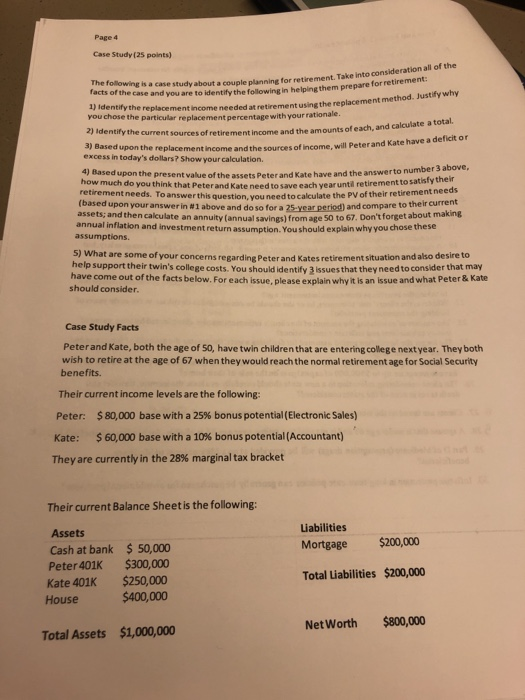

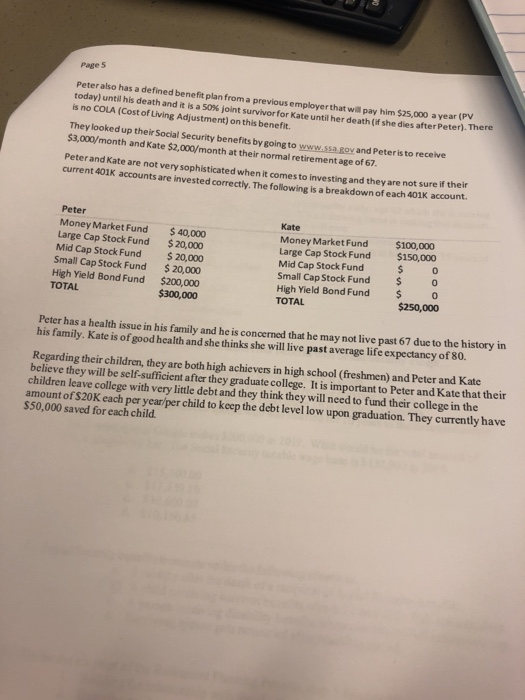

Page 4 Case Study (25 points) The following is a case study about a co a case study about a couple planning for retirement Take into consideration all of the are for retirement: Facts of the case and you are to identify the following in helping them prepare for 1) Identify the replacement income needed at retire me needed at retirement using the replacement method. Justify why you chose the particular replacement percentage with your rationale. 2) Identify the current dentify the current sources of retirement income and the amounts of each, and calculate a tota Based upon the replacement income and the sources of income, will Peter and Kate have a deci excess in today's dollars? Show your calculation. Based upon the present value of the assets Peter and Kate have and the answerto numbe answerto number 3 above, how much do you think that Peterand Kate need to save each year until retirement to sa retirement needs. To answer this question, you need to calculate the PV of their retirement nee (based upon your answer in #1 above and do so for a 25-year period) and compare to their current assets; and then calculate an annuity annual savings fromage 50 to 67. Don't forget about me for at about making annual inflation and investment return assumption. You should explain why you chose these assumptions. 5) What are some of your concerns regarding Peter and Kates retirement situation and also desire to help support their twin's college costs. You should identify issues that they need to consider that may have come out of the facts below. For each issue, please explain why it is an issue and what Peter & Kate should consider. Case Study Facts Peter and Kate, both the age of 50, have twin children that are entering college next year. They both wish to retire at the age of 67 when they would reach the normal retirement age for Social Security benefits. Their current income levels are the following: Peter: $80,000 base with a 25% bonus potential (Electronic Sales) Kate: $60,000 base with a 10% bonus potential (Accountant) They are currently in the 28% marginal tax bracket Their current Balance Sheet is the following: Liabilities Mortgage $200,000 Assets Cash at bank Peter 401K Kate 401K House $ 50,000 $300,000 $250,000 $400,000 Total Liabilities $200,000 Net Worth $800,000 Total Assets $1,000,000 Page 5 Peter also has a defined benefit plan from a previous employer that will pay him $25,000 a year (P today) until his death and it is a 50% joint survivorfor kate until her death (if she dies after Peter). There is no COLA (Cost of Living Adjustment) on this benefit. They looked up their Social Security benefits by going to www.ssa ov and Peter is to receive $3,000/month and Kate $2,000/month at their normal retirement age of 67. Peter and Kate are not very sophisticated when it comes to investing and they are not sure if the current 401K accounts are invested correctly. The following is a breakdown of each 401K account Peter Money Market Fund Large Cap Stock Fund Mid Cap Stock Fund Small Cap Stock Fund High Yield Bond Fund TOTAL $ 40,000 $20,000 $20,000 $20,000 $200,000 $300,000 Kate Money Market Fund Large Cap Stock Fund Mid Cap Stock Fund Small Cap Stock Fund High Yield Bond Fund TOTAL $100,000 $150,000 0 $ 0 $ 0 $250,000 Peter has a health issue in his family and he is concerned that he may not live past 67 due to the history in his family. Kate is of good health and she thinks she will live past average life expectancy of 80. Regarding their children, they are both high achievers in high school (freshmen) and Peter and Kate believe they will be self-sufficient after they graduate college. It is important to Peter and Kate that their children leave college with very little debt and they think they will need to fund their college in the amount of $20K each per year per child to keep the debt level low upon graduation. They currently have $50,000 saved for each of year per child to keep the dehk they will need to fund theer and Kate that their Page 4 Case Study (25 points) The following is a case study about a co a case study about a couple planning for retirement Take into consideration all of the are for retirement: Facts of the case and you are to identify the following in helping them prepare for 1) Identify the replacement income needed at retire me needed at retirement using the replacement method. Justify why you chose the particular replacement percentage with your rationale. 