PAGES 1-4 ARE INFO- HOW DO I DO NUMBER #5?

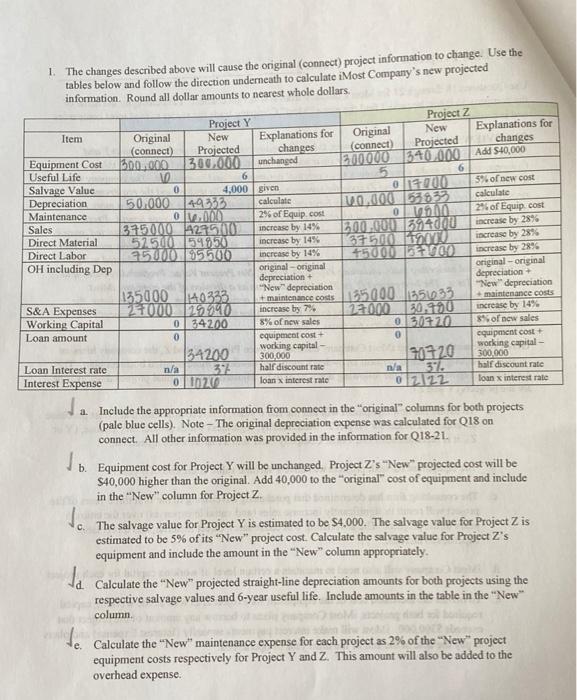

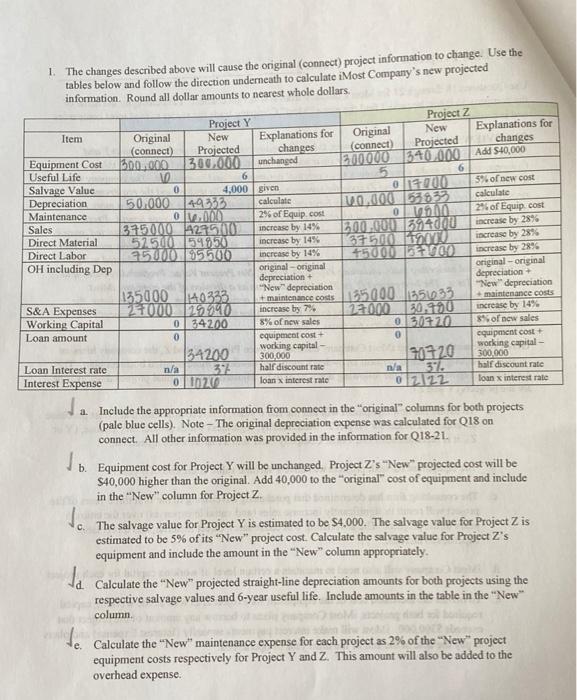

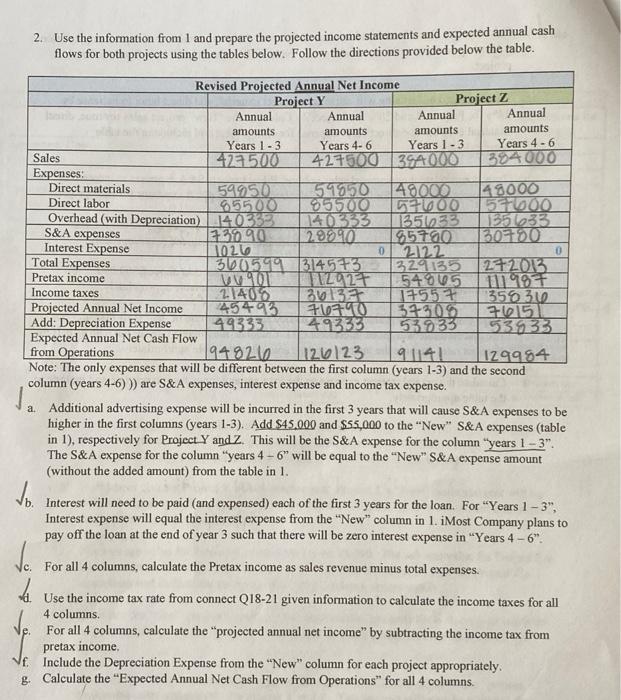

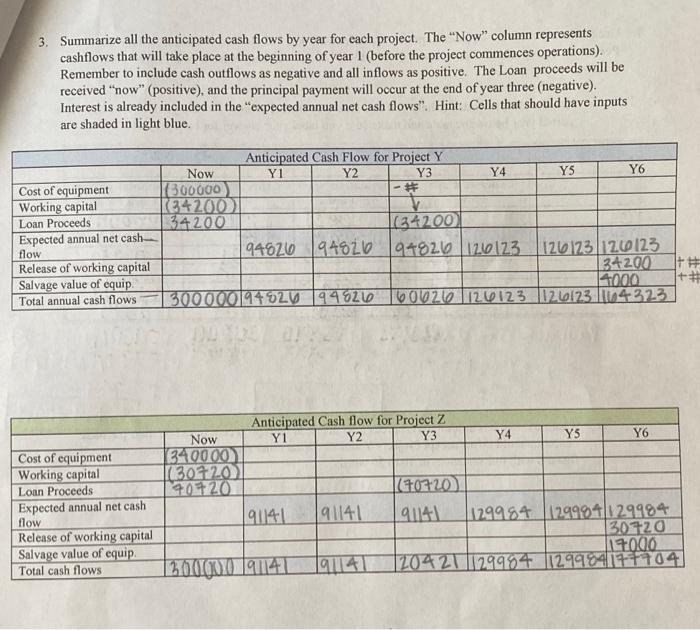

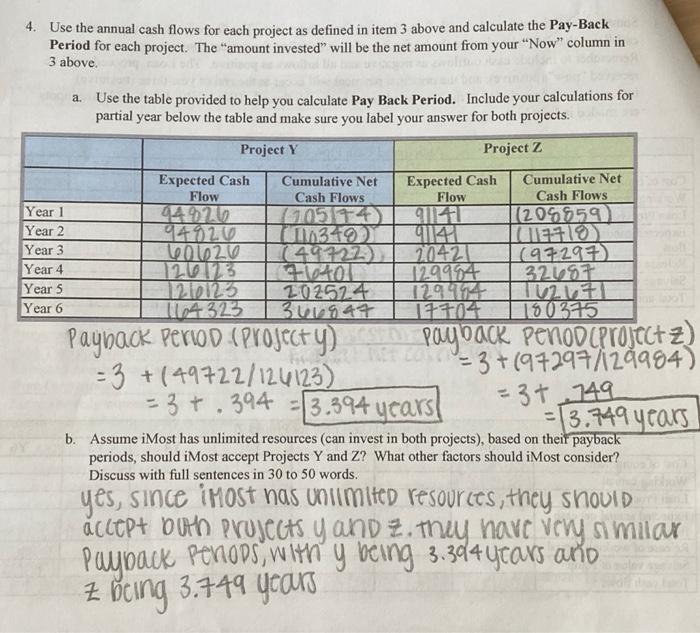

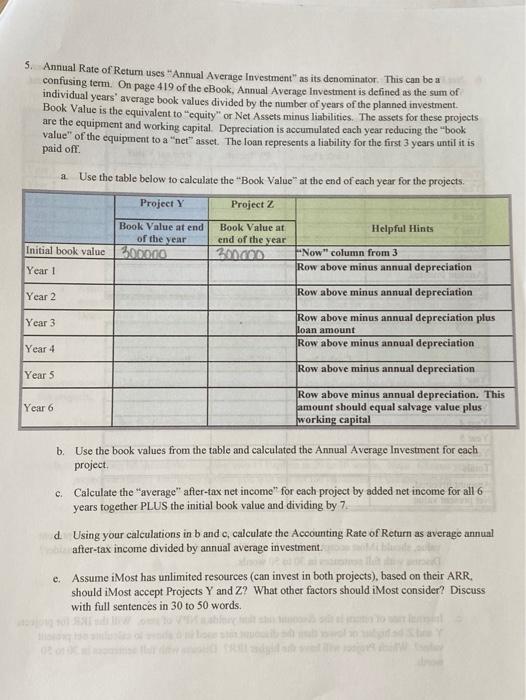

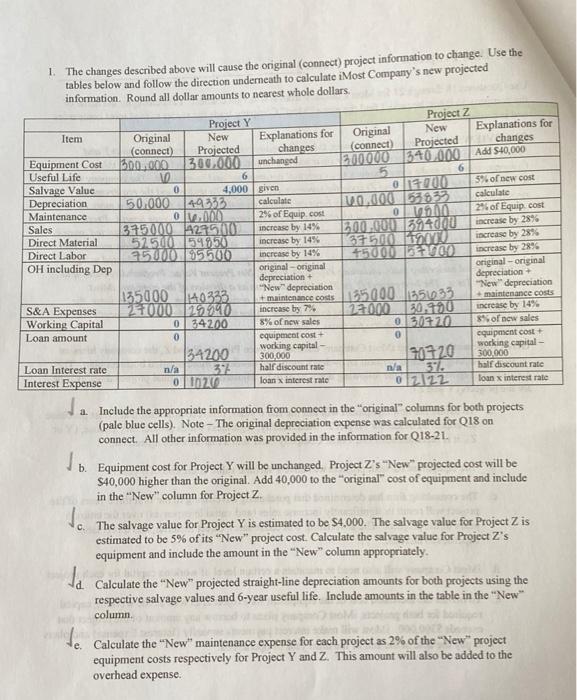

1. The changes described above will cause the original (connect) project information to change. Use the tables below and follow the direction underneath to calculate iMost Company's new projected information. Round all dollar amounts to nearest whole dollars. Project Y Project Z Item Original New Explanations for Original New Explanations for (connect Projected changes (connect changes Projected Equipment Cost 300.000 300.000 unchanged 1300000 1540.000 Add $40,000 Useful Life 6 10 6 Salvage Value 0 5% of new cost 4,000 given 0157000 Depreciation 50.000 49333 calculate 10.000 53832 calculate Maintenance 2% of Equip cost 01000 29 of Equip cost Sales 37500014275110 increase by 14% 1300.000 594000 increase by 28% Direct Material 57.500 59050 increase by 14% 157500 OUT) increase by 28% Direct Labor 950D055016 increase by 14% +5000 1100 increase by 2896 OH including Dep original - orginal original - original depreciation depreciation "New" depreciation 135000 "New" depreciation 140333 + maintenance costs 155000 55633 maintenance costs S&A Expenses 1000 119.990 increase by 7% 22000 30.00 increase by 14% Working Capital 0 34200 8% of new sales 030720 85% of new sales Loan amount 0 equipment cost 0 equipment cost working capital 134200 working capital 300.000 10720 300,000 Loan Interest rate n/a 31 half discount rate half discount rate Interest Expense 010260 loan x interest rate 0222 loan x interest rate 4 0 1. Include the appropriate information from connect in the original" columns for both projects (pale blue cells). Note - The original depreciation expense was calculated for Q18 on connect. All other information was provided in the information for Q18-21. to b. Equipment cost for Project Y will be unchanged. Project Z's "New" projected cost will be 540,000 higher than the original. Add 40,000 to the original cost of equipment and include in the "New" column for Project Z. to. c. The salvage value for Project Y is estimated to be $4,000. The salvage value for Project Z is estimated to be 5% of its "New" project cost. Calculate the salvage value for Project Z's equipment and include the amount in the "New" column appropriately. Calculate the "New projected straight-line depreciation amounts for both projects using the respective salvage values and 6-year useful life. Include amounts in the table in the "New column 51. da Calculate the "New" maintenance expense for each project as 2% of the "New" project equipment costs respectively for Project Y and Z. This amount will also be added to the overhead expense 2. Use the information from 1 and prepare the projected income statements and expected annual cash flows for both projects using the tables below. Follow the directions provided below