Answered step by step

Verified Expert Solution

Question

1 Approved Answer

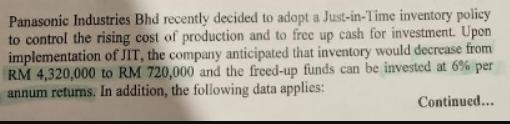

Panasonic Industries Bhd recently decided to adopt a Just-in-Time inventory policy to control the rising cost of production and to free up cash for

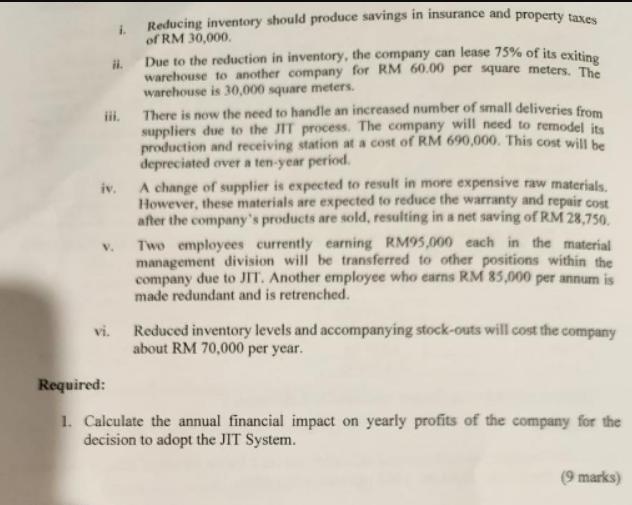

Panasonic Industries Bhd recently decided to adopt a Just-in-Time inventory policy to control the rising cost of production and to free up cash for investment. Upon implementation of JIT, the company anticipated that inventory would decrease from RM 4,320,000 to RM 720,000 and the freed-up funds can be invested at 6% per annum returns. In addition, the following data applies: Continued... Reducing inventory should produce savings in insurance and property taxes of RM 30,000. 1. ii. Due to the reduction in inventory, the company can lease 75% of its exiting warehouse to another company for RM 60.00 per square meters. The warehouse is 30,000 square meters. iii. There is now the need to handle an increased number of small deliveries from suppliers due to the JIT process. The company will need to remodel its production and receiving station at a cost of RM 690,000. This cost will be depreciated over a ten-year period. iv. A change of supplier is expected to result in more expensive raw materials. However, these materials are expected to reduce the warranty and repair cost after the company's products are sold, resulting in a net saving of RM 28,750. Two employees currently earning RM95,000 each in the material management division will be transferred to other positions within the company due to JIT. Another employee who earns RM 85,000 per annum is made redundant and is retrenched. vi. Reduced inventory levels and accompanying stock-outs will cost the company about RM 70,000 per year. Required: 1. Calculate the annual financial impact on yearly profits of the company for the decision to adopt the JIT System. (9 marks)

Step by Step Solution

★★★★★

3.46 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the annual financial impact on yearly profits for the decision to adopt the JIT JustinT...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started