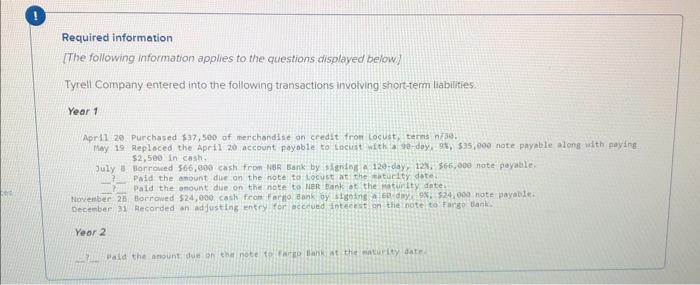

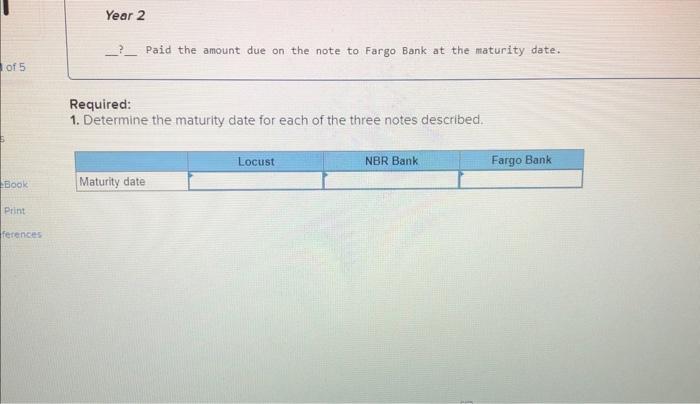

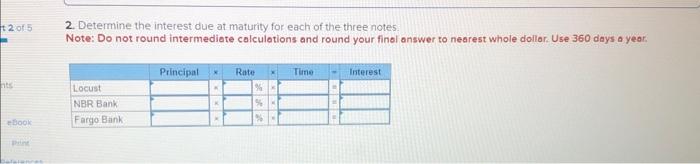

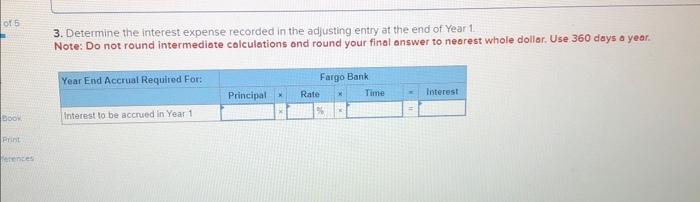

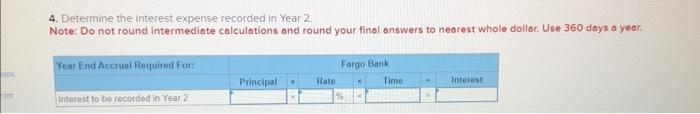

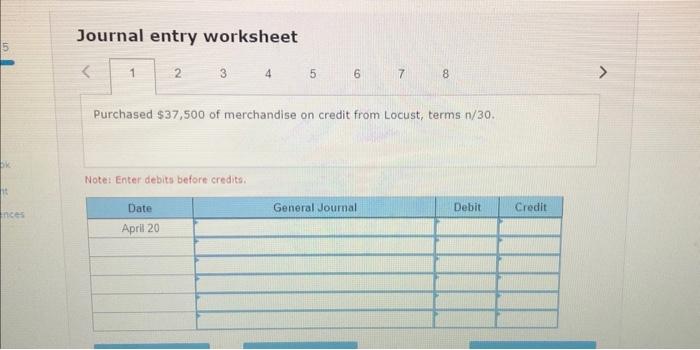

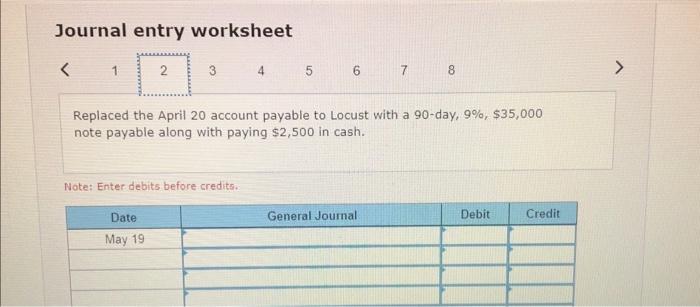

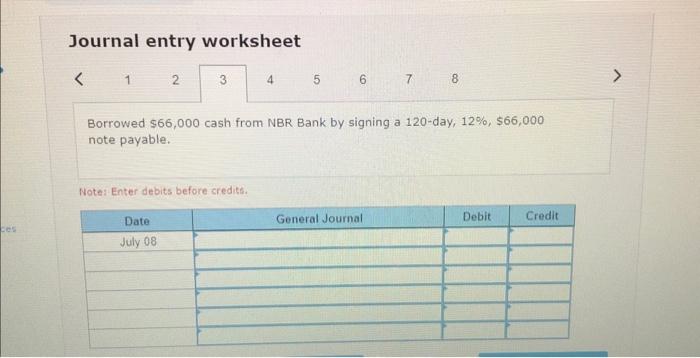

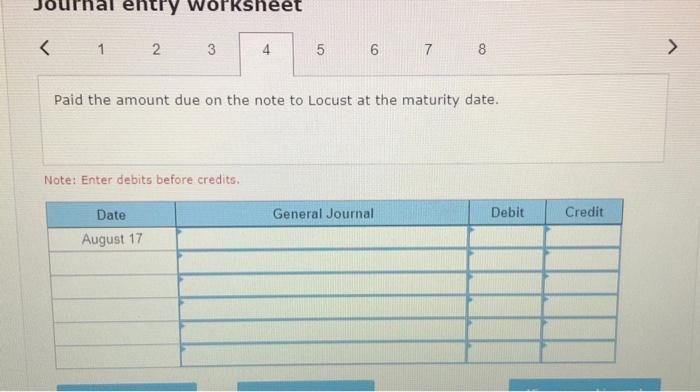

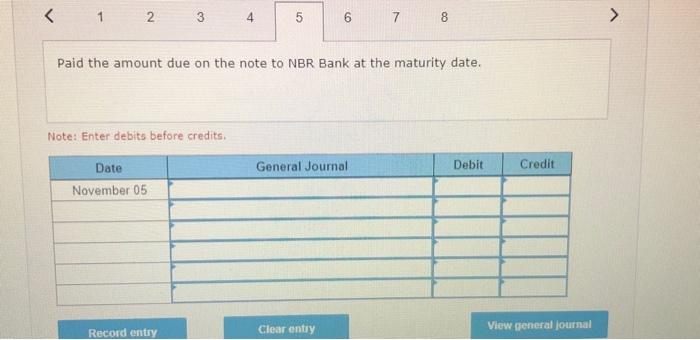

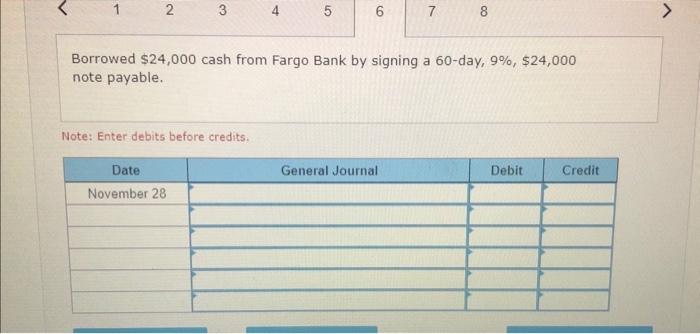

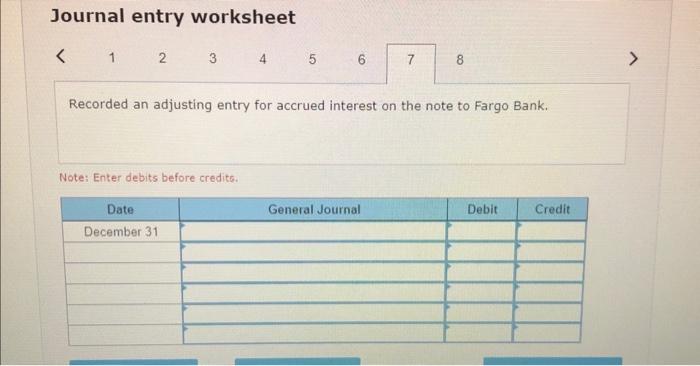

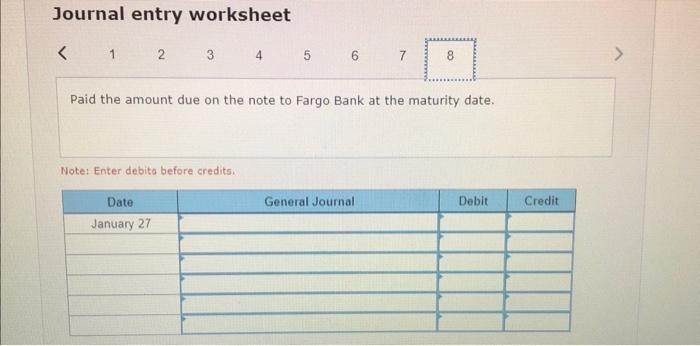

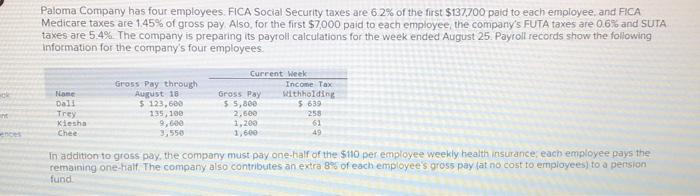

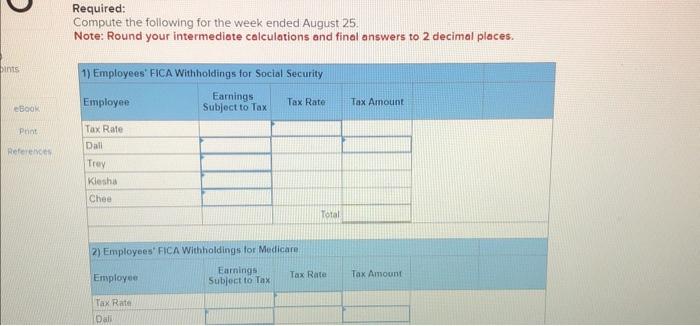

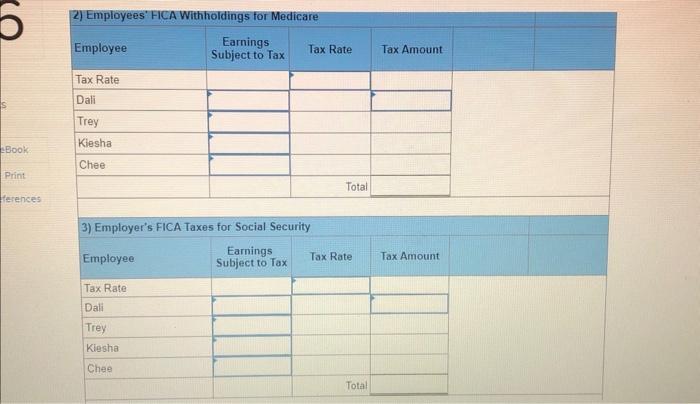

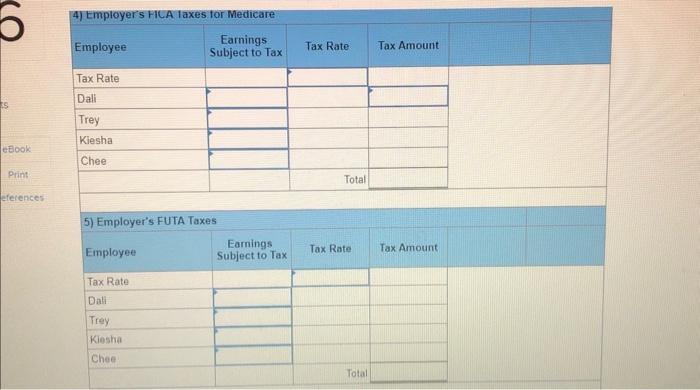

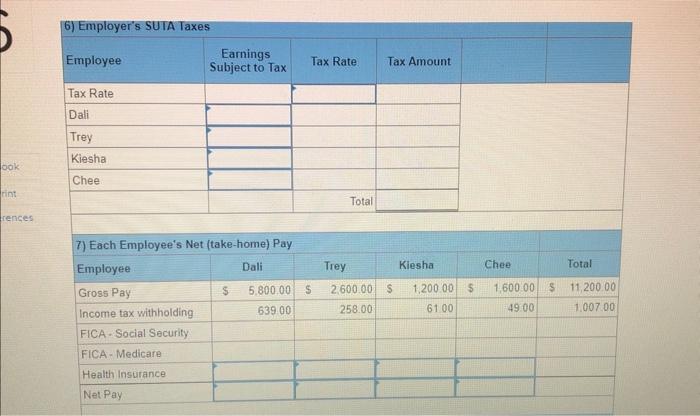

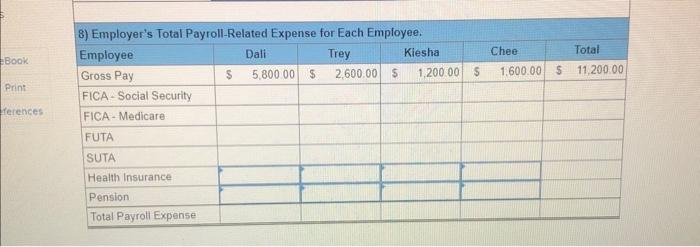

Paid the amount due on the note to Fargo Bank at the maturity date. Required: 1. Determine the maturity date for each of the three notes described. Journal entry worksheet note payable. Note: Enter debits before credits. Journal entry worksheet Replaced the April 20 account payable to Locust with a 90 -day, 9%,$35,000 note payable along with paying $2,500 in cash. Note: Enter debits before credits. Journal entry worksheet Paid the amount due on the note to Fargo Bank at the maturity date. Note: Enter debito before credits. Journal entry worksheet 345678 Purchased $37,500 of merchandise on credit from Locust, terms n/30. Note: Enter debits before credits. Paloma Company has four employees. FICA Social Security taxes are 6.2% of the first $137,700 paid to each employee, and FiCA Medicare taxes are 1.45% of gross pay. Also, for the first $7,000 paid to each employee, the company's FUTA taxes are 0.6% and 5U UA taxes are 5.4%. The company is preparing its payroll calculations for the week ended