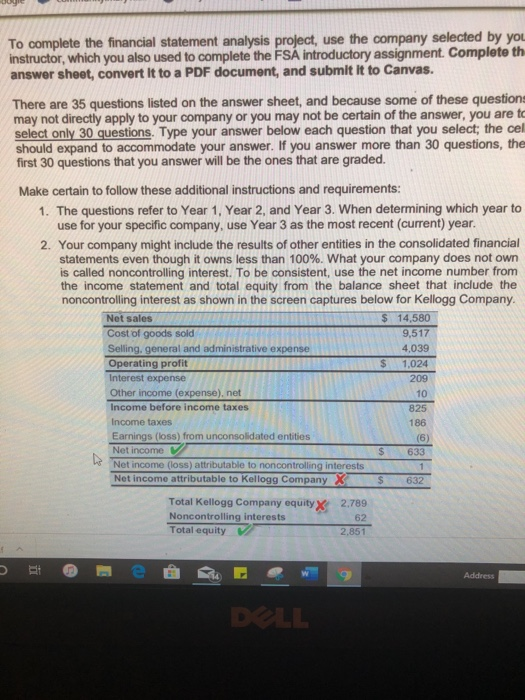

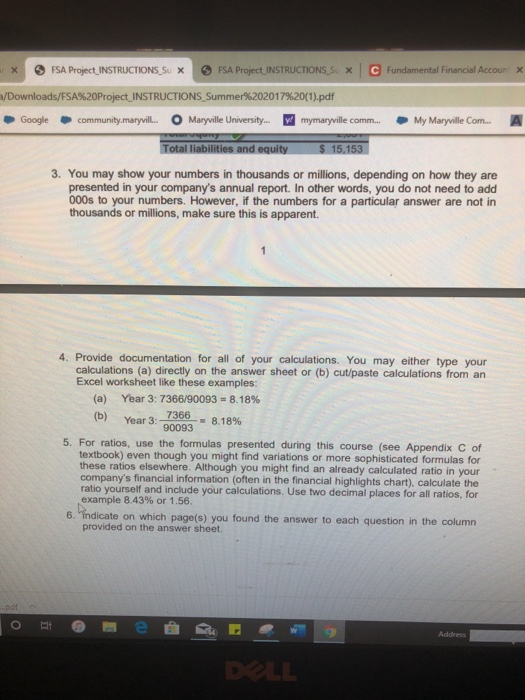

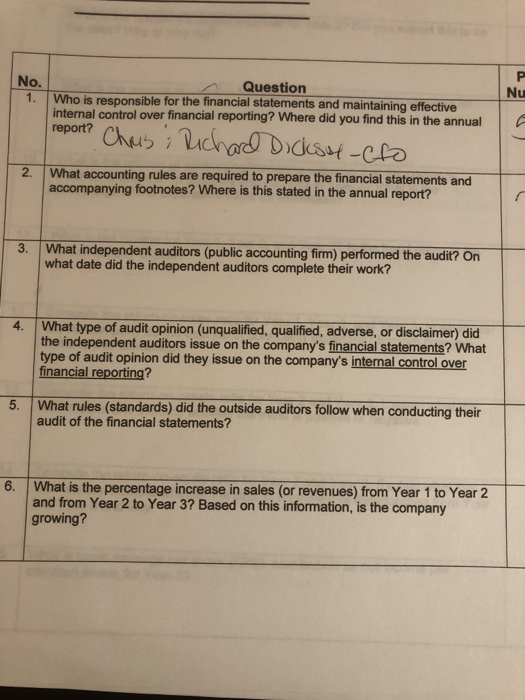

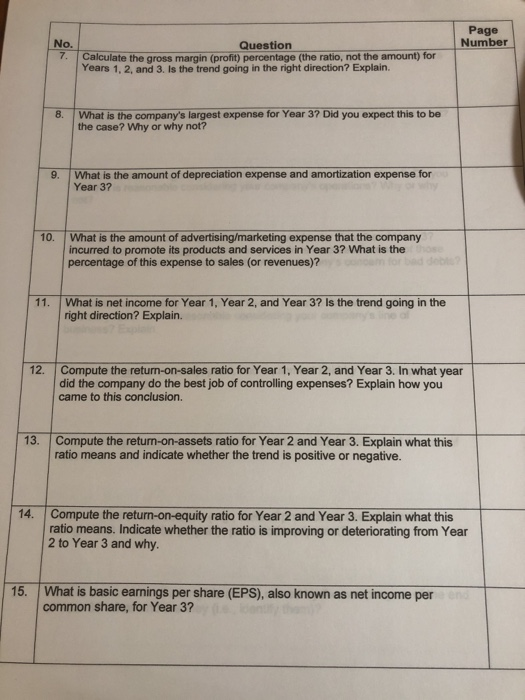

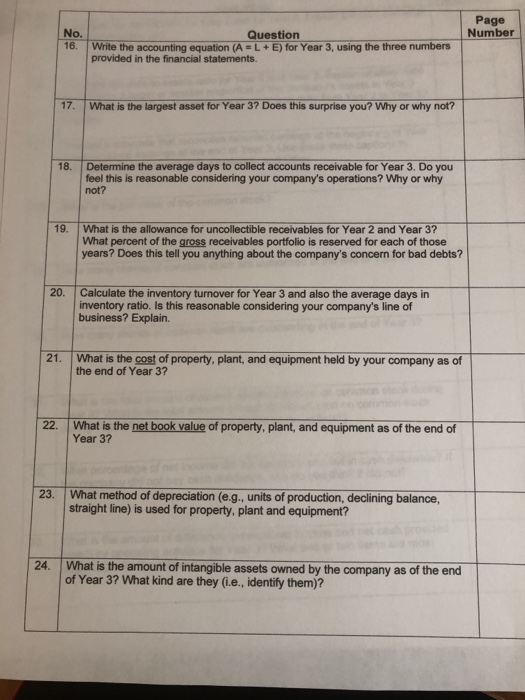

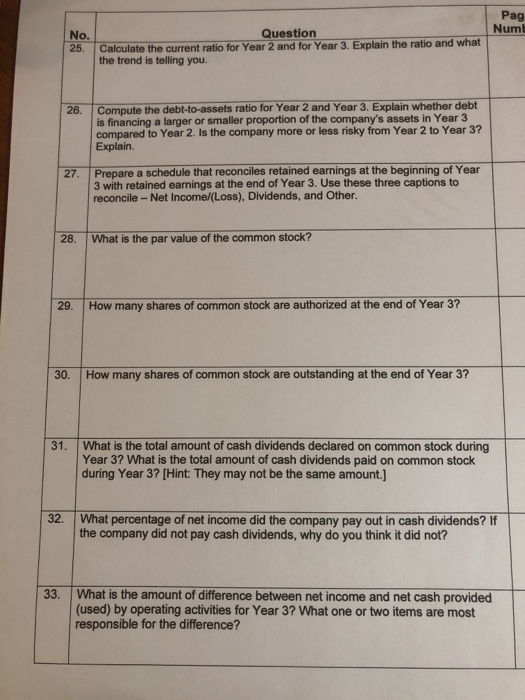

PAI > Assignments > Week 8: Financial Statement Analysis Project Week 8: Financial Statement Analysis Project Submit Assignment Due Oct 20 by 11:59pm Points 120 Submitting a file upload Available Aug 26 at 12am - Oct 20 at 11:59pm about 2 months File Types pdf This is the second of the two assignments related to the Financial Statement Analysis (FSA) project: 1. Introductory assignment to locate the key financial statements within a company's annual report/Form 10-K 2. FSA Project to find a variety of items and calculate financial ratios using a company's annual report/Form 10-K All class members will use the same company. Mattel, Inc., which was used for the introductory assignment. Use Mattel's 2016 annual report/Form 10-K that is available here: MATTELINGLANNUAL RERORT Here are the instructions for this project: ESA PROJECT INSTRUCTIONS Complete and submit this FSA PROJECT ANSWER SHEET after converting it to a PDF document, to obtain fullor partial credit for this project. On your answer sheet use the page numbers of the actual report (not the PDF page numbers). GROUP OPTION: If you formed a group for the introductory assignment, you will continue to work with the same classmates for this project. You may still form a group for this project even if you worked individually on the introductory assignment. Notify she will set up your group in canvas. Each group will submit only one answer sheet, and all group ICLO To complete the financial statement analysis project, use the company selected by you instructor, which you also used to complete the FSA introductory assignment. Complete th answer sheet, convert it to a PDF document, and submit it to Canvas. There are 35 questions listed on the answer sheet, and because some of these questioni may not directly apply to your company or you may not be certain of the answer, you are te select only 30 questions. Type your answer below each question that you select; the cel should expand to accommodate your answer. If you answer more than 30 questions, the first 30 questions that you answer will be the ones that are graded. Make certain to follow these additional instructions and requirements: 1. The questions refer to Year 1 Year 2, and Year 3. When determining which year to use for your specific company, use Year 3 as the most recent (current) year. 2. Your company might include the results of other entities in the consolidated financial statements even though it owns less than 100%. What your company does not own is called noncontrolling interest. To be consistent, use the net income number from the income statement and total equity from the balance sheet that include the noncontrolling interest as shown in the screen captures below for Kellogg Company. Net sales $ 14,580 Cost of goods sold 9,517 Selling, general and administrative expense 4,039 Operating profit 1,024 Interest expense 209 Other income (expense), net Income before income taxes Income taxes Earnings (loss) from unconsolidated entities V Net income S 633 Net income (loss) attributable to noncontrolling interests 1 Net income attributable to Kellogg Company X S 632 186 Total Kellogg Company equity X Noncontrolling interests Total equity V 2 2.789 62 .851 Address DLL fundamental Financial Account X PSA Project INSTRUCTIONS Su PSA Project INSTRUCTIONS S X C a/Downloads/FSA%20Project INSTRUCTIONS Summer%202017%20(1).pdf Google community.maryvill. Maryville University.. mymaryville comm... My Maryville Com... Total liabilities and equity $ 15,153 3. You may show your numbers in thousands or millions, depending on how they are presented in your company's annual report. In other words, you do not need to add 000s to your numbers. However, if the numbers for a particular answer are not in thousands or millions, make sure this is apparent. 