Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Painter Corporation was organized by five individuals on January 1 of the current year. At the end of January of the current year, the

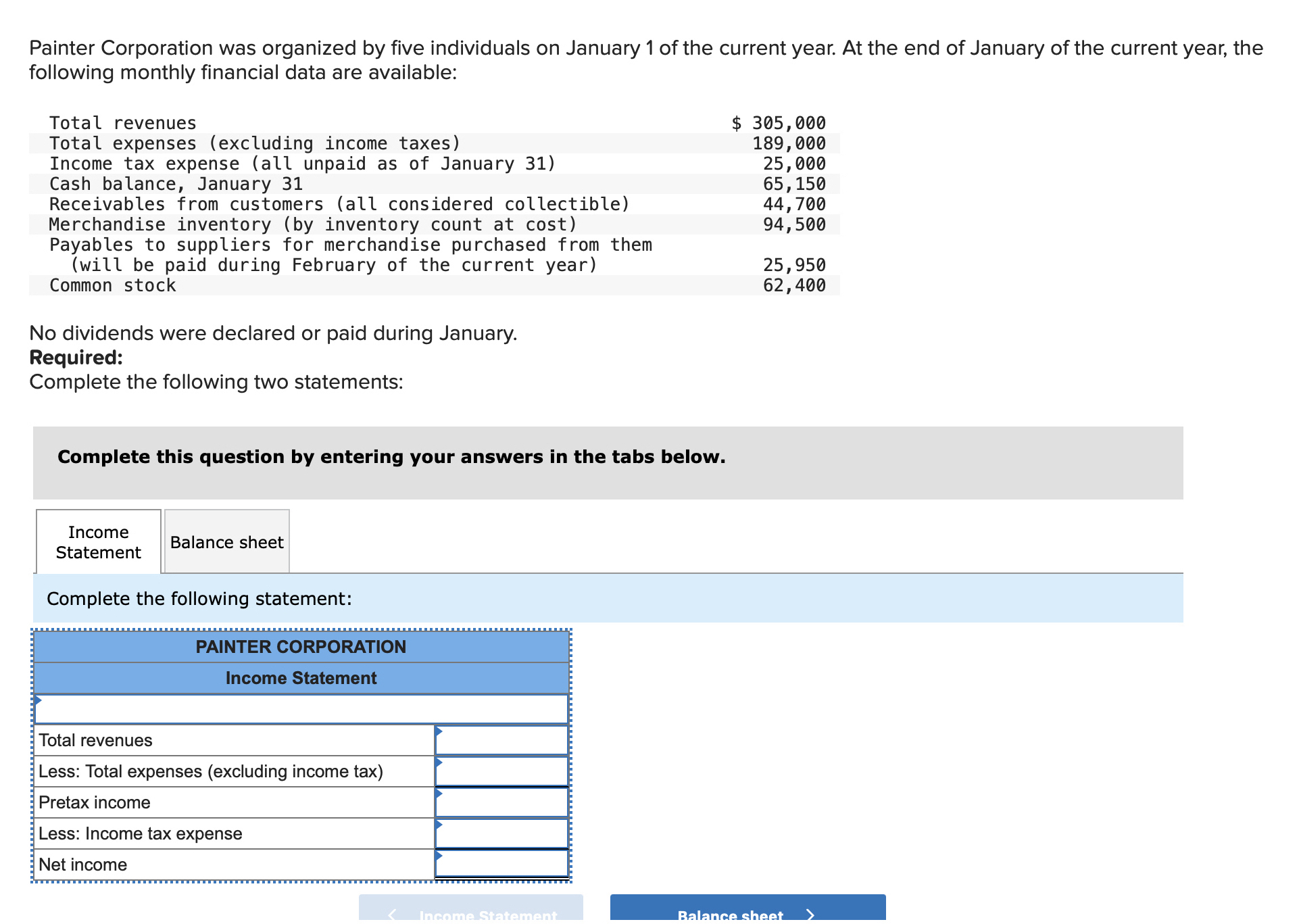

Painter Corporation was organized by five individuals on January 1 of the current year. At the end of January of the current year, the following monthly financial data are available: Total revenues Total expenses (excluding income taxes) $ 305,000 189,000 Income tax expense (all unpaid as of January 31) Cash balance, January 31 25,000 65,150 Receivables from customers (all considered collectible) Merchandise inventory (by inventory count at cost) 44,700 94,500 Payables to suppliers for merchandise purchased from them (will be paid during February of the current year) Common stock 25,950 62,400 No dividends were declared or paid during January. Required: Complete the following two statements: Complete this question by entering your answers in the tabs below. Income Statement Balance sheet Complete the following statement: PAINTER CORPORATION Income Statement Total revenues Less: Total expenses (excluding income tax) Pretax income Less: Income tax expense Net income Income Statement Balance sheet >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The income statement is given below Painter Corporation Income Statem...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started