Palo Alto Electronics (PAE) of the US exports 140,000 sets of routers per year to the Philippines. It sells them for the equivalent of

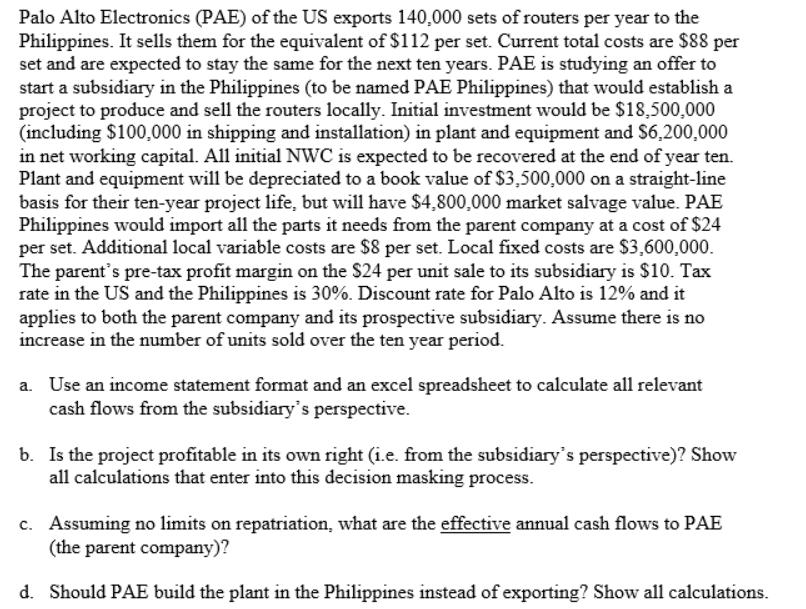

Palo Alto Electronics (PAE) of the US exports 140,000 sets of routers per year to the Philippines. It sells them for the equivalent of $112 per set. Current total costs are $88 per set and are expected to stay the same for the next ten years. PAE is studying an offer to start a subsidiary in the Philippines (to be named PAE Philippines) that would establish a project to produce and sell the routers locally. Initial investment would be $18,500,000 (including $100,000 in shipping and installation) in plant and equipment and $6,200,000 in net working capital. All initial NWC is expected to be recovered at the end of year ten. Plant and equipment will be depreciated to a book value of $3,500,000 on a straight-line basis for their ten-year project life, but will have $4,800,000 market salvage value. PAE Philippines would import all the parts it needs from the parent company at a cost of $24 per set. Additional local variable costs are $8 per set. Local fixed costs are $3,600,000. The parent's pre-tax profit margin on the $24 per unit sale to its subsidiary is $10. Tax rate in the US and the Philippines is 30%. Discount rate for Palo Alto is 12% and it applies to both the parent company and its prospective subsidiary. Assume there is no increase in the number of units sold over the ten year period. a. Use an income statement format and an excel spreadsheet to calculate all relevant cash flows from the subsidiary's perspective. b. Is the project profitable in its own right (i.e. from the subsidiary's perspective)? Show all calculations that enter into this decision masking process. c. Assuming no limits on repatriation, what are the effective annual cash flows to PAE (the parent company)? d. Should PAE build the plant in the Philippines instead of exporting? Show all calculations.

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Here are the calculations for this multiple part question a Income statement for PAE Philippines all ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started