the table. S&A expenses 0 Revised Projected Annual Net Income Project Y Project Z Annual Annual Annual Annual amounts amounts amounts amounts Years 1 - 3 Years 4-6 Years 1 - 3 Years 4-6 Sales 423500 427500 3GA000 304000 Expenses: Direct materials 59950 59850 44800 148000 Direct labor 85500 05500 5700 57000 Overhead (with Depreciation) 1403333 140333 1351033 135 1033 +30.90 20090 85700 30700 Interest Expense 1026 0 2122 Total Expenses 360599 314573 3291135 272013 Pretax income WV 901 TLL91T 54865 111197 Income taxes 21408 3613 1+55 + 355312 Projected Annual Net Income 45493 76790 76015 Add: Depreciation Expense 49333 49333 53033 53033 Expected Annual Net Cash Flow from Operations 194826 126123 129984 Note: The only expenses that will be different between the first column (years 1-3) and the second column (years 4-6))) are S&A expenses, interest expense and income tax expense. a. Additional advertising expense will be incurred in the first 3 years that will cause S&A expenses to be higher in the first columns (years 1-3). Add $45.000 and $55,000 to the "New" S&A expenses (table in 1), respectively for Project Y and Z. This will be the S&A expense for the column "years 1 - 3". The S&A expense for the column "years 4 - 6" will be equal to the "New" S&A expense amount (without the added amount) from the table in 1. Jo. Interest will need to be paid (and expensed) each of the first 3 years for the loan. For "Years 1 3", Interest expense will equal the interest expense from the "New column in 1. iMost Company plans to pay off the loan at the end of year 3 such that there will be zero interest expense in "Years 4 - 6". For all 4 columns, calculate the Pretax income as sales revenue minus total expenses. Use the income tax rate from connect Q18-21 given information to calculate the income taxes for all 4 columns. For all 4 columns, calculate the projected annual net income" by subtracting the income tax from pretax income f. Include the Depreciation Expense from the "New" column for each project appropriately. g. Calculate the "Expected Annual Net Cash Flow from Operations for all 4 columns 3. Summarize all the anticipated cash flows by year for each project. The "Now" column represents cashflows that will take place at the beginning of year 1 (before the project commences operations) Remember to include cash outflows as negative and all inflows as positive. The Loan proceeds will be received "now" (positive), and the principal payment will occur at the end of year three (negative). Interest is already included in the "expected annual net cash flows". Hint: Cells that should have inputs are shaded in light blue. Anticipated Cash Flow for Project Y Now Y1 Y2 Y3 Y4 Y5 Y6 Cost of equipment (300000) - # Working capital (34200 Loan Proceeds 34200 (34200 Expected annual net cash_ flow 194826 94826 94826 126123 126123 126 123 Release of working capital 1134200 || Salvage value of equip. 