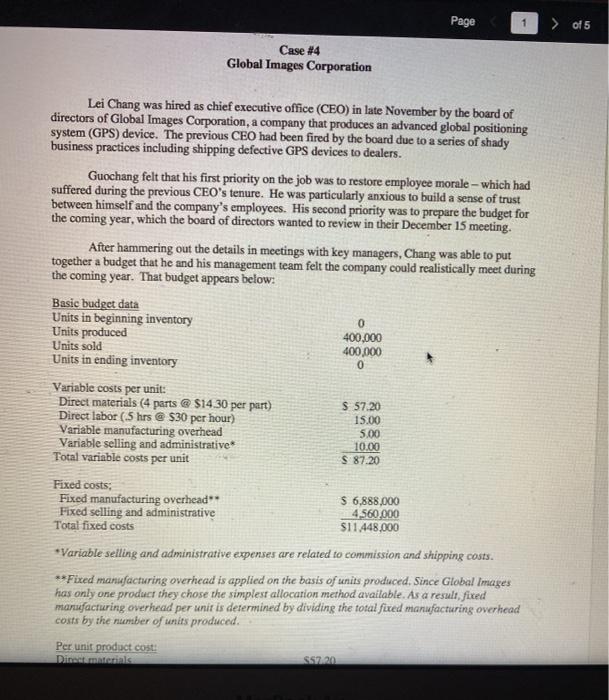

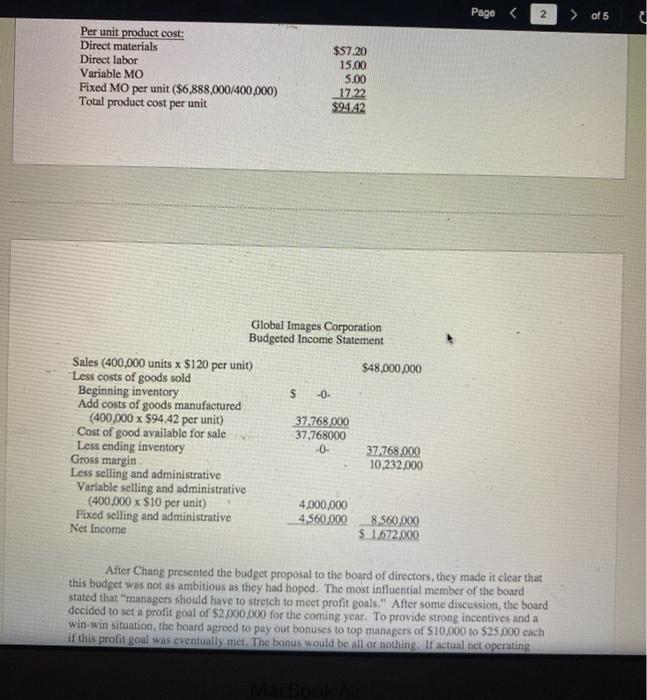

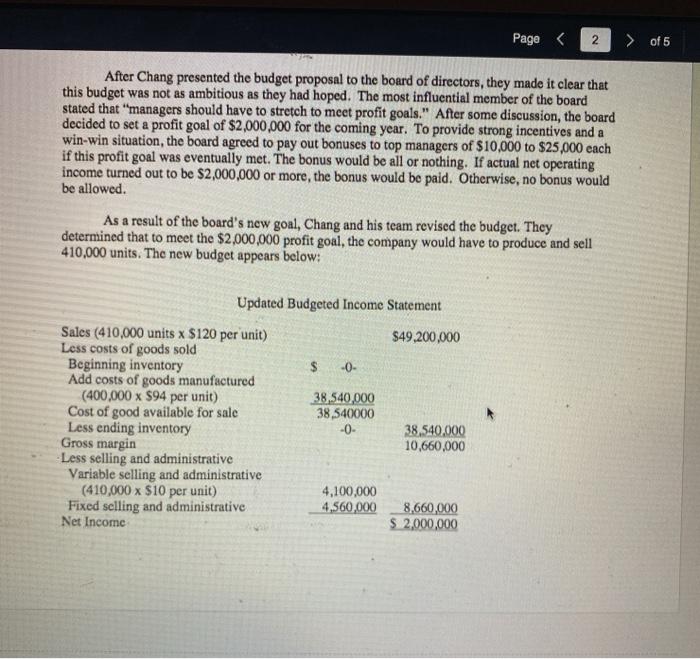

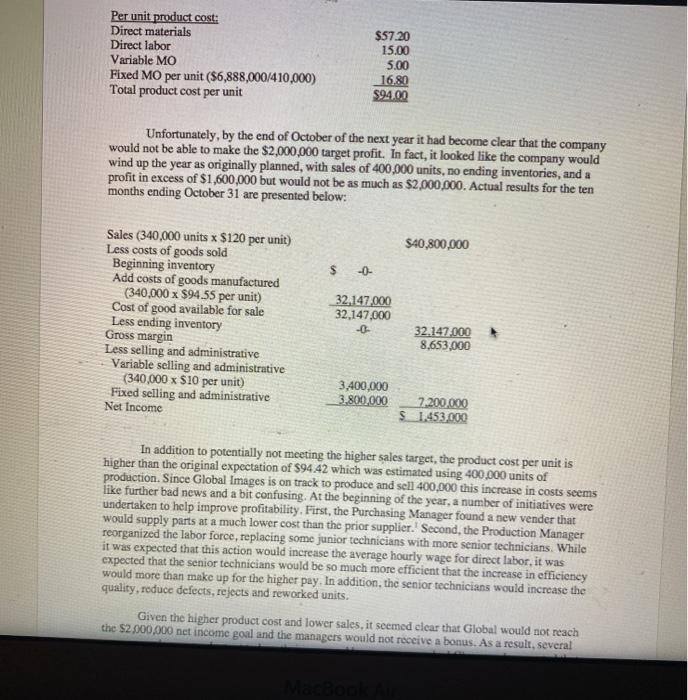

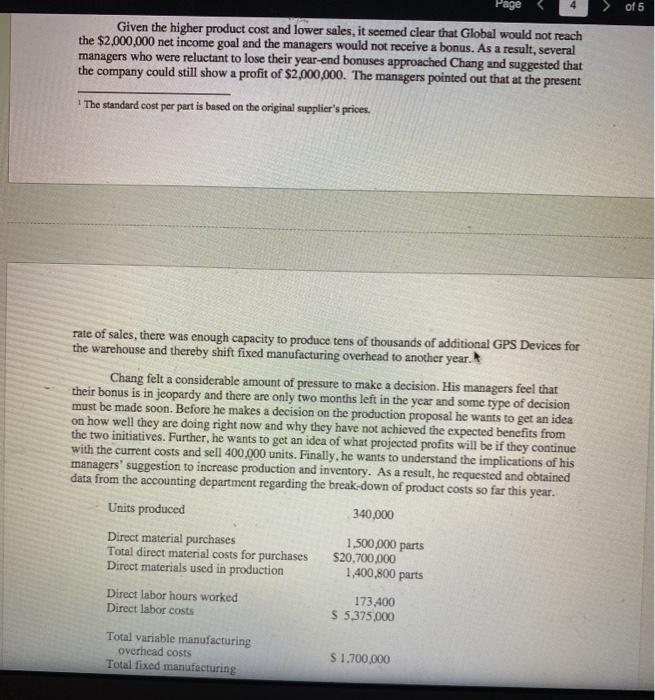

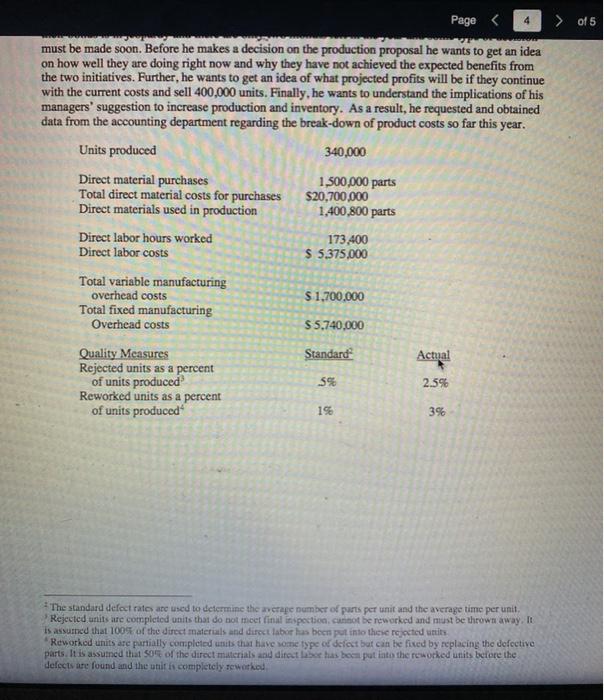

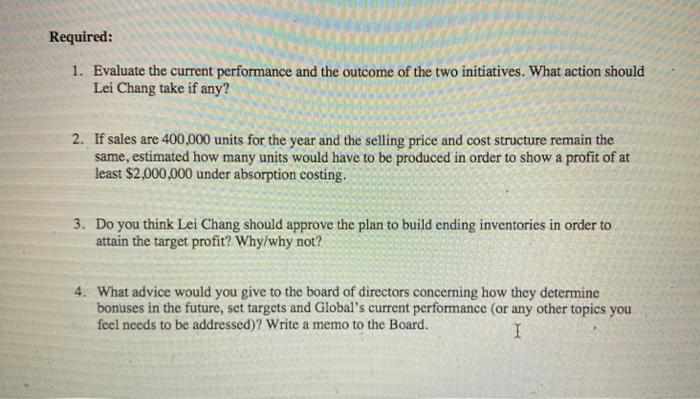

Page > of 5 Case #4 Global Images Corporation Lei Chang was hired as chief executive office (CEO) in late November by the board of directors of Global Images Corporation, a company that produces an advanced global positioning system (GPS) device. The previous CEO had been fired by the board due to a series of shady business practices including shipping defective GPS devices to dealers. Guochang felt that his first priority on the job was to restore employee morale - which had suffered during the previous CEO's tenure. He was particularly anxious to build a sense of trust between himself and the company's employees. His second priority was to prepare the budget for the coming year, which the board of directors wanted to review in their December 15 meeting. After hammering out the details in meetings with key managers, Chang was able to put together a budget that he and his management team felt the company could realistically meet during the coming year. That budget appears below: Basic budget data Units in beginning inventory 0 Units produced 400.000 Units sold 400,000 Units in ending inventory Variable costs per unit: Direct materials (4 parts@ $14.30 per part) S 57.20 Direct labor (5 hrs @ $30 per hour) 15.00 Variable manufacturing overhead 5.00 Variable selling and administrative* 10.00 Total variable costs per unit S 87.20 Fixed costs: Fixed manufacturing overhead" $ 6,888,000 Fixed selling and administrative 4.560,000 Total fixed costs $11.448,000 *Variable selling and administrative expenses are related to commission and shipping costs. **Fixed manufacturing overhead is applied on the basis of units produced. Since Global Images has only one product they chose the simplest allocation method available. As a result, fixed manufacturing overhead per unit is determined by dividing the total fixed manufacturing overhead costs by the number of units produced. 0 Per unit product cost. Dinsdentials SS20 Pages 2 > of 5 Per unit product cost: Direct materials Direct labor Variable MO Fixed MO per unit ($6,888,000/400,000) Total product cost per unit $57.20 15.00 5.00 17.22 $94.42 Global Images Corporation Budgeted Income Statement Sales (400,000 units x $120 per unit) $48,000,000 "Less costs of goods sold Beginning inventory s -0- Add costs of goods manufactured (400,000 x 594.42 per unit) 37.768.000 Cost of good available for sale 37,768000 Less ending inventory -0- 37.768,000 Gross margin 10,232,000 Less selling and administrative Variable selling and administrative (400,000 x $10 per unit) 4,000,000 Fixed selling and administrative 4,560,000 8,560,000 Net Income $ 1672.000 After Chang presented the budget proposal to the board of directors, they made it clear that this budget was not as ambitious as they had hoped. The most influential member of the board stated that "managers should have to stretch to meet profit goals." After some discussion, the