Question

Panther Corporation appeared to be experiencing a good year. Sales in the first quarter were one-third ahead of last year, and the sales department predicted

Panther Corporation appeared to be experiencing a good year. Sales in the first quarter were one-third ahead of last year, and the sales department predicted that this rate would continue throughout the entire year. The controller asked Janet Nomura, a summer accounting intern, to prepare a draft forecast for the year and to analyze the differences from last year's results. She based the forecast on actual results obtained in the first quarter plus the expected costs of production to be completed in the remainder of the year. She worked with various department heads (production, sales, and so on) to get the necessary information. The results of these efforts follow:

| PANTHER CORPORATION Expected Account Balances for December 31, Year 2 | |||||

| Cash | $ | 5,200 | |||

| Accounts receivable | 324,000 | ||||

| Inventory (January 1, Year 2) | 190,000 | ||||

| Plant and equipment | 540,000 | ||||

| Accumulated depreciation | $ | 168,000 | |||

| Accounts payable | 184,000 | ||||

| Notes payable (due within one year) | 204,000 | ||||

| Accrued payables | 97,000 | ||||

| Common stock | 320,000 | ||||

| Retained earnings | 587,200 | ||||

| Sales revenue | 2,440,000 | ||||

| Other income | 44,000 | ||||

| Manufacturing costs | |||||

| Materials | 912,000 | ||||

| Direct labor | 971,000 | ||||

| Variable overhead | 555,000 | ||||

| Depreciation | 24,000 | ||||

| Other fixed overhead | 35,000 | ||||

| Marketing | |||||

| Commissions | 88,000 | ||||

| Salaries | 68,000 | ||||

| Promotion and advertising | 188,000 | ||||

| Administrative | |||||

| Salaries | 68,000 | ||||

| Travel | 12,000 | ||||

| Office costs | 40,000 | ||||

| Income taxes | |||||

| Dividends | 24,000 | ||||

| $ | 4,044,200 | $ | 4,044,200 | ||

Adjustments for the change in inventory and for income taxes have not been made. The scheduled production for this year is 454,000 units, and planned sales volume is 404,000 units. Sales and production volume was 304,000 units last year. The company uses a full-absorption costing and FIFO inventory system and is subject to a 40 percent income tax rate. The actual income statement for last year follows:

| PANTHER CORPORATION Statement of Income and Retained Earnings For the Budget Year Ended December 31, Year 1 | ||||||||