4. Provide documentation for all of your calculations. You may either type your calculations (a) directly on the answer sheet or (b) cut/paste calculations from an Excel worksheet like these examples: (a) Year 3: 7366/90093 = 8.18% (b) Year 3 90093 7366 8.18% 5. For ratios, use the formulas presented during this course (see Appendix C of textbook) even though you might find variations or more sophisticated formulas for these ratios elsewhere. Although you might find an already calculated ratio in your company's financial information (often in the financial highlights chart), calculate the ratio yourself and include your calculations. Use two decimal places for all ratios, for example 8.43% or 1.56. 6. Indicate on which page(s) you found the answer to each question in the column provided on the answer sheet. Address No. Question Who is responsible for the financial statements and maintaining effective internal control over financial reporting? Where did you find this in the annual report? Chiusi Richard Dicksu-cfo 2. What accounting rules are required to prepare the financial statements and accompanying footnotes? Where is this stated in the annual report? 3. What independent auditors (public accounting firm) performed the audit? On what date did the independent auditors complete their work? What type of audit opinion (unqualified, qualified, adverse, or disclaimer) did the independent auditors issue on the company's financial statements? What type of audit opinion did they issue on the company's internal control over financial reporting? 5. What rules (standards) did the outside auditors follow when conducting their audit of the financial statements? 6. What is the percentage increase in sales (or revenues) from Year 1 to Year 2 and from Year 2 to Year 3? Based on this information, is the company growing? Page Number No. Question Calculate the gross margin (profit) percentage (the ratio, not the amount) for Years 1, 2, and 3. Is the trend going in the right direction? Explain. What is the company's largest expense for Year 37 Did you expect this to be the case? Why or why not? 9. What is the amount of depreciation expense and amortization expense for Year 3? 10. What is the amount of advertising/marketing expense that the company incurred to promote its products and services in Year 3? What is the percentage of this expense to sales (or revenues)? 11. What is net income for Year 1, Year 2, and Year 3? Is the trend going in the right direction? Explain. 12. Compute the return-on-sales ratio for Year 1, Year 2, and Year 3. In what year did the company do the best job of controlling expenses? Explain how you came to this conclusion. 13. Compute the return-on-assets ratio for Year 2 and Year 3. Explain what this ratio means and indicate whether the trend is positive or negative. 14. Compute the return-on-equity ratio for Year 2 and Year 3. Explain what this ratio means. Indicate whether the ratio is improving or deteriorating from Year 2 to Year 3 and why. 15. What is basic earnings per share (EPS), also known as net income per common share, for Year 3? Page Number No. 16. Question Write the accounting equation (A=L+E) for Year 3, using the three numbers provided in the financial statements. 17. What is the largest asset for Year 37 Does this surprise you? Why or why not? 18. Determine the average days to collect accounts receivable for Year 3. Do you feel this is reasonable considering your company's operations? Why or why not? 19. What is the allowance for uncollectible receivables for Year 2 and Year 37 What percent of the gross receivables portfolio is reserved for each of those years? Does this tell you anything about the company's concern for bad debts? 