board decided to set a profit goal of $2.000.000 for the coming year. To provide strong incentives and a win-win situation, the baard agreed to pay out bonuses to top managers of S10,000 to $25.000 each if this profit goal was eventually met. The bonus would be all or nothing. If actual net operating Page of 5 After Chang presented the budget proposal to the board of directors, they made it clear that this budget was not as ambitious as they had hoped. The most influential member of the board stated that "managers should have to stretch to meet profit goals." After some discussion, the board decided to set a profit goal of $2,000,000 for the coming year. To provide strong incentives and a win-win situation, the board agreed to pay out bonuses to top managers of $10,000 to $25,000 each if this profit goal was eventually met. The bonus would be all or nothing. If actual net operating income turned out to be $2,000,000 or more, the bonus would be paid. Otherwise, no bonus would be allowed. As a result of the board's new goal, Chang and his team revised the budget. They determined that to meet the $2,000,000 profit goal, the company would have to produce and sell 410,000 units. The new budget appears below: Updated Budgeted Income Statement $49,200,000 $ -0- Sales (410,000 units x $120 per unit) Less costs of goods sold Beginning inventory Add costs of goods manufactured (400,000 x $94 per unit) Cost of good available for sale Less ending inventory Gross margin -Less selling and administrative Variable selling and administrative (410,000 x $10 per unit) Fixed selling and administrative Net Income 38,540,000 38,540000 -0- 38,540.000 10,660,000 4,100,000 4,560,000 8,660,000 $ 2,000,000 Per unit product cost: Direct materials Direct labor Variable MO Fixed MO per unit ($6,888,000/410,000) Total product cost per unit $57.20 15.00 5.00 16.80 $94.00 Unfortunately, by the end of October of the next year it had become clear that the company would not be able to make the $2,000,000 target profit. In fact, it looked like the company would wind up the year as originally planned, with sales of 400,000 units, no ending inventories, and a profit in excess of $1,600,000 but would not be as much as $2,000,000. Actual results for the ten months ending October 31 are presented below: $40,800,000 $ -0- Sales (340,000 units x $120 per unit) Less costs of goods sold Beginning inventory Add costs of goods manufactured (340,000 x $94.55 per unit) Cost of good available for sale Less ending inventory Gross margin Less selling and administrative Variable selling and administrative (340,000 x $10 per unit) Fixed selling and administrative Net Income 32.147.000 32.147.000 -0 32.147.000 8.653.000 3,400,000 3,800,000 7.200,000 $1.453.000 In addition to potentially not meeting the higher sales target, the product cost per unit is higher than the original expectation of S94 42 which was estimated using 400,000 units of production. Since Global Images is on track to produce and sell 400,000 this increase in costs seems like further bad news and a bit confusing. At the beginning of the year, a number of initiatives were undertaken to help improve profitability. First, the