| Revenues | ||||||||

| Sales revenue | $ | 1,900,000 | ||||||

| Other income | 68,000 | $ | 1,968,000 | |||||

| Expenses | ||||||||

| Cost of goods sold | ||||||||

| Materials | $ | 544,000 | ||||||

| Direct labor | 596,000 | |||||||

| Variable overhead | 328,000 | |||||||

| Fixed overhead | 52,000 | |||||||

| $ | 1,520,000 | |||||||

| Beginning inventory | 190,000 | |||||||

| $ | 1,710,000 | |||||||

| Ending inventory | 190,000 | $ | 1,520,000 | |||||

| Selling | ||||||||

| Salaries | $ | 58,000 | ||||||

| Commissions | 64,000 | |||||||

| Promotion and advertising | 130,000 | 252,000 | ||||||

| General and administrative | ||||||||

| Salaries | $ | 60,000 | ||||||

| Travel | 7,500 | |||||||

| Office costs | 36,000 | 103,500 | ||||||

| Income taxes | 37,000 | 1,912,500 | ||||||

| Operating profit | 55,500 | |||||||

| Beginning retained earnings | 555,700 | |||||||

| Subtotal | $ | 611,200 | ||||||

| Less dividends | 24,000 | |||||||

| Ending retained earnings | $ | 587,200 | ||||||

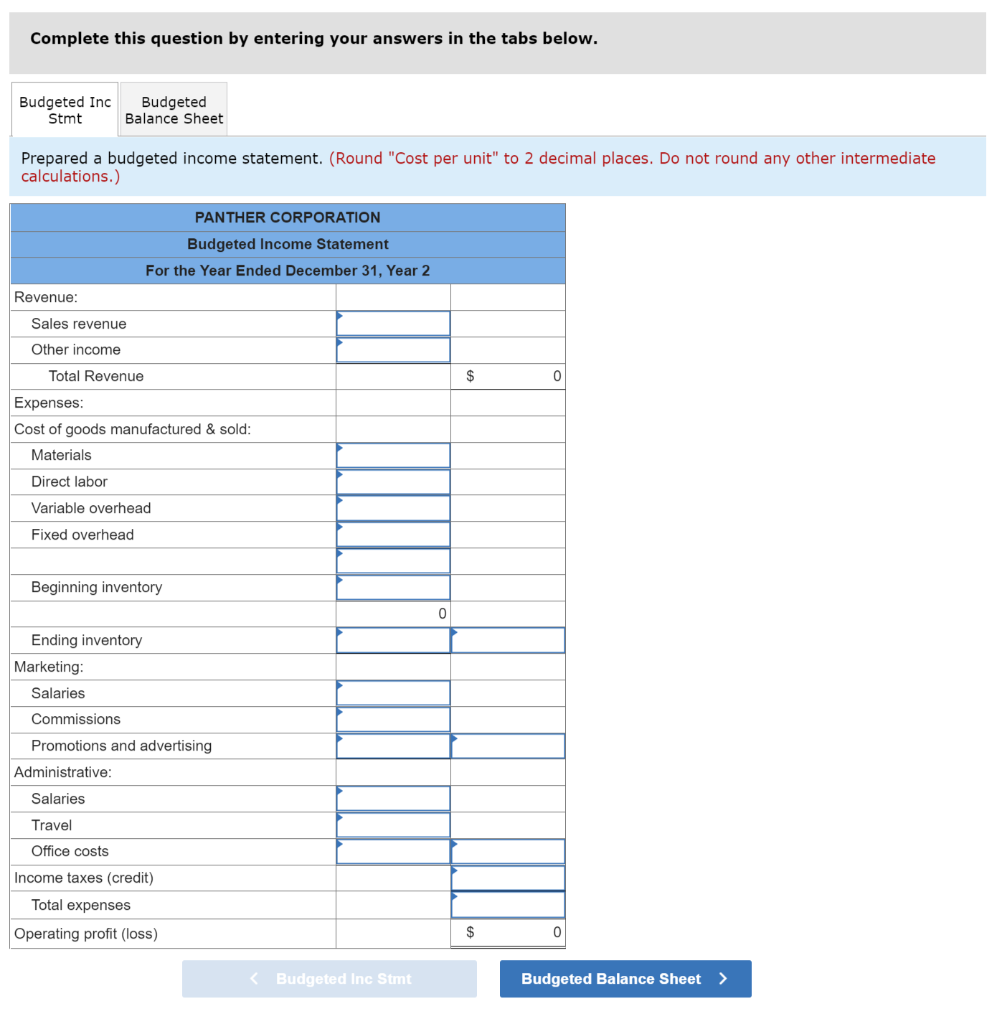

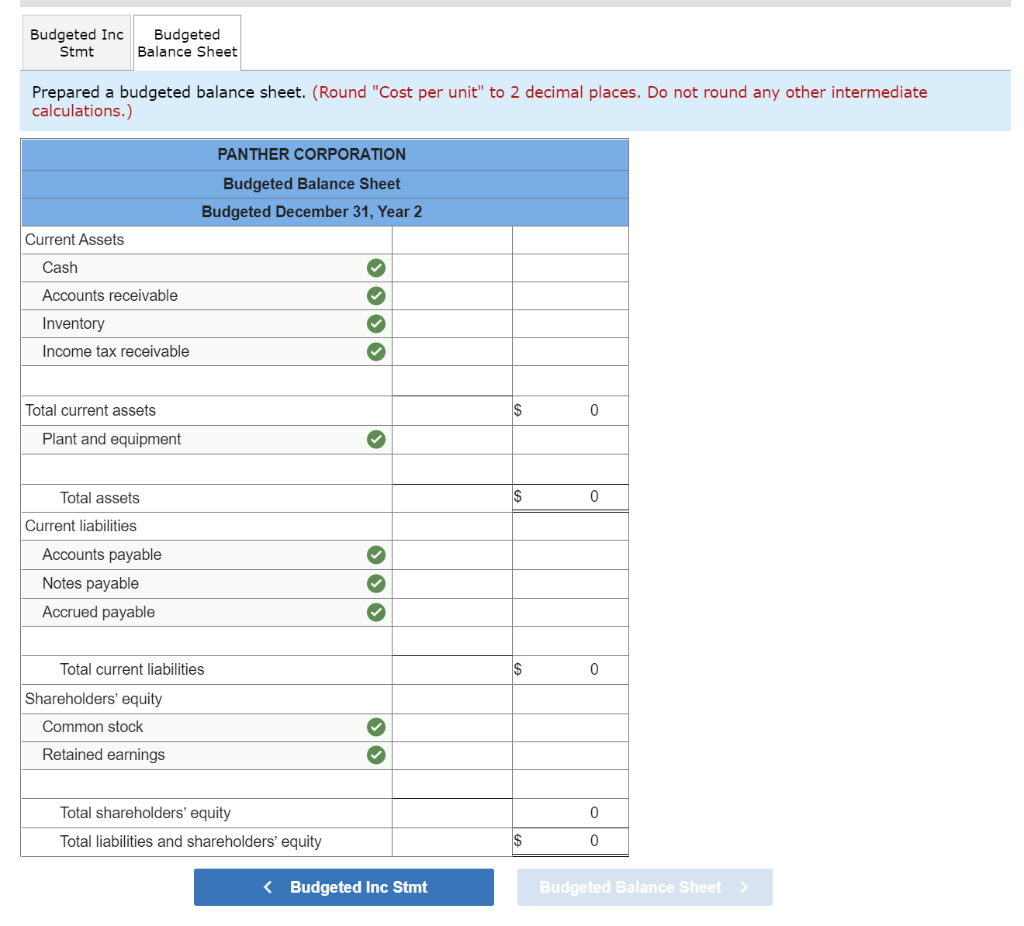

Required:

Prepared a budgeted income statement and balance sheet.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started