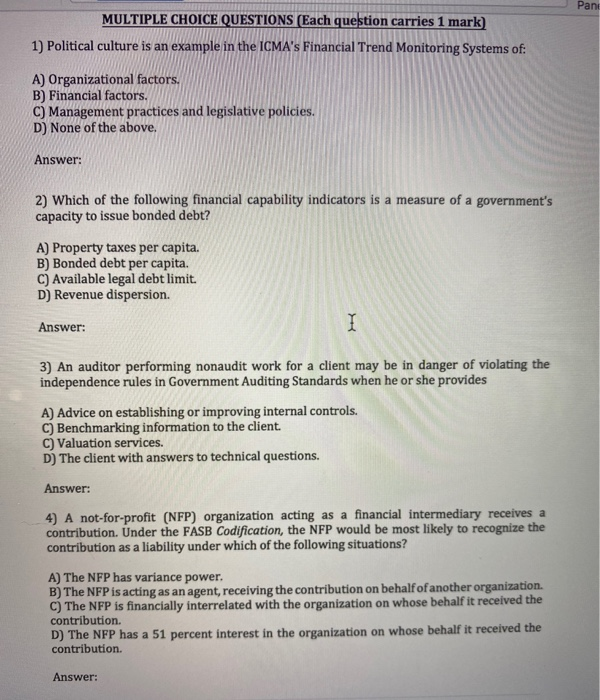

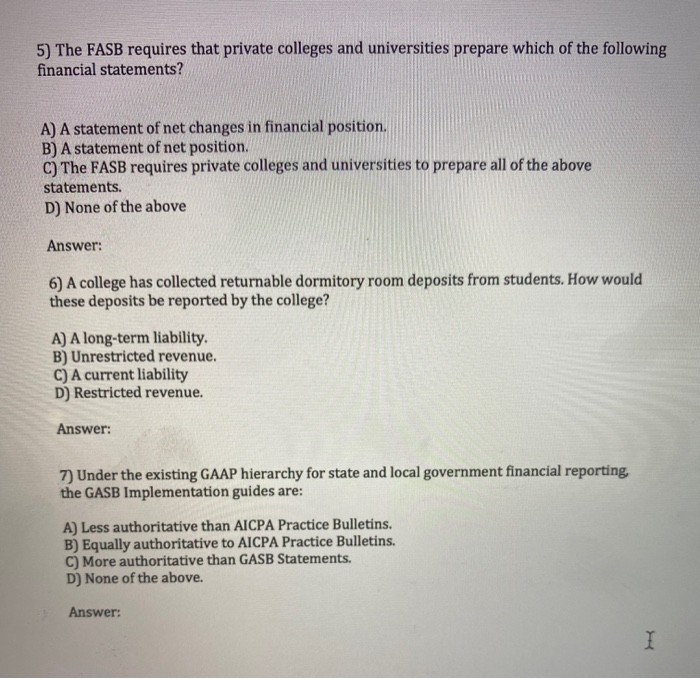

Pani MULTIPLE CHOICE QUESTIONS (Each question carries 1 mark) 1) Political culture is an example in the ICMA's Financial Trend Monitoring Systems of: A) Organizational factors. B) Financial factors, C) Management practices and legislative policies. D) None of the above. Answer: 2) Which of the following financial capability indicators is a measure of a government's capacity to issue bonded debt? A) Property taxes per capita. B) Bonded debt per capita. C) Available legal debt limit. D) Revenue dispersion. Answer: I 3) An auditor performing nonaudit work for a client may be in danger of violating the independence rules in Government Auditing Standards when he or she provides A) Advice on establishing or improving internal controls. C) Benchmarking information to the client. C) Valuation services. D) The client with answers to technical questions. Answer: 4) A not-for-profit (NFP) organization acting as a financial intermediary receives a contribution. Under the FASB Codification, the NFP would be most likely to recognize the contribution as a liability under which of the following situations? A) The NFP has variance power. B) The NFP is acting as an agent, receiving the contribution on behalf of another organization. C) The NFP is financially interrelated with the organization on whose behalf it received the contribution D) The NFP has a 51 percent interest in the organization on whose behalf it received the contribution. Answer: 5) The FASB requires that private colleges and universities prepare which of the following financial statements? A) A statement of net changes in financial position. B) A statement of net position. C) The FASB requires private colleges and universities to prepare all of the above statements. D) None of the above Answer: 6) A college has collected returnable dormitory room deposits from students. How would these deposits be reported by the college? A) A long-term liability, B) Unrestricted revenue. C) A current liability D) Restricted revenue. Answer: 7) Under the existing GAAP hierarchy for state and local government financial reporting, the GASB Implementation guides are: A) Less authoritative than AICPA Practice Bulletins. B) Equally authoritative to AICPA Practice Bulletins. C) More authoritative than GASB Statements. D) None of the above