Purchasing Manager found a new vender that would supply parts at a much lower cost than the prior supplier. Second, the Production Manager reorganized the labor force, replacing some junior technicians with more senior technicians. While it was expected that this action would increase the average hourly wage for direct labor, it was expected that the senior technicians would be so much more efficient that the increase in efficiency would more than make up for the higher pay. In addition, the senior technicians would increase the quality,roduce defects, rejects and reworked units. Given the higher product cost and lower sales, it seemed clear that Global would not reach the $2.000.000 net income goal and the managers would not receive a bonus. As a result, several Page of 5 Given the higher product cost and lower sales, it seemed clear that Global would not reach the $2,000,000 net income goal and the managers would not receive a bonus. As a result, several managers who were reluctant to lose their year-end bonuses approached Chang and suggested that the company could still show a profit of $2,000,000. The managers pointed out that at the present The standard cost per part is based on the original supplier's prices. rate of sales, there was enough capacity to produce tens of thousands of additional GPS Devices for the warehouse and thereby shift fixed manufacturing overhead to another year. Chang felt a considerable amount of pressure to make a decision. His managers feel that their bonus is in jeopardy and there are only two months left in the year and some type of decision must be made soon. Before he makes a decision on the production proposal he wants to get an idea on how well they are doing right now and why they have not achieved the expected benefits from the two initiatives. Further, he wants to get an idea of what projected profits will be if they continue with the current costs and sell 400,000 units. Finally, he wants to understand the implications of his managers' suggestion to increase production and inventory. As a result, he requested and obtained data from the accounting department regarding the break-down of product costs so far this year. Units produced 340.000 Direct material purchases 1,500,000 parts Total direct material costs for purchases $20,700,000 Direct materials used in production 1,400,800 parts Direct labor hours worked 173.400 Direct labor costs $ 5,375.000 Total variable manufacturing overhead costs $1,700,000 Total fixed manufacturing Page of 5 must be made soon. Before he makes a decision on the production proposal he wants to get an idea on how well they are doing right now and why they have not achieved the expected benefits from the two initiatives. Further, he wants to get an idea of what projected profits will be if they continue with the current costs and sell 400,000 units. Finally, he wants to understand the implications of his managers' suggestion to increase production and inventory. As a result, he requested and obtained data from the accounting department regarding the break-down of product costs so far this year. Units produced 340,000 Direct material purchases 1,500,000 parts Total direct