20. Calculate the inventory turnover for Year 3 and also the average days in inventory ratio. Is this reasonable considering your company's line of business? Explain. 21. What is the cost of property, plant, and equipment held by your company as of the end of Year 3? 22. What is the net book value of property, plant, and equipment as of the end of Year 3? 23. What method of depreciation (e.g., units of production, declining balance, straight line) is used for property, plant and equipment? 24. What is the amount of intangible assets owned by the company as of the end of Year 3? What kind are they (i.e., identify them)? Pag Num! No. 25. Question Calculate the current ratio for Year 2 and for Year 3. Explain the ratio and what the trend is telling you. 26. Compute the debt-to-assets ratio for Year 2 and Year 3. Explain whether debt is financing a larger or smaller proportion of the company's assets in Year 3 compared to Year 2. Is the company more or less risky from Year 2 to Year 3? Explain 27. Prepare a schedule that reconciles retained earnings at the beginning of Year 3 with retained earnings at the end of Year 3. Use these three captions to reconcile - Net Income (Loss), Dividends, and Other. 28. What is the par value of the common stock? 29. How many shares of common stock are authorized at the end of Year 37 30. How many shares of common stock are outstanding at the end of Year 3? 31. What is the total amount of cash dividends declared on common stock during Year 37 What is the total amount of cash dividends paid on common stock during Year 3? (Hint: They may not be the same amount.) 32. What percentage of net income did the company pay out in cash dividends? If the company did not pay cash dividends, why do you think it did not? 33 What is the amount of difference between net income and net cash provided (used) by operating activities for Year 37 What one or two items are most responsible for the difference? PAI > Assignments > Week 8: Financial Statement Analysis Project Week 8: Financial Statement Analysis Project Submit Assignment Due Oct 20 by 11:59pm Points 120 Submitting a file upload Available Aug 26 at 12am - Oct 20 at 11:59pm about 2 months File Types pdf This is the second of the two assignments related to the Financial Statement Analysis (FSA) project: 1. Introductory assignment to locate the key financial statements within a company's annual report/Form 10-K 2. FSA Project to find a variety of items and calculate financial ratios using a company's annual report/Form 10-K All class members will use the same company. Mattel, Inc., which was used for the introductory assignment. Use Mattel's 2016 annual report/Form 10-K that is available here: MATTELINGLANNUAL RERORT Here are the instructions for this project: ESA PROJECT INSTRUCTIONS Complete and submit this FSA PROJECT ANSWER SHEET after converting it to a PDF document, to obtain fullor partial credit for this project. On your answer sheet use the page numbers of the actual report (not the PDF page numbers). GROUP OPTION: If you formed a group for the introductory assignment, you will continue to work with the same classmates for this project. You may still form a group for this project even if you worked individually on the introductory assignment. Notify she will set up your group in canvas. Each group will submit only one answer sheet, and all group ICLO To complete the financial statement analysis project, use the company selected by you instructor, which you also used to complete the FSA introductory assignment. Complete th answer sheet, convert it to a PDF document, and submit it to Canvas. There are 35 questions listed on the answer sheet, and because some of these questioni may not directly apply to