August 25 . Payroll records show the following information for the company's four employees. In addition to gross pay, the company must pay one-half of the $110 per employee weekly health insurance, each employee pays the remaining one-tralf The company also contributes an extra 8% of each employee's gross pay (at no cost to employees) to a pension fund Paid the amount due on the note to NBR Bank at the maturity date. Note: Enter debits before credits. 3. Determine the interest expense recorded in the adjusting entry at the end of Year 1 Note: Do not round intermediate colculations and round your final answer to nearest whole dollor. Use 360 days a year. 6) Employer's SUIA Taxes \begin{tabular}{|l|l|l|l|} \hline 6) Employer's SUIA Taxes & \multicolumn{1}{|c|}{\begin{tabular}{l} Earnings \\ Eubject to Tax \end{tabular}} & Tax Rate. & Tax Amount \\ \hline Employee & & & \\ \hline Tax Rate & & & \\ \hline Dali & & & \\ \hline Trey & & & \\ \hline Kiesha & & & \\ \hline Chee & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{11}{|c|}{ 7) Each Employee's Net (take-home) Pay } \\ \hline Employee & & Dali & & Trey & & Kiesha & & Chee & & Total \\ \hline Gross Pay & s & 5.800,00 & S & 2.600 .00 & $ & 1.200 .00 & $ & 1,60000 & $ & 11,200.00 \\ \hline Income tax withholding & & 639.00 & & 258.00 & & 6100 & & 4900 & & 1.007 .00 \\ \hline \multicolumn{11}{|l|}{ FICA. Social Security } \\ \hline \multicolumn{11}{|l|}{ FICA - Medicare } \\ \hline \multicolumn{11}{|l|}{ Health Insurance } \\ \hline NetPay & & & & & & & & & & \\ \hline \end{tabular} 4. Determine the interest expense recorded in Year 2. Note: Do not round intermediate calculations and round your final answers to nearest whole dollar. Use 360 days o year. 2. Determine the interest due at maturity for each of the three