material costs for purchases $20,700.000 Direct materials used in production 1,400,800 parts Direct labor hours worked 173,400 Direct labor costs $ 5.375,000 $ 1,700.000 S5,740,000 Total variable manufacturing overhead costs Total fixed manufacturing Overhead costs Quality Measures Rejected units as a percent of units produced Reworked units as a percent of units produced Standard Actual S 2.5% 19 3% The standard defect rates are used to determine the average number of parts per unit and the average time per unit Rejected units are completed units that do not meet finil inspection cannot be reworked and must be thrown away. It is assumed that 100% of the direct materials and direct labor has been put into these rejected untity Reworked units are partially completed units that have some type of defect but can be fixed by replacing the defective parts. It is assumed that Sost of the direct materials and direct laser has been put into the reworked units before the defects are found and the unit is completely reworked Required: 1. Evaluate the current performance and the outcome of the two initiatives. What action should Lei Chang take if any? 2. If sales are 400,000 units for the year and the selling price and cost structure remain the same, estimated how many units would have to be produced in order to show a profit of at least $2,000,000 under absorption costing. 3. Do you think Lei Chang should approve the plan to build ending inventories in order to attain the target profit? Why/why not? 4. What advice would you give to the board of directors concerning how they determine bonuses in the future, set targets and Global's current performance (or any other topics you feel needs to be addressed)? Write a memo to the Board. I Page > of 5 Case #4 Global Images Corporation Lei Chang was hired as chief executive office (CEO) in late November by the board of directors of Global Images Corporation, a company that produces an advanced global positioning system (GPS) device. The previous CEO had been fired by the board due to a series of shady business practices including shipping defective GPS devices to dealers. Guochang felt that his first priority on the job was to restore employee morale - which had suffered during the previous CEO's tenure. He was particularly anxious to build a sense of trust between himself and the company's employees. His second priority was to prepare the budget for the coming year, which the board of directors wanted to review in their December 15 meeting. After hammering out the details in meetings with key managers, Chang was able to put together a budget that he and his management team felt the company could realistically meet during the coming year. That budget appears below: Basic budget data Units in beginning inventory 0 Units produced 400.000 Units sold 400,000 Units in ending inventory Variable costs per unit: Direct materials (4 parts@ $14.30 per part) S 57.20 Direct labor (5 hrs @ $30 per hour) 15.00 Variable manufacturing overhead 5.00 Variable selling and administrative* 10.00 Total variable costs per unit S 87.20 Fixed costs: Fixed manufacturing overhead" $ 6,888,000 Fixed selling and administrative 4.560,000 Total fixed costs $11.448,000 *Variable selling and administrative expenses are related to commission and shipping costs. **Fixed manufacturing overhead is applied on the basis of units produced. Since Global Images has only one product they chose the simplest allocation method available. As a result, fixed manufacturing overhead per unit is determined by dividing the total fixed manufacturing overhead costs by the number of units produced. 