14000 1+# Total annual cash flows 300000194026 94626 60W26 126123 120123 14-323 Anticipated Cash flow for Project Z Now Y1 Y2 Y3 Y4 Y5 Y6 Cost of equipment 340000 Working capital (130720) Loan Proceeds 40120 (40720 Expected annual net cash flow 91141 91141 91141 1299.84 129994129984 Release of working capital 30720 Salvage value of equip 19000 Total cash flows 1300120YO 191141 1141 120421129984 129984174704 4. Use the annual cash flows for each project as defined in item 3 above and calculate the Pay-Back Period for each project. The "amount invested will be the net amount from your "Now" column in 3 above. a. Use the table provided to help you calculate Pay Back Period. Include your calculations for partial year below the table and make sure you label your answer for both projects. Project Y Project Z Expected Cash Cumulative Net Expected Cash Cumulative Net Flow Cash Flows Flow Cash Flows Year 1 105 14 911141 (209859 Year 2 (110349 914 Year 3 1201020 (149722) 2042 (97297) Year 4 2013 32487 Year 5 102524 Year 6 1104 323 366847 100375 Payback period (Project y) sa pagback penos (projectz) -3 + (49722/120123) = 3+(97297/20984) - 3+.394 = 3.394 years -3.749 years b. Assume iMost has unlimited resources (can invest in both projects), based on their payback periods, should iMost accept Projects Y and Z? What other factors should iMost consider? Discuss with full sentences in 30 to 50 words. yes, since iMost nas unlimited resources, they should accept both projects y and they have very similar Payback penops, with y being 3.304 years ario Z z ting 3.749 years =3+ 749 5. Annual Rate of Retum uses "Annual Average Investment" as its denominator. This can be a confusing term. On page 419 of the eBook, Annual Average Investment is defined as the sum of individual years' average book values divided by the number of years of the planned investment. Book Value is the equivalent to "equity" or Net Assets minus liabilities. The assets for these projects are the equipment and working capital. Depreciation is accumulated each year reducing the book value" of the equipment to a "net" asset. The loan represents a liability for the first 3 years until it is paid off a. Use the table below to calculate the "Book Value" at the end of each year for the projects. Project Y Project 2 Book Value at end of the year Initial book value 300000 Year 1 Book Value at Helpful Hints end of the year COD Now" column from 3 Row above minus annual depreciation Year 2 Row above minus annual depreciation Year 3 Row above minus annual depreciation plus loan amount Row above minus annual depreciation Year 4 Row above minus annual depreciation Year 5 Year 6 Row above minus annual depreciation. This amount should equal salvage value plus working capital b. Use the book values from the table and calculated the Annual Average Investment for each project c. Calculate the "average" after-tax net income" for each project by added net income for all 6 years together PLUS the initial book value and dividing by 7. d Using your calculations in b and c, calculate the Accounting Rate of Return as average annual after-tax income divided by annual average investment e. Assume iMost has unlimited resources can invest in both projects), based on their ARR should iMost accept Projects Y and Z? What other factors should iMost consider? Discuss with full sentences in 30 to 50 words. 