Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Page:1 Page:2 Answer all the questions. 1 EXERS 1. A bond of Rs. 1000 was issued five years ago at a coupon rate of 6

Page:1

Page:2

Answer all the questions.

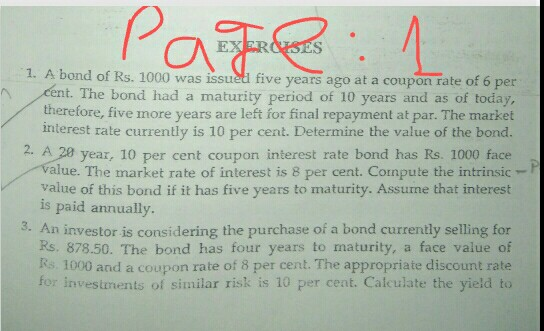

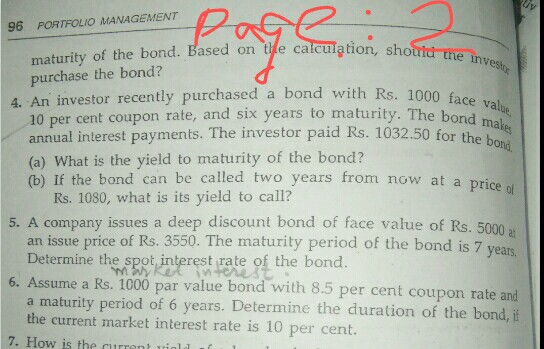

1 EXERS 1. A bond of Rs. 1000 was issued five years ago at a coupon rate of 6 per cent. The bond had a maturity period of 10 years and as of today, therefore, five more years are left for final repayment at par. The market interest rate currently is 10 per cent. Determine the value of the bond. 2. A 20 year, 10 per cent coupon interest rate bond has Rs. 1000 face value. The market rate of interest is 8 per cent. Compute the intrinsic value of this bond if it has five years to maturity. Assume that interest is paid annually. 3. An investor is considering the purchase of a bond currently selling for Rs. 878.50. The bond has four years to maturity, a face value of Rs 1000 and a coupon rate of 8 per cent. The appropriate discount rate for investments of similar risk is 10 per cent. Calculate the yield to the investe 1000 face value The bond makes 632.50 for the bond 96 PORTFOLIO MANAGEMENT D aca maturity of the bond. Based on the calculation, shoid purchase the bond? 4. An investor recently purchased a bond with Rs. 1000 for 10 per cent coupon rate, and six years to maturity. The bor annual interest payments. The investor paid Rs. 1032.50 for (a) What is the yield to maturity of the bond? (b) If the bond can be called two years from now at a price Rs. 1080, what is its yield to call? 5. A company issues a deep discount bond of face value of Rs. 5000 an issue price of Rs. 3550. The maturity period of the bond is 7 years Determine the spot interest rate of the bond. 6. Assume a Rs. 1000 par value bond with 8.5 per cent coupon rate and a maturity period of 6 years. Determine the duration of the bond, it the current market interest rate is 10 per cent. 7. How is the current yield 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started