Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Calculate liquidity, asset utilization, leverage, and profitability ratios for OnGoal. 2. Pair off and compare your ratios. Discuss which of the ratios look

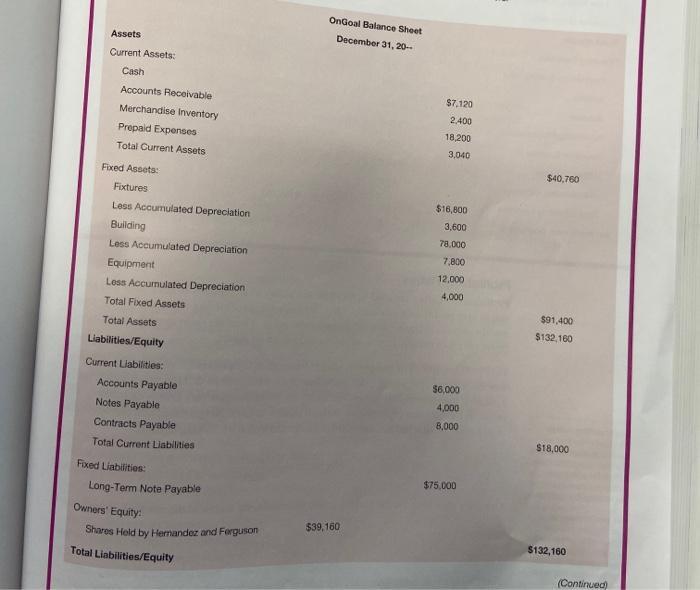

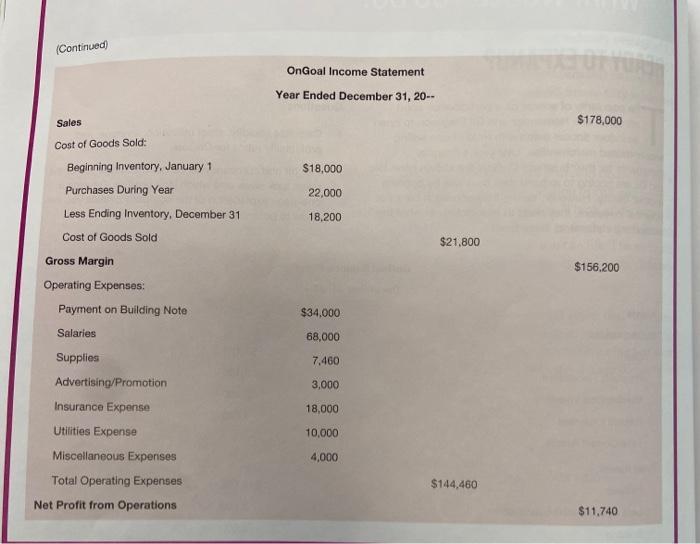

1. Calculate liquidity, asset utilization, leverage, and profitability ratios for OnGoal. 2. Pair off and compare your ratios. Discuss which of the ratios look weak and which look positive. Develop a one-page explanation of the company's ratios you can show to potential lenders. OnGoal Balance Sheet December 31, 20-- Assets Current Assets: Cash $7,120 Accounts Receivable 2,400 Merchandise Inventory 18,200 Prepaid Expenses 3,040 Total Current Assets $40,760 Fixed Assets: Fixtures $16,800 Less Accumulated Depreciation 3,600 Building 78.000 Less Accumulated Depreciation 7,800 Equipment 12,000 Less Accurmulated Depreciation 4,000 Total Fixed Assets $91,400 $132,160 Total Assets Liabilities/Equity Current Liabilities: $6,000 Accounts Payable 4,000 Notes Payable 8,000 Contracts Payable $18,000 Total Current Liabilities Fixed Liabilities: $75,000 Long-Term Note Payable Owners' Equity: $39,160 Shares Held by Hernandez and Ferguson $132,160 Total Liabilities/Equity (Continued) (Continued) OnGoal Income Statement Year Ended December 31, 20-- $178,000 Sales Cost of Goods Sold: Beginning Inventory, January 1 $18,000 Purchases During Year 22,000 Less Ending Inventory, December 31 18.200 Cost of Goods Sold $21,800 Gross Margin $156,200 Operating Expenses: Payment on Building Note $34,000 Salaries 68,000 Supplies 7,460 Advertising/Promotion 3,000 Insurance Expense 18,000 Utilities Expense 10,000 Miscellaneous Experises 4,000 Total Operating Expenses $144,460 Net Profit from Operations $11,740

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 Current Ratio Current Assets Current Liabilities Current Assets 40760 Current Liabilities 18000 Current Ratio 40760 18000 226 2 Assets Turnover Ratio Net sales Total Assets Net sales 178000 Total As...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started