Cost of New Common Stock - 11.00% Ravencorp's Existing LT Capital Structure: LT Debt-60% Preferred Equity 5% Common Equity 35% 10. Calculate the WACC for a capital project if the company maintains its existing long-term capital structure and Common Equity is raised entirely from Retained Earnings. Enter your answer as a decimal and round four past (e.g., .xxxx) (4 points) 11. Calculate the WACC for a capital project if the company maintains its existing long-term capital structure and Common Equity is split equally between Retained Earnings and New Common Stock. Enter your answer as a decimal and round four past (e.g.,.xxxx) (4 points) 12. Calculate the WACC for a capital project if the company does not issue any New Preferred Stock, does not issue any New Common Stock, and the capital is split equally between LT Debt and Retained Earnings. Enter your answer as a decimal and round four past (e.g.,.xxxx) (4 points) 13. Calculate the WACC for a project requiring $25,000,000 of total capital according to the following schedule. New Long-Term Debt = $13,000,000 New Preferred Stock = $1,000,000 Retained Earnings = $8,000,000 New Common Stock = $3,000,000 Enter your answer as a decimal and round four past (e.g.,.xxxx) (4 points) New Common Stock-$3,000,000 Enter your answer as a decimal and round four past (e.g.,.xxxx) (4 points) 14. Multiple Choice: Choose the change in weights (the "w") that would raise the WACC in problem #10 (2 points) 15. Multiple Choice: Choose the change in weights (the "w") that would lower the WACC in problem #11 (2 points) 16. Multiple Choice: Choose the action that would cause the WACC in problem #13 to increase? (2 points) QUESTION 14 Choose the correct answer O Increasing LT Debt and decreasing Retained Earnings O Increasing LT Debt and decreasing New Preferred Stock Dividing Common Equity equally (50/50) between Retained Earnings and New Common Stock Increasing New Preferred Stock and decreasing Retained Earnings QUESTION 15 Choose the correct answer O Increasing Retained Earnings and decreasing New Preferred Stock Using only New Common Stock Earnings for Common Equity O Increasing New Common Stock and decreasing Retained Earnings O Decreasing New Preferred Stock and increasing LT Debt QUESTION 16 Choose the correct answer O Raise more capital from issuing New Common Stock O Raise all capital from LT Debt Raise less capital from Retained Earnings and replace it with capital from LT Debt O Raise more capital from LT Debt Page 2 Assume the following for problems 10 thru 13: Ravencorp's Cost of LT Debt-3.00% Ravencorp's Cost of New Preferred Stock-7.00% Ravencorp's Cost of Retained Earnings - 10.00% Ravencorp's Cost of New Common Stock - 11.00% Ravencorp's Existing LT Capital Structure: LT Debt-60% Preferred Equity 5% Common Equity 35% 10. Calculate the WACC for a capital project if the company maintains its existing long-term capital structure and Common Equity is raised entirely from Retained Earnings. Enter your answer as a decimal and round four past (e.g., .xxxx) (4 points) 11. Calculate the WACC for a capital project if the company maintains its existing long-term capital structure and Common Equity is split equally between Retained Earnings and New Common Stock. Enter your answer as a decimal and round four past (e.g.,.xxxx) (4 points) 12. Calculate the WACC for a capital project if the company does not issue any New Preferred Stock, does not issue any New Common Stock, and the capital is split equally between LT Debt and Retained Earnings. Enter your answer as a decimal and round four past (e.g.,.xxxx) (4 points) 13. Calculate the WACC for a project requiring $25,000,000 of total capital according to the following schedule. New Long-Term Debt = $13,000,000 New Preferred Stock = $1,000,000 Retained Earnings = $8,000,000 New Common Stock = $3,000,000 Enter your answer as a decimal and round four past (e.g.,.xxxx) (4 points) New Common Stock-$3,000,000 Enter your answer as a decimal and round four past (e.g.,.xxxx) (4 points) 14. Multiple Choice: Choose the change in weights (the "w") that would raise the WACC in problem #10 (2 points) 15. Multiple Choice: Choose the change in weights (the "w") that would lower the WACC in problem #11 (2 points) 16. Multiple Choice: Choose the action that would cause the WACC in problem #13 to increase? (2 points) QUESTION 14 Choose the correct answer O Increasing LT Debt and decreasing Retained Earnings O Increasing LT Debt and decreasing New Preferred Stock Dividing Common Equity equally (50/50) between Retained Earnings and New Common Stock Increasing New Preferred Stock and decreasing Retained Earnings QUESTION 15 Choose the correct answer O Increasing Retained Earnings and decreasing New Preferred Stock Using only New Common Stock Earnings for Common Equity O Increasing New Common Stock and decreasing Retained Earnings O Decreasing New Preferred Stock and increasing LT Debt QUESTION 16 Choose the correct answer O Raise more capital from issuing New Common Stock O Raise all capital from LT Debt Raise less capital from Retained Earnings and replace it with capital from LT Debt O Raise more capital from LT Debt