0 Per unit product cost. Dinsdentials SS20 Pages 2 > of 5 Per unit product cost: Direct materials Direct labor Variable MO Fixed MO per unit ($6,888,000/400,000) Total product cost per unit $57.20 15.00 5.00 17.22 $94.42 Global Images Corporation Budgeted Income Statement Sales (400,000 units x $120 per unit) $48,000,000 "Less costs of goods sold Beginning inventory s -0- Add costs of goods manufactured (400,000 x 594.42 per unit) 37.768.000 Cost of good available for sale 37,768000 Less ending inventory -0- 37.768,000 Gross margin 10,232,000 Less selling and administrative Variable selling and administrative (400,000 x $10 per unit) 4,000,000 Fixed selling and administrative 4,560,000 8,560,000 Net Income $ 1672.000 After Chang presented the budget proposal to the board of directors, they made it clear that this budget was not as ambitious as they had hoped. The most influential member of the board stated that "managers should have to stretch to meet profit goals." After some discussion, the board decided to set a profit goal of $2.000.000 for the coming year. To provide strong incentives and a win-win situation, the baard agreed to pay out bonuses to top managers of S10,000 to $25.000 each if this profit goal was eventually met. The bonus would be all or nothing. If actual net operating Page of 5 After Chang presented the budget proposal to the board of directors, they made it clear that this budget was not as ambitious as they had hoped. The most influential member of the board stated that "managers should have to stretch to meet profit goals." After some discussion, the board decided to set a profit goal of $2,000,000 for the coming year. To provide strong incentives and a win-win situation, the board agreed to pay out bonuses to top managers of $10,000 to $25,000 each if this profit goal was eventually met. The bonus would be all or nothing. If actual net operating income turned out to be $2,000,000 or more, the bonus would be paid. Otherwise, no bonus would be allowed. As a result of the board's new goal, Chang and his team revised the budget. They determined that to meet the $2,000,000 profit goal, the company would have to produce and sell 410,000 units. The new budget appears below: Updated Budgeted Income Statement $49,200,000 $ -0- Sales (410,000 units x $120 per unit) Less costs of goods sold Beginning inventory Add costs of goods manufactured (400,000 x $94 per unit) Cost of good available for sale Less ending inventory Gross margin -Less selling and administrative Variable selling and administrative (410,000 x $10 per unit) Fixed selling and administrative Net Income 38,540,000 38,540000 -0- 38,540.000 10,660,000 4,100,000 4,560,000 8,660,000 $ 2,000,000 Per unit product cost: Direct materials