Wildcats, Inc. purchased a truck on 1/1/2016, at a cost of $88,000. The machine's estimated useful life at the time of the purchase was

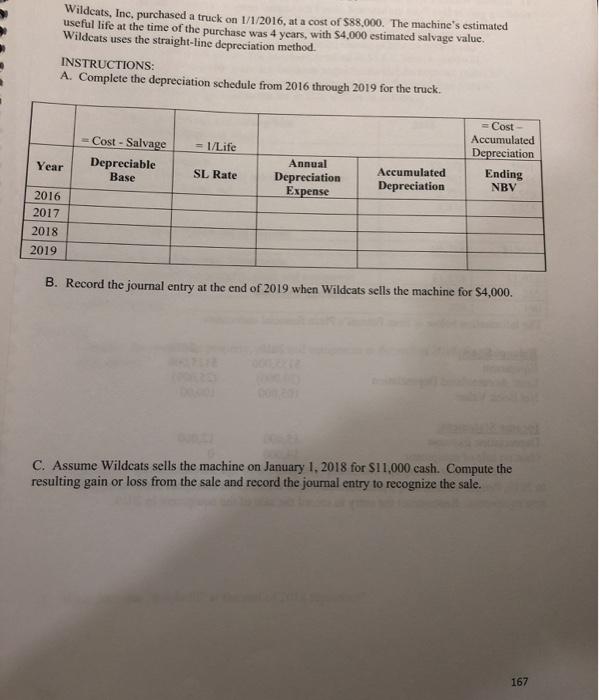

Wildcats, Inc. purchased a truck on 1/1/2016, at a cost of $88,000. The machine's estimated useful life at the time of the purchase was 4 years, with $4,000 estimated salvage value. Wildcats uses the straight-line depreciation method. INSTRUCTIONS: A. Complete the depreciation schedule from 2016 through 2019 for the truck. Year 2016 2017 2018 2019 M Cost - Salvage Depreciable Base = 1/Life SL Rate Annual Depreciation Expense Accumulated Depreciation = Cost- Accumulated Depreciation Ending NBV B. Record the journal entry at the end of 2019 when Wildcats sells the machine for $4,000. C. Assume Wildcats sells the machine on January 1, 2018 for $11,000 cash. Compute the resulting gain or loss from the sale and record the journal entry to recognize the sale. 167

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

A Depreciation per year on the basis of straight line depreciation Cost Salvage value Life 88000 400...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started