Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Panther operated as a single company, but in 20x4 decided to expand its operations. Panther. acquired a 60% interest in Sabre on 1 July

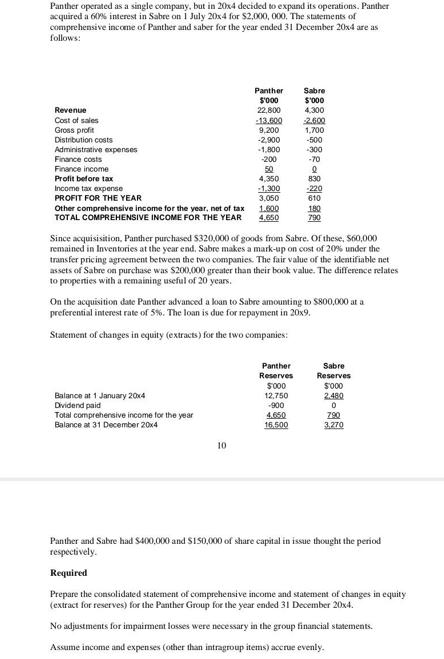

Panther operated as a single company, but in 20x4 decided to expand its operations. Panther. acquired a 60% interest in Sabre on 1 July 20x4 for $2,000, 000. The statements of comprehensive income of Panther and saber for the year ended 31 December 20x4 are as follows: Revenue Cost of sales Gross profit Distribution costs Administrative expenses Finance costs Finance income Profit before tax Income tax expense PROFIT FOR THE YEAR Other comprehensive income for the year, net of tax TOTAL COMPREHENSIVE INCOME FOR THE YEAR Balance at 1 January 20x4 Dividend paid Panther $'000 22,800 Total comprehensive income for the year Balance at 31 December 20x4 -13.600 9,200 10 -2,900 -1,800 -200 50 4,350 -1.300 3,050 1.600 4.650 Since acquisisition, Panther purchased $320,000 of goods from Sabre. Of these, $60,000 remained in Inventories at the year end. Sabre makes a mark-up on cost of 20% under the transfer pricing agreement between the two companies. The fair value of the identifiable net assets of Sabre on purchase was $200,000 greater than their book value. The difference relates to properties with a remaining useful of 20 years. On the acquisition date Panther advanced a loan to Sabre amounting to $800,000 ata preferential interest rate of 5%. The loan is due for repayment in 20x9. Statement of changes in equity (extracts) for the two companies: Sabre $'000 4,300 -2.600 1,700 -500 300 -70 Panther Reserves 2 830 -220 610 180 790 $000 12,750 -900 4.650 16.500 Sabre Reserves $000 2.480 0 790 3,270 Panther and Sabre had $400,000 and $150,000 of share capital in issue thought the period respectively. Required Prepare the consolidated statement of comprehensive income and statement of changes in equity (extract for reserves) for the Panther Group for the year ended 31 December 20x4. No adjustments for impairment losses were necessary in the group financial statements. Assume income and expenses (other than intragroup items) accrue evenly.

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started