your company or you may not be certain of the answer, you are te select only 30 questions. Type your answer below each question that you select; the cel should expand to accommodate your answer. If you answer more than 30 questions, the first 30 questions that you answer will be the ones that are graded. Make certain to follow these additional instructions and requirements: 1. The questions refer to Year 1 Year 2, and Year 3. When determining which year to use for your specific company, use Year 3 as the most recent (current) year. 2. Your company might include the results of other entities in the consolidated financial statements even though it owns less than 100%. What your company does not own is called noncontrolling interest. To be consistent, use the net income number from the income statement and total equity from the balance sheet that include the noncontrolling interest as shown in the screen captures below for Kellogg Company. Net sales $ 14,580 Cost of goods sold 9,517 Selling, general and administrative expense 4,039 Operating profit 1,024 Interest expense 209 Other income (expense), net Income before income taxes Income taxes Earnings (loss) from unconsolidated entities V Net income S 633 Net income (loss) attributable to noncontrolling interests 1 Net income attributable to Kellogg Company X S 632 186 Total Kellogg Company equity X Noncontrolling interests Total equity V 2 2.789 62 .851 Address DLL fundamental Financial Account X PSA Project INSTRUCTIONS Su PSA Project INSTRUCTIONS S X C a/Downloads/FSA%20Project INSTRUCTIONS Summer%202017%20(1).pdf Google community.maryvill. Maryville University.. mymaryville comm... My Maryville Com... Total liabilities and equity $ 15,153 3. You may show your numbers in thousands or millions, depending on how they are presented in your company's annual report. In other words, you do not need to add 000s to your numbers. However, if the numbers for a particular answer are not in thousands or millions, make sure this is apparent. 4. Provide documentation for all of your calculations. You may either type your calculations (a) directly on the answer sheet or (b) cut/paste calculations from an Excel worksheet like these examples: (a) Year 3: 7366/90093 = 8.18% (b) Year 3 90093 7366 8.18% 5. For ratios, use the formulas presented during this course (see Appendix C of textbook) even though you might find variations or more sophisticated formulas for these ratios elsewhere. Although you might find an already calculated ratio in your company's financial information (often in the financial highlights chart), calculate the ratio yourself and include your calculations. Use two decimal places for all ratios, for example 8.43% or 1.56. 6. Indicate on which page(s) you found the answer to each question in the column provided on the answer sheet. Address No. Question Who is responsible for the financial statements and maintaining effective internal control over financial reporting? Where did you find this in the annual report? Chiusi Richard Dicksu-cfo 2. What accounting rules are required to prepare the financial statements and accompanying footnotes? Where is this stated in the annual report? 3. What independent auditors (public accounting firm) performed the audit? On what date did the independent auditors complete their work? What type of audit opinion (unqualified, qualified, adverse, or disclaimer) did the independent auditors issue on the company's financial statements? What type of audit opinion did they issue on the company's internal control over financial reporting? 5. What rules (standards) did the outside auditors follow when conducting their audit of the financial statements? 