Question

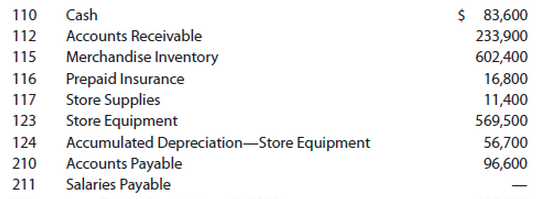

Palisade Creek Co. is a merchandising business. The account balances for Palisade Creek Co. as of May 1, 2014 (unless otherwise indicated), are as follows:

Palisade Creek Co. is a merchandising business. The account balances for Palisade Creek Co. as of May 1, 2014 (unless otherwise indicated), are as follows:

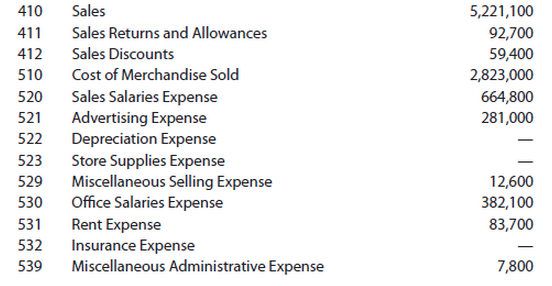

310 Capital Stock 100,000

311 Retained Earnings 585,300

312 Dividends 135,000

313 Income Summary 5,221,100

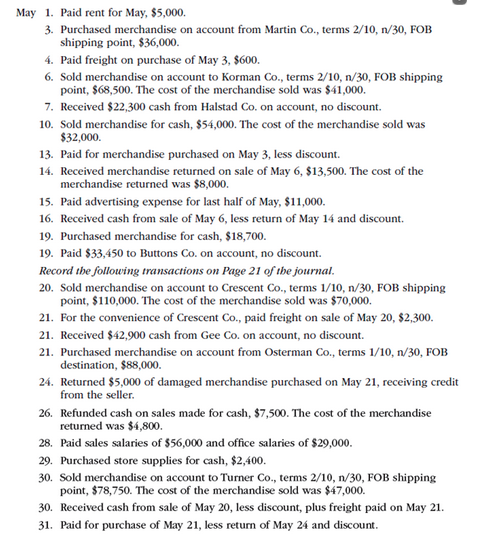

During May, the last month of the fiscal year, the following transactions were completed:

Questions:

Enter the balances of each of the accounts in the appropriate balance column of a four-column account. Write balance in the item section and place a check mark in the Posting reference column. Journalize the transactions for May, starting on page 20 of the journal.

Post the journal to the general ledger, extending the month-end balances to the appropriate balance columns after all posting is completed. In this problem, you are not required to update or post to the accounts receivable and accounts payable subsidiary ledgers.

Prepare and unadjusted trial balance

At the end of May, the following adjustments data were assembled. Analyze and use these data to complete (5) and (6)

Merchandise inventory on May 31 $550,000

Insurance expired during the year 12,000

Store Supplies on hand on May 31 4,000

Depreciation for the current year 14,000

Accrued salaries on May 31:

Sales salaries 7,000

Office salaries 6,000 13,600

5. Enter the unadjusted trial balance on a 10-column end-of-period spreadsheet and complete the spreadsheet

6. Journalize the post the adjusting entries. Record the adjusting entries on Page 22 of the journal

7. Prepare and adjusted trial balance

8. Prepare an income statement, a retained earnings statement, and a balance sheet.

9. Prepare and post the closing entries. Record the closing entries on Page 23 of the journal. Indicate closed accounts by inserting a line in both the balance columns opposite the closing entry. Insert the new balance in the retained earnings account

10. Prepare a post-closing trial balance.

110 Cash 112 Accounts Receivable 115 Merchandise Inventory 116 Prepaid Insurance 117 Store Supplies 123 Store Equipment Accumulated Depreciation-Store Equipment 124 210 Accounts Payable 211 Salaries Payable 83,600 233,900 602,400 16,800 11,400 569,500 56,700 96,600Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started