1. The changes described above will cause the original (connect) project information to change. Use the tables below and follow the direction underneath to calculate iMost Company's new projected information. Round all dollar amounts to nearest whole dollars. Project Y Project Z Item Original New Explanations for Original New Explanations for (connect Projected changes (connect changes Projected Equipment Cost 300.000 300.000 unchanged 1300000 1540.000 Add $40,000 Useful Life 6 10 6 Salvage Value 0 5% of new cost 4,000 given 0157000 Depreciation 50.000 49333 calculate 10.000 53832 calculate Maintenance 2% of Equip cost 01000 29 of Equip cost Sales 37500014275110 increase by 14% 1300.000 594000 increase by 28% Direct Material 57.500 59050 increase by 14% 157500 OUT) increase by 28% Direct Labor 950D055016 increase by 14% +5000 1100 increase by 2896 OH including Dep original - orginal original - original depreciation depreciation "New" depreciation 135000 "New" depreciation 140333 + maintenance costs 155000 55633 maintenance costs S&A Expenses 1000 119.990 increase by 7% 22000 30.00 increase by 14% Working Capital 0 34200 8% of new sales 030720 85% of new sales Loan amount 0 equipment cost 0 equipment cost working capital 134200 working capital 300.000 10720 300,000 Loan Interest rate n/a 31 half discount rate half discount rate Interest Expense 010260 loan x interest rate 0222 loan x interest rate 4 0 1. Include the appropriate information from connect in the original" columns for both projects (pale blue cells). Note - The original depreciation expense was calculated for Q18 on connect. All other information was provided in the information for Q18-21. to b. Equipment cost for Project Y will be unchanged. Project Z's "New" projected cost will be 540,000 higher than the original. Add 40,000 to the original cost of equipment and include in the "New" column for Project Z. to. c. The salvage value for Project Y is estimated to be $4,000. The salvage value for Project Z is estimated to be 5% of its "New" project cost. Calculate the salvage value for Project Z's equipment and include the amount in the "New" column appropriately. Calculate the "New projected straight-line depreciation amounts for both projects using the respective salvage values and 6-year useful life. Include amounts in the table in the "New column 51. da Calculate the "New" maintenance expense for each project as 2% of the "New" project equipment costs respectively for Project Y and Z. This amount will also be added to the overhead expense 2. Use the information from 1 and prepare the projected income statements and expected annual cash flows for both projects using the tables below. Follow the directions provided below the table. S&A expenses 0 Revised Projected Annual Net Income Project Y Project Z Annual Annual Annual Annual amounts amounts amounts amounts Years 1 - 3 Years 4-6 Years 