Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pan Corporation acquired an 85% interest in Sly Corporation on August 1, 2017 for $522,750, equal to the 85% of the underlying equity of

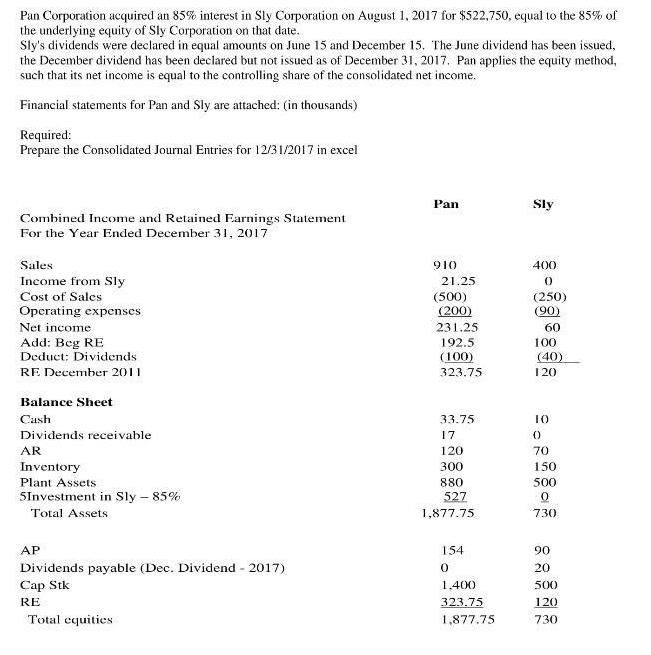

Pan Corporation acquired an 85% interest in Sly Corporation on August 1, 2017 for $522,750, equal to the 85% of the underlying equity of Sly Corporation on that date. Sly's dividends were declared in equal amounts on June 15 and December 15. The June dividend has been issued, the December dividend has been declared but not issued as of December 31, 2017. Pan applies the equity method, such that its net income is equal to the controlling share of the consolidated net income. Financial statements for Pan and Sly are attached: (in thousands) Required: Prepare the Consolidated Journal Entries for 12/31/2017 in excel Pan Sly Combined Income and Retained Earnings Statement For the Year Ended December 31, 2017 Sales 910 400 Income from Sly 21.25 (250) (90) Cost of Sales (500) (200) Operating expenses 231.25 192.5 (100) Net income 60 Add: Beg RE Deduct; Dividends 100 RE December 2011 (40) 1 20 323.75 Balance Sheet Cash 33.75 10 Dividends receivable 17 AR 120 70 Inventory 300 150 Plant Assets 880 500 SInvestment in Sly 85% 527 Total Assets 1,877.75 730 AP 154 90 Dividends payable (Dec. Dividend - 2017) Cap Stk 20 1.400 500 RE 323.75 120 Total equities 1,877.75 730

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Consolidated entries Income from Sly 2125 Share of NCI in net income 375 To dividends 20 To investment in Sly 425 To noncontrolling interest 075 Retai...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started