notes. Note: Do not round intermediate colculations and round your finol onswer to nearest whole dollor. Use 360 days a year. Required: Compute the following for the week ended August 25. Note: Round your intermediate calculations and final answers to 2 decimal places. Borrowed $24,000 cash from Fargo Bank by signing a 60 -day, 9%,$24,000 note payable. Note: Enter debits before credits. Journal entry worksheet 123456 Recorded an adjusting entry for accrued interest on the note to Fargo Bank. Note: Enter debits before credits. 8) Employer's Total Payroll-Related Expense for Each Employee. Book \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline Employee & & Dali & & Trey & & Giesha & & Chee & & Total \\ \hline Gross Pay & 5 & 5,800.00 & $ & 2,600.00 & 5 & 1,200.00 & $ & 1.600 .00 & 5 & 11,200.00 \\ \hline \multicolumn{11}{|l|}{ FICA - Social Security } \\ \hline \multicolumn{11}{|l|}{ FICA-Medicare } \\ \hline \multicolumn{11}{|l|}{ FUTA } \\ \hline \multicolumn{11}{|l|}{ SUTA } \\ \hline \multicolumn{11}{|l|}{ Health Insurance } \\ \hline \multicolumn{11}{|l|}{ Pension } \\ \hline Total Payroll Expense & & & & & & & & & & \\ \hline \end{tabular} 123 8 Paid the amount due on the note to Locust at the maturity date. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below] Tyrell Company entered into the following transactions involving short-term liabilities. Year 1 Apr11 20 . Purchased $37,500 of merchandise on credit from Cosust, terns infBa. Hay 19 Replaced the April 20 account payoble to tocust wtk a 90 -doy, 95, 535, ooe note payable along with paying 52,500 in eash. Pald the anount die on the note to luer park of the patinity date. Yeor 2 4) Employer's HICA laxes for Medicare \begin{tabular}{|c|c|c|c|} \hline Employee & \begin{tabular}{l} Earnings \\ Subject