Question

Paladin Furnishings generated $2 million in sales during 2016, and its year-end total assets were $1.5 million. Also, at year-end 2016, current liabilities were $500,000,

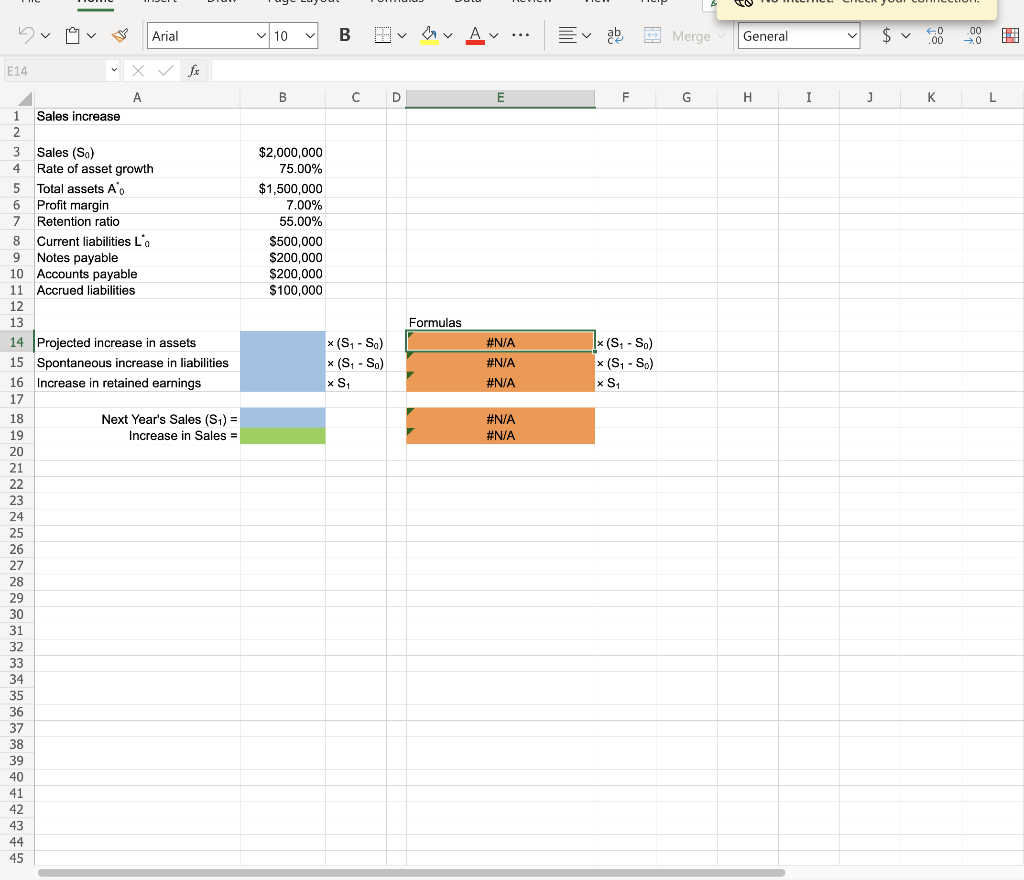

Paladin Furnishings generated $2 million in sales during 2016, and its year-end total assets were $1.5 million. Also, at year-end 2016, current liabilities were $500,000, consisting of $200,000 of notes payable, $200,000 of accounts payable, and $100,000 of accrued liabilities. Looking ahead to 2017, the company estimates that its assets must increase by $0.75 for every $1.00 increase in sales. Paladin's profit margin is 7%, and its retention ratio is 55%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below.

Use the spreadsheet in picture

How large of a sales increase can the company achieve without having to raise funds externally? Write out your answer completely. For example, 25 million should be entered as 25,000,000. Do not round intermediate calculations. Round your answer to the nearest cent.

$ ______

5 HP Arial x fx A E14 1 Sales increase 2 3 Sales (So) 4 Rate of asset growth 5 Total assets A 6 Profit margin 7 Retention ratio 8 Current liabilities L'o 9 Notes payable 10 Accounts payable 11 Accrued liabilities 12 13 14 Projected increase in assets 15 16 Increase in retained earnings 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 Spontaneous increase in liabilities Next Year's Sales (S) = Increase in Sales = 10 B $2,000,000 75.00% $1,500,000 7.00% 55.00% $500,000 $200,000 $200,000 $100,000 B x (S- So) x (S- So) x S Av .. D E Formulas #N/A #N/A #N/A #N/A #N/A Ev ab F x (S - So) x (S - So) x S Merge G General H I J $ .0 .00 K .00 .0 LStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started