1 - 3 Years 4-6 Sales 423500 427500 3GA000 304000 Expenses: Direct materials 59950 59850 44800 148000 Direct labor 85500 05500 5700 57000 Overhead (with Depreciation) 1403333 140333 1351033 135 1033 +30.90 20090 85700 30700 Interest Expense 1026 0 2122 Total Expenses 360599 314573 3291135 272013 Pretax income WV 901 TLL91T 54865 111197 Income taxes 21408 3613 1+55 + 355312 Projected Annual Net Income 45493 76790 76015 Add: Depreciation Expense 49333 49333 53033 53033 Expected Annual Net Cash Flow from Operations 194826 126123 129984 Note: The only expenses that will be different between the first column (years 1-3) and the second column (years 4-6))) are S&A expenses, interest expense and income tax expense. a. Additional advertising expense will be incurred in the first 3 years that will cause S&A expenses to be higher in the first columns (years 1-3). Add $45.000 and $55,000 to the "New" S&A expenses (table in 1), respectively for Project Y and Z. This will be the S&A expense for the column "years 1 - 3". The S&A expense for the column "years 4 - 6" will be equal to the "New" S&A expense amount (without the added amount) from the table in 1. Jo. Interest will need to be paid (and expensed) each of the first 3 years for the loan. For "Years 1 3", Interest expense will equal the interest expense from the "New column in 1. iMost Company plans to pay off the loan at the end of year 3 such that there will be zero interest expense in "Years 4 - 6". For all 4 columns, calculate the Pretax income as sales revenue minus total expenses. Use the income tax rate from connect Q18-21 given information to calculate the income taxes for all 4 columns. For all 4 columns, calculate the projected annual net income" by subtracting the income tax from pretax income f. Include the Depreciation Expense from the "New" column for each project appropriately. g. Calculate the "Expected Annual Net Cash Flow from Operations for all 4 columns 3. Summarize all the anticipated cash flows by year for each project. The "Now" column represents cashflows that will take place at the beginning of year 1 (before the project commences operations) Remember to include cash outflows as negative and all inflows as positive. The Loan proceeds will be received "now" (positive), and the principal payment will occur at the end of year three (negative). Interest is already included in the "expected annual net cash flows". Hint: Cells that should have inputs are shaded in light blue. Anticipated Cash Flow for Project Y Now Y1 Y2 Y3 Y4 Y5 Y6 Cost of equipment (300000) - # Working capital (34200 Loan Proceeds 34200 (34200 Expected annual net cash_ flow 194826 94826 94826 126123 126123 126 123 Release of working capital 1134200 || Salvage value of equip. 