Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Paid the beginning accounts payable and received all owed. Bought 10 Fluffs, sold 14. Bought for $48,000 each, sold for $70,000. Bought for 25%

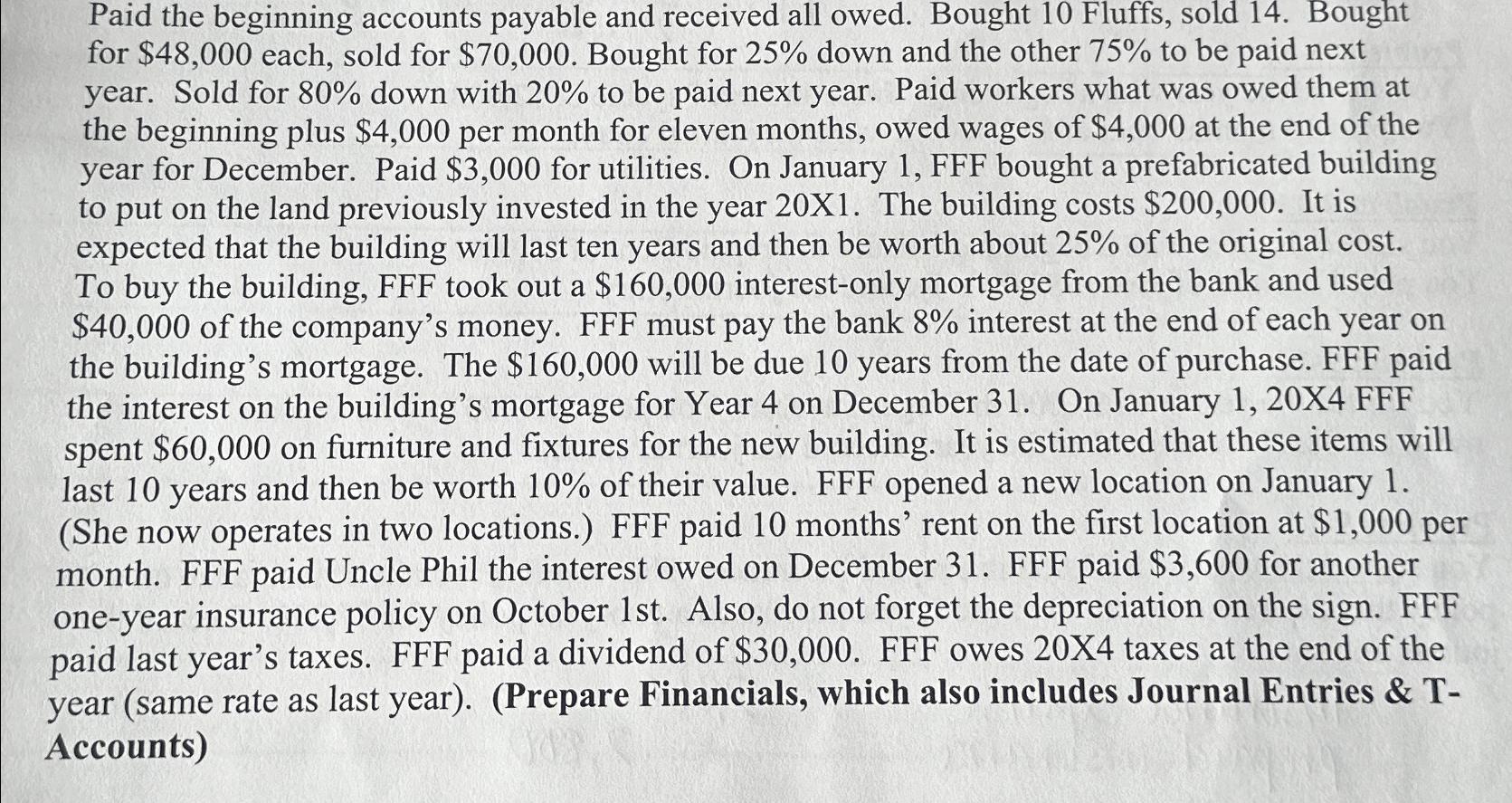

Paid the beginning accounts payable and received all owed. Bought 10 Fluffs, sold 14. Bought for $48,000 each, sold for $70,000. Bought for 25% down and the other 75% to be paid next year. Sold for 80% down with 20% to be paid next year. Paid workers what was owed them at the beginning plus $4,000 per month for eleven months, owed wages of $4,000 at the end of the year for December. Paid $3,000 for utilities. On January 1, FFF bought a prefabricated building to put on the land previously invested in the year 20X1. The building costs $200,000. It is expected that the building will last ten years and then be worth about 25% of the original cost. To buy the building, FFF took out a $160,000 interest-only mortgage from the bank and used $40,000 of the company's money. FFF must pay the bank 8% interest at the end of each year on the building's mortgage. The $160,000 will be due 10 years from the date of purchase. FFF paid the interest on the building's mortgage for Year 4 on December 31. On January 1, 20X4 FFF spent $60,000 on furniture and fixtures for the new building. It is estimated that these items will last 10 years and then be worth 10% of their value. FFF opened a new location on January 1. (She now operates in two locations.) FFF paid 10 months' rent on the first location at $1,000 per month. FFF paid Uncle Phil the interest owed on December 31. FFF paid $3,600 for another one-year insurance policy on October 1st. Also, do not forget the depreciation on the sign. FFF paid last year's taxes. FFF paid a dividend of $30,000. FFF owes 20X4 taxes at the end of the year (same rate as last year). (Prepare Financials, which also includes Journal Entries & T- Accounts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the financials including journal entries and Taccounts based ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started