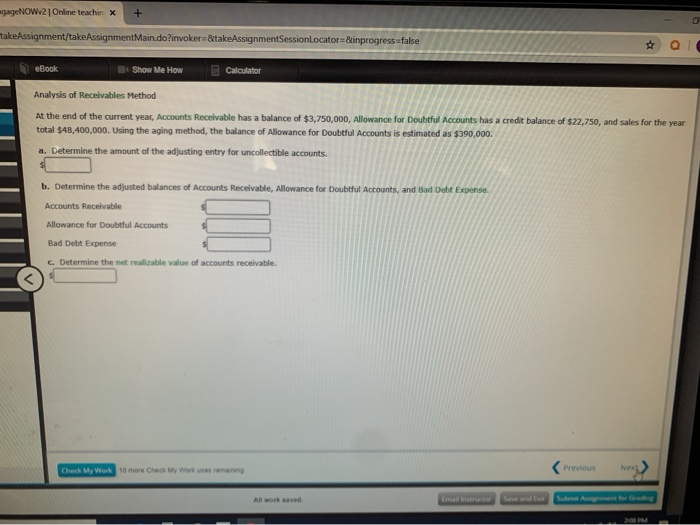

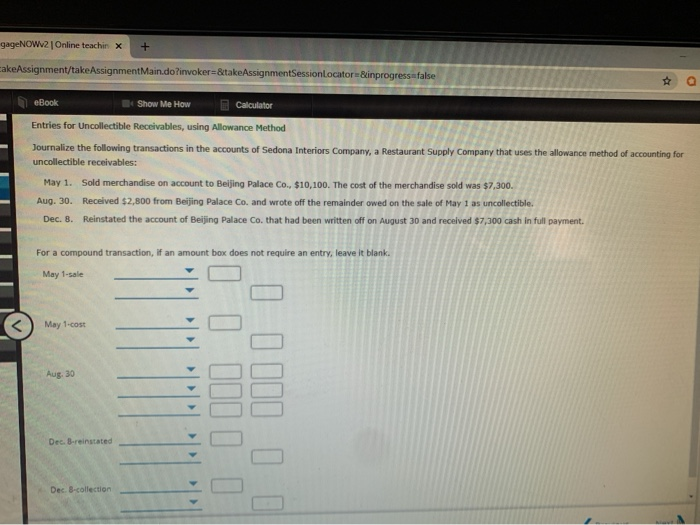

pageNOW 2 Online teachin x + akeAssignment/take Assignment Main.do?invokerStakeAssignmentSessionLocator=&inprogressa false Book Show Me How Calculator Analysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $3,750,000, Allowance for Doubtful Accounts has a credit balance of $22,750, and sales for the year total $48,400,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $390.000 a. Determine the amount of the adjusting entry for uncollectible accounts. b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense Accounts Receivable Allowance for Doubtful Accounts Bad Debt Expense Determine the net realizate value of accounts receivable. Previous My Worth Emal e Sud Agent Gede gageNOWV2 Online teachin x + akeAssignment/take AssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogressefalse RO eBook Show Me How Calculator Entries for Uncollectible Receivables, using Allowance Method Journalize the following transactions in the accounts of Sedona Interiors Company, a Restaurant Supply Company that uses the allowance method of accounting for uncollectible receivables: May 1. Sold merchandise on account to Beijing Palace Co., $10,100. The cost of the merchandise sold was $7.300. Aug. 30. Received $2,800 from Beijing Palace Co. and wrote off the remainder owed on the sale of May 1 as uncollectible Dec. 8. Reinstated the account of Beijing Palace Co. that had been written off on August 30 and received $7,300 cash in full payment. For a compound transaction, if an amount box does not require an entry, leave it blank. May 1-sale May 1-cost 001 1 0 Det Brentated O Dec B- collection. pageNOW 2 Online teachin x + akeAssignment/take Assignment Main.do?invokerStakeAssignmentSessionLocator=&inprogressa false Book Show Me How Calculator Analysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $3,750,000, Allowance for Doubtful Accounts has a credit balance of $22,750, and sales for the year total $48,400,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $390.000 a. Determine the amount of the adjusting entry for uncollectible accounts. b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense Accounts Receivable Allowance for Doubtful Accounts Bad Debt Expense Determine the net realizate value of accounts receivable. Previous My Worth Emal e Sud Agent Gede gageNOWV2 Online teachin x + akeAssignment/take AssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogressefalse RO eBook Show Me How Calculator Entries for Uncollectible Receivables, using Allowance Method Journalize the following transactions in the accounts of Sedona Interiors Company, a Restaurant Supply Company that uses the allowance method of accounting for uncollectible receivables: May 1. Sold merchandise on account to Beijing Palace Co., $10,100. The cost of the merchandise sold was $7.300. Aug. 30. Received $2,800 from Beijing Palace Co. and wrote off the remainder owed on the sale of May 1 as uncollectible Dec. 8. Reinstated the account of Beijing Palace Co. that had been written off on August 30 and received $7,300 cash in full payment. For a compound transaction, if an amount box does not require an entry, leave it blank. May 1-sale May 1-cost 001 1 0 Det Brentated O Dec B- collection