Answered step by step

Verified Expert Solution

Question

1 Approved Answer

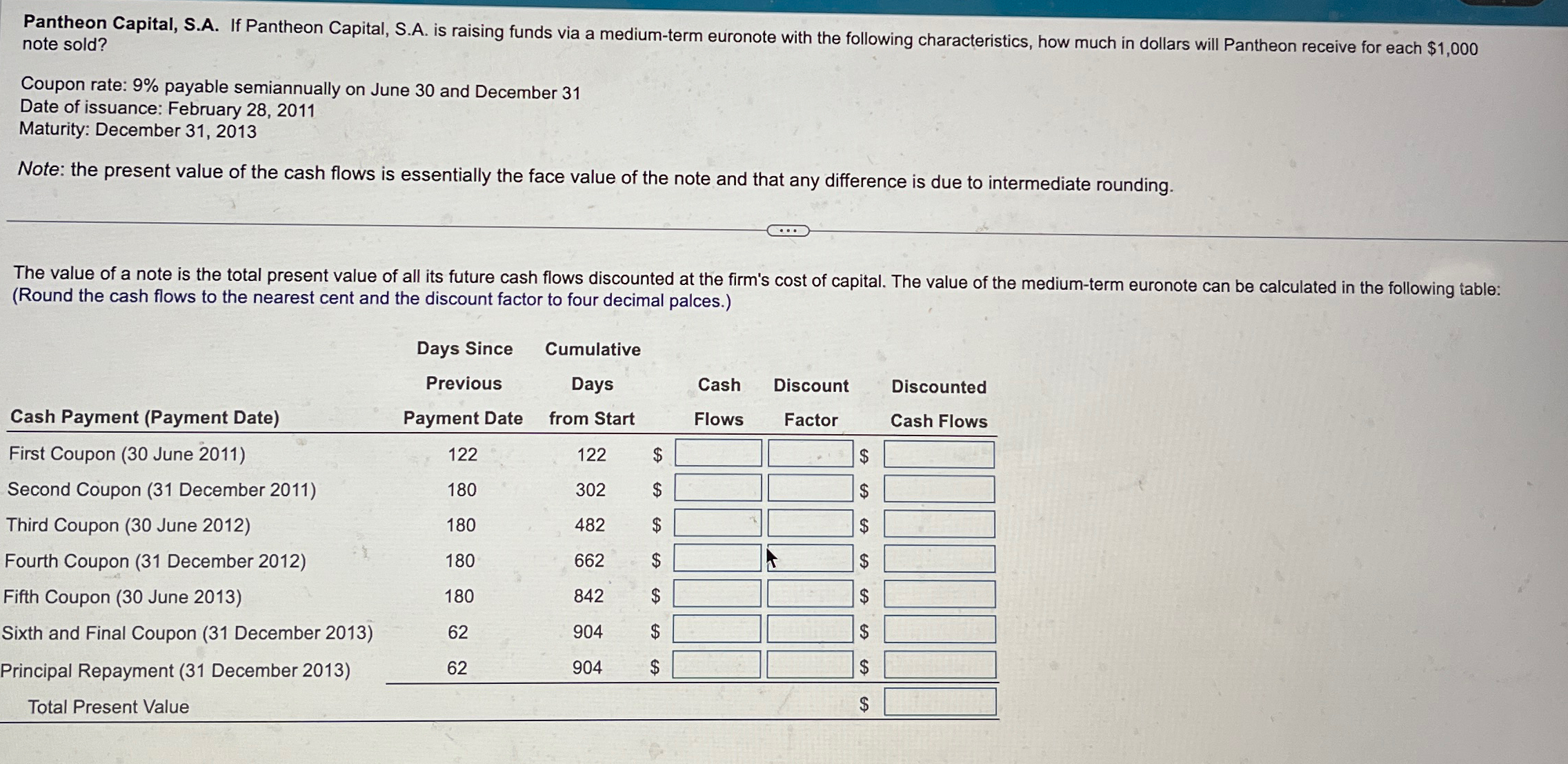

Pantheon Capital, S . A . If Pantheon Capital, S . A . is raising funds via a medium - term euronote with the following

Pantheon Capital, SA If Pantheon Capital, SA is raising funds via a mediumterm euronote with the following characteristics, how much in dollars will Pantheon receive for each $ note sold?

Coupon rate: payable semiannually on June and December

Date of issuance: February

Maturity: December

Note: the present value of the cash flows is essentially the face value of the note and that any difference is due to intermediate rounding.

The value of a note is the total present value of all its future cash flows discounted at the firm's cost of capital. The value of the mediumterm euronote can be calculated in the following table:

Round the cash flows to the nearest cent and the discount factor to four decimal palces.

tableCash Payment Payment DatetableDays SincePreviousPayment DatetableCumulativeDaysfrom StarttableCashFlowstableDiscountFactortableDiscountedCash FlowsFirst Coupon June $$Second Coupon December $$Third Coupon June $$Fourth Coupon December $TFifth Coupon June $$Sixth and Final Coupon December $$Principal Repayment December $$Total Present Value,,,,,,$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started