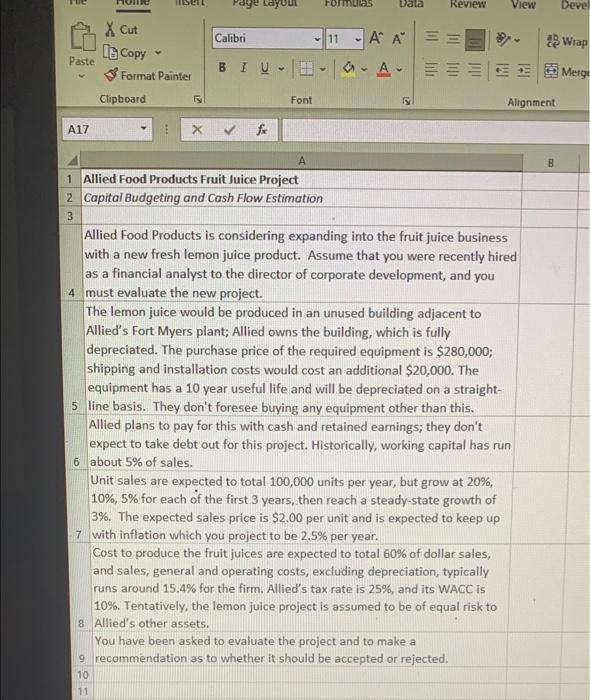

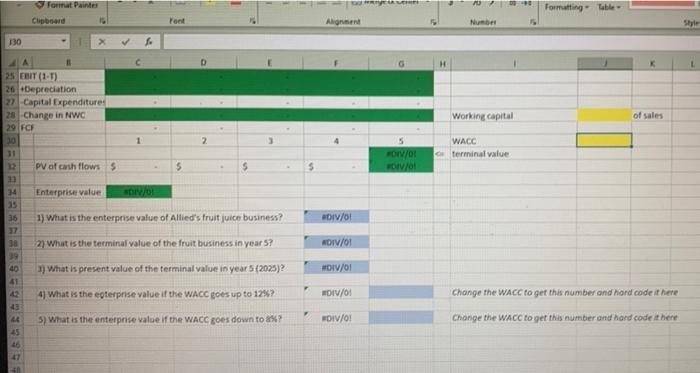

Page Layout Formulas Data Review View Devel Calibri X Cut Lo Copy Format Painter - 11 - A A A A E a. A Paste Wrap Merge u v Clipboard is Font Alignment A17 fx B 1 Allied Food Products Fruit Juice Project 2 Capital Budgeting and Cash Flow Estimation 3 Allied Food Products is considering expanding into the fruit juice business with a new fresh lemon juice product. Assume that you were recently hired as a financial analyst to the director of corporate development, and you 4 must evaluate the new project. The lemon juice would be produced in an unused building adjacent to Allied's Fort Myers plant; Allied owns the building, which is fully depreciated. The purchase price of the required equipment is $280,000; shipping and installation costs would cost an additional $20,000. The equipment has a 10 year useful life and will be depreciated on a straight- 5 line basis. They don't foresee buying any equipment other than this. Allied plans to pay for this with cash and retained earnings; they don't expect to take debt out for this project. Historically, working capital has run 6 about 5% of sales. Unit sales are expected to total 100,000 units per year, but grow at 20%, 10%, 5% for each of the first 3 years, then reach a steady-state growth of 3%. The expected sales price is $2.00 per unit and is expected to keep up 7 with inflation which you project to be 2.5% per year. Cost to produce the fruit juices are expected to total 60% of dollar sales, and sales, general and operating costs, excluding depreciation, typically runs around 15.4% for the firm. Allied's tax rate is 25%, and its WACC is 10%. Tentatively, the lemon juice project is assumed to be of equal risk to 8 Allied's other assets. You have been asked to evaluate the project and to make a 9 recommendation as to whether it should be accepted or rejected. 10 a 11 Format Painter Clipboard Formatting Table Font AN Number 130 > D H Working capital of sales 4 WACC terminal value DIV/0! DIV/! 5 25 EBIT (1-T) 26 Depreciation 27 Capital Expenditures 28 Change in NWC 29 FCI 30 2 31 12 pv af cash flows 5 5 $ 13 34 Enterprise value DIV/0! 15 36 1) What is the enterprise value of Allied's truit juice business? 17 38 2) What is the terminal value of the fruit business in year ? ? What is present value of the terminal value in year 5 (2025) DIV/0! NOIV/01 #DIV/01 4) What is the egterprise value if the WACC goes up to 12%? #DIV/01 39 40 41 42 3 LE 45 46 Change the WACC to get this number and hard code it here 3) What is the enterprise value of the WACC goes down to DIV/! Change the WACC to get this number and hard code there 40 Page Layout Formulas Data Review View Devel Calibri X Cut Lo Copy Format Painter - 11 - A A A A E a. A Paste Wrap Merge u v Clipboard is Font Alignment A17 fx B 1 Allied Food Products Fruit Juice Project 2 Capital Budgeting and Cash Flow Estimation 3 Allied Food Products is considering expanding into the fruit juice business with a new fresh lemon juice product. Assume that you were recently hired as a financial analyst to the director of corporate development, and you 4 must evaluate the new project. The lemon juice would be produced in an unused building adjacent to Allied's Fort Myers plant; Allied owns the building, which is fully depreciated. The purchase price of the required equipment is $280,000; shipping and installation costs would cost an additional $20,000. The equipment has a 10 year useful life and will be depreciated on a straight- 5 line basis. They don't foresee buying any equipment other than this. Allied plans to pay for this with cash and retained earnings; they don't expect to take debt out for this project. Historically, working capital has run 6 about 5% of sales. Unit sales are expected to total 100,000 units per year, but grow at 20%, 10%, 5% for each of the first 3 years, then reach a steady-state growth of 3%. The expected sales price is $2.00 per unit and is expected to keep up 7 with inflation which you project to be 2.5% per year. Cost to produce the fruit juices are expected to total 60% of dollar sales, and sales, general and operating costs, excluding depreciation, typically runs around 15.4% for the firm. Allied's tax rate is 25%, and its WACC is 10%. Tentatively, the lemon juice project is assumed to be of equal risk to 8 Allied's other assets. You have been asked to evaluate the project and to make a 9 recommendation as to whether it should be accepted or rejected. 10 a 11 Format Painter Clipboard Formatting Table Font AN Number 130 > D H Working capital of sales 4 WACC terminal value DIV/0! DIV/! 5 25 EBIT (1-T) 26 Depreciation 27 Capital Expenditures 28 Change in NWC 29 FCI 30 2 31 12 pv af cash flows 5 5 $ 13 34 Enterprise value DIV/0! 15 36 1) What is the enterprise value of Allied's truit juice business? 17 38 2) What is the terminal value of the fruit business in year ? ? What is present value of the terminal value in year 5 (2025) DIV/0! NOIV/01 #DIV/01 4) What is the egterprise value if the WACC goes up to 12%? #DIV/01 39 40 41 42 3 LE 45 46 Change the WACC to get this number and hard code it here 3) What is the enterprise value of the WACC goes down to DIV/! Change the WACC to get this number and hard code there 40