Direct labor Variable MO Fixed MO per unit ($6,888,000/410,000) Total product cost per unit $57.20 15.00 5.00 16.80 $94.00 Unfortunately, by the end of October of the next year it had become clear that the company would not be able to make the $2,000,000 target profit. In fact, it looked like the company would wind up the year as originally planned, with sales of 400,000 units, no ending inventories, and a profit in excess of $1,600,000 but would not be as much as $2,000,000. Actual results for the ten months ending October 31 are presented below: $40,800,000 $ -0- Sales (340,000 units x $120 per unit) Less costs of goods sold Beginning inventory Add costs of goods manufactured (340,000 x $94.55 per unit) Cost of good available for sale Less ending inventory Gross margin Less selling and administrative Variable selling and administrative (340,000 x $10 per unit) Fixed selling and administrative Net Income 32.147.000 32.147.000 -0 32.147.000 8.653.000 3,400,000 3,800,000 7.200,000 $1.453.000 In addition to potentially not meeting the higher sales target, the product cost per unit is higher than the original expectation of S94 42 which was estimated using 400,000 units of production. Since Global Images is on track to produce and sell 400,000 this increase in costs seems like further bad news and a bit confusing. At the beginning of the year, a number of initiatives were undertaken to help improve profitability. First, the Purchasing Manager found a new vender that would supply parts at a much lower cost than the prior supplier. Second, the Production Manager reorganized the labor force, replacing some junior technicians with more senior technicians. While it was expected that this action would increase the average hourly wage for direct labor, it was expected that the senior technicians would be so much more efficient that the increase in efficiency would more than make up for the higher pay. In addition, the senior technicians would increase the quality,roduce defects, rejects and reworked units. Given the higher product cost and lower sales, it seemed clear that Global would not reach the $2.000.000 net income goal and the managers would not receive a bonus. As a result, several Page of 5 Given the higher product cost and lower sales, it seemed clear that Global would not reach the $2,000,000 net income goal and the managers would not receive a bonus. As a result, several managers who were reluctant to lose their year-end bonuses approached Chang and suggested that the company could still show a profit of $2,000,000. The managers pointed out that at the present The standard cost per part is based on the original supplier's prices. rate of sales, there was enough capacity to produce tens of thousands of additional GPS Devices for the warehouse and thereby shift fixed manufacturing overhead to another year. Chang felt a considerable amount of pressure to make a decision. His managers feel that their bonus is in jeopardy and there are only two months left in the year and some type of decision must be made soon. Before he makes a decision on the production proposal he wants to get an idea on how well they are doing right now and why they