Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pam's Creations had the following sales and purchase transactions during Year 2. Beginning inventory consisted of 60 items at $350 each. The company uses the

Pam's Creations had the following sales and purchase transactions during Year 2. Beginning inventory consisted of 60 items at $350 each. The company uses the FIFO cost flow assumption and keeps perpetual inventory records.

| Date | Transaction | Description |

|---|---|---|

| March 5 | Purchased | 50 items @ $ 370 |

| April 10 | Sold | 30 items @ $ 450 |

| June 19 | Sold | 60 items @ $ 450 |

| September 16 | Purchased | 70 items @ $ 390 |

| November 28 | Sold | 45 items @ $ 480 |

Required

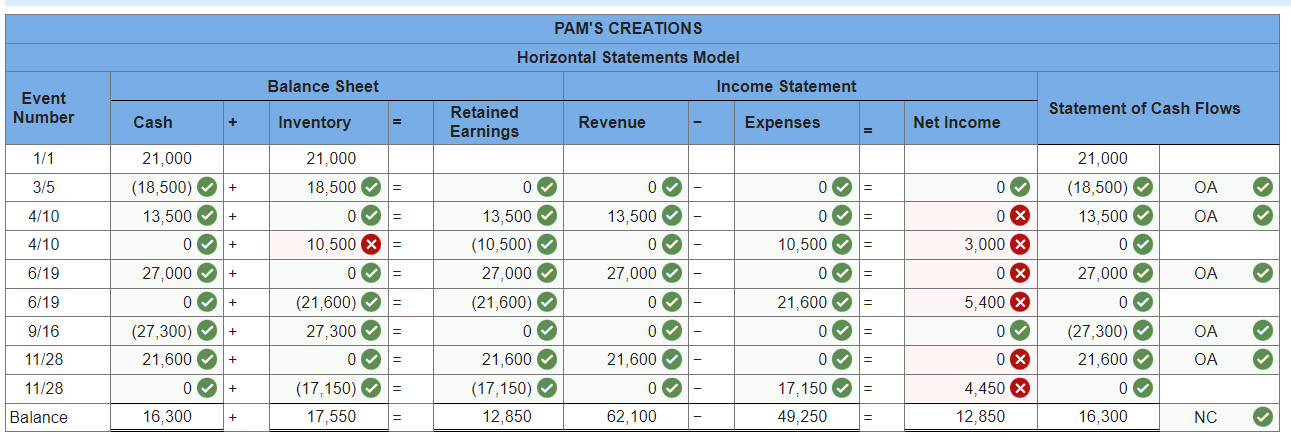

- Record the inventory transactions in a financial statements model.

- Calculate the gross margin Pam's Creations would report on the Year 2 income statement.

- Determine the ending inventory balance Pam's Creations would report on the December 31, Year 2, balance sheet.

PAM'S CREATIONS Horizontal Statements Model Balance Sheet Income Statement Event Number Retained Statement of Cash Flows Cash + Inventory Revenue Expenses Net Income Earnings 1/1 21,000 21,000 3/5 (18,500) + 18,500 0 0 0 0 21,000 (18,500) OA 4/10 13,500 + 0 13,500 13,500 0 = 0 13,500 OA 4/10 0 + 10,500 = (10,500) 0 10,500 3,000 0 6/19 27,000 + 0 27,000 27,000 0 0 27,000 OA 6/19 0 9/16 (27,300) + (21,600) 27,300 = (21,600) 0 21,600 = 5,400 0 0 0 0 0 (27,300) OA 11/28 21,600 + 0 21,600 21,600 0 = 0 21,600 OA 11/28 0 + (17,150) (17,150) 0 17,150 4,450 x 0 Balance 16,300 + 17,550 12,850 62,100 49,250 = 12,850 16,300 NC

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started