to Tax \end{tabular} & Tax Rate & Tax Amount \\ \hline \multicolumn{4}{|l|}{ Tax Rate } \\ \hline \multicolumn{4}{|l|}{ Dali } \\ \hline \multicolumn{4}{|l|}{ Trey } \\ \hline \multicolumn{4}{|l|}{ Kiesha } \\ \hline \multicolumn{4}{|l|}{ Chee } \\ \hline & & Total & \\ \hline \end{tabular} 5) Employer's FUTA Taxes \begin{tabular}{|l|l|l|l|} \hline Employed & \begin{tabular}{c} Earmings \\ Subject to Tax \end{tabular} & Tax Rate & Tax Amount \\ \hline Tax Rate & & \\ \hline Dali & & \\ \hline Trey & & & \\ \hline Kiesha & & & \\ \hline Chee & & & \\ \hline \end{tabular} 2) Employees' HCA Withholdings for Medicare \begin{tabular}{|c|c|c|c|} \hline Employee & \begin{tabular}{l} Earnings \\ Subject to Tax \end{tabular} & Tax Rate & Tax Amount \\ \hline \multicolumn{4}{|l|}{ Tax Rate } \\ \hline \multicolumn{4}{|l|}{ Dali } \\ \hline \multicolumn{4}{|l|}{ Trey } \\ \hline \multicolumn{4}{|l|}{ Kiesha } \\ \hline \multicolumn{4}{|l|}{ Chee } \\ \hline & & Total & \\ \hline \end{tabular} 3) Employer's FICA Taxes for Social Security \begin{tabular}{|l|l|l|l|} \hline Employee & \begin{tabular}{c} Earnings \\ Subject to Tax \end{tabular} & Tax Rate & Tax Amount \\ \hline Tax Rate & & & \\ \hline Dali & & & \\ \hline Trey & & & \\ \hline Kiesha & & \\ \hline Chee & & \\ \hline \end{tabular} Paid the amount due on the note to Fargo Bank at the maturity date. Required: 1. Determine the maturity date for each of the three notes described. Journal entry worksheet note payable. Note: Enter debits before credits. Journal entry worksheet Replaced the April 20 account payable to Locust with a 90 -day, 9%,$35,000 note payable along with paying $2,500 in cash. Note: Enter debits before credits. Journal entry worksheet Paid the amount due on the note to Fargo Bank at the maturity date. Note: Enter debito before credits. Journal entry worksheet 345678 Purchased $37,500 of merchandise on credit from Locust, terms n/30. Note: Enter debits before credits. Paloma Company has four employees. FICA Social Security taxes are 6.2% of the first $137,700 paid to each employee, and FiCA Medicare taxes are 1.45% of gross pay. Also, for the first $7,000 paid to each employee, the company's FUTA taxes are 0.6% and 5U UA taxes are 5.4%. The company is preparing its payroll calculations for the week ended August 25 . Payroll records show the following information for the company's four employees. In addition to gross pay, the company must pay one-half of the $110 per employee weekly health insurance, each employee pays the remaining one-tralf The company also contributes an extra 8% of each employee's gross pay (at no cost to employees) to a pension fund Paid the amount due on the note to NBR Bank at the maturity date. Note: Enter debits before credits. 3. Determine the interest expense recorded in the adjusting entry at the end of Year 1 Note: Do not round intermediate colculations and round your final answer to nearest whole dollor. Use 360 days a year. 6) Employer's SUIA Taxes \begin{tabular}{|l|l|l|l|} \hline 6) Employer's SUIA Taxes & \multicolumn{1}{|c|}{\begin{tabular}{l} Earnings \\ Eubject to Tax \end{tabular}} & Tax Rate. & Tax Amount \\ \hline Employee & & & \\ \hline Tax Rate & & & \\ \hline Dali & & & \\ \hline Trey & & & \\ \hline Kiesha & & & \\ \hline Chee & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{11}{|c|}{ 7) Each Employee's Net (take-home) Pay } \\ \hline Employee & & Dali & & Trey & & Kiesha & & Chee & & Total \\ \hline Gross Pay & s & 5.800,00 & S & 2.600 .00 & $ & 1.200 .00 & $ & 1,60000 & $ & 11,200.00 \\ \hline Income tax withholding & & 639.00 & & 258.00 & & 6100 & & 4900 & & 1.007 .00 \\ \hline \multicolumn{11}{|l|}{ FICA. Social Security } \\ \hline \multicolumn{11}{|l|}{ FICA - Medicare } \\ \hline \multicolumn{11}{|l|}{ Health Insurance } \\ \hline NetPay & & & & & & & & & & \\ \hline \end{tabular} 4. Determine the interest expense recorded in Year 2. Note: Do not round intermediate calculations and round your final answers to nearest whole dollar. Use 360 days o year. 2. Determine the interest due at maturity for each of the three notes. Note: Do not round intermediate colculations and round your finol onswer to nearest whole dollor. Use 360 days a year. Required: Compute the following for the week ended August 25. Note: Round your intermediate calculations and final answers to 2 decimal places. Borrowed $24,000 cash from Fargo Bank by signing a 60 -day, 9%,$24,000 note payable. Note: Enter debits before credits. Journal entry worksheet 123456 Recorded an adjusting entry for accrued interest on the note to Fargo Bank. Note: Enter debits before credits. 8) Employer's Total Payroll-Related Expense for Each Employee. Book \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline Employee & & Dali & & Trey & & Giesha & & Chee & & Total \\ \hline Gross Pay & 5 & 5,800.00 & $ & 2,600.00 & 5 & 1,200.00 & $ & 1.600 .00 & 5 & 11,200.00 \\ \hline \multicolumn{11}{|l|}{ FICA - Social Security } \\ \hline \multicolumn{11}{|l|}{ FICA-Medicare } \\ \hline \multicolumn{11}{|l|}{ FUTA } \\ \hline \multicolumn{11}{|l|}{ SUTA } \\ \hline \multicolumn{11}{|l|}{ Health Insurance } \\ \hline \multicolumn{11}{|l|}{ Pension } \\ \hline Total Payroll Expense & & & & & & & & & & \\ \hline \end{tabular} 123 8 Paid the amount due on the note to Locust at the maturity date. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below] Tyrell Company entered into the following transactions involving short-term liabilities. Year 1 Apr11 20 . Purchased $37,500 of merchandise on credit from Cosust, terns infBa. Hay 19 Replaced the April 20 account payoble to tocust wtk a 90 -doy, 95, 535, ooe note payable along with paying 52,500 in eash. Pald the anount die on the note to luer park of the patinity date. Yeor 2 4) Employer's HICA laxes for Medicare \begin{tabular}{|c|c|c|c|} \hline Employee & \begin{tabular}{l} Earnings \\ Subject to Tax \end{tabular} & Tax Rate & Tax Amount \\ \hline \multicolumn{4}{|l|}{ Tax Rate } \\ \hline \multicolumn{4}{|l|}{ Dali } \\ \hline \multicolumn{4}{|l|}{ Trey } \\ \hline \multicolumn{4}{|l|}{ Kiesha } \\ \hline \multicolumn{4}{|l|}{ Chee } \\ \hline & & Total & \\ \hline \end{tabular} 5) Employer's FUTA Taxes \begin{tabular}{|l|l|l|l|} \hline Employed & \begin{tabular}{c} Earmings \\ Subject to Tax \end{tabular} & Tax Rate & Tax Amount \\ \hline Tax Rate & & \\ \hline Dali & & \\ \hline Trey & & & \\ \hline Kiesha & & & \\ \hline Chee & & & \\ \hline \end{tabular} 2) Employees' HCA Withholdings for Medicare \begin{tabular}{|c|c|c|c|} \hline Employee & \begin{tabular}{l} Earnings \\ Subject to Tax \end{tabular} & Tax Rate & Tax Amount \\ \hline \multicolumn{4}{|l|}{ Tax Rate } \\ \hline \multicolumn{4}{|l|}{ Dali } \\ \hline \multicolumn{4}{|l|}{ Trey } \\ \hline \multicolumn{4}{|l|}{ Kiesha } \\ \hline \multicolumn{4}{|l|}{ Chee } \\ \hline & & Total & \\ \hline \end{tabular} 3) Employer's FICA Taxes for Social Security \begin{tabular}{|l|l|l|l|} \hline Employee & \begin{tabular}{c} Earnings \\ Subject to Tax \end{tabular} & Tax Rate & Tax Amount \\ \hline Tax Rate & & & \\ \hline Dali & & & \\ \hline Trey & & & \\ \hline Kiesha & & \\ \hline Chee & & \\ \hline \end{tabular}