have not achieved the expected benefits from the two initiatives. Further, he wants to get an idea of what projected profits will be if they continue with the current costs and sell 400,000 units. Finally, he wants to understand the implications of his managers' suggestion to increase production and inventory. As a result, he requested and obtained data from the accounting department regarding the break-down of product costs so far this year. Units produced 340.000 Direct material purchases 1,500,000 parts Total direct material costs for purchases $20,700,000 Direct materials used in production 1,400,800 parts Direct labor hours worked 173.400 Direct labor costs $ 5,375.000 Total variable manufacturing overhead costs $1,700,000 Total fixed manufacturing Page of 5 must be made soon. Before he makes a decision on the production proposal he wants to get an idea on how well they are doing right now and why they have not achieved the expected benefits from the two initiatives. Further, he wants to get an idea of what projected profits will be if they continue with the current costs and sell 400,000 units. Finally, he wants to understand the implications of his managers' suggestion to increase production and inventory. As a result, he requested and obtained data from the accounting department regarding the break-down of product costs so far this year. Units produced 340,000 Direct material purchases 1,500,000 parts Total direct material costs for purchases $20,700.000 Direct materials used in production 1,400,800 parts Direct labor hours worked 173,400 Direct labor costs $ 5.375,000 $ 1,700.000 S5,740,000 Total variable manufacturing overhead costs Total fixed manufacturing Overhead costs Quality Measures Rejected units as a percent of units produced Reworked units as a percent of units produced Standard Actual S 2.5% 19 3% The standard defect rates are used to determine the average number of parts per unit and the average time per unit Rejected units are completed units that do not meet finil inspection cannot be reworked and must be thrown away. It is assumed that 100% of the direct materials and direct labor has been put into these rejected untity Reworked units are partially completed units that have some type of defect but can be fixed by replacing the defective parts. It is assumed that Sost of the direct materials and direct laser has been put into the reworked units before the defects are found and the unit is completely reworked Required: 1. Evaluate the current performance and the outcome of the two initiatives. What action should Lei Chang take if any? 2. If sales are 400,000 units for the year and the selling price and cost structure remain the same, estimated how many units would have to be produced in order to show a profit of at least $2,000,000 under absorption costing. 3. Do you think Lei Chang should approve the plan to build ending inventories in order to attain the target profit? Why/why not? 4. What advice would you give to the board of directors concerning how they determine bonuses in the future, set targets and Global's current performance (or any other topics you feel needs to be addressed)? Write a memo to the Board