14000 1+# Total annual cash flows 300000194026 94626 60W26 126123 120123 14-323 Anticipated Cash flow for Project Z Now Y1 Y2 Y3 Y4 Y5 Y6 Cost of equipment 340000 Working capital (130720) Loan Proceeds 40120 (40720 Expected annual net cash flow 91141 91141 91141 1299.84 129994129984 Release of working capital 30720 Salvage value of equip 19000 Total cash flows 1300120YO 191141 1141 120421129984 129984174704 4. Use the annual cash flows for each project as defined in item 3 above and calculate the Pay-Back Period for each project. The "amount invested will be the net amount from your "Now" column in 3 above. a. Use the table provided to help you calculate Pay Back Period. Include your calculations for partial year below the table and make sure you label your answer for both projects. Project Y Project Z Expected Cash Cumulative Net Expected Cash Cumulative Net Flow Cash Flows Flow Cash Flows Year 1 105 14 911141 (209859 Year 2 (110349 914 Year 3 1201020 (149722) 2042 (97297) Year 4 2013 32487 Year 5 102524 Year 6 1104 323 366847 100375 Payback period (Project y) sa pagback penos (projectz) -3 + (49722/120123) = 3+(97297/20984) - 3+.394 = 3.394 years -3.749 years b. Assume iMost has unlimited resources (can invest in both projects), based on their payback periods, should iMost accept Projects Y and Z? What other factors should iMost consider? Discuss with full sentences in 30 to 50 words. yes, since iMost nas unlimited resources, they should accept both projects y and they have very similar Payback penops, with y being 3.304 years ario Z z ting 3.749 years =3+ 749 5. Annual Rate of Retum uses "Annual Average Investment" as its denominator. This can be a confusing term. On page 419 of the eBook, Annual Average Investment is defined as the sum of individual years' average book values divided by the number of years of the planned investment. Book Value is the equivalent to "equity" or Net Assets minus liabilities. The assets for these projects are the equipment and working capital. Depreciation is accumulated each year reducing the book value" of the equipment to a "net" asset. The loan represents a liability for the first 3 years until it is paid off a. Use the table below to calculate the "Book Value" at the end of each year for the projects. Project Y Project 2 Book Value at end of the year Initial book value 300000 Year 1 Book Value at Helpful Hints end of the year COD Now" column from 3 Row above minus annual depreciation Year 2 Row above minus annual depreciation Year 3 Row above minus annual depreciation plus loan amount Row above minus annual depreciation Year 4 Row above minus annual depreciation Year 5 Year 6 Row above minus annual depreciation. This amount should equal salvage value plus working capital b. Use the book values from the table and calculated the Annual Average Investment for each project c. Calculate the "average" after-tax net income" for each project by added net income for all 6 years together PLUS the initial book value and dividing by 7. d Using your calculations in b and c, calculate the Accounting Rate of Return as average annual after-tax income divided by annual average investment e. Assume iMost has unlimited resources can invest in both projects), based on their ARR should iMost accept Projects Y and Z? What other factors should iMost consider? Discuss with full sentences in 30 to 50 words