2) Identify the current dentify the current sources of retirement income and the amounts of each, and calculate a tota Based upon the replacement income and the sources of income, will Peter and Kate have a deci excess in today's dollars? Show your calculation. Based upon the present value of the assets Peter and Kate have and the answerto numbe answerto number 3 above, how much do you think that Peterand Kate need to save each year until retirement to sa retirement needs. To answer this question, you need to calculate the PV of their retirement nee (based upon your answer in #1 above and do so for a 25-year period) and compare to their current assets; and then calculate an annuity annual savings fromage 50 to 67. Don't forget about me for at about making annual inflation and investment return assumption. You should explain why you chose these assumptions. 5) What are some of your concerns regarding Peter and Kates retirement situation and also desire to help support their twin's college costs. You should identify issues that they need to consider that may have come out of the facts below. For each issue, please explain why it is an issue and what Peter & Kate should consider. Case Study Facts Peter and Kate, both the age of 50, have twin children that are entering college next year. They both wish to retire at the age of 67 when they would reach the normal retirement age for Social Security benefits. Their current income levels are the following: Peter: $80,000 base with a 25% bonus potential (Electronic Sales) Kate: $60,000 base with a 10% bonus potential (Accountant) They are currently in the 28% marginal tax bracket Their current Balance Sheet is the following: Liabilities Mortgage $200,000 Assets Cash at bank Peter 401K Kate 401K House $ 50,000 $300,000 $250,000 $400,000 Total Liabilities $200,000 Net Worth $800,000 Total Assets $1,000,000 Page 5 Peter also has a defined benefit plan from a previous employer that will pay him $25,000 a year (P today) until his death and it is a 50% joint survivorfor kate until her death (if she dies after Peter). There is no COLA (Cost of Living Adjustment) on this benefit. They looked up their Social Security benefits by going to www.ssa ov and Peter is to receive $3,000/month and Kate $2,000/month at their normal retirement age of 67. Peter and Kate are not very sophisticated when it comes to investing and they are not sure if the current 401K accounts are invested correctly. The following is a breakdown of each 401K account Peter Money Market Fund Large Cap Stock Fund Mid Cap Stock Fund Small Cap Stock Fund High Yield Bond Fund TOTAL $ 40,000 $20,000 $20,000 $20,000 $200,000 $300,000 Kate Money Market Fund Large Cap Stock Fund Mid Cap Stock Fund Small Cap Stock Fund High Yield Bond Fund TOTAL $100,000 $150,000 0 $ 0 $ 0 $250,000 Peter has a health issue in his family and he is concerned that he may not live past 67 due to the history in his family. Kate is of good health and she thinks she will live past average life expectancy of 80. Regarding their children, they are both high achievers in high school (freshmen) and Peter and Kate believe they will be self-sufficient after they graduate college. It is important to Peter and Kate that their children leave college with very little debt and they think they will need to fund their college in the amount of $20K each per year per child to keep the debt level low upon graduation. They currently have $50,000 saved for each of year per child to keep the dehk they will need to fund theer and Kate that their