Answered step by step

Verified Expert Solution

Question

1 Approved Answer

^^ Page( 35) Page (36) ^^^^ Page (38)^^^^ et's take a look at a hypothetical firm, MoMi Brothers. The market value of its total assets

^^ Page( 35)

Page (36) ^^^^

Page (38)^^^^

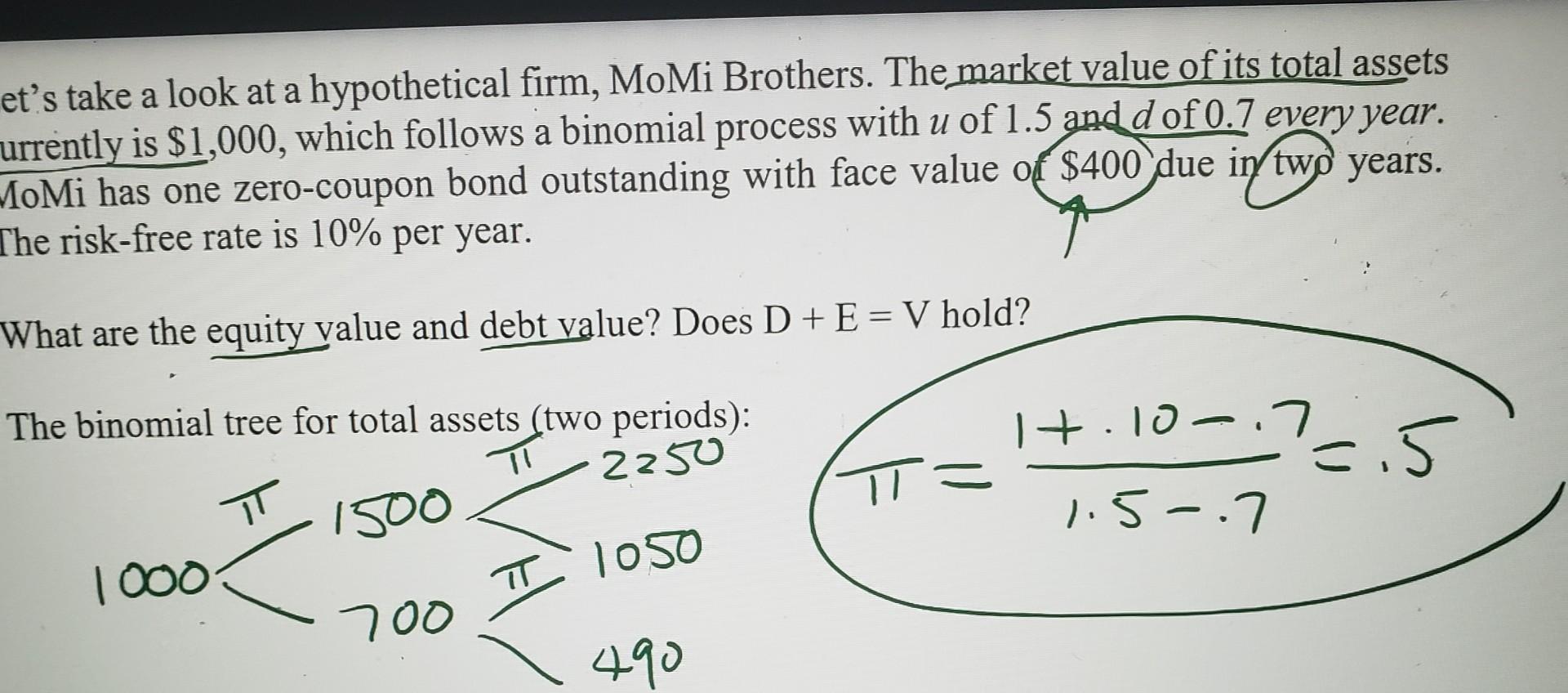

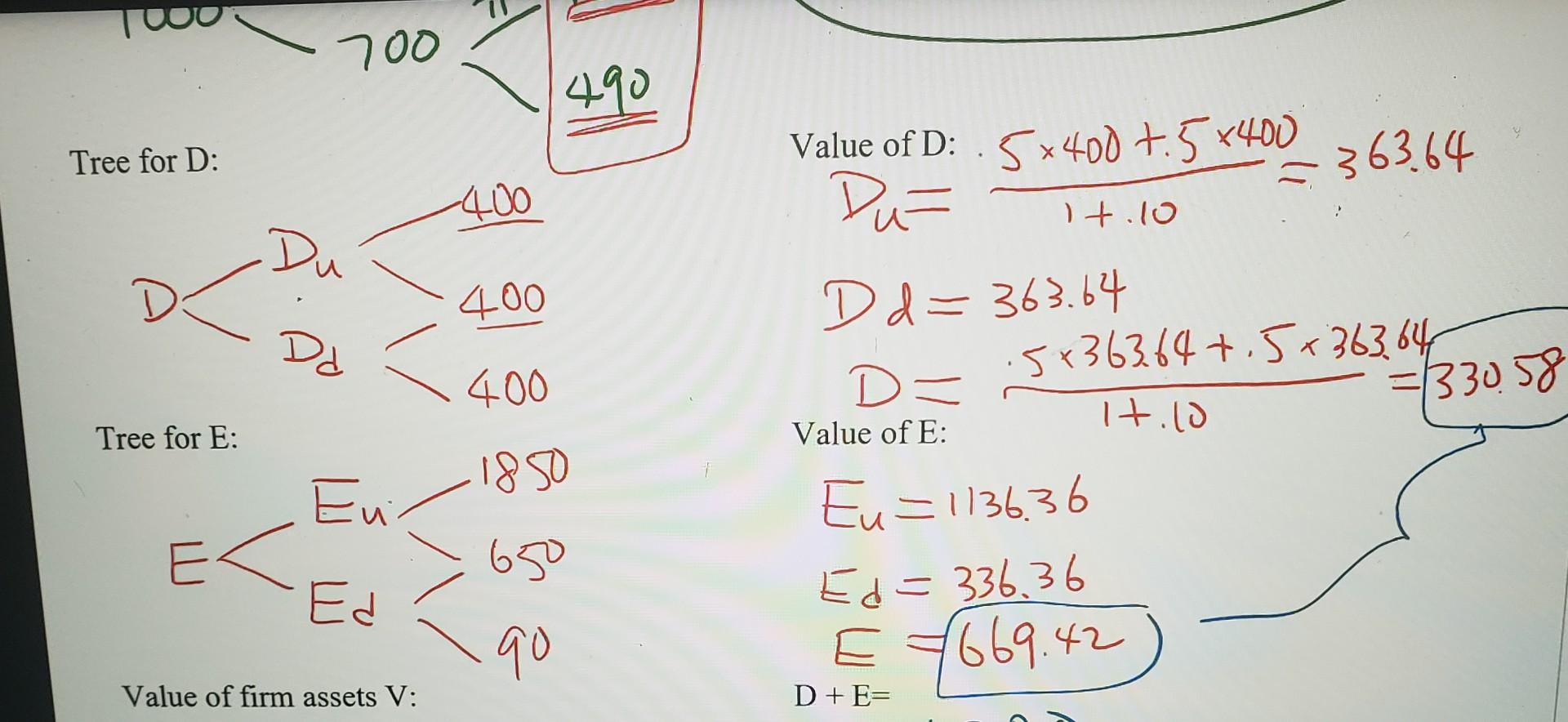

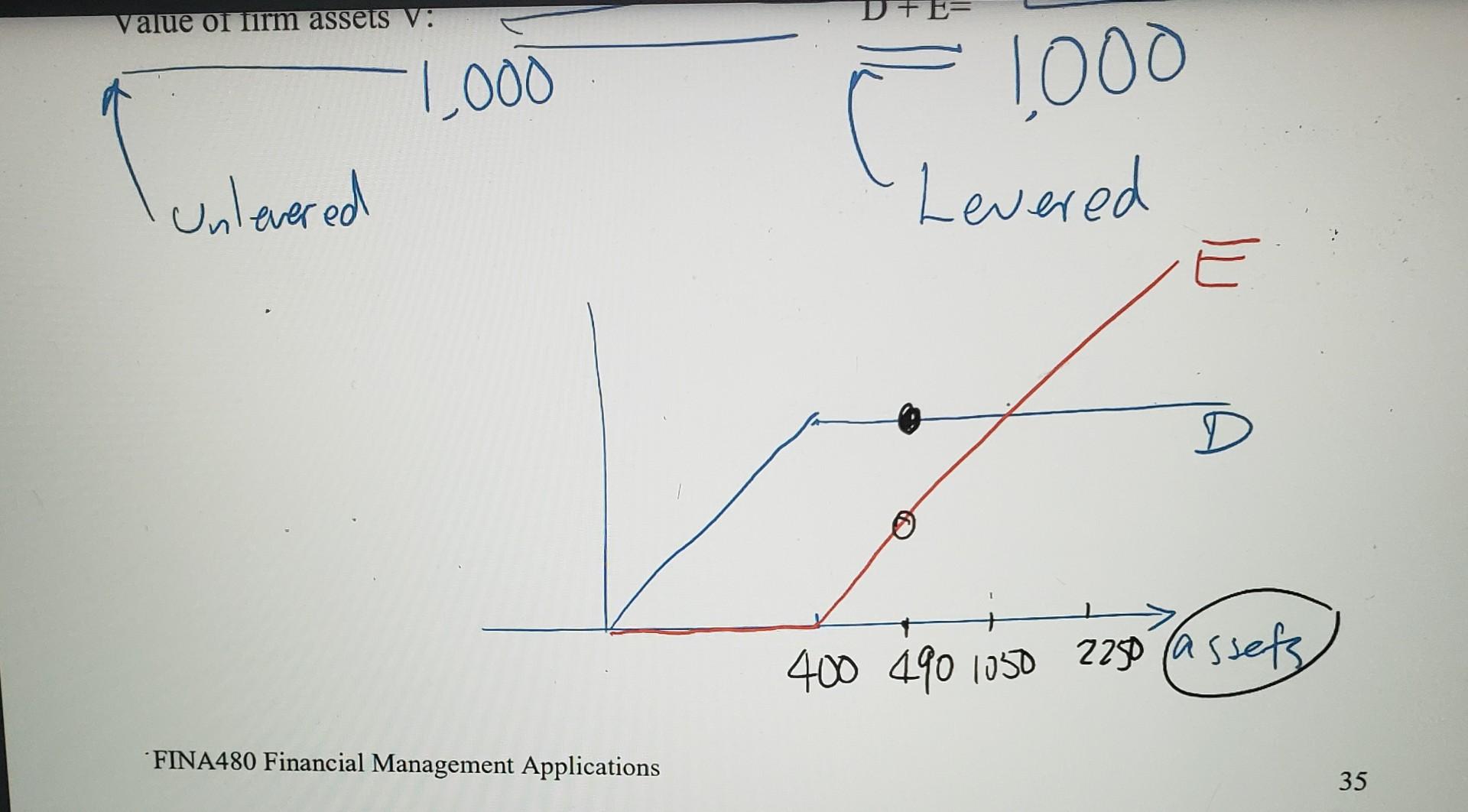

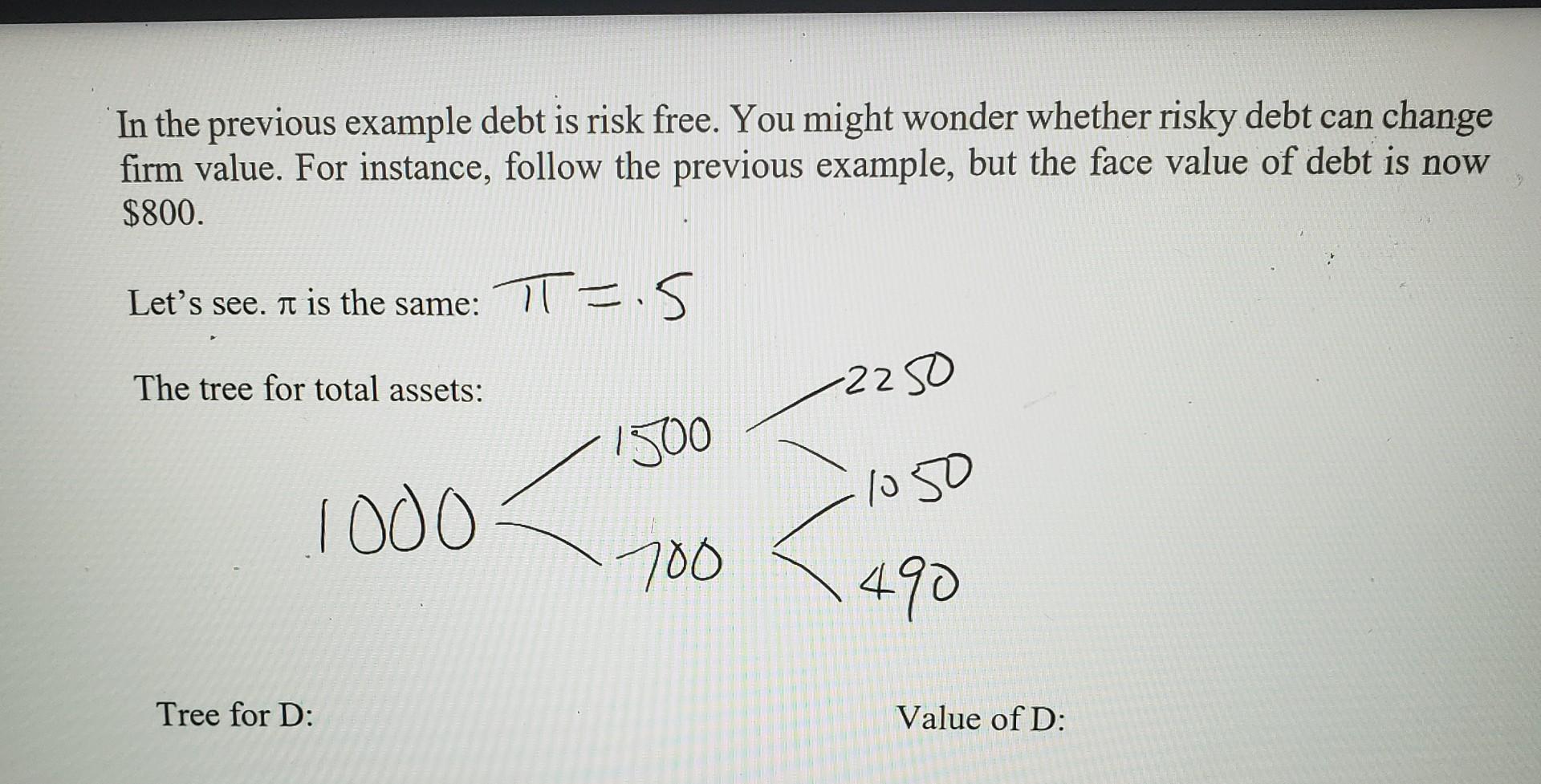

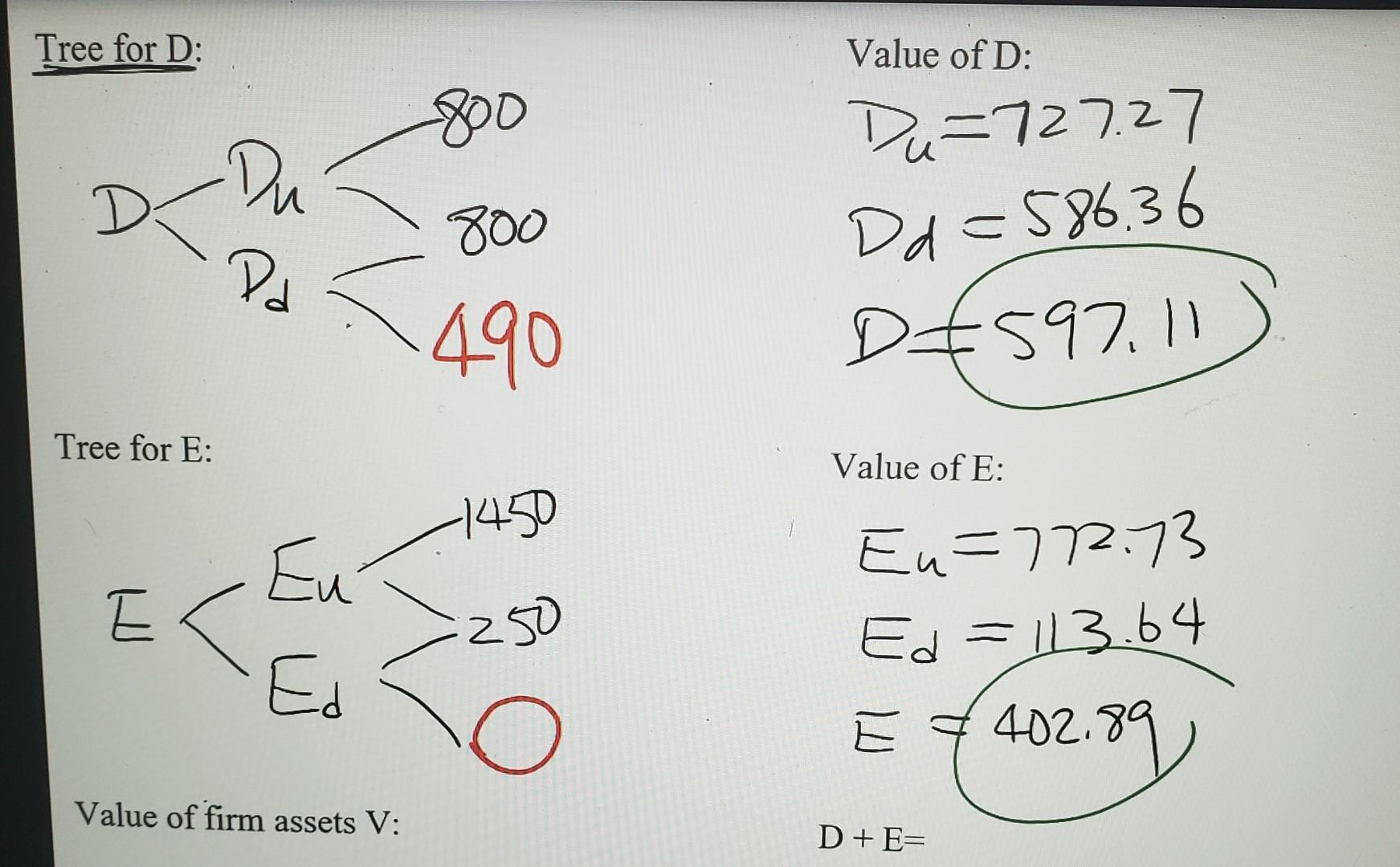

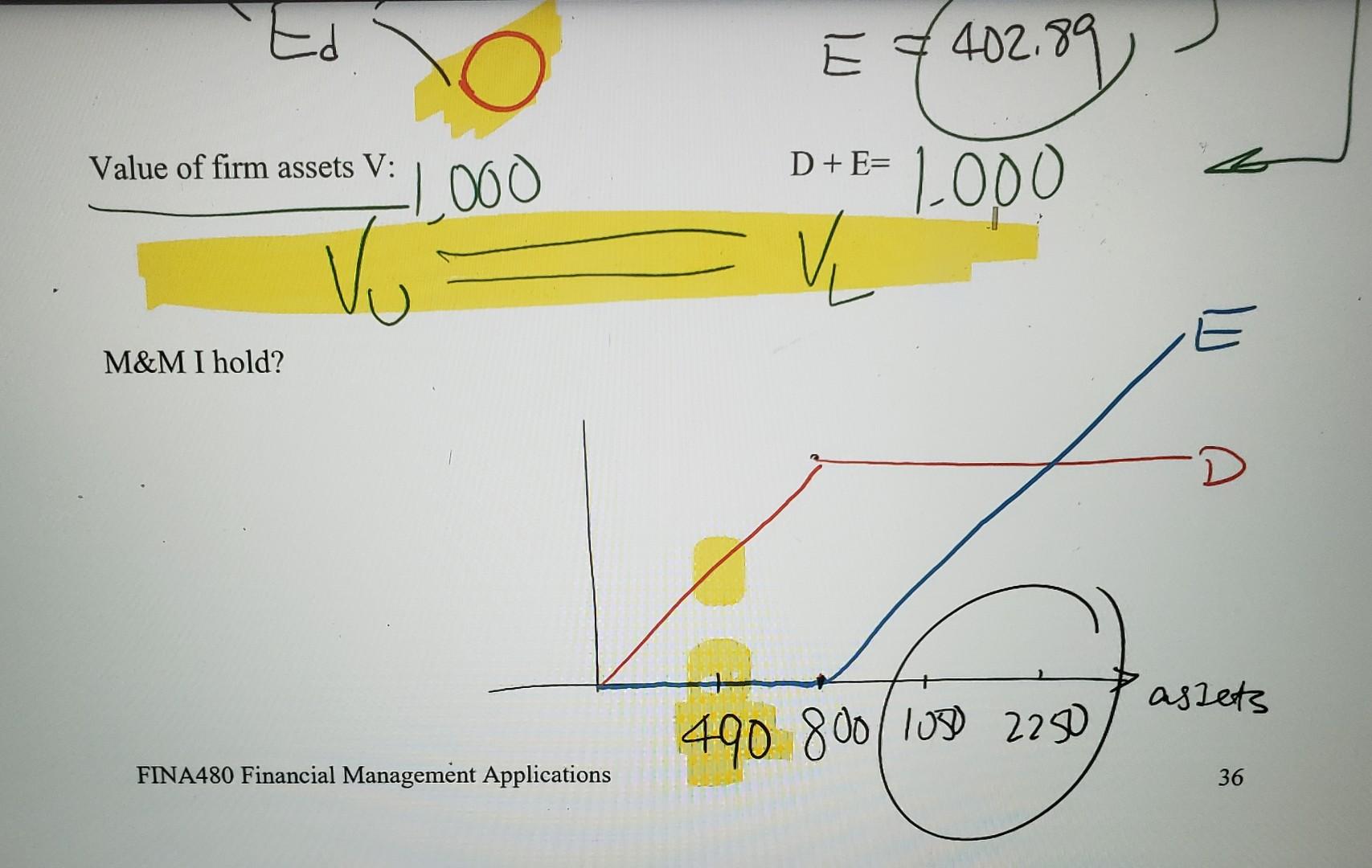

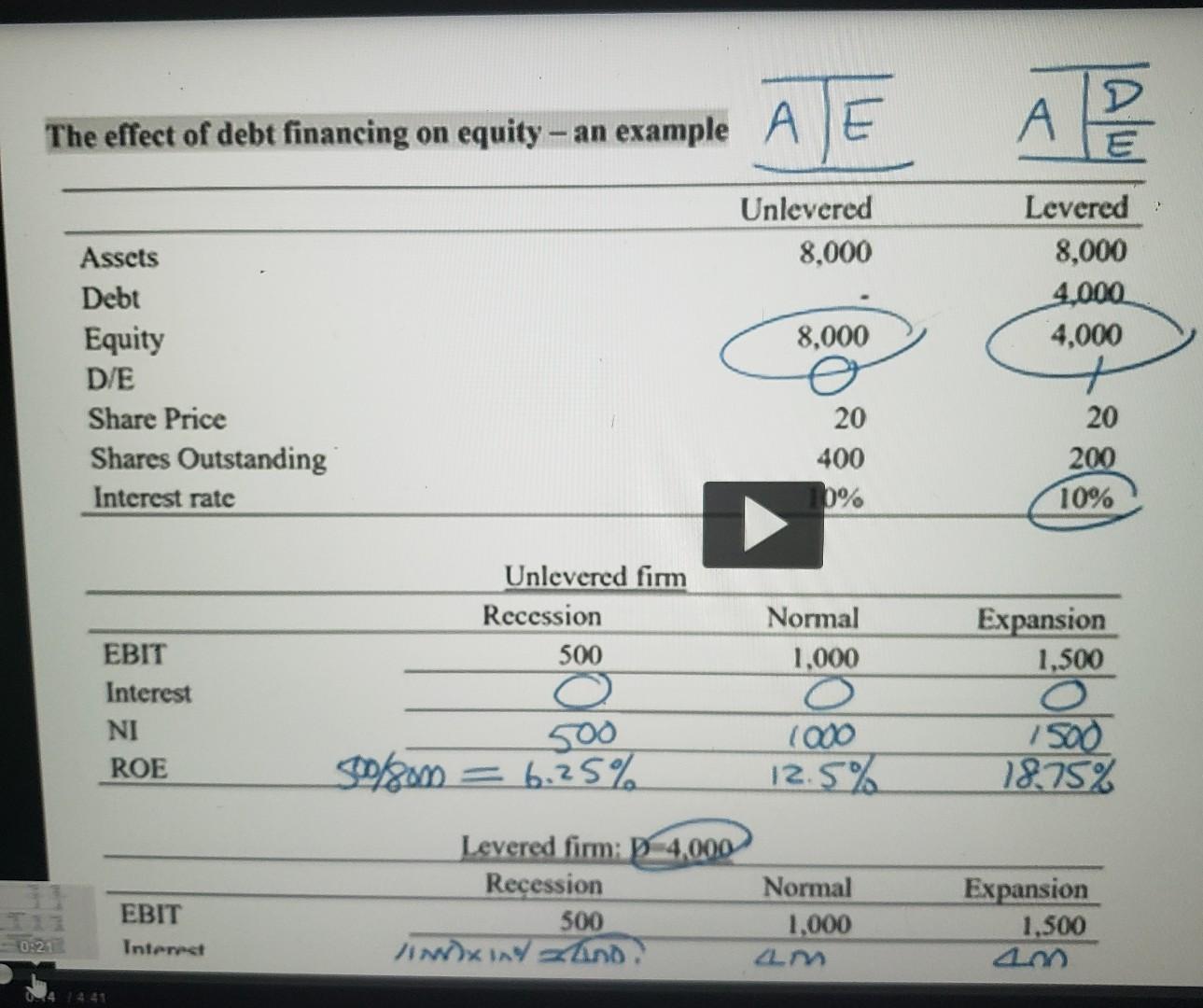

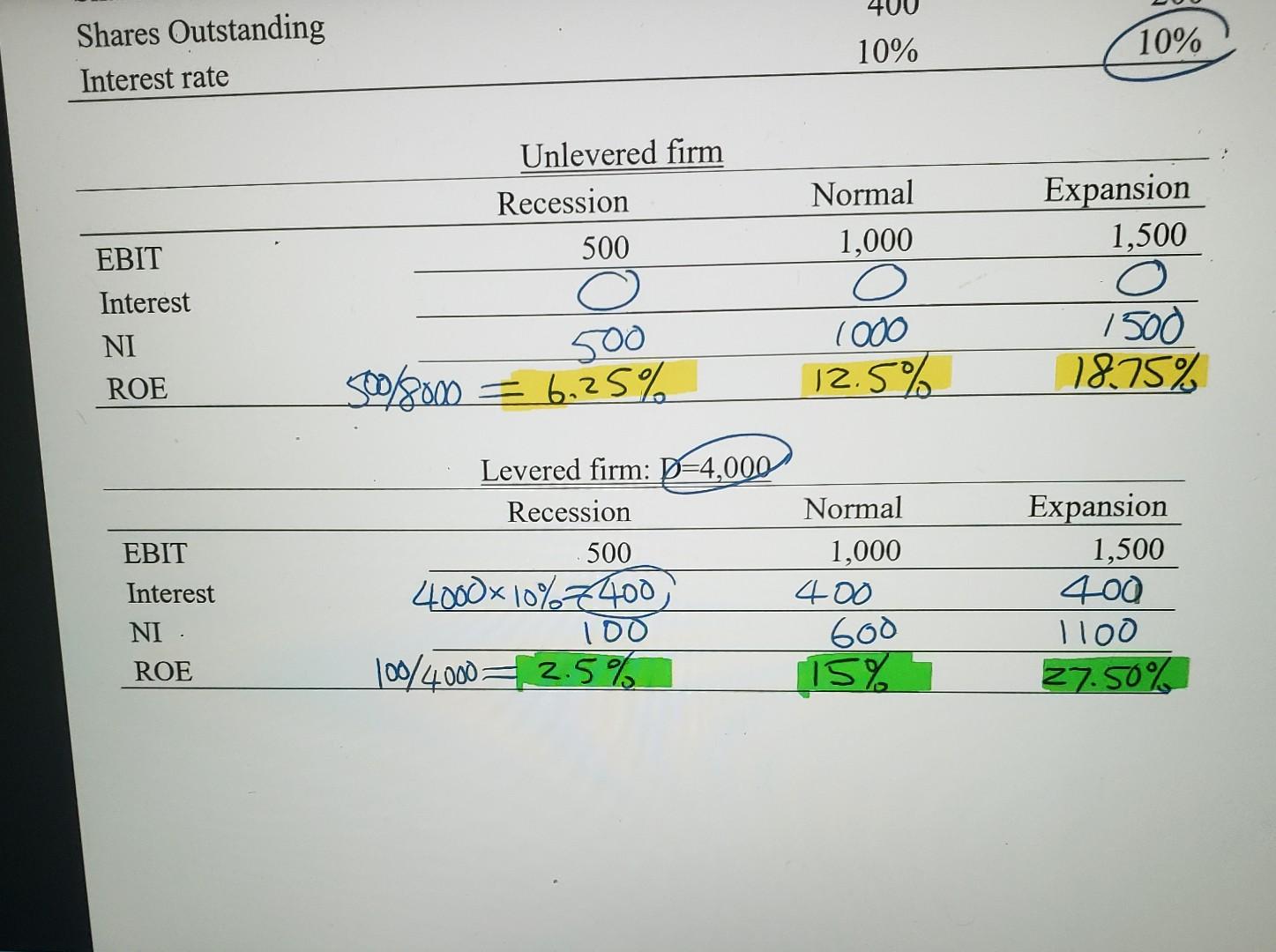

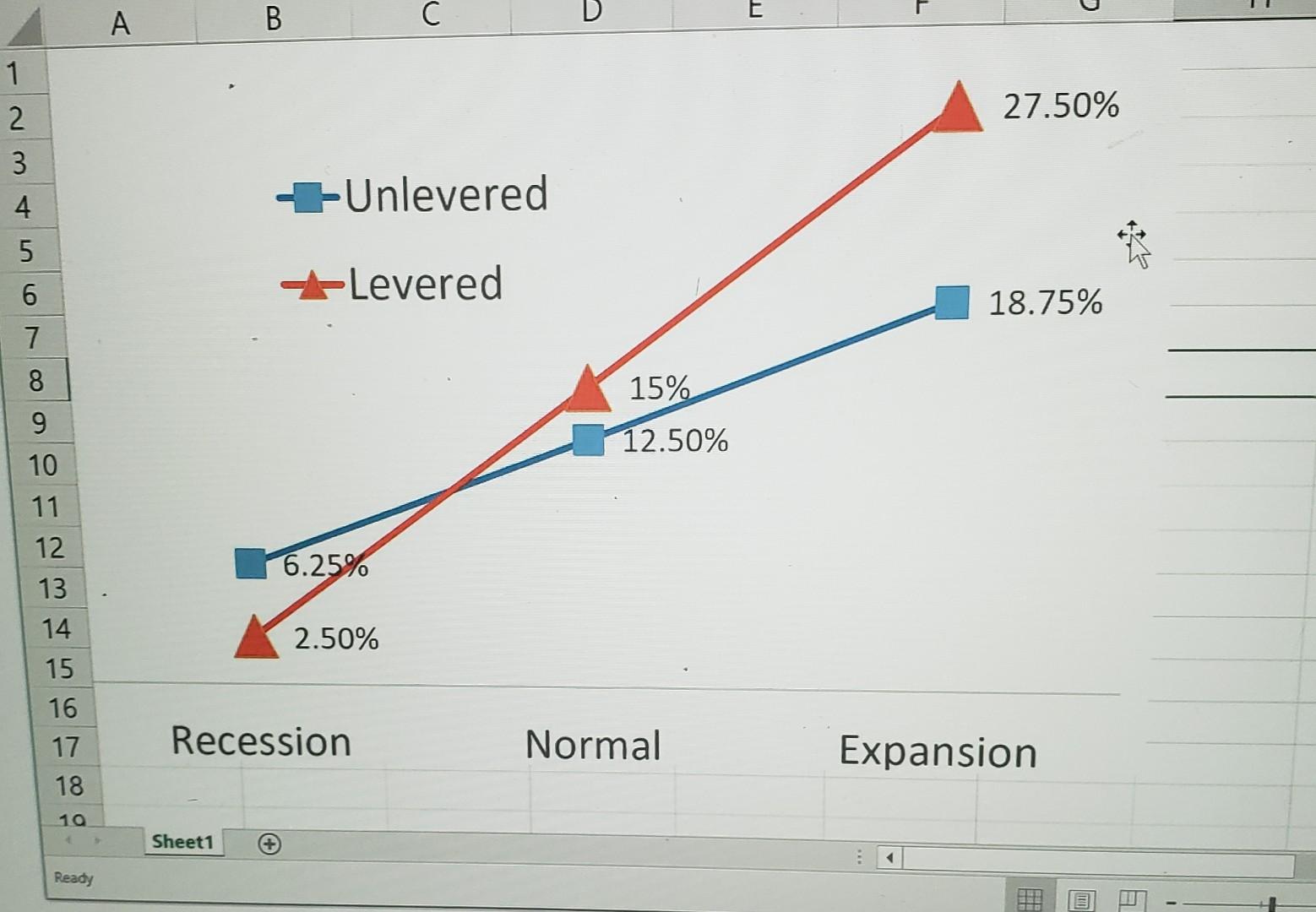

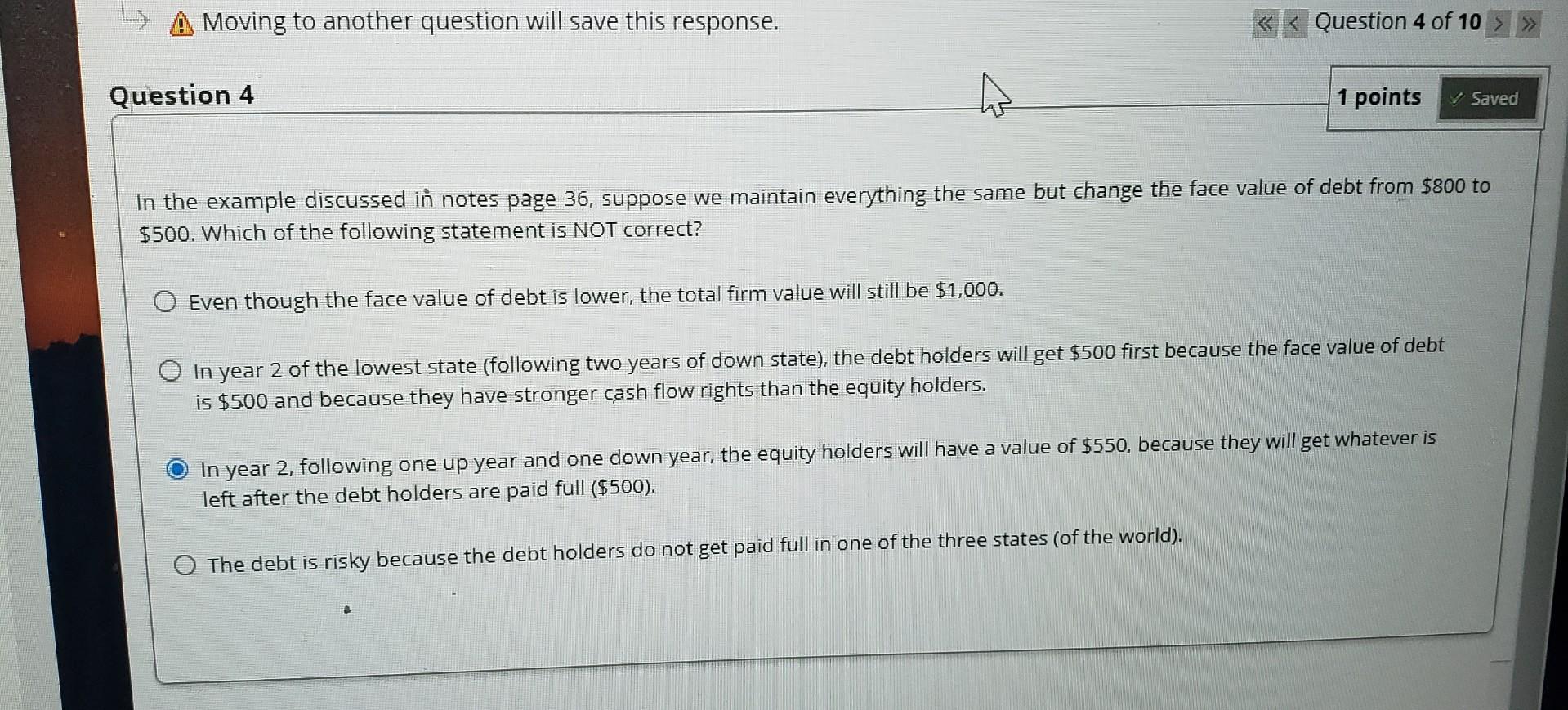

et's take a look at a hypothetical firm, MoMi Brothers. The market value of its total assets urrently is $1,000, which follows a binomial process with u of 1.5 and d of 0.7 every year. MoMi has one zero-coupon bond outstanding with face value of $400 due in two years. The risk-free rate is 10% per year. What are the equity value and debt value? Does D + E = V hold? The binomial tree for total assets (two periods): 14.10.2=.5 2250 IT 1500 1.5-.7 1000 I 1050 TO 700 490 700 490 Tree for D: Value of D: 5x400 7.5x400 Die 363.64 -400 1.10 Du 400 Dd 400 it.is Tree for E: Value of E: 1850 D d=363.64 D=+ .5*363.64+.5+363.64 =133058 Eu=1136.36 Ed=336.36 E 669.42 E Eur Ed EX 650 90 Value of firm assets V: D + E= DEFE= value or Iirm assets V: 2000 1000 Tulared unlevered Levered 400 490 1050 2250 (assets *FINA480 Financial Management Applications 35 In the previous example debt is risk free. You might wonder whether risky debt can change firm value. For instance, follow the previous example, but the face value of debt is now $800. Let's see. T is the same: T=.5 s The tree for total assets: -2250 1300 1050 1000 700 490 Tree for D: Value of D: Tree for D: Value of D: 800 Du=727.27 Du D 800 Dd=586.36 Dd 490 D+597,11 Tree for E: Value of E: 1450 Eu Eu=72.73 Ed = 113.64 250 0 E 402.89 Value of firm assets V: D + EN Ed 402.89 Value of firm assets V: D + E= 2000 1000 vo V M&M I hold? assets 490 800/10D 2280 FINA480 Financial Management Applications 36 The effect of debt financing on equity- an example A APP Unlevered 8,000 Levered 8,000 4,000 4,000 8,000 Assets Debt Equity D/E Share Price Shares Outstanding Interest rate 20 400 0% 20 200 10% Unlevered firm Rccession 500 Normal 1,000 Expansion 1,500 EBIT Interest NI ROE 500 59%800 = 6.25% 1000 12.5% / 500 1875% Levered firm: 4,000 Recession 500 Horixind and EBIT Interest Normal 1.000 LM Expansion 1,500 0:21 400 Shares Outstanding Interest rate 10% 10% Unlevered firm Recession 500 Normal 1,000 Expansion 1,500 EBIT ) Interest 500 NI ROE 1000 12.5% 1500 1875% Soo 8000 = 6,25% EBIT Interest NI ROE Levered firm: D=4,000 Recession Normal 500 1,000 4000+ 10% 7400 400 100 600 100/4000 = 2.5% 15% Expansion 1,500 4.00 1100 27.50% B A C E 1 27.50% 2 3 Unlevered 4. 5 6 Levered 18.75% 7 7 8 15% 12.50% 9 10 11 12 13 14 6.25% 2.50% 15 16 17 18 Recession Normal Expansion 10 Sheet1 # Ready Moving to another question will save this response. Question 1 In the example of notes page 35, suppose we keep everything else the same but change the risk free rate from 10% to 5%, which of the following statements is correct? The total value of equity and debt (in time 0) will be still equal to $1,000. O The risk-neutral probability remains the same. O The equity value remains the same. The debt value remains the same. A Moving to another question will save this response. Moving to another question will save this response.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started