Answered step by step

Verified Expert Solution

Question

1 Approved Answer

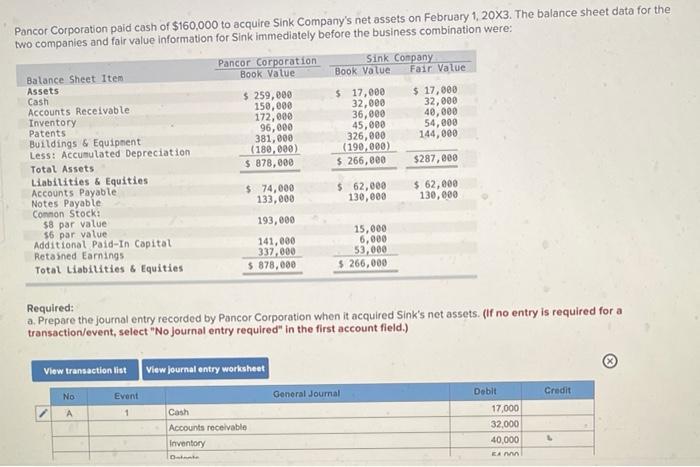

Pancor Corporation paid cash of $160,000 to acquire Sink Company's net assets on February 1, 20X3. The balance sheet data for the two companies

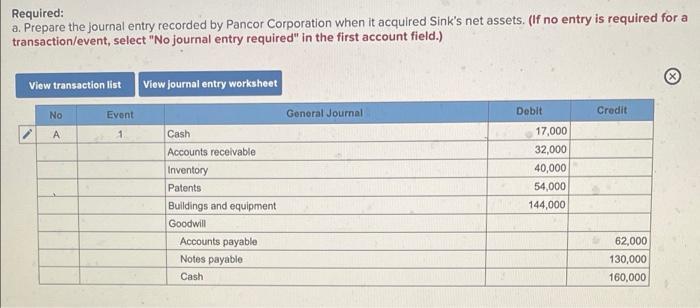

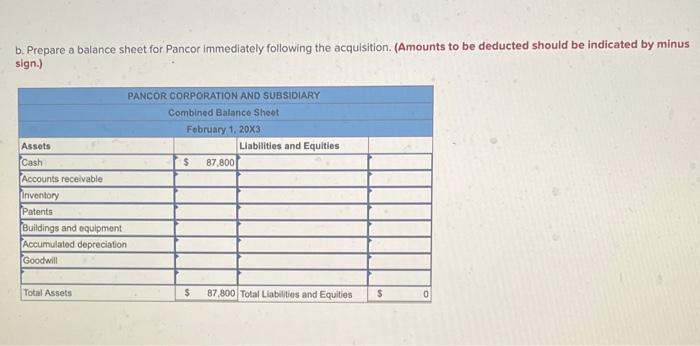

Pancor Corporation paid cash of $160,000 to acquire Sink Company's net assets on February 1, 20X3. The balance sheet data for the two companies and fair value information for Sink immediately before the business combination were: Balance Sheet Item Assets Cash Accounts Receivable Inventory Patents Buildings & Equipment Less: Accumulated Depreciation Total Assets Liabilities & Equities Accounts Payable: Notes Payable Common Stock: $8 par value $6 par value. Additional Paid-In Capital Retained Earnings Total Liabilities & Equities Pancor Corporation Book Value No A $ 259,000 150,000 172,000 96,000 Event 1 381,000 (180,000) $ 878,000 $ 74,000 133,000 193,000 141,000 337,000 $ 878,000 View transaction list View journal entry worksheet Cash Accounts receivable Inventory Detente Sink Company Book Value Fair Value $ 17,000 32,000 36,000 45,000 326,000 (190,000) $ 266,000 $ 62,000 130,000 Required: a. Prepare the journal entry recorded by Pancor Corporation when it acquired Sink's net assets. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 15,000 6,000 53,000 $ 266,000 $ 17,000 32,000 General Journal 40,000 54,000 144,000 $287,000 $ 62,000 130,000 Debit 17,000 32,000 40,000 Ennn Credit Required: a. Prepare the journal entry recorded by Pancor Corporation when it acquired Sink's net assets. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list View journal entry worksheet No A Event 1. Cash Accounts receivable Inventory Patents Buildings and equipment Goodwill Accounts payable Notes payable Cash General Journal Debit 17,000 32,000 40,000 54,000 144,000 Credit 62,000 130,000 160,000 b. Prepare a balance sheet for Pancor immediately following the acquisition. (Amounts to be deducted should be indicated by minus sign.) Assets Cash Accounts receivable Inventory Patents Buildings and equipment Accumulated depreciation Goodwill Total Assets PANCOR CORPORATION AND SUBSIDIARY Combined Balance Sheet February 1, 20X3 $ 87,800 Liabilities and Equities $ 87,800 Total Liabilities and Equities $

Step by Step Solution

★★★★★

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Date Account Dr Cr Cash 17000 Accounts Receivable 32000 Inventory 40000 patents 54000 bu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started