6. What is the percentage increase in sales (or revenues) from Year 1 to Year 2 and from Year 2 to Year 3? Based on this information, is the company growing? Page Number No. Question Calculate the gross margin (profit) percentage (the ratio, not the amount) for Years 1, 2, and 3. Is the trend going in the right direction? Explain. What is the company's largest expense for Year 37 Did you expect this to be the case? Why or why not? 9. What is the amount of depreciation expense and amortization expense for Year 3? 10. What is the amount of advertising/marketing expense that the company incurred to promote its products and services in Year 3? What is the percentage of this expense to sales (or revenues)? 11. What is net income for Year 1, Year 2, and Year 3? Is the trend going in the right direction? Explain. 12. Compute the return-on-sales ratio for Year 1, Year 2, and Year 3. In what year did the company do the best job of controlling expenses? Explain how you came to this conclusion. 13. Compute the return-on-assets ratio for Year 2 and Year 3. Explain what this ratio means and indicate whether the trend is positive or negative. 14. Compute the return-on-equity ratio for Year 2 and Year 3. Explain what this ratio means. Indicate whether the ratio is improving or deteriorating from Year 2 to Year 3 and why. 15. What is basic earnings per share (EPS), also known as net income per common share, for Year 3? Page Number No. 16. Question Write the accounting equation (A=L+E) for Year 3, using the three numbers provided in the financial statements. 17. What is the largest asset for Year 37 Does this surprise you? Why or why not? 18. Determine the average days to collect accounts receivable for Year 3. Do you feel this is reasonable considering your company's operations? Why or why not? 19. What is the allowance for uncollectible receivables for Year 2 and Year 37 What percent of the gross receivables portfolio is reserved for each of those years? Does this tell you anything about the company's concern for bad debts? 20. Calculate the inventory turnover for Year 3 and also the average days in inventory ratio. Is this reasonable considering your company's line of business? Explain. 21. What is the cost of property, plant, and equipment held by your company as of the end of Year 3? 22. What is the net book value of property, plant, and equipment as of the end of Year 3? 23. What method of depreciation (e.g., units of production, declining balance, straight line) is used for property, plant and equipment? 24. What is the amount of intangible assets owned by the company as of the end of Year 3? What kind are they (i.e., identify them)? Pag Num! No. 25. Question Calculate the current ratio for Year 2 and for Year 3. Explain the ratio and what the trend is telling you. 26. Compute the debt-to-assets ratio for Year 2 and Year 3. Explain whether debt is financing a larger or smaller proportion of the company's assets in Year 3 compared to Year 2. Is the company more or less risky from Year 2 to Year 3? Explain 27. Prepare a schedule that reconciles retained earnings at the beginning of Year 3 with retained earnings at the end of Year 3. Use these three captions to reconcile - Net Income (Loss), Dividends, and Other. 28. What is the par value of the common stock? 29. How many shares of common stock are authorized at the end of Year 37 30. How many shares of common stock are outstanding at the end of Year 3? 31. What is the total amount of cash dividends declared on common stock during Year 37 What is the total amount of cash dividends paid on common stock during Year 3? (Hint: They may not be the same amount.) 32. What percentage of net income did the company pay out in cash dividends? If the company did not pay cash dividends, why do you think it did not? 33 What is the amount of difference between net income and net cash provided (used) by operating activities for Year 37 What one or two items are most responsible for the difference