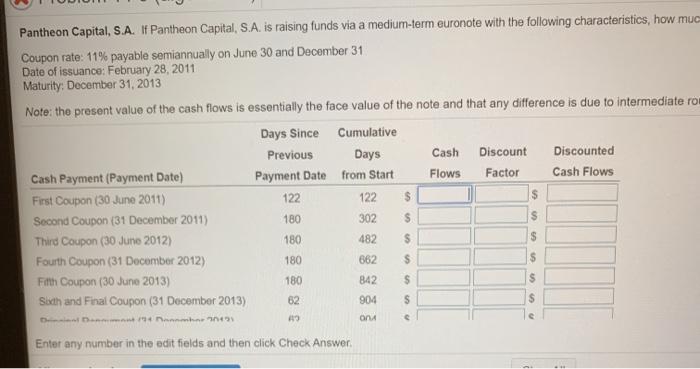

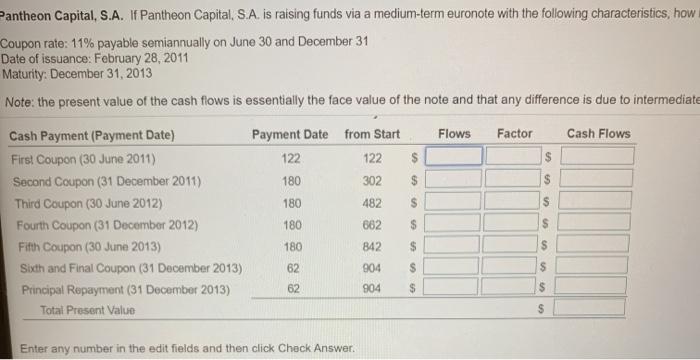

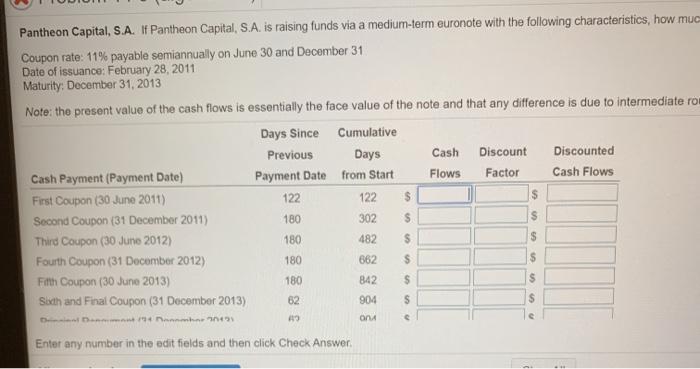

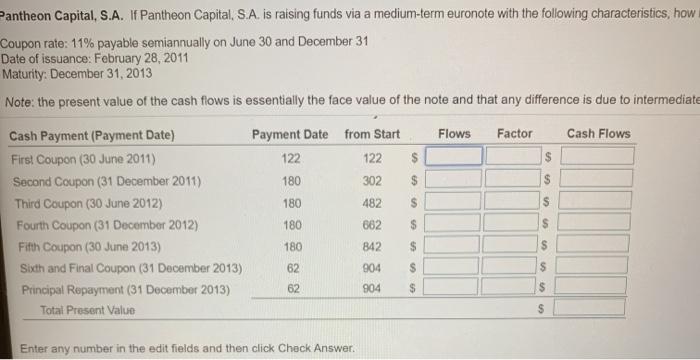

Pantheon Capital, S.A.If Pantheon Capital, S.A. is raising funds via a medium-term euronote with the following characteristics, how much in dollars will Pantheon receive for each $1,000 note sold?

Coupon rate: 11%

payable semiannually on June 30 and December 31

Date of issuance: February 28, 2011

Maturity: December 31, 2013

Note: the present value of the cash flows is essentially the face value of the note and that any difference is due to intermediate rounding.

The value of a note is the total present value of all its future cash flows discounted at the firm's cost of capital. The value of the medium-term euronote can be calculated in the following table:(Round the cash flows to the nearest cent and the discount factor to four decimal palces.)

Score: Sos.com X Problem 14-5 (algorithmic) Question Hello Pantheon Capital, S.A. I Partoon Capital. Ang tunds via a medium-.onurence with the wing characterite how much does we Pantheon move for each $1,000 note ok! Cevne til en and December Doo Feary 21, 2011 May December 31, 2013 Now the value of the cash flow is essentially the foon value of the note and that any difference is to intermediate rounding The media neto a The terment vite of the fare con fowe do coured as the tenn coat of arms. The view of the musuntem dunnotw can de calculatie en the following the Plans the came from to the reason and discount for dem Days Since Curate Previous Days Cash Discount Discounted Cash Payment Payment Date Payment Date from start Flowe Factor Cash Flows First on 2011 $ Second Coupont Dober 2011) 302 The Coon 2012 180 $ Four Couport en 2005 160 5 Emany number cold and the Check Answer Pantheon Capital, S.A. If Pantheon Capital, S.A. is raising funds via a medium-term euronote with the following characteristics, how much Coupon rate: 11% payable semiannually on June 30 and December 31 Date of issuance: February 28, 2011 Maturity: December 31, 2013 Note: the present value of the cash flows is essentially the face value of the note and that any difference is due to intermediate ro Days Since Cumulative Previous Days Cash Discount Discounted Cash Payment (Payment Date) Payment Date from Start Flows Factor Cash Flows First Coupon (30 June 2011) 122 122 Second Coupon (31 December 2011) 180 302 Third Coupon (30 June 2012) 180 482 $ Fourth Coupon (31 December 2012) 180 662 Fifth Coupon (30 June 2013) 180 842 Sidh and Final Coupon (31 December 2013) 62 904 $ S $ $ $ S $ $ S S one Enter any number in the edit fields and then click Check Answer Pantheon Capital, S.A. If Pantheon Capital, S.A. is raising funds via a medium-term euronote with the following characteristics, how Coupon rate: 11% payable semiannually on June 30 and December 31 Date of issuance: February 28, 2011 Maturity: December 31, 2013 Note: the present value of the cash flows is essentially the face value of the note and that any difference is due to intermediate Cash Payment (Payment Date) Payment Date from Start Flows Factor Cash Flows First Coupon (30 June 2011) 122 122 $ $ Second Coupon (31 December 2011) 180 s Third Coupon (30 June 2012) 180 482 S Fourth Coupon (31 December 2012) 180 682 Fifth Coupon (30 June 2013) 180 842 $ S Sixth and Final Coupon (31 December 2013) 62 904 Principal Repayment (31 December 2013) 62 904 Total Present Value 302 $ $ $ $ S $ $ $ $ $ Enter any number in the edit fields and then click Check Answer, Pantheon Capital, S.A. If Pantheon Capital, S.A. is raising funds via a medium-term euronote with the following characteristics, how much Coupon rate: 11% payable semiannually on June 30 and December 31 Date of issuance: February 28, 2011 Maturity: December 31, 2013 Note: the present value of the cash flows is essentially the face value of the note and that any difference is due to intermediate ro Days Since Cumulative Previous Days Cash Discount Discounted Cash Payment (Payment Date) Payment Date from Start Flows Factor Cash Flows First Coupon (30 June 2011) 122 122 Second Coupon (31 December 2011) 180 302 Third Coupon (30 June 2012) 180 482 $ Fourth Coupon (31 December 2012) 180 662 Fifth Coupon (30 June 2013) 180 842 Sidh and Final Coupon (31 December 2013) 62 904 $ S $ $ $ S $ $ S S one Enter any number in the edit fields and then click Check Answer Pantheon Capital, S.A. If Pantheon Capital, S.A. is raising funds via a medium-term euronote with the following characteristics, how Coupon rate: 11% payable semiannually on June 30 and December 31 Date of issuance: February 28, 2011 Maturity: December 31, 2013 Note: the present value of the cash flows is essentially the face value of the note and that any difference is due to intermediate Cash Payment (Payment Date) Payment Date from Start Flows Factor Cash Flows First Coupon (30 June 2011) 122 122 $ $ Second Coupon (31 December 2011) 180 s Third Coupon (30 June 2012) 180 482 S Fourth Coupon (31 December 2012) 180 682 Fifth Coupon (30 June 2013) 180 842 $ S Sixth and Final Coupon (31 December 2013) 62 904 Principal Repayment (31 December 2013) 62 904 Total Present Value 302 $ $ $ $ S $ $ $ $